The Dividend Growth Investing strategy (DGI) has taken root as a favourite strategy across money blogs & literature, particularly websites & books which focus on saving for retirement.

If you’re serious about putting dividend growth investing into action, then I recommend the ‘Dividend Growth Investing’ complete course on Udemy.

It includes 22 hours of highly-rated content, which makes my lengthy guide look like a short tour. The tips learned over the full course can pay back the cost of the course in less than a year, so do check it out if you have an investment portfolio of £5,000 or more.

If you’re your looking for broader education, visit my investment courses page to discover the full range of education available at your fingertips.

An introduction to DGI

At its core, dividend growth investing is simple:

Depending on where you look online, you will find many viewpoints on DGI, ranging from glowing pieces written with religious intensity, to withering critiques. The best dividend investing books will hopefully provide some balance to this debate.

It is still really helpful to explore the arguments on both sides. There are some genuinely interesting learning points to cover here, which will deepen your understanding of how shares are priced.

In August 2019 Vanguard reopened its Dividend Growth Fund (Ticker: VDIGX) to new investors, showing a willingness to cash in on its resurgence.

DGI also helps to promote a healthy investing mindset.

Which are the best UK stockbrokers?

We’ve shortlisted the best of the best UK stockbrokers below to help your search:

Trade shares with zero commission. Open an account with just $100. High performance and useful friendly trading app. Other fees apply. For more information, visit etoro.com/trading/fees.

Large UK trading platform with a flat account fee and a free trade every month. Cheapest for investors with big pots.

The UK’s no. 1 investment platform for private investors. Boasting over £135bn in assets under administration and over 1.5m active clients. Best for funds.

Youinvest stocks & shares ISA offers lower prices the more you trade! Which? 'Recommended Provider' for last 3 years.

Choose a pre-made portfolio in minutes with Nutmeg. Choose your level of risk and let Nutmeg efficiently handle the rest.

Buy and sell funds at nil cost with Fidelity International, plus simple £10 trading fees for stocks & shares and ETFs.

Capital is at risk

Trade stocks & options on the advanced yet low-cost Freedom24 platform that arms retail investors with the tools to trade like professionals.

Capital is at risk

Please also see our Hargreaves Lansdown review, our AJ Bell review and interactive investor review.

What is dividend growth investing?

Dividend growth investing is an active investing strategy which involves buying and holding a portfolio of shares. Dividend growth investors build a basic investment portfolio by looking for companies with a track record of paying reliable and growing dividends year on year.

Dividend growth investors don’t spend days tirelessly trawling through the financial pages to find good buys.

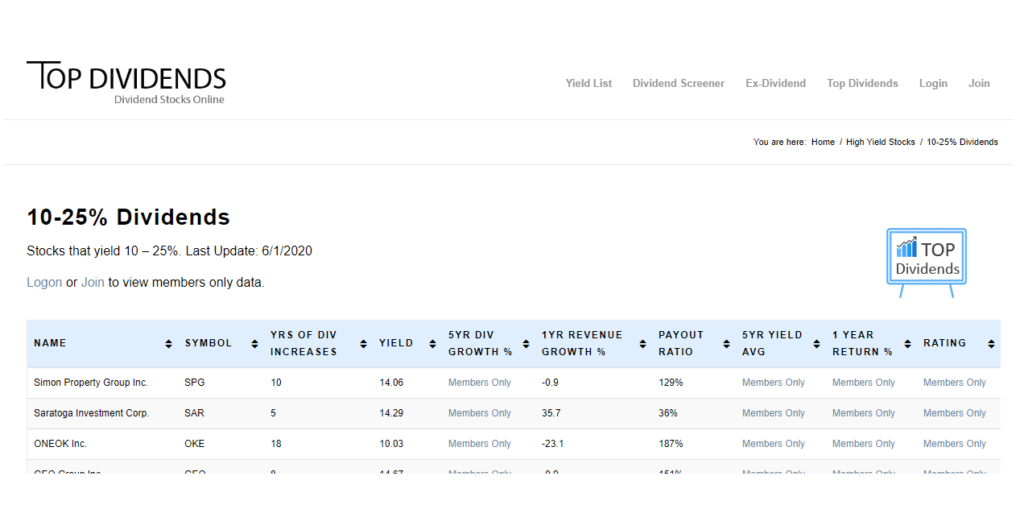

They use online stock screening tools to do this automatically. An example is pictured below.

The theory is that companies which meet these strict conditions will be:

- Stable and mature businesses

- Likely to increase their dividends each year

- Less likely to cut their dividend in the future

This makes them attractive to investors. Who doesn’t want to own a company with a good track record of steadily increasing their returns to shareholders?

Receiving dividends is one of the two key reasons why people invest in shares. The other being capital gains from any increase in the share price.

Dividend growth investors look at their portfolio as an income-generating machine. They measure their success, not on its latest market value, but by the value of dividends it pushes into their bank account each year.

Why do people enthuse about dividend growth investing?

Dividend stability

Compared to the fluctuating value of a share, dividend income is relatively stable. Companies tend to increase their dividends gradually as their business becomes more profitable.

This stability is supported by the fact that companies don’t pay out 100% of their income as earnings. They usually pay between 20% – 70% as a dividend. They retain the remainder to reinvest in their operations.

Broker AJ Bell reported that the FTSE 100 forecasted earnings in 2019 would cover expected dividends 1.65 times over. This means that currently, FTSE 100 companies pay out approximately 60% of their profits as dividends.

This 40% buffer keeps dividends steady because it allows the payment amount to be held firm (or even grow) if earnings disappoint.

As the best business books will confirm, managers are very aware of investor expectations of ever higher dividends, and will often pay reasonable dividends even during difficult years as a way of retaining the market’s confidence in the company.

Rewarding progression

Sturdy dividends, combined with a pattern of regular investments into the portfolio, will be sure to produce a steadily increasing income stream.

This smooth progress removes some of the uncertainty around buying shares and investing in the stock market.

Which experience would you prefer:

- Tracking a zigzagging portfolio value line as it jolts up and down in reaction to market news, taking your mood up and down with it?

- Or plotting your dividend income on a monthly basis, watching it gradually rise over time?

Another rewarding moment is realising that both the dividends per share and the number of shares in your portfolio are rising over time. This feels like a double-victory.

How do dividend growth investors pick companies?

Dividend growth investors use ‘stock screening tools’ to filter thousands of listed businesses by strict criteria. These criteria might include:

- A minimum dividend yield e.g. 3%. This ensures that the investment is capable of returning a sensible amount and has a policy of paying higher-than-average dividends. In his dividend guide on What Stocks to Buy, Conor Smart listed 25 top-dividend US stocks which he picked on the basis of high dividend yield.

- A minimum dividend cover, check that the company has a sufficient buffer between its earnings and dividend payments.

- An unbroken track record of increasing dividends over a period of years, e.g. 10.

Alternatively, some dividend growth investors skip the laborious process of choosing what to invest in, by picking a fund that follows an active dividend growth strategy.

Does the research support this strategy?

Over the years, researchers have tested the merits of dividend growth investing and dividend-focused strategies in general.

The results are mixed but are broadly positive. DGI wouldn’t have been a bad strategy to follow from 1930 – 2019.

Most of the studies involve researchers creating hypothetical portfolios at a point in time. Using historical price movements, they are able to track how that strategy would have performed up to the present day. This technique is called backtesting.

Sometimes, the back-tested strategy has closely matched the average market return, and sometimes it has fared worse. On balance, however, even the critics agree that the dividend growth strategy fares well when held up against historical data.

However, as solid as backtesting sounds, even over 80 years of data, these results are not quite as conclusive as it sounds.

Backtesting methods are not perfect, For example, they use historical data which doesn’t include the impact of investors actually trading the strategy.

If the prices could include the distorting effect of participants moving prices by trading with the strategy, this would have given a worse result.

Let me explain further; in 1940 nobody was picking shares using a filter for dividend growth investing criteria. If they were, the shares of those companies would be more frequently purchased and their prices would have been generally higher. This means that the cost of investing in these companies would have been higher, and returns from a DGI strategy would be lower.

The dividend mindset

Dividend growth investing instils a positive mindset. By shifting a focus away from share prices and towards dividend payments, DGI reduces the stress of investing.

DGI investors don’t wrestle with the unanswerable question of ‘Is now a good time to invest in the stock market?‘. Instead, they see each investment as an incremental accumulation of dividend producing units.

Whether the market is high or low, each purchase will increase the expected dividend haul.

And if the worst should happen, and the market takes a sharp downward turn, take a look at the difference between mindsets:

Traditional mindset: “I’ve sustained a serious hit. My recent investments are underwater and I made a mistake to invest in them at that time. I would have been richer today if I hadn’t invested. I should be cautious about investing further this year.”

Dividend growth mindset: “The purchase price for these units of income are now priced at a discount! Each £100 I invest now will buy more dividends than last month. Dividend yields now look higher and this is a buying opportunity.”

Only one of these mindsets gives a helpful nudge to buy low.

Dividend growth investing versus ‘Dogs of the FTSE’

It is important to distinguish dividend growth investing from a strategy known as ‘Dogs of the FTSE’, as the two have notable similarities.

Dogs of the FTSE is a simple investing strategy which says you should buy the ten FTSE 100 companies with the highest dividend yields and hold them for a year.

This sounds like a very similar dividend-seeking approach, but it is actually more of a ‘value’ strategy.

Once upon a time, high yielding companies used to have a pretty moderate dividend yield… until their share price fell off a cliff.

When a share price falls dramatically, the dividend may not be revised downwards for another 3 or 6 months. This leaves a very high dividend yield in the short term which doesn’t reflect reality.

The dogs of the FTSE tend to be companies which have

- Low investor expectations

- Recent bad news

- An uphill battle in the year ahead

The strategy is, therefore, a bet that the market generally over-sells companies having a tough time.

The differences between the Dogs and DGI should now be apparent.

DGI investors seek companies with a good track record of dividend growth which give no indication that this will change. The dogs of the FTSE, in contrast, are companies which have unsustainable yields.

A critique of dividend growth

So far, this article has explained how dividend growth investing works, and why it has attracted popular support.

In the second half, I will share the theory or counterarguments that suggest dividend growth investing has no merit.

Dividend policy shouldn’t matter

To financial and non-financial minds alike, dividend growth investing has many appealing elements. They include:

- Two types of compounding (reinvesting dividends into new shares in addition to seeing companies grow their dividend payments per share)

- Steady dividend streams

- Companies with a great track records

However while these ‘sound’ and ‘feel’ like a solid strategy – they don’t provide any theoretical edge over say; investing in companies which don’t even pay dividends. Here’s why:

A higher quantity of shares @ lower value = A smaller quantity of shares @ greater value

Let’s explore how this applies to dividend policies.

The act of paying a dividend is like slamming the brakes on business growth. Cash is what companies need to grow. So when a company distributes a dividend, it reduces the fuel available to its growth engine. But the plus side is that shareholders can reinvest their income into more shares.

If a company retains 100% of its profits, it can invest in new projects, hire more staff and potentially acquire other businesses. The value of the company, and therefore each share, would grow faster as a result. However the investor would receive no cash. Their total return would come from the appreciation of their existing holdings.

This is why the following equation explains why investors should be indifferent whether a company pays dividends or not. The left side of the equation represents a dividend-paying company, and the right side is a non-dividend payer.

More shares @ low value = Fewer shares @ greater value

Dividends are tangible and countable – so what?

If simple maths can demonstrate that a shareholder shouldn’t care whether a company delivers its return through dividends or share price appreciation, why do people prefer dividends?

I believe that it’s the tangible nature of cash income, combined with the stable nature of dividends.

However, in any effective portfolio, that cash income is immediately reinvested into more shares, therefore its presence in your investment account is only a fleeting moment.

Dividend income doesn’t provide any real security of return. If anything, dividends just create the need for you to place a trade to convert them straight back into intangible shareholdings.

The stability of dividends gives a false sense of security – it’s the volatile total profit number that matters to valuation.

The stability of dividends is also a misnomer. As we explain in the science of diversification, volatility hurts investment returns.

However, while the dividend amounts themselves are stable, they don’t contribute to a stable share price. That’s because investors don’t value a company based on its dividends – they look at its total profit number.

This is the true driver of value, because all profit can eventually be paid as a dividend.

Forecasts for total profits will fluctuate up and down as forecasts change, regardless of whether the company has a policy of paying dividends.

Dividend growth is an active investing strategy

Dividend growth investing relies upon the picking of companies which will outperform the rest of the stock market.

As we covered in our article Active funds versus passive funds, active strategies fail more often than they succeed for unavoidable reasons – namely their own cost base.

Some of this curse is the higher fees charged by active funds. You might be able to avoid this if you invest directly in companies yourself. However, have you considered how much your time is worth? If it takes you a few hours to research each company in a portfolio of 20 – you’ve spent hundreds of pounds of your time in setup costs.

Dividend signalling theory reaches a different conclusion

Dividend signalling theory is an academic viewpoint which delves into the reasons why managers choose to pay dividends. Through analysis of that decision-making process, it concludes that business which pay large dividends are not good investment prospects.

A successful business with excellent growth prospects will have access to investment opportunities which will provide a market-beating rate of return. These opportunities might include launching a new product line or expanding into a new location.

Managers have a duty to run the company on behalf of the shareholders, therefore if the company has an ability to generate a market-beating rate of return by seizing new opportunities – it should do so!

Therefore, signalling theory concludes that companies which pay low dividends must have access to such opportunities.

Conversely, it suggests that companies which consistently pay out a large proportion of their income dividends must have access to few opportunities. This doesn’t bode well for the future growth prospects of the company as a whole.

This is only a theory and isn’t the only driver behind dividend policies. Dividend signalling was disputed by the research paper ‘Surprise! Higher Dividends = Higher Earnings Growth, published by Robert Arnott and Clifford Asness in 2003. They discovered that companies which paid out a higher proportion of their profits tended to outgrow their conservative peers.

The authors suggested that this was because only confident managers would be comfortable with low coverage of the dividend. On the other hand, managers who are secretly concerned about their companies future will naturally be quite cautious when setting the dividend level.

Investing strategies are undermined by their popularity

Buying popular assets is very expensive, as prices will be premium. This is why active investing strategies don’t work for long.

If a group of assets have special characteristics which the market believes will give them a superior return, then the price of those assets will rise to the point where its new forward-looking return equalises with all other assets.

To expect that dividend growth investing will continue to work, is to believe that:

- There is strong evidence that these companies will outperform the market, based on historic data,

- Investors are ignoring this when bidding for or selling the asset.

Considering how widespread the dividend growth strategy is – why would we assume the second point is true? As we are not company valuation experts, we have no way to gauge whether the current market price already reflects heightened expectations.

Considering the sophistication of the market participants in the UK and US stock markets, it’s safe to assume it does.

Restrictive filters hinder diversification

Applying strict filters to a list of shares will quickly whittle thousands of options down to a hundred or less. This limits dividend growth investors to a very narrow list of companies, which can be unhealthy from a diversification perspective.

As the pace of economic and technological change accelerates, large companies are struggling. Disruption is now an established business model for high growth companies looking to topple titans of industry.

Read more: Books about economics

Entire sectors are being turned on their head by cash-rich newbies, willing to take risks to get to the top.

Facebook, Amazon, Apple, Netflix and Google have driven much of the US stock market bull run since 2010 which has seen the S&P 500 rise consistently over the period.

But here’s the twist – these companies pay low dividends, if they pay them at all. A dividend growth investor would have completely missed out on this class of company. Demanding a ten year period of dividends will guarantee that investors lose out on the high growth phase of businesses like Google.

My personal viewpoint

The dividend growth investing mania has brought many new investors into the stock market, which is a very good thing in general.

I think that too few people buy shares, and all-too-often, it’s only a lack of knowledge which is preventing these people from seeing the opportunities.

Read more: The best stocks & shares books

The dividend growth strategy isn’t terrible – it encourages a degree of diversification and expects its users to perform research on the track record of companies before investing. Historically, it has performed reasonably well.

However, there isn’t a compelling reason why dividend growth investing will deliver superior returns going forward, compared to holding a basket of shares in a passive index fund, for example.

A dividend paid out is worth the same to an investor as profits retained in a company. It’s still the same amount of value, still owned by the investor. On paper, dividend policy shouldn’t matter.

But different academic theories suggest that dividends do matter because they are a window we can use to analyse the confidence of management. Only, even these theories can come to opposite conclusions.

Ultimately, even if this strategy did work once upon a time – it shouldn’t work now. In an efficient market like the UK and US stock markets, popular investing strategies cease to work. The volume of cash chasing a particular group of companies will raise company prices until they lose their bargain status.

If you’ve enjoyed this introduction to dividend growth investing, I recommend you take the following course as a natural follow-on to this article. It explores the world of building a stream of passive income in far more detail and also deals with the practical side of managing an investment portfolio for dividends.

Course Progress

Learning Summary

The Ultimate Guide to Dividend Growth Investing

Dividend Growth Investing (DGI) is an investment strategy. DGI investors only invest in companies which have a track record of paying significant and growing dividends.

DGI investors view their portfolio as an income generator. They invest frequently, including during downturns, and seek to maximise the effects of compounding.

Companies with steady, growing dividends can be found using one of many free 'stock screening' tools which are widely available online.

Research into dividend growth investing has largely validated its performance over the last century. However, historic studies do not guarantee superior returns in the future.

Critics of dividend growth contend that it appeals to a human desire for tangible & stable returns, but offers neither. Dividends are immediately reinvested which makes them an admin burden. Returns are ultimately driven by the total profits of a company, not the stable portion which is shared as a dividend.

As an active investing strategy, DGI suffers from the curse of popularity. The very knowledge of the strategy will render it less effective, because DGI shares will be over-bought and poor value as a result of investors piling into a limited number of qualifying companies.

Ultimately Financial Expert doesn't promote dividend growth investing over the simple passive investing approach. Passive investing is cheaper over the long run, which provides an real edge.

Quiz

Take Action

- Are you still puzzled why I don't support dividend growth investing despite the strategy working on historical data? Read this article to learn about the ways in which backtesting can back fire.

- If you would like to shift your portfolio towards income-producing assets to take advantage of the income mindset, consider buying funds that distribute their income as dividends (usually labelled as 'Inc' or 'Income' at the end of their name) rather than accumulating (acc) funds. This will allow you to track your own income over time and map your progress towards an income goal.

Next Article in the Course

Before you move on, please leave a comment below to share your thoughts. Do you subscribe to the Dividend Growth Investing approach? Think I missed any arguments for or against?

Comments 2

Thanks for the nice article. Here is another one that looks at the performance from investing in dividend aristocrats: https://decodingmarkets.com/investing-in-dividend-aristocrats/

Thanks! Let us know what other kinds of information you’d like to see and we’ll try to add it in the future. Best of luck!