Stocks & shares ISAs are a ‘tax-sheltered’ investment account. This means that the government gives favourable tax treatment to assets held inside an ISA, compared to if you held in an ordinary stockbroker account. You can search high and low for the best stockbroker (UK), but always struggle to find benefits that outweigh the simple advantage of being sheltered from tax. But are stocks & shares ISAs tax-free? Or do they only protect from some taxes?

In this guide I’ll walk you through the basic tax treatment of each key tax. The results may surprise you

Important tax disclaimer: For professional tax advice tailored to your circumstances, find an independent financial adviser using our impartial guide. A financial adviser could also offer advice on how investments are taxed in the UK, the best funds or companies to invest in. Financial Expert is not authorised to provide financial advice. This is a journalistic article, written with due care, but we offer no guarantees as to its completeness or accuracy and you should not rely upon it for investment decisions. One reason for this is that tax rates and rules change often, and therefore information can become obsolete quickly. Therefore I will provide links to the relevant HMRC website pages which will allow you to perform your own research.

Are Stocks & Shares ISAs Tax-Free?

The simple answer is no. Stocks & shares ISAs are not totally tax-free. It surprises some, but the truth is that stocks & shares ISAs aren’t a universal panacea for taxation. The best books about saving tax will point out that ISAs are designed to protect your assets from some taxes but not others.

Let’s find out which taxes ISAs were built to block, and which taxes they don’t protect you from.

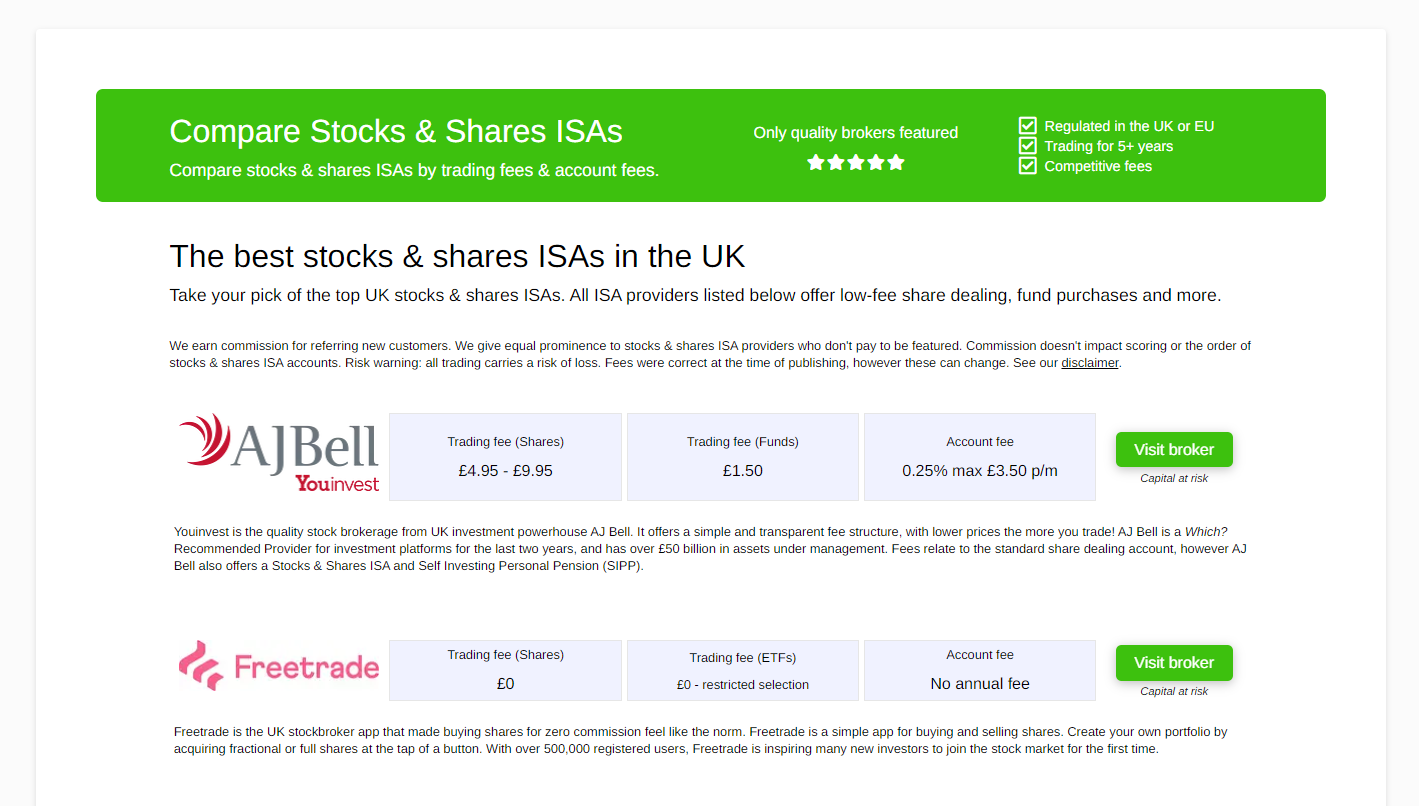

Which are the best stocks & shares ISAs?

We’ve shortlisted the best of the best stocks & shares ISAs below to help your search:

Large UK trading platform with a flat account fee and a free trade every month. Cheapest for investors with big pots.

The UK’s no. 1 investment platform for private investors. Boasting over £135bn in assets under administration and over 1.5m active clients. Best for funds.

Youinvest stocks & shares ISA offers lower prices the more you trade! Which? 'Recommended Provider' for last 3 years.

Buy and sell funds at nil cost with Fidelity International, plus simple £10 trading fees for stocks & shares and ETFs.

Capital is at risk

Please also see our Hargreaves Lansdown review, our AJ Bell review and interactive investor review.

Stocks & shares ISAs shield assets from these taxes:

- Income tax – Dividends

- Income tax – Interest

- Income tax – Rental income (through dividends)

- Capital gains tax

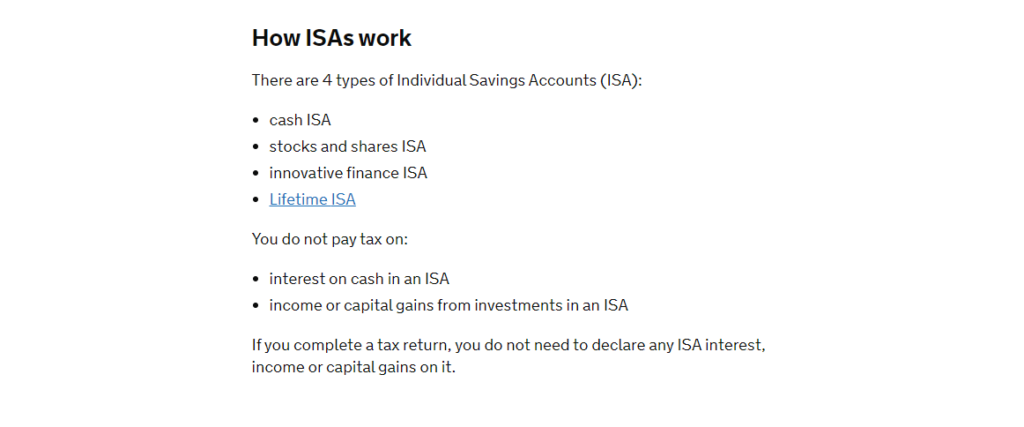

Income tax

Income tax is paid on wages, self-employment income and any income generated from investments. Income tax forms about 25% of the tax revenues raised by HM Treasury, making it the largest single source of income for the government.

Stocks & shares ISAs provide a perfect shield from income tax. This is underlined by the fact that you don’t need to disclose any income from your ISA investments on your tax return.

Income in a stocks & shares ISA can take several forms:

- Individual company shares and equity funds pay dividends

- Bonds and bond funds pay interest coupons

- Real Estate Investment Trusts (definition) make distributions that take the form of dividends but represent property income

Read more: The best dividend books

Fortunately, HMRC applies a simple rule for income in respect to these categories, by declaring that no ISA interest or other income needs to be declared on a tax return.

You wouldn’t expect a government to make it so easy to avoid tax when investing. But providing tax perks creates an incentive for responsible citizens to save for their future, which reduces the burden of retirees on the government.

Capital gains tax

A capital gain is an appreciation in the value of investments during the period of ownership. A capital gain is measured as the selling price less the buy price, with some added complexity for assets purchased a long time ago.

At the point of selling an asset, the capital gain is said to have ‘crystalised’. This date determines which tax return you would declare the gain and be taxed upon it.

Small capital gains have been exempt from tax for decades. HMRC gives an ‘annual exemption limit, which allows investors to not report capital gains in a tax year so long as total gains don’t exceed the exemption limit. You can read the latest annual exemption allowance here.

Stocks & shares ISAs provide a perfect shield from capital gains tax. Like income tax, you simply don’t have to disclose capital gains of any size, so long as they occurred within a stocks & shares ISA.

Stocks & shares ISAs do not protect assets from:

- Stamp duty

- Inheritance tax

- Corporation tax (indirect)

This is true of all accounts. Even the best stocks & shares ISAs don’t hold an edge over other ISA providers when it comes to these limitations.

Stamp duty

Stamp duty reserve tax is a transaction tax paid when shares are transferred from one owner to another.

Not to be confused with the stamp duty land tax levied on property transactions. Stamp duty is 0.5% of the transaction value and is rounded up to the nearest £5. It has stayed at this rate since the tax was launched in 1986.

Stocks & shares ISAs do not allow investors to escape stamp duty. This is unfortunate, particularly for investors building a small but diversified portfolio of individual company shares.

The ’rounding up’ rules increases the effective tax rate on transactions under £1,000. £5 is 1% of £500 and 2% of a £250 trade.

Some of the best stockbrokers in the UK offer fee-free trading of stocks & shares which actually means that investors don’t pay the stamp duty reserve tax. However, these commission-free investment accounts are not stocks & shares ISAs.

Inheritance tax

Inheritance tax is a complex area of taxation, so the below is only a brief overview. The best inheritance tax books will provide a much better guide, particularly for unusual scenarios.

Inheritance tax, currently 40%, is charged on the value of the estate of the deceased which exceeds the ‘nil rate band’. The nil rate band is £325,000 for 2020/21.

When the first spouse dies, their estate can pass in its entirety to their partner without any IHT being charged. In such cases, the deceased also gifts any unused nil rate band. Meaning that on the second death, the effective nil rate band could be as much as £650,000.

Still, with average house prices being as high as they are, many families find themselves with an estate worth more than the nil rate band.

A stocks & shares ISA does not provide protection from inheritance tax. The ISA can transfer tax-free from first spouse to the second, but this is true of all assets, and is not the result of any favourable tax rule. On the death of the second spouse, the full ISA account will be included within the estate value like any other investment held outside an ISA.

Corporation tax

Funds and companies you invest in will continue to pay corporation tax on capital gains etc inside the fund, irrespective of whether you hold the investment inside a stocks & shares ISA or not.

This makes complete sense, given that the fund will not even be aware of how their units or shares are held. Tax rules are set at the fund level, not at the investor level.

Some collective investment schemes, such as Investment Trusts and Real Estate Investment Trusts have very generous tax rules to help avoid income being taxed multiple times by the time it lands in an investors bank account. But others don’t.

Therefore even if you’re holding a fund inside a stocks & shares ISA, it’s worth performing research to understand how tax-efficient the underlying fund structure is before you make a long term investment. To learn more about corporate taxes, check out the best corporate tax textbooks available.

Summary: are stocks & shares ISAs tax-free?

I hope this article provided a useful summary of whether stocks and shares ISAs are tax-free. As you will have read, the answer is ‘almost’, and you need a good understanding of 5 different taxes to appreciate the true tax position of a stocks & shares ISA.

Everything you need to know about stocks & shares ISAs

- What is a stocks & shares ISA?

- What investments can be held in a stocks & shares ISA?

- How to become a stocks & shares ISA millionaire

- The history of stocks & shares ISAs

- Who can open a stocks & shares ISA?

- What is the minimum amount needed to open a stocks & shares ISA?

- Are stocks & shares ISAs only available in the UK?

- Full list of stocks & shares ISA providers

- How risky are stocks & shares ISAs?

- What fees do stocks & shares ISA accounts charge?

- What is the current stocks & shares ISA allowance?

- Are stocks & shares ISAs tax free?

- Do you need to disclose income and gains in stocks & shares ISA on your tax return?

- What happens to a stocks & shares ISA when I die?

- Stockbroker reviews (UK)