A stocks & shares ISA is one of the most popular investment accounts for UK savers. There are two main draws of stocks & shares ISAs; their investment options with higher returns, and the fact that all profits made within them are free from tax. The freedom of choice of what to invest in is very wide with an ISA, as the account can be used to hold a wide variety of investments.

As a stocks & shares ISA investor, the main risks you face are:

- Investment risk – your investments perform poorly

- Bankruptcy risk – your ISA provider fails

Let’s understand these risks in turn, to and see how they can be mitigated.

Investment risk

The future performance of investments is unknown.

But that’s the whole point. Investments tend to yield a higher return than savings accounts because this is the return you have earned for taking that risk.

Generally speaking, the more risky an investment is:

- The higher its expected return will be, &

- The further its actual return could turnout against that expectation

The market value of a share or bond portfolio can be quite volatile. Your investments could outperform expectations, and could underperform. In a bad year, you could see no return. In an even worse year, you could lose a significant part of your capital.

It can be quite difficult to stomach the sight of your stocks & shares ISA increasing or decreasing by £00s or £000s per day. But this is the reality of investing in the stock market for any investor looking to deposit £50,000+ in a stocks and shares ISA.

On the average day, the market moves up or down by between 0% – 2%. It’s possible for the market to rise or fall by over 30% in a year. These figures can help you understand what the daily or yearly movement for your portfolio could feel like.

How can the investment risk of a stocks & shares ISA be mitigated?

There are three steps to mitigating investment risk:

- Diversify

- Choose a lower risk asset allocation

- Invest over long time horizons

Diversification is the process of buying many different examples of a given asset. Once you spread your money equally across 20 different shares, you will have significantly reduced whats known as specific risk. Specific risk is the risk of a freak accident or stroke of great luck sending your portfolio into an upward or downward spiral.

If you invest in a single company, your stocks & shares ISA will feel every piece of good or bad news about that company. If you invest in 20,000 companies then all of this daily ‘noise’ will simply cancel out. What is left is the impact of economic & political news stories which affect the whole market. This risk is inherent in all stock market investments, however, you can try to diversify further by ensuring that your portfolio is spread across different geographies and sectors. This way, you don’t need to necessarily pick the best company or best fund to invest in. The focus is on picking a selection of good opportunities.

Read more: Our guide to the science of diversification, or alternatively check out the best economics books & the best portfolio management books.

Choosing a lower risk asset allocation is about designing your portfolio to weight more money towards lower-risk assets, and less money towards higher risk asset classes.

- Corporate bonds and cash are lower risk

- Equities, property, commodities and alternative investments are examples of higher risk asset classes.

When you consider the huge range of investments allowed in a stocks and shares ISA, you’ll begin to realise that no two ISAs are the same from a risk perspective.

To answer the question: ‘Are stocks and shares ISAs risky?‘ I’d have to ask first: what is your asset allocation?

Read more: The best asset allocation books

Investing over a long time horizon means committing your money to a stocks & shares ISA for a longer period of time. You could see this as ‘locking your money away’ for a set period.

Share prices bounce wildly over the course of a day, almost as if being driven by an invisible energy. Over a monthly timespan, they tend to trend down and up. But over the course of years and decades, the chart of shares prices begin to look much smoother.

This is because when you invest over hundreds of companies, over hundreds of months, you are no longer betting on a hunch that a company will see good news, or that industry will enjoy a particularly favourable season. Instead, you’re betting on the overall success of the global business over the long term. Who wouldn’t take that bet?

For this reason, stocks and shares ISAs are not generally recommended for savers looking to put away money for a short-term savings goal. If you’re saving up for a holiday next year, a stocks and shares ISA is a risky option indeed. There is a sizeable chance that the stock market could enter a downturn before your holiday comes around, leaving you in the red at the point of needing to sell and withdraw your funds. Best avoided.

Read more: Our guide to investing time horizons

Bankruptcy risk

There is a risk that your ISA provider goes bankrupt. Stocks & Shares ISA providers are usually large financial institutions, but they are sometimes much smaller. As the 2008 financial crisis taught us, even large institutions can fail.

So what happens to your investments if your provider fails and the bankruptcy attorneys are called in?

If a UK stockbroker or ISA provider falls into administration, known colloquially as filing for bankruptcy, its investors should be protected.

Firstly, UK regulated stockbrokers do not mix client shareholdings with their own business assets. Client assets are ringfenced, which means that a broker cannot sell client investments to help pay their business debts. In practice, the custodian of client investments is usually a separate company entirely to the stockbroking firm. This helps further segregate. What this means is that if a stockbroker incurred heavy losses and folded, its client’s assets should remain untouched.

Secondly, UK regulated stockbrokers fall under the Financial Services Compensation Scheme. If you’re a savvy saver you’ll already appreciate that this is the UK’s compensation scheme for savers. As of writing this article in 2021, the scheme guaranteed the first £85,000 of savings held with a single institution. This means that even if the ringfenced assets were taken, a client should be later compensated through the FSCS scheme. However, this could take time.

How can the bankruptcy risk of a stocks & shares ISA be mitigated?

After understanding these risks, a few options for reducing them become apparant:

- Limit your exposure to individual brokers

- Take a stockbroker’s financial stability into account when picking a stocks & shares ISA

Limiting your exposure allows you to take maximum advantage of the FSCS protection. As this tops out at £85k per client per institution, you may want to consider opening multiple stocks and shares ISAs to ensure that larger portfolios receive greater protection.

Bankruptcy risk can be mitigated by the careful choice of a broker. An old and established institution with decades (or centuries) of trading history will have a smaller chance of going bankrupt than a brand-new broker.

Similarly, a stocks and shares ISA provider which is part of a wider banking or insurance group may have more financial stability, owing to the many different business divisions which can support each other in times of need.

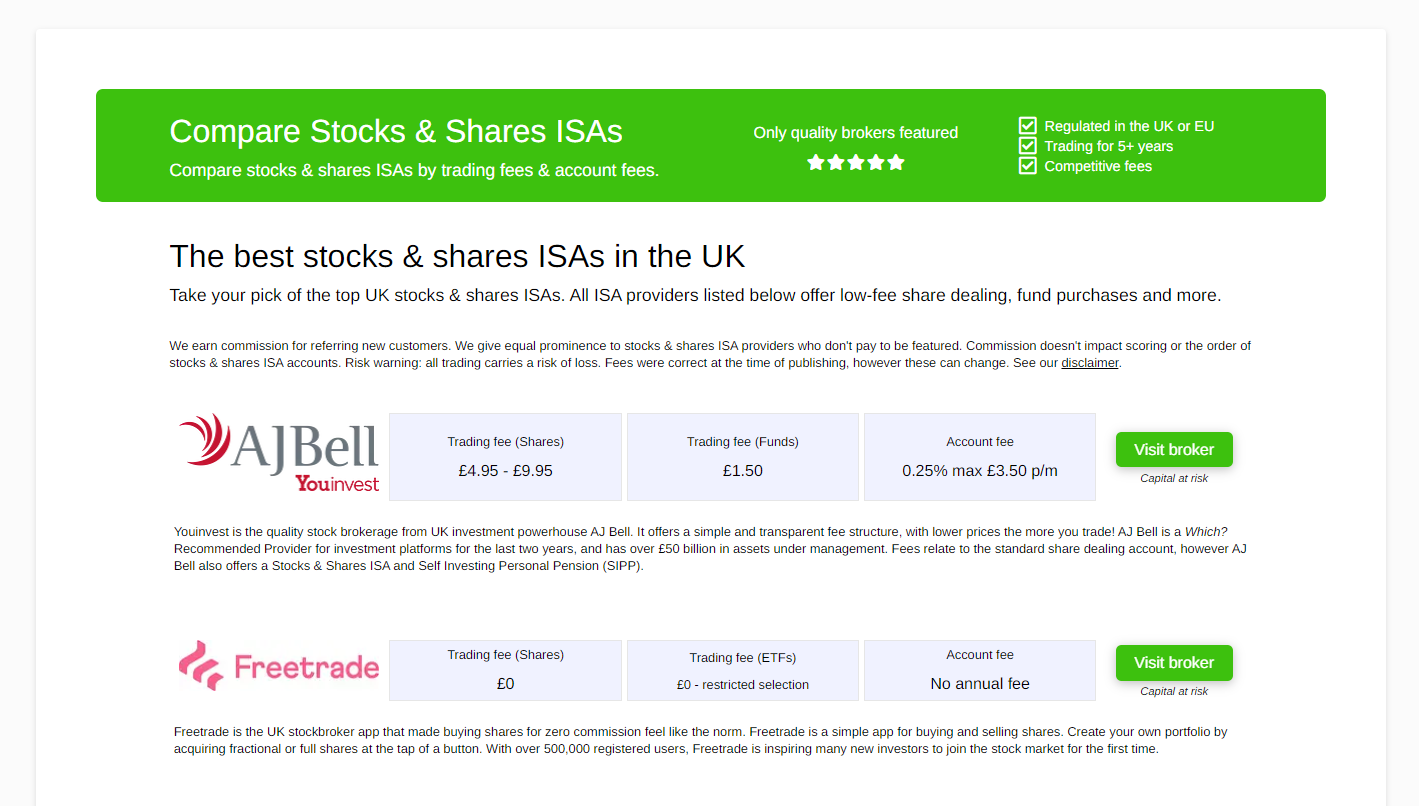

Which are the best stocks & shares ISAs?

We’ve shortlisted the best of the best stocks & shares ISAs below to help your search:

Large UK trading platform with a flat account fee and a free trade every month. Cheapest for investors with big pots.

The UK’s no. 1 investment platform for private investors. Boasting over £135bn in assets under administration and over 1.5m active clients. Best for funds.

Youinvest stocks & shares ISA offers lower prices the more you trade! Which? 'Recommended Provider' for last 3 years.

Buy and sell funds at nil cost with Fidelity International, plus simple £10 trading fees for stocks & shares and ETFs.

Capital is at risk

Please also see our Hargreaves Lansdown review, our AJ Bell review and interactive investor review.

Everything you need to know about stocks & shares ISAs

- What is a stocks & shares ISA?

- What investments can be held in a stocks & shares ISA?

- How to become a stocks & shares ISA millionaire

- The history of stocks & shares ISAs

- Who can open a stocks & shares ISA?

- What is the minimum amount needed to open a stocks & shares ISA?

- Are stocks & shares ISAs only available in the UK?

- Full list of stocks & shares ISA providers

- How risky are stocks & shares ISAs?

- What fees do stocks & shares ISA accounts charge?

- What is the current stocks & shares ISA allowance?

- Are stocks & shares ISAs tax free?

- Do you need to disclose income and gains in stocks & shares ISA on your tax return?

- What happens to a stocks & shares ISA when I die?

- Stockbroker reviews (UK)