Foundation Course

Take your first steps towards money confidence and financial independence with our free course for beginners

Your course here?

We could help introduce curious and motivated students to your courses, contact us for details.

Foundation: at a glance

Introduction to the stock market

Understanding risk & reward

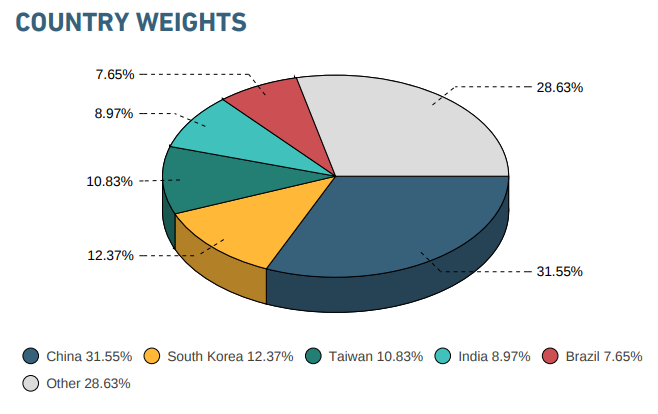

The science of diversification

Building an investment portfolio

Avoiding investment scams

Complete all topics to graduate!

1

Is it time you unlocked the growth potential of your money?

10 min

- What is the Saver's Dilemma, and how does it hold us back?

- Should we save or invest our money?

- What is the most common costly financial decision?

- What are the alternatives to savings accounts?

2

Become familiar with the world most popular investment

12 min

- What are shares and how do they work?

- What are the different ways an investor can profit from shares?

- An introduction to dividends

- Why are shares such a popular investment?

Inspiration - the power of compounding

Did you know that investing £400 each month for 25 years could grow to...

With a stock market return of 7%

- Take our quick questionnaire to receive a risk tolerance rating

- Understand which investments may not be suitable for your tolerance

- Find the investments which complement your risk profile

- Explore the time horizon concept and calculate your own time horizon

- Discover any investments which are not compatible with your time horizon

- How to split your portfolio to maximise returns

Further research: definitions

- Learn the different methods of buying shares

- Introduction to ticker symbols

- Definitions and jargon used by stock brokers

- The step-by-step process of placing a trade online

- Understand how corporate bonds work

- Why do companies issue corporate bonds?

- The popular (and unpopular) ways to access this asset class

Mastery: Bond bonanza

A core holding for stable returns

- An introduction to the different types of investment risk

- How volatile investments reduce your long term return

- Why diversification is a no-brainer

8

Let's bring together what you've learned so far, and create something special

10 min

- The half-way milestone in the Foundation Course

- Bringing together and refreshing the theory covered so far

- Why professional investment portfolios look the way they do

- How to build a portfolio from scratch

Mastery: portfolio management

Manage your investments like a professional with this series of explainers

- The difference between regulated and unregulated investments

- How protected is your money?

- Who can you trust online?

- How to tell the difference between a scam and a legitimate website

10

How to choose between these two different investment strategies

15 min

- A comparison of the passive and active investment strategies

- The pros and cons of each approach

- How to choose between approaches as a new investor

11

The reliable and free places to get your hands on the latest information

6 min

- How to find live share pricing, for free

- How to interpret basic online financial information

- How to gain free access to the financial statements of companies

12

Let's consider the factors we should consider when deciding whether to invest now

12 min

- What does perfect timing look like, and is it possible?

- Two core theories that attempt to explain why investors fail at market timing.

- How to choose a healthy mindset to avoid over-trading.

13

Helping you choose an excellent investing 'partner' for the long term

9 min

- What should you consider when picking an investing platform?

- How do traditional stock brokers compare against modern competition?

- Why you should think 'long term' when comparing your options.