“Is now a good time to invest in the stock market?” as well as “Should I save or invest?” are probably the most common question I am asked by readers, friends and family.

In this article, I will tackle this subject and provide a few market timing tips and ways to gauge the latest outlook for the stock market. I hope to convince you that this question is the wrong one for you to ask.

What does perfect market timing look like?

Optimal market timing would involve investing at the market bottom and selling after the following market rally. We can picture this strategy for the FTSE 100 index of shares in the chart below:

By using three simple trades:

(1) Buy at 2,000, sell at 6,500.

(2) Buy at 4,000, sell at 6,500.

(3) Buy at 4,000 and hold to 7,000.

An investor would have returned 911% over two decades. In contrast, buying at 2,000 and holding to the present day would have returned only 350%.

Successful market timing is therefore incredibly profitable. The question is, it is possible to be successful?

Methods for predicting the direction of the stock market

This is where views in the investing community differ. Investors usually choose from one of the following schools of thought:

- Quantitative Analysis

- Fundamental Analysis

- Efficient Market Hypothesis

Quantitative Analysis

Quantitative analysis is based on the assumption that past prices contain information that allow us to predict what comes next.

A key part of the technique is recognising chart ‘patterns’. Quantitative analysts, known as ‘quants’, believe these can provide a signal of an imminent price rise or fall. Investors who follow this strategy will place trades when they see such signals appear in the data.

The theory rests upon a belief that investors are sometimes irrational, and therefore, human psychology drives prices.

The patterns reveal something about the mood and sentiment of the market. This information could give quants the edge in interpreting where a share price will go next.

Imagine a share which regularly trades across a wide range of prices but never exceeds £20. Quants may declare that £20 is its ‘price ceiling’. In other words, market participants appear to agree that £20 is currently too much to pay for the share.

Imagine next that a few days later, the price suddenly moves through this price ‘ceiling’. Quants may interpret this as a signal that the market sentiment has changed. Curiously, they don’t actually need to understand what has changed, nor why. The data is simply telling them that optimism appears to have shifted. They may buy shares this point in anticipation of a further increase.

Read more: Best quantitative and fundamental analysis books

Fundamental Analysis

Fundamental analysis takes a very different approach. Its philosophy is that quality research of the underlying facts and circumstances, will produce superior valuations. These independent valuations can inform investors as to whether assets are under or overpriced.

If fundamental analysis sounds familiar, this is because it is the default mindset applied by financial gurus and pundits. Commentary with fundamental flavour might sound like this:

“Economic development in China will drive tremendous growth in the middle class. This presents a huge opportunity for multinational corporations, but this is not yet reflected in their share price, therefore we believe there is upside to these companies shares.”

Fundamental analysis can take many shapes, but the most widely recognised approaches are value investing and growth investing.

The Efficient Market Hypothesis

The Efficient Market Hypothesis, or EMH for short, dismisses the Quantitative and Fundamental methods. It answers the question ‘is now the right time to invest?’ with the same answer; yes.

The core principle of EMH is that investors already have access to all public information available and use it to price shares. It clarifies that any new information is absorbed into a share price in an instant.

As a result, it states that no investor using public information can expect to gain an advantage by basing trades upon anything in the public domain. Therefore, this theory rejects the quantitative and fundamental methods because both price charts and company information are already publicly available.

The theory concludes with a bold prediction. Once you take for granted that prices incorporate the market’s best estimate of future events using all available knowledge, you can conclude that the chances of events turning out better or worse than expected should be 50:50. Therefore, it follows that the probability of a price rising or falling tomorrow will also be 50:50. This is known as the ‘random walk’ of prices.

The random walk

To understand how prices magically move to always sit at the best estimate, it’s helpful to follow through the sequence of events that occur when good news is released about a company.

- The first investor to receive and understand the good news will conclude that the current market valuation of the company has increased.

- Anticipating that the value of the share price will soon rise to align with an improved valuation, investors will buy shares to benefit from this slight advantage.

- This buying activity drives up the share price, as the buyers will outweigh sellers.

- The price soon reaches the value at which investors feel the share price includes the new information

- At this point, the market value of the company reflects its true value and therefore its future movement is no longer biased in any particular direction. The random walk has been reestablished.

These price nudges occur almost continuously throughout the day – reacting to big and small pieces of news that have a direct or indirect impact on the expected future dividends from a company.

Which view is correct? A critique of the quantitative theory

Empirical studies have shown that share prices do take a daily random walk.

The fact that these movements follow a random pattern, raises scepticism over those who claim to be able to ‘read the tea leaves’ in the share price charts of companies.

A critique of the quantitative field is that it is easy to attach an explanation to a rise or a fall with the benefit of hindsight. For any set of data, it may be possible to develop a trading technique that would generate a profit on that data. At this point, it would appear that you have cracked the magic formula. However such techniques usually only work on that specific data set, and become useless when applied to the real markets.

When reviewing historical charts with peaks and troughs, it is easy to fall into a false belief that you too could have predicted the price swing with ease. However, in real life when the chart ahead is blank… you will often fail. You are effectively playing a game of chance.

Good financial planning (as the best financial planning books will tell you) is about putting in place a plan for deposits which doesn’t require genius market timing. Investing is a long game.

Which view is correct? A critique of fundamental analysis

Fundamental analysis is the bread and butter of most active fund manager strategies. Managers look for companies that they believe are undervalued by the market, and buy their shares in the hope that the market will eventually correct itself. This applies whether the fund manager is investing locally or investing in emerging markets.

As we report in our Passive Funds versus Active Funds article, fund managers do actually generate a small premium above the market. This lends support to the notion that markets don’t always perfectly reflect all information, and therefore expertise can generate an edge. However, after the extra fees are factored in, these active funds actually lag behind the market. This renders the approach practically useless for investors.

This also validates a prediction of the Efficient Markets Hypothesis, which states that there will still always be a role for smart and reactive market participants to use information. Consider the gains made by the investors in our sequence of events above.

However, it goes on to predict that the return on investment for this research would only just cover the cost, meaning that the profit would not necessarily scale up when a fund manager has £billions at their disposal to jump on such opportunities. This also is consistent with our example, as only a limited number of shares could be bought before the price had risen to the point where no advantage existed.

What does this mean for the direction of the stock market?

The supremacy of the Efficient Market Hypothesis allows us to draw time following conclusion, explained well by Warren Buffet in a recent interview with USA Today:

“People that think they can predict the short-term movement of the stock market — or listen to other people who talk about (timing the market) — they are making a big mistake,”

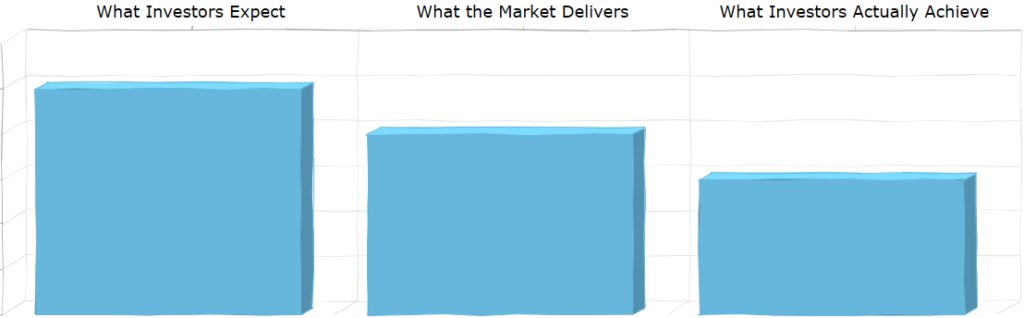

In other words, investors have actually found it futile to try and ‘time the market’. In fact, investor performance is actually worse than you would expect.

Studies have shown that retail investors often receive disappointing returns in their stocks & shares ISAs compared to the market average. Retail investors tend to ride the rollercoaster down during crashes, fall out of their seat, and miss out on the upward ride afterwards!

In other words, rather than buying low and selling high. The average investor is buying high and selling low!

Why do retail investors do so badly?

There are many, understandable reasons why investors behave in the opposite way to their intentions. Firstly, investors can fail to:

These are so prolific that we have created dedicated articles which address each avoidable issue separately.

In our review of Interactive Investor and our AJ Bell review, we’ve pointed out that transaction costs do fall per trade when trading volumes are high. However, at these trading volumes (10+ traders per month), costs will still be high in pound terms.

Specifically, in relation to market timing, the following reasons can cause investors to pick their timing poorly;

- Seeing a good track record of recent returns encourages investors to buy an asset. This tendency leads investors towards assets which have already achieved most of their gains through an investment cycle.

- The national media dramatically increase their coverage of financial markets when the stock market is hitting record highs. The ‘fear of missing out’ draws investor money into equities precisely at the point where valuations are high.

- A loss-making investment can cause a great deal of discomfort. This can nudge investors towards selling them investments to rid themselves of the red number on their portfolio statement.

- A sharp market fall leaves some investors very exposed. For those without the suitable investment risk appetite or time horizon, this is a wake-up call. Investors who need short-term access to cash, or who feel very distressed by the volatility, may feel that they have no choice but to liquidate their shares to eliminate further losses.

The factor which beats timing

We should place less focus on investing at the right time, and place more focus on simply being in the stock market.

One can wait on the sidelines for years during recessions and volatility, hoping for the right moment. But more often than not, the perfect buying opportunity only becomes fully apparent once it has passed us by.

You can see this happen in 2008 when investors took fright at the financial crisis and fleed from equity funds into government bonds for safety. In the following year, while bad news continued to emerge, the FTSE 100 actually rose by 18.35%. This was in spite of a pervasive sense of gloom, for example in February 2009, Deutsche Bank announced €5.7bn in losses.

As a result, many retail investors locked in losses at the very bottom and then missed out on the rebound. Such times make for interesting case studies that should just how hard it is to detect when the stock market will pick back up.

While you sit on a pile of cash, your money cannot reward you with dividends!

The income perspective

A positive alternative is to change your investing mindset. Forget about speculating on the value of shares going up in value. Begin visualising each monthly investment as a purchase of future income. It’s like planting a money tree every month. This mindset is taken from the dividend growth investing strategy.

The income comes in the form of dividends paid by companies and funds. If desired, you can be selective in where you invest to maximise the size of dividends. You can pick companies with a history of high payouts (such as pharmaceuticals, consumer goods and telecoms) or funds which specialise in equity income.

The strength of the income perspective comes from your commitment to holding the shares for the very long term – perhaps as long as 30 or 40 years. Every time you invest, you are making a positive contribution to your stack of income-generating assets.

With your view fixated on the income stream of your portfolio, short term price swings become irrelevant. In fact, downward swings will feel favourable because at a lower share price, you will be able to buy more shares (and thus more dividends). This is a much healthier mindset than the speculation mindset because it encourages you to buy low rather than buying high.

With the income perspective, now is always the right time to invest

The income perspective should remove the hesitation that many people feel when considering an investment, particularly during a volatile period.

First of all, because the interest rates paid on cash are so low, the income approach will encourage you to invest your cash as soon as possible to turn it into a productive asset.

Secondly, if you ask yourself the right question when investing – you won’t feel regret even if the stock market takes a downward turn next.

You simply frame the decision in the following way: Does the current price of this share/ fund offer me a dividend yield that fairly compensates me for the risk? If the answer is yes, invest now to lock-in that dividend income. Deciding what to invest in this year is always difficult. Don’t expect a choice to ever feel like 100% the right decision.

Even if the stock market falls in value later, you will probably still receive that dividend income yield, therefore your original reason for investing still holds, and you needn’t feel any regret.

Furthermore, dividends are more stable than share prices. Therefore, you will lose less sleep over the question of is now a good time to invest, if you track your dividend income instead of portfolio value.

Course Progress

Learning Summary

Is Now a Good Time to Invest in the Stock Market?

Three financial theories attempt to explain whether the stock market is currently over or undervalued.

Quantitative analysis theory states that historical prices can give a strong indication of future price movements, because they reveal information about the sentiment and behaviour of investors.

However, spotting 'buy and sell signals' in pricing charts is easier with hindsight. In practice, few collective investment schemes successfully based on these strategies.

Fundamental analysis theory suggests that insights gained from superior research into companies and the economy should guide trading. Active fund managers typically use this strategy, but underperform the market when the costs of research are taken into account.

The Efficient Market Hypothesis (EMH) concludes that attempting to 'beat the market' using public information is not possible, because current prices already incorporate all knowledge. This means that future movements are completely random.

The EMH relies upon questionable assumptions such as 'investors have perfect information' and 'investors are logical'. These conditions certaintly don't always apply. However, the random pattern of price movements observed in the stock markets supports the principle that future movements cannot be predicted. Investors have therefore generally accepted EMH as 'common wisdom'.

Studies have shown that retail investors consistently underperform the market average. This is because their attempts to 'time the market', fail more than they succeed. It would be naive to assume that you would not fall victim to these mistakes.

It is therefore strategic to stay fully invested and receive the full market return, rather than to try to beat the market and risk underperforming it.

A positive solution is to change your mindset to focus on increasing the income you earn from assets, rather than their market value. This way, the timing of new investments is irrelevant, as each additional share or fund unit purchases will successfully increase your income regardless. This encourages a gradual, consistent investment approach.

Quiz

Next Article in the Course

Before you move on, please leave a comment below to share your thoughts. Does your view on the economy impact whether you make investments?

Comments 1

I pressed the next article button and went to “How to chose a Stockbroker…..” page. The end of this page had no link to the next article or quiz. Is this the end of the foundation course?