Buying shares is a proven way to grow your savings over the long term. Shares have produced an average return of between 5% – 8% annually. For this reason, many investors place shares at the centre of their investment portfolio. This guide will show you how to buy shares using a stockbroker or fund manager.

To avoid common investing mistakes, you should tackle investment decisions in the right order. So please check out the other topics in our Foundation course to see the bigger picture.

Guide at a Glance: How to buy shares

The simple steps to investing in the stock market

1. Your decision: shares versus funds

Investing in individual company shares

Investing in funds

2. Choose an investment platform

What to look for in an investment account

What features do you need?

3. How to buy shares

How to place a trade, step by step

4. How to buy funds

How to buy funds at the lowest cost

1. Your decision: individual shares versus funds

Before you race off to compare stockbrokers, you need to make an investment strategy choice first. Take a length amount of time to decide what to invest in, to give yourself a chance to reflect on any risky choices.

Do you want to invest directly into individual companies or do you want to pool your money with other investors in funds?

Regardless of your method, as I explain in the Science of Diversification, you will want to spread your money across at least 25 companies to reduce your exposure to specific risks. Share investments can carry unnecessary risks without diversifying in this way. The best funds to invest in usually contain more than 50 individual securities.

The pros and cons of buying individual shares

Pros:

Direct investing gives you precise control over the make-up of your holdings

Picking individual companies is much more fun and engaging than choosing between generic equity funds

By applying criteria, you can build a portfolio to fit your investing objectives, such as seeking dividends or capital growth

As you manage your own portfolio, you will avoid paying 'annual management charges' leveed on fund investors, which can exceed 1.5%

Cons:

Control means accountability. You may feel more pressure (and regret) when taking all decisions yourself

Choosing companies will require time-consuming research

A DIY portfolio will need re-balancing each year to prevent the more successful holdings dominating the others

Creating a diversified portfolio from scratch will require 20+ shares, resulting in 20 trading fees. This will represent a high upfront cost for smaller sums

Ideal for:

Investing enthusiasts following an active investing approach, who have the time and desire to perform detailed company research.

Why do people invest directly in individual companies?

The advantage of investing in individual companies is that you have complete control over your holdings. This makes it the only choice for active investment professionals and passionate amateur investors.

Granular customisation has many benefits.

Have a disdain for a particular company or industry? Don’t invest in it.

Have a passion for another company? You can purposefully back it with a higher allocation of your cash, and feel part of its success over the years.

Need to abide by ethical, religious, or professional rules on what you can and cannot invest in? Buying shares directly means that you will only place money in companies that you approve. The best companies to invest in will be different for each investor based upon their own personal ‘rules’ and filters they apply when screening out companies.

With your own manual portfolio, you will also enjoy a closer experience to what it is like to be a real stock trader on Wall Street.

The drawbacks of direct investing

Frankly, direct investing is a much larger task than picking a couple of funds. The number of decisions you will need to make to simply start your portfolio could be quite intimidating. Choosing a portfolio of 20+ companies will require hours of research at the outset.

You will also need to schedule in some time during the year to review your holdings and consider making tweaks to rebalance the value of different assets or even make strategic purchases or disposals.

Generally speaking, armchair investors are unlikely to possess the inside information or technical abilities which can match experience within the investing industry. Even the best day trading books can’t conceivably convert you into a pro overnight.

Therefore, can you be sure that you will have a consistent edge against the other professionals competing against you in the marketplace?

This is the question at the centre of the active trading versus passive investing debate. Which asks – is it worth trying to ‘beat’ the market, or is settling for the market average good enough?

Unless you plan to hold each company until your untimely end (or theirs), you will also need to grapple with the question – when is the right time to sell shares? This requires a clear view on the current outlook of the stock market.

Although direct investing offers the promise of ‘no management fees’, the cost of ‘doing it yourself’ can still be significant, and can sometimes outweigh fund charges.

This is because you will spend a sizeable sum to buy each batch of shares. At £8.95 per trade, it would cost almost £200 just to build a basic investment portfolio worth £10,000.

Even an expensive fund would charge less than this in annual management fees.

The pros and cons of buying funds

Pros:

By pooling your money with others, the administrative costs of managing the portfolio are shared across many investors this usually results in good value. Some charge as little as 0.2% per year

A fund can be purchased in a single trade, resulting in instant diversification across 50+ assets without any of the effort.

By mixing and matching different funds without your portfolio, you can still enjoy a good level of personalisation

Some funds trade at a premium or discount to the value of their underlying holdings, which can add an additional level of volatility (see investment trusts).

Cons:

The investment manager has total discretion over investments made, meaning that a fund could invest in companies which you are ethically uncomfortable with.

Funds don't remove all difficult decisions. Picking a good fund is just as tricky as picking the right company to invest in.

Funds usually trade once per day, meaning you will not be able to choose the precise price point to enter or exit the fund

Ideal for:

Keen savers with a healthy appetite for risk, and who want a low maintenance and efficient investment approach.

The benefits of investing in funds

Funds provide a quick and convenient route into epic diversification. They work by pooling your investment with other investor cash and buying many company shares to execute the funds’ investment strategy.

Funds allow investors to achieve instant diversification. All funds will invest in 10 companies or more, and some include as many as 1,000 companies.

Topping up your investments is easy. Most brokers allow you to create a standing order to push a regular amount into the account each month, with an instruction to direct it into specific funds. It’s investing on autopilot.

The investment strategies of funds are very diverse and may provide access to equity markets where you have little knowledge and would be difficult to research or trade-in yourself.

For example, the Vanguard Emerging Markets Index fund invests in 1,100 companies across countries as diverse as Argentina, Malaysia and South Africa. An individual investor could not feasibly replicate this portfolio without spending £5,000 in trading fees and weeks of labour.

In stark contrast, a fund investor could invest as little as £50 in this fund in under 10 minutes! In our Hargreaves Lansdown review and review of Interactive Investor, we highlight these brokers for their range of funds.

The drawbacks of fund investing

As the fund manager exercises discretion over the holdings of the fund, you lose the ability to make tweaks to your holdings.

You should perform diligent research on the fund in advance to gain an understanding of which companies the fund invests in. Funds give transparency by disclosing their top holdings in their fund factsheets on their websites.

Some funds charge ‘initial investment fees’ of up to 5% of your investment which will erode your capital before you even begin.

Stay away from any fund that charges an upfront fee. This is no longer the industry standard, and any attempt to charge this sends a clear indication that the fund is not seeking to attract the ‘smart money’.

Ultimately there are few disadvantages to fund ownership, which explains their popularity with investors. Funds are the lowest cost way to achieve the level of diversification you need to mitigate the specific risks of individual companies.

2. Choose an investment platform

Before you make an investment, you will need to choose an account to hold your money, execute transactions and hold your shares or funds.

Investment platforms go by many names:

- Stockbroker

- Share dealing service

- Investment account

- Fund supermarket

- Stocks & Shares ISA (UK Only)

What they all have in common is that they will provide you with a route to the stock market. Functionality and level of service will vary.

I’ve created a separate guide on how to compare stockbrokers and investment platforms which I recommend you visit for further reading.

Which type of investment platform will suit your needs? Only you can answer this question.

Some accounts, such as share dealing services or fund supermarkets may restrict you to one type of investment. Traditional stockbrokers will typically offer the broadest range of investment options.

However, don’t be suckered into signing up for an expensive account with features that you won’t need. If you only want to invest in funds, then consider simple accounts that only offer funds. The fund manager themself may allow you to invest directly with them at virtually zero cost.

When comparing stockbrokers, the most relevant information to compare will be:

- Total annual account charge

- Trading fees

- Any fees to transfer shares out to another investment platform

The first two will impact your cost of investing, and it’s healthy to check that you won’t be stung with an unreasonable charge if you want to switch provider in the future.

How an investment platform works

Stockbrokers have access to the trading platforms used by stock markets. They execute trades on your behalf, after receiving your instruction. Brokers receive most of their instructions online, as they charge a higher fee for orders placed over the phone.

Stockbrokers make trades on your behalf. The brokerage name, rather than your name, will appear on the shareholder register as the owner of the share. However, in all legal respects, you are still the owner of the share.

To fund your account, you will deposit cash in a similar way to an online bank account. Brokers treat your cash and investments in a very different way to a bank. Brokerage firms ‘ring-fence’ client assets from their own business assets.

This is different to banks, which pool your cash with other customer monies and use this to lend mortgages etc to generate a return. A bank puts your cash to work behind the scenes and gives you an interest rate as a reward. A brokerage is more like a guardian who acts only upon your instructions.

As your holdings are kept separately from business funds, investors will be able to recover their money and shares if the brokerage went out of business. You are still the owners of those shares and therefore these could be transferred to another brokerage to manage. Another brokerage would be able to receive a transfer of the shares and cash, which will remain untouched, as ringfenced funds cannot be used to settle debts.

If you’re interested in how the investment industry works, consider reading some of the best wealth management books.

3. How to buy shares

Placing a trade, step by step

Online investment platforms make trading shares easy. I’ll explain everything you need to know to buy shares successfully and in the shortest amount of time.

How to buy shares - brief overview

1. Open your favourite investment platform

Check you have enough cash for purchase

2. Navigate to the 'buy' or 'trade instruction' page

3. Provide the instruction

Identify the asset by ticker symbol or name

Confirm number or value of shares to buy

Choose whether to trade live or in the future

Opt for the shortest settlement period

4. Congratulations! You are now a shareholder!

From your account dashboard, navigate to the main trading screen.

Your broker will always need the following information before they can place a trade:

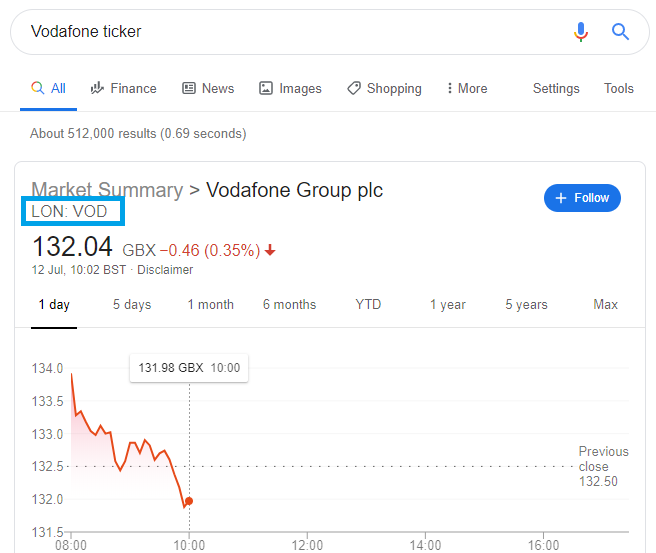

A) Ticker symbol. This is the shortcode which identifies each listed company, bond or fund. For example, BP’s ticker symbol is BP. Unilever is ULVR. You can find any ticker symbol with a simple Google search. Learn more about this in our article how to research company share prices.

B) Quantity of shares v amount to invest. Brokers ask you to either specify how many shares you want to buy, or how much you want to invest. I recommend you input the value you wish to invest and let the website do the maths to convert into a number of shares. More than anything else, this reduces the chance of human error. Shares are sometimes priced in pence (GBX) rather than pounds (GBP) which is one source of errors.

C) Live market price v limit order price. Brokers will ask if you want to execute at the next market price, or create a ‘limit order’ at a lower price which will only execute if the market price eventually falls to your price. Limit orders are effectively short term bets on the direction a share will move. If the share price moves down, you win, and if the share price moves up, you lose. The investor has no natural edge, therefore, using limit orders will not benefit an investor in the long run.

D) Settlement period. A broker may ask you to choose a settlement period, such as ‘T+2’ or ‘T+5’. This refers to the gap between the transaction date (T) and the ‘settlement’. The settlement process is managed by the broker and concerns the transfer of cash to the seller in return for the electronic share certificates. It is simply the completion of the transaction and the updating of records by both sides. Don’t delay this process. Always select the shortest settlement period.

The process takes less than 60 seconds from start to finish. The following sentence contains all the information you would need to execute a trade:

“I want to buy £2,000 of Next PLC shares (ticker: NXT) at the live price, to settle on a T+2 basis“.

After submitting the information, the broker will display a preview of the trade, including the latest price to allow you to check the details before confirming your order.

Enjoying this article? To read more about stocks & shares, check out our ranking of the best stocks & shares books.

4. How to buy funds

Before you can invest in a fund, you should understand which legal form the fund takes:

Exchange-Traded Funds (ETFs)

These is a popular type of fund which is listed on the stock market. See ETF definition.

Investment trusts

These are listed companies which buy investments. They have similar characteristics to a fund. See investment trust definition.

Mutual funds (unit trusts & open-ended investment companies)

These are private funds. While they aren’t listed on the stock market, their prices are publicly available, and you can still trade them daily with relative ease through most platforms. See unit trust and OEIC definition.

How to buy ETFs and investment trusts

ETFs and investment trusts are listed on stock exchanges just like companies. Therefore you can buy them in the same way you would buy any shares in the guide above.

How to buy mutual funds

There are several ways to buy mutual funds. The right choice for you will depend upon how constrained you wish to be in your investment choices.

You can usually buy units in a fund directly from the fund manager, by joining their website and depositing funds. You will only be able to use that account to buy other funds from the same provider.

You will usually need to mix and match funds from different providers to build a full portfolio. Therefore this route could lead to multiple accounts with different providers which will make your portfolio more bothersome to manage.

One step closer to simplicity is the fund supermarket option.

Fund supermarkets are investment accounts that provide a wide selection of funds and don’t restrict you to a single manager. Some fund supermarkets don’t charge transaction fees on fund investments either.

They will, however, charge an annual or quarterly fee for their service, which is usually around 0.5 – 0.75%.

Finally, if you want to buy shares while keeping all investment options open, you could use a stockbroker to buy mutual funds. A stockbroker account is likely to have a slightly higher account fee but it will provide the greatest amount of flexibility. These could include individual shares, ETFs and preference shares.

Course Progress

Learning Summary

How to buy shares and invest in the stock market

To buy shares online, choose a stockbroker or share deadling service.

To place a trade, find the ticker symbol of the company you wish to buy. This is a shortcode which identifies the share on the exchange.

You should buy at the live price, and opt for the transaction to settle as soon as possible. This is typically after 2 days, also known as 'T+2'.

Funds such as Exchanged Traded Funds (ETFs) or Investment Trusts are listed on the stock exchange. They also have a ticker symbol and you can buy them in a stockbroker or share dealing account alongside shares.

Unlisted funds, such as Mutual Funds and Unit Trusts are available via four main channels: Stock Brokers, Fund Supermarkets and buying direct from the fund manager.

Buying direct will restrict your choice of investments to the single provider with that account. Therefore this will require accounts with multiple providers.

Most investors use either a stockbroker or a fund supermarket to buy funds. A fund supermarket will restrict you to only investing in funds, whereas a stock broker account also allows shares.

Quiz

Take Action

- When you have completed the rest of the Foundation articles, return to this guide to as a reference when making your first trades in the stock market.

Next Article in Course

Before you move on, please leave a comment below to share your thoughts. Did you find your first investing experience easier or more difficult than you imagined? Have you encountered any nightmares while trying to trade?

Comments 4

In the article you can find answers to frequently asked questions about investing in business The publication will arouse interest because many are concerned about the problems of investing in business It will be useful both for beginners and those who already have experience of such investments

whoah this blog is great i love reading your posts. Keep up the good work! You know, a lot of people are searching around for this info, you can help them greatly.

Great overview of the basics!

I would have liked the article to have explained other costs of buying shares ie UK stock market charges