Here’s the low-down on the best forex and CFD brokers who accept UK retail clients. Beginning with our favourite, we’ll add more brokers to this page until it represents a complete overview of the regulated UK market of respected brokers.

Risk warning: Forex trading and CFD trading is a high-risk investment activity

As we explain in our beginner’s guide to forex trading, forex trading can be a high risk investing activity, which may only be suitable for sophisticated investors.

Currencies tend to move in only small increments on a daily basis. Forex brokers often provide CFDs, margin trading or trading on leverage to allow traders to amplify returns from their currency exposure.

This increases the volatility of the investment, relative to the traders capital, and could increase the risk of a total loss of capital (or in some cases, a loss greater than initial capital).

CFD providers report that between 50% and 90% of accounts lose money when trading CFDs with providers. You will help support Financial Expert remain free to all users, by using the referral links below, as the site will receive a commission for users who sign up through these links (at no additional cost to users).

The best forex / CFD brokers

Established broker in Italy brings competitiveness to UK

Fineco is a CFD an Italian equity trading broker that is expanding into the UK. It is making waves with its appears to be leading to better client outcomes, which is just one of the reasons we currently rate it as the best CFD broker for UK traders.

Fineco is the No.1 bank in Italy according to Forbes.

Trading platform: Fineco UK offers trading via a proprietary web platform accessed through the browser.

Fees: Fineco only charges the underlying market spread on share CFDs and does not generate revenue from an additional spread like other brokers. Currency conversion also occurs without spread. Spreads vary by market. No inactive fee is levied on funded accounts if you don't trade for a period. Other fees apply.

Best for: Day traders

Minimum initial deposit: £0

Regulation: Fineco falls under the temporary permissions regime of the Financial Conduct Authority, in addition to Italian regulations. Deposits are protected (up to €100,000 by the Italian deposit protection scheme).

Low trading fees

Account charges

Reputation

Overall

77% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

One of the original and best CFD brokers

CMC Markets provides spread betting and contracts for difference and more to UK retail investors. With a browser trading interface that is recognised as one of the leading trading platforms, CMC enables trading in 12,000 instruments at competitive spreads. You can open an account to try their demo account without making a deposit to see their website for yourself.

CMC Markets was awarded Best Forex Broker 2023 (Good Money Guide Awards).

Trading platform: CMC Markets can be access via their proprietary platform or via MetaTrader 4.

Fees: CMC Markets charges spreads on most trades, plus a share commission charge on equity positions. Spreads vary by market. Other fees apply such as fees for overnight funding (positions held overnight), currency conversion, guaranteed stop orders. Funded accounts left inactive for one year will attract a £10 monthly inactivity fee. Please visit the CMC website for details of all spread fees, account fees and overnight holding charges.

Best for: CFD & forex traders.

Minimum initial deposit: £0

Regulation: CMC Markets UK plc (173730) and CMC Spreadbet plc (170627) are authorised and regulated by the Financial Conduct Authority (FCA) in the UK.

Low trading fees

Account charges

Reputation

Overall

69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

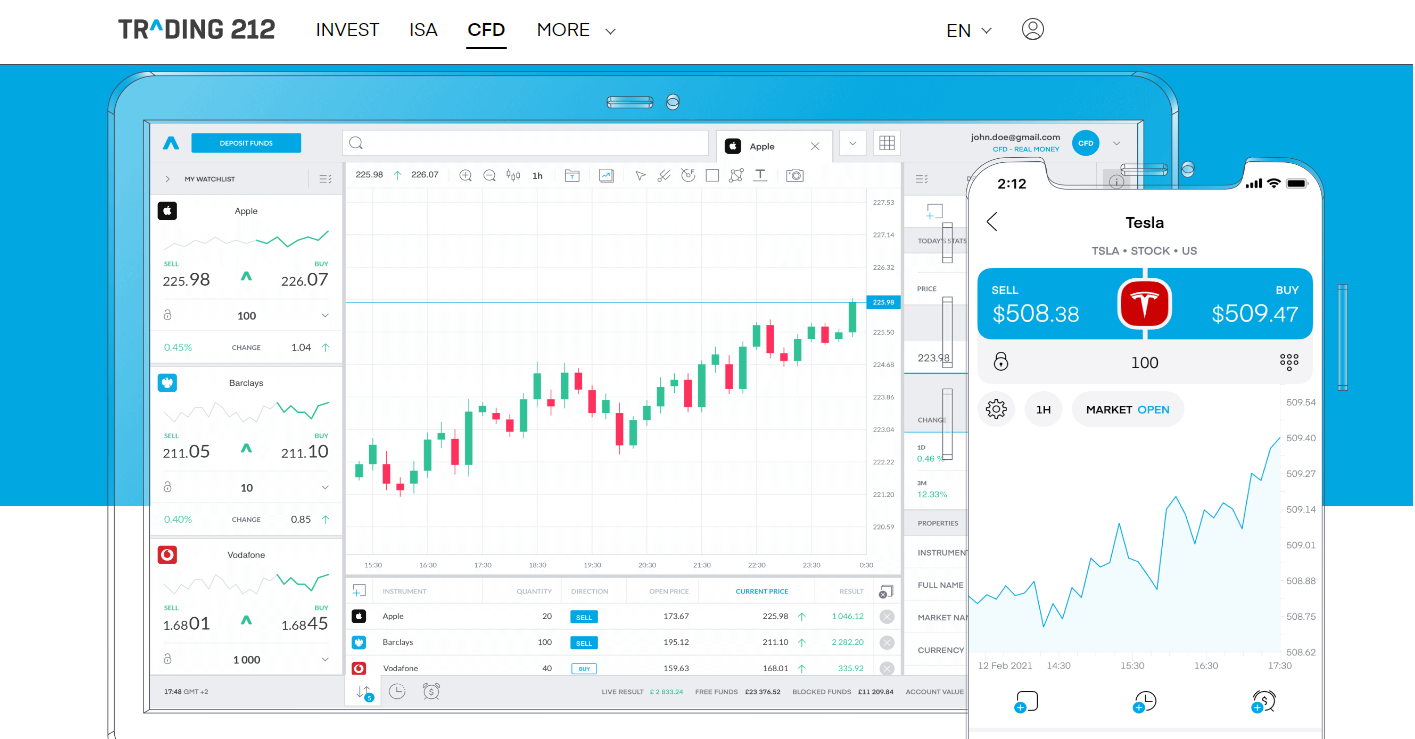

Responsible trading, at scale

Trading 212 is the UK-based CFD provider and stockbroker that caters to 1.5 million traders around the world. This incredible scale is paired with responsible management. The firm strategically paused onboarding for new clients during the pandemic to ensure that it could continue to provide an excellent trading service to its existing clients, rather than chasing growth at all costs. Its Trust Pilot rating of 4.6 shows that this broker has built a brand and reputation on fair dealing and high client retention.

Trading platform: Online platform.

Fees: No commission charges, 0.5% FX charge, 0.7% charge if using a card to fund account with >£2,000 (no fees for deposits made via bank transfer), interest SWAP (roll-over fee) applies to trades held open for the next day. For more information on charges, please refer to the Trading 212 website.

Best for: Day trading

Minimum initial deposit: £1

Regulation: Trading 212 UK Ltd is registered in London and is regulated by the FCA.

Low trading fees

Account charges

Reputation

Overall

83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

A great choice for trading Forex CFDs

Plus500 is a massive CFD provider with a broad forex offering. Plus500 offers CFD trading on over 60 forex pairs, with up to 30:1 leverage. At 30:1 leverage, a £500 deposit could be used to take a £15,000 trading position on a currency pair.

Trading platform: Plus500 trading is done via its own trading platform.

Fees: Plus500 charges no commission on CFD trades. Spreads vary by market. Other fees apply such as fees for overnight funding, currency conversion, guaranteed stop orders and an inactivity fee after 3 months with no account login. Please visit the Plus500 website for more information.

Best for: CFD traders.

Minimum initial deposit: £100 (although this varies depending on payment method)

Regulation: Plus500UK Ltd is authorised and regulated by the Financial Conduct Authority (FRN 509909)

Low trading fees

Account charges

Reputation

Overall

84% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Find out more about trading forex

If you’re interested in learning more about trading forex, either through day trading or swing trading, consider the following sources:

The best forex trading books – in this article we pick our 5 favourite forex books written with beginners in mind. Successfully trading forex is difficult, like with any financial market, therefore it pays to educate yourself and learn from the mistakes of others before you begin.

How to trade forex for beginners – this is our flagship forex article which seeks to explain how the forex market works, and how traders leverage price movements to seek a positive return.

Thanks for visiting our guide to the best forex brokers for UK retail investors. Please let us know if you have any broker suggestions in the comment section below.

Comments 2

How do I make a formal complaint against a Company in London, UK whom I don`t believe is Registered under the Financial Conduct Authority and is committing acts of Fraud against myself.

Author

Beyond reaching out directly to the company in question, ‘complaints’ on their own only really have power if they are made in accordance with a regulatory framework that provides additional enforcement, such as the Financial Ombudsman Service. If the firm you have an issue with would not fall within the scope of an independent adjudicator such as the Ombudsman, you may only have recourse through the police or through a civil action in the courts. In which case you may need a solicitor to advise you of your options. I would recommend speaking to consumer rights groups like Citizen’s Advice to see if they could suggest any other free routes to exhaust before turning to the more costly options.