Welcome to our comprehensive guide on how invest in property. In this article we will delve into property as an asset class, and debunk several myths. We will also explore six different methods you can use to invest.

Property, also known as real estate, could be a valuable addition to an investment portfolio. Property complements the ‘balanced’ and ‘adventurous’ risk profiles. Quickly discover your risk profile here.

Is your Primary Residence an Investment?

Millions of people already invest in property when they buy their first home. However, we do not recommend that you view your dwelling as a part of your investment portfolio.

You will always need a place to live in. Therefore, unlike your investments in bonds and shares, you may not see any proceeds from your home until you leave this earth.

Therefore your home’s value is somewhat inconsequential to any savings goals you might have in the meantime, such as building an investment income for retirement.

Furthermore, the inclusion of a house in a portfolio is likely to inflate your portfolio’s value. This may lessen the sense of urgency for additional savings, which would be counterproductive.

Once we take the home off the table, many portfolios appear to neglect property. Therefore we hope you will benefit from this guide on how to invest in property. We will hopefully pique your interest and prompt you to further research the investment routes that appeal to you.

Why do People Invest in Property?

Property has an excellent investment case, but not perhaps for the reasons chiefly tossed across dinner tables and pubs across the country. There are many pros and cons of real estate investing.

In some circles, property investment is a ticket to ‘get rich quick’. The following is an example article from a Google search for ‘How to Invest in Property’, which gives an insight into the hubris that sometimes surrounds this asset class.

This guide will dispell this myth – property does not have magical characteristics. In fact, until the 21st Century, property consistently returned less than the stock market. This shouldn’t surprise, given that it has less risk than the stock market.

Returning to the basics; property is attractive because it:

- Has a positive expected return which is likely to exceed inflation

- Has a low correlation with equities (the stock market in general)

Our article on diversification explains the benefits of low correlation investments. Property prices and rental income will vary year to year, but it will vary in a different pattern to the stock market or bonds. Therefore, placing these in a portfolio alongside those asset classes will smooth out choppy returns. An investor who reaches beyond bonds and shares to property will build a broader and more robust portfolio.

Even though property may not live up to the unrealistic expectations created by investment seminars newspapers, it has earned its place in an investment portfolio.

What is the Realistic Return on Property Investment?

Return on property investments come in two forms: rental income (measured as rental yield) and price increases.

Rental Income

Rental yield is the rental income of a property, divided by the value of the property. It represents the annual return on property investment before factoring in any increases in property value. This is useful when comparing with shares, which produce a dividend yield.

A typical landlord in the UK will earn a net rental yield of between 1-5% after all maintenance, letting agent fees and taxes have been considered. There is a huge variance across regions and property types. Student lets are consistently the highest yielding category. Student properties do however come with greater risks, such damage from unruly behaviour!

You may assume that a 1% net rental yield would be an unacceptable return for landlords. Anecdotally, it would appear that they agree! In 2018 the market saw a wave of landlords exiting the buy-to-let market. A series of unfavourable tax and rule changes triggered this exodus. These have increased costs and therefore have squeezed the net rental yield enjoyed by investors.

Be wary of brochures that quote high yields such as 8%. This may be referring to the gross rental yield instead. Gross yield only compares the rent to the price and does not factor in expenses. In other words, it measures the revenue generated rather than the profit seen by the investor.

Price Increases

Having established that rental yields are relatively low numbers for most properties, it will not surprise readers to learn that price increases have driven most of the returns seen by investors in recent decades.

House prices have increased strongly in the last two decades, producing windfalls for those lucky enough to have invested at the turn of the century.

It is important to remember that much of the gain over this period has been caused by inflation. The inflationary element does not really represent a true gain, as it merely allows the value to keep up with the increasing price of the same goods and services.

For example, you may hear older generations talking about buying a house for only £10,000 in 1975. I hear stories like this all the time. They cause younger people to despair at how ‘easy’ the previous generations had it.

Let’s put these old numbers in the proper context. £10,000 in 1975 is actually equivalent to £95,000 at today’s prices. In other words, £10,000 was a huge amount of money, because both wages and prices were far lower. The average annual salary in 1975 was less than £3,000. A £10,000 house was perhaps not such a bargain after all. It would have still taken years of saving to buy a house at that price.

That being said, it is true that house prices have consistently outstripped the growth in inflation and wages and are more expensive now than in any other decade.

During the last two decades, the average house has risen from £65k to £215k (source). This is an annual return of 6.1%. Prices in London have exploded in comparison to the rest of the UK, seeing gains of 8%.

Historically, rental yields of 1-5% per year are typical, combined with price increases of 4-8% per year.

Will Property Values Continue to Rise in the Immediate Future?

The meteoric rises in market values have generated most of the buzz that circles around the property market.

It is incredibly difficult to predict the short term direction of an asset. However, after many years of growth, the UK property market has become an asset bubble. This bubble lingers within a weak British economy. An economy which may suffer further shocks whens it leaves the European Union.

Estate agent Knight Frank expects average house price increases of 2% per year until 2025. If true, this implies that house prices will barely keep up with inflation.

The following arguments help to explain why a surging housing market may stall:

- The most reliable driver of house prices throughout the last century has been growth in household incomes. With a limited supply of homes, prices increase with wages, as buyers can afford to throw more money at the seller when bidding. House prices have risen sharply since the 2008 financial crisis, despite a small increase in wages. This leads commentators to conclude that house prices have become unsustainably high.

- In fact, the ratio between average incomes and average house prices have reached a record high in this decade. History has shown that when the ratio spikes, it later reverts to the average. A return to an ordinary ratio would require a imply in house prices will occur.

- The UK is currently experiencing a historically low era of interest rates. This has inflated house prices by enabling buyers to borrow more funds through extremely cheap mortgages. This era will eventually pass. The eventual return to normality will create downward pressure on prices as buyers firepower reduces.

- We expect developed economies to enter a downturn phase in 2020-2025. This assessment is on the basis that the current upward expansion since the great recession of 2008 has already lastest longer than the average economic cycle. House price falls typically accompany economic downturns.

Is Property a ‘Safe’ Investment?

The ‘conventional’ wisdom is that property is a safe asset. You may have heard the phrase ‘safe as houses’ or ‘house prices can only ever go up’.

Given that London homes have seen a 4.4% drop in value over the 12 months to 2019, this belief is under pressure.

Nobody disputes that property is expensive. A house costs an average of 7 times median earnings compared to 3 times earnings a few decades ago. However, there are reasons believe this situation could persist over the long term. Fundamentally, the UK consistently builds fewer homes than it needs and nothing suggests that this trend is about to change.

The shortage of new homes creates a market in which buyers chase a limited supply of housing. In this ‘buyers market’, buyers must outbid each other to secure a home. This keeps prices at the edge of affordability.

What price is affordable, however, may reduce. As discussed above, interest rate rises or an economic downturn will reduce prices in spite of no reduction in the desires of young people to own a house.

The Risks of Leverage

The key reason why property appears to deliver astonishing gains is that people often invest with a combination of a small house deposit and a large mortgage.

This has the effect of ‘leveraging’ the investment, which amplifies gains or losses. Anyone could do the same with shares and also experience huge returns if the market moved favourably. Spread betting is essentially stock market investing with leverage, but as we explain in our spread betting guide, the risk and volatility can become toxic to long term returns.

If the housing market turns against a leveraged investor, the owner can experience ‘negative equity’. This occurs when the market price of the property has fallen to the point where their deposit has been wiped out.

Example: You buy a £200,000 house in cash which subsequently drops in value to £150,000. You have suffered a 25% loss but you still have an asset worth £150,000.

Alternatively you could have invested with a mortgage. If you had saved up a house deposit of £50,000, you would require a loan of £150,000. If the same price drop occurred, you would continue to owe £150,000 on a house now worth £150,000. Because the bank has the first claim on the house, you have no asset (or ‘equity’) left – your £50,000 deposit has suffered a 100% loss.

The use of mortgages on investment property is a curious phenomenon. Retail investors are continuously advised to not borrowing money to invest in other asset classes. ‘Margin’ stockbroker accounts are only suitable for sophisticated investors, and leveraged commodities Exchange Traded Funds are widely considered to be dangerous and not suitable for long term investment.

Yet leveraged investment in property is the norm, not the exception. When researching how to invest in property, an investor is likely to hear mentions of mortgages as frequently as houses!

If interest rates stay low and if banks are willing to lend, mortgage-backed buy-to-let investments will continue to deliver strong returns if the market continues upwards. But now that the economic tide is turning, many of those ‘ifs’ may fall apart. Many landlords will soon be left shirtless when the tide goes out.

Financial Expert generally advises against borrowing funds to make investments. However, as this is a possible means of how to invest in property in the UK, we will continue to discuss it below.

How to Invest in Property

1. Direct Investment in Property

The original method of investing in property is to get in touch with the ever-hated estate agent and purchase some investment property.

This usually takes the form of apartments and houses to let in the UK, or a holiday property abroad.

It is traditional to use buy-to-let mortgages to finance up to 75% of the property purchase, although some investors simply buy the property with cash.

The interest on any borrowing will eat away at much of the rental yield, however, it will amplify the effect of any house price increase when you come to sell.

Advantages:

- Leverage can be used to multiply returns if prices are rising.

- Owning a real asset can be a rewarding experience for ‘hands-on’ investors who enjoy seeing their money working for them.

Disadvantages:

- Being a landlord means taking on legal risks and needing to comply with many complex regulations.

- Both the Conservative and Labour political parties favour homeownership over the rental market. The attractiveness of property investments could worsen further if adverse tax and regulation changes continue to emerge.

- Managing a property can consume a surprising amount of time. Letting agents can help with the administration but this will reduce your returns.

- Investors of modest means cannot diversify across enough properties. Owning one or two properties leaves a landlord very vulnerable to empty periods or a catastrophic event such as flooding.

- Properties are illiquid investments and transaction costs are high. It may take up to a year to achieve a good market price for a property sale. This means that the time horizon needed for direct investment is 5- 10 years.

2. Shares in Listed Property-related Companies

Listed property companies include construction firms, housebuilders, estate agents, property developers and large landlords. Our ‘How to buy shares’ guide walks through the share buying process.

Owning shares in a property developer will not be identical to owning a house, but these companies will generate higher profits when house prices rise, which will deliver higher dividends and/or capital growth. You may already hold shares in such companies already, but this can be multiplied through an investment in a real estate themed exchange-traded fund (ETF).

Advantages:

- As investments, shares are highly liquid and can be sold immediately in an emergency. However, shares are volatile as an asset class. Therefore, we still recommend they are only held if your time horizon is longer than 5 years.

- You can hold such shares in a tax-free stocks & shares ISA, subject to annual limits.

- Share investors wondering how to invest in property without making dramatic changes to their portfolio will appreciate the simplicity of this approach.

Disadvantages:

- The share price of property companies will not move in line with house prices. At best this method will provide an investor with ‘indirect’ exposure to property prices.

- It may be difficult to diversify away all specific risks attached to the companies themselves. There are fewer than 20 property companies listed on the main market of the London Stock Exchange. You may already own these companies through equity funds. This may lead to a concentration of a chunk of your portfolio in just a handful of companies.

3. Collective Investment Schemes

The following options illustrate how to invest in property using investments that pool your funds with those of other investors.

3.1 Property Crowd Funding Platforms

Since 2010, a number of property crowdfunding platforms have appeared on the UK scene and illustrate how to invest in property in the digital age.

These platforms act as both an investment vehicle and letting agent, in bringing investors together to collectively buy and let real properties.

The most established platform of its kind in the UK is Property Partner. The sizeable employee base of the company seek out property opportunities, launch a funding campaign on their website. Once the funding amount been met, Property Partner will buy and manage the property on the members behalf.

As an investor, you are awarded given ‘shares’ in the Limited company created to purchase the property. Based on your share, you will eventually see a monthly stream of rental income appear in your account as dividends from the company.

Property Partner has some properties in some very interesting locations, which can be seen in the map view below:

You can sell shares via the ‘secondary market’ on the platform. This works much like a mini-stock market, with buyers and sellers placing orders for properties at desired price points. An investor can choose to sell immediately by agreeing to the highest price currently offered by a buyer. Likewise, an investor can buy shares in an existing property immediately by accepting the lowest price offered by the sellers.

The secondary market is a useful feature but is not as liquid as a stock market. Transactions could stall if buyers or sellers dry up. This may occur if negative news emerges about Property Partner, or if the property market enters a downturn.

To protect investors from the failure of the secondary market, Property Partner uses anniversary milestones. Five years from the date of each property funding, all investors will be offered the opportunity to sell their shares at an official surveyor valuation price.

Read more: The best property valuation books

If these shares are not taken up by other investors, then the property itself will be sold and the full proceeds from the sale will be distributed to all investors. This mechanism ensures that investors are not locked in for more than five years.

Property Partner charges a number of fees for its platforms and services. It charges 1.2% on accounts worth under £25,000 or 0.7% on accounts worth over £25,000. Transaction fees of 0-2% apply to new investments. This varies depending on your account value and the timing of the investment.

Rental income is distributed after all expenses such as letting agent fees and maintenance have been deducted.

Advantages

- Property Partner provides access to real buy-to-let returns without the administrative hassle of becoming a landlord.

- A low minimum investment requirement allows investors of any size to diversify themselves across 20+ properties across the UK. In the direct investment market, this was only possible for very wealthy individuals.

- Each property is held in an individual company, separately ring-fenced from Property Partner itself.

Disadvantages

- The fees charged will erode returns. However, the fees charged by Property Partner are not significantly higher than the fees incurred by landlords. Landlords pay up to 3% in estate agent fees to sell a property, whereas it is free to sell properties on Property Partner. Furthermore, if you value your time, Property Partner fees are justified by the hundreds of hours saved which you would need to spend to build a portfolio of properties yourself.

- If the secondary resale market fails, you could be locked into an investment for up to five years before you can sell your investment.

Check out Pounds and Sense for reviews of other property crowdfunding platforms.

3.2 Property Unit Trusts & Investment Trusts

Unit trusts and investment trusts are popular with retail investors seeking exposure to a wide range of sectors and asset classes. Property is no exception.

Property unit trusts feel like ordinary funds. You invest a minimum amount into the fund, and the fund manager pools it with other investors. A fund manager will invest the pool in a range of properties, according to the fund’s stated strategy. Fund strategies include property income, commercial property and student accommodation.

You can find a long list of property unit trust options on this list maintained by The Association of Real Estate Funds.

Advantages

Shared ownership in a diverse range of property, with the ability to buy and sell units quickly. Small minimum investment. Many are ISA compatible.

Disadvantages

- Potentially high initial and annual management fees. (up to 5% and 2% respectively).

- While professional fund managers will pick property investment opportunities, choosing investment trusts doesn’t remove the dillemna of what to invest in, as you’ll still have to choose the best investment trust.

- Property funds will invest in property which is an illiquid asset. In turbulent economic conditions, the fund may have to ‘gate’ or block withdrawals. This is necessary when the fund manager determines that they cannot sell properties quick enough to meet withdrawal demands. Gating a fund provides the fund manager with breathing space to sell its assets at decent market prices. This may inconvenience fundholders but it is done in their best interest. This means that while liquidity is high during ordinary trading conditions, you may lose access to your funds for six months in a market crash. A UK property fund closed its gates in 2019 for this precise reason.

3.3 Property Authorised Investment Funds (PAIFs)

PAIFs are investment funds (similar to the above) but with special tax privileges over unit trusts. In return for meeting criteria set by HMRC, PAIFs incur no tax whatsoever within the fund and pay the proceeds to investors gross (before tax).

This is slightly more efficient than unit trusts and OEICs. Unit and trusts and OEICs must to pay corporation tax on elements of their internal profits before they are distributed to investors.

Advantages

- PAIFs have identical advantages and disadvantages to 3.1 Unit Trusts, with the addition of tax efficiency. All gains from PAIFs are tax free if the investment sits within an ISA. PAIFs also incur no taxation within the fund.

3.4 Insurance Company Property Funds

Life insurance products such as unit-linked bonds can give exposure to property.

Investments structured this way are sometimes tax-free. However, this comes with strings attached. For example, you must hold the investment for 7.5 years to avoid paying tax. The mandatory life insurance policy, (which enables the tax dodge) may also be inappropriate for your situation. Holding an equivalent unit trust inside an ISA should deliver similar returns, similar tax allowances but with few penalties for withdrawal.

Advantages

- Gains are potentially tax-free if is written as a ‘qualifying policy’.

Disadvantages

- Investment providers must package these investments with life insurance. These policies may be expensive or completely unnecessary for your circumstances. This would be a waste of money in either case.

- Face to face advisers are often the sellers of such complex insurance products. These are expensive routes to take out investments and will generally increase the cost of investing, which leads to poorer outcomes.

- Financial Expert recommends that you choose investments and insurance independently rather than obtaining as a package. If you break each element into a separate transaction, you can be satisfied that each deal is a ‘best-buy’ in its own right.

3.5 Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts, known as REITs for short, are a modern form of investment company. REITs have only been around since 2007. REITs offer tax benefits that have made them popular with investors.

A REIT is a listed company which runs a property development or buy to let property portfolio. REITs provide a combination of income and capital growth. Regulations require REITs to distribute 90% of rental income to investors. This means that all REITs provide a regular investment income.

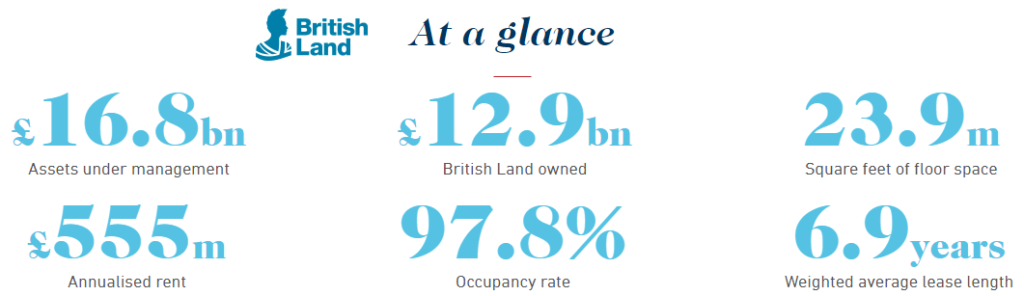

At the time of publication, a large UK REIT British Land Company has a dividend yield of 5.82% (Ticker: BLND) for example.

REITs will often borrow money to finance their holdings. This allows them to engage in large projects and will enhance their yield. However, this means that the dividends and the share prices of REITs tend to move more aggressively than the underlying property prices due to the effects of leverage.

The government has created a generous taxation regime for REITs. The core business of REITs (renting) is protected from corporation tax, allowing the distribution of rent payments from their tenants to flow straight through to your dividend without being hit by taxes inside the company.

If you hold the REIT in an ISA, your dividends will be received gross and will be not be taxed. It is worth pointing out that tax rules could always change in the future.

Advantages

- REITs are listed on the stock exchange. Their shares are highly liquid investments which can be bought at a low cost.

- REITs are a tax-efficient way to earn rental income, as the dividends that are paid attract no income tax or capital gains tax if you hold the shares in an ISA wrapper. Landlords, in contrast, cannot place their properties in an ISA!

Disadvantages

- REITs can use debt to increase the size of their investment portfolios. This leverage makes REITs very sensitive to changes in economic conditions and interest rates. REITs often ‘overreact’ in both directions in response house price news.

- In the financial crisis of 2008, several indebted REITs faced possible bankruptcy as a result of their overstretched finances. This hammered their share price at the time.

- For tax reasons, some large investors would prefer that companies retain profits rather than distribute them as income. Due to the 90% distribution rule, all REITs pay sizeable dividends.

Our guide to the best real estate investment trusts (UK) includes a list of real examples.

Discovering more about property

There’s a a few places I’d suggest you look next to learn more about investing in property.

I’d start with our list of the best property investment books and the best land & forestry investment books.

If financing is an issue, consider the best mortgage investment books, which may open your eyes to a number of ways to get approved or secure a lower interest rate on your borrowings.

Course Progress

Learning Summary

How to Invest in Property

The property asset class has historically returned 5% per year over the last century. This is a lower return than the stock market and matches the lower risk.

Over the last two decades, property has returned closer to 6%. However, this has been helped by some short-term favourable factors such as low interest rates which won't continue forever.

The direct method of investing in property is to purchase a house or flat and rent it out. This provides a twofold return; rent income collected from tenants and capital gains from appreciation in the value of the property.

Property investment is often combined with mortgage borrowing to allow investors to acquire a larger portfolio. In an upward market, leverage dramatically increases the profits from house price increases.

However, the dark side of leverage is that losses are also accelerated. If you only contribute 25% of the house price as a deposit, then it will only take a 25% price fall to completely wipe out your investment.

Recent examples of losses exist. Residents in London who put down a 10% deposit to buy a property in June 2018 would have experienced a 50% loss of their investment when prices fell by 5% in the following year.

The shares of property-related companies such as housebuilders will tend to rise and fall in the same direction as house prices. This offers an indirect way to benefit from upward property prices without actually investing in property.

Collective investment vehicles give a another route into property investment. Unit Trusts, Property Authorised Investment Funds (PAIFs) and Real Estate Investment Trusts (REITs) each have different tax advantages and may suit different investors.

Crowdfunding platforms allow small individual investors to replicate a real buy-to-let portfolio by buying 'shares' in properties. This provides better diversification than an ordinary buy-to-let investor can usually achieve. However, it may be difficult to withdraw funds from platforms in tough market conditions.

Quiz

Next Article in Course

Before you move on, please leave a comment below to share your thoughts. Do you already have a property investment? Does investing in property come more naturally to you than investing in the stock market?

Comments 1

Hi, What happens to your property or savings when you pass away?