Overall broker score:

eToro offers zero-commission trading on shares, and charges no monthly account fee. This makes it best in class for short term traders and investors looking to cheaply build a portfolio of shares.

Capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Breakdown:

Trading fees

Account fees

Investment range

User experience

UK Regulation

Size of firm

Customer service

Account opening

- Customer service increased to 86% (Trustpilot score rose to 4.3/5)

- Size of firm increased to 88% (Assets under management hit $10.7 billion)

Pros:

Most user-friendly app on the market

Zero share dealing commission

No monthly platform charge

Copytrade™ feature

Cons:

No stocks & shares ISA

$5 withdrawal fee

No OEICs or unit trusts

Customer service isn't best in class

Welcome to our in-depth eToro review. When we say ‘in-depth’, we mean it. You’re looking at the most detailed eToro review available online.

Alongside 14 other UK stockbrokers, we have an affiliate relationship with eToro. This means that qualifying referrals through links on this site help generate a small income for the website. Please know that this relationship doesn’t skew our UK stockbroker reviews or impact the overall ratings of providers. Read about our editorial and ethical standards here for more information.

It should hopefully be apparent from our review that this is a balanced piece, and we don’t hold back in our criticisms of eToro or any other investment platform. No stockbroker is perfect. Any website that fails to find fault in a financial provider is probably not writing from an objective standpoint.

Review verdict: eToro is our top pick for 2025

We conclude that eToro is delivering on its promise to open up investing to all, and we currently rate it as our top stockbroker for 2025.

If you want to be able to open an account quickly, buy shares in a few taps, and pay no annual or trading fees to do so, then eToro could be an excellent investing partner for you.

When we want to trade a trend or take a stake in an individual company, we personally use eToro to trade ourselves. We’re excited to see what new features or user improvements will be rolled out over the coming year.

Sign-up to eToro today with a minimum deposit of just £80 / $100 (UK investors)

Capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Alongside eToro’s share dealing service, it also offers trading in high-risk instruments called CFDs. Most investors don’t use CFDs to invest, as these are not particularly suitable for positions held over a long period, and include higher fees.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Our detailed eToro review:

Who is eToro?

eToro was founded as an Israeli company in 2007 in Tel Aviv. It began as a private company offering forex trading services, before expanding internationally and adding stocks & CFD trading products to its offering. It gained its licence as a UK stockbroker on 9 May 2013 (source). eToro is now a group of international companies.

The firm has offices in the US, UK, Cyprus and Australia.

The address of its UK office is: 24th floor, One Canada Square, Canada Square, Canary Wharf, London E14 5AB

What products does eToro offer?

eToro offers a single investor account to UK investors, which can be used to trade a variety of financial instruments:

- Underlying stocks & shares

- Underlying cryptocurrencies

- Contracts for Difference (CFDs), covering stocks, indices, currencies and commodities. We don’t cover CFDs in detail in this review, as we want to focus on the traditional stockbroker offering of buying and selling real assets. Crypto CFDs are not available to retail investors since a 2021 change in UK regulations.

eToro also offers some unique functionality called CopyTrader™ and CopyPortfolios™. These allow users to automatically replicate the trades of other successful users on the platform.

Wish your holdings could track the most successful eToro trader from the previous year? You can do that on auto-pilot using these copy features, which we’ll discuss in detail later.

Sign-up to eToro today with a minimum deposit of just £80 / $100 (UK investors)

Capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Trading underlying stocks & shares with eToro

How does it work?

Once you’ve deposited money in your account, you will be able to make your first purchase of underlying shares.

I use the term ‘underlying shares’ to mean ‘real shares’; a simple purchase of shares in a company. This is to distinguish this share trading from eToro’s Contract for Difference (CFD) product, which allows you to profit or loss from the price movements of shares without actually owning them.

- Search for a company in the search bar, and tap on the company name.

- This brings up the share information, such as the current share price, price history, and comments from other users about this company.

- Tap ‘trade’, and then input the amount you’d like to invest in shares.

- Using the latest share price, eToro will calculate automatically how many shares this equates to.

- Once you’re happy with the value you want to invest, tap buy and confirm, and the transaction will be completed instantaneously.

Other notes:

- You are able to buy a fraction of a share if you want to invest less than the price of one share.

- The minimum purchase amount for any share purchase is $50, so about £40.

Like 99% of online stockbrokers, eToro will buy and sell shares on your behalf (from other users or the stock exchange) and hold any current investments in trust on your behalf. This is known as a ‘nominee’ account. Officially, eToro will be noted as the registered owner of the shares, however, in legal form, all benefits of the shares, including dividends and cash proceeds from the sale, will accrue to you. Therefore you are still effectively the owner of the shares. This is how the overwhelming majority of share investments are made in the UK.

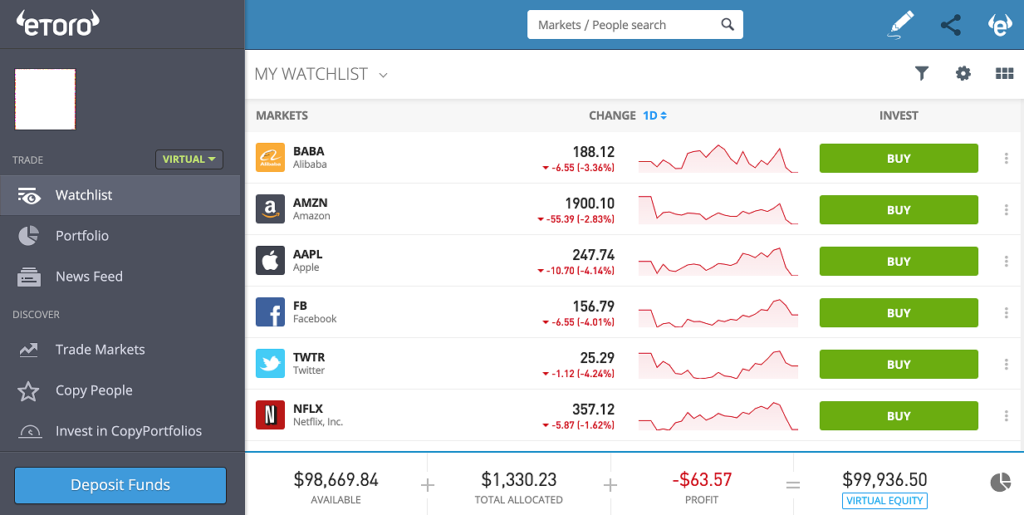

What does the platform look like?

The eToro trading platform has a neat, minimalist layout with a simple design. We found it easy to search for investment ideas, and quickly enter into a trade without going through many screens, having to re-enter passwords or having to do any math in your head.

As a criticism, we think that eToro could do more to make it easier to browse the full range of investments available to trade. We found that where we didn’t have a name of a company in mind, we were forced to scroll through a long list of every tradeable instrument, rather than having a number of smart filters or browse options to provide inspiration.

How much does it cost?

eToro is famous for offering ‘zero commissions’ on stocks & shares trading. This means that if you spend £200 on shares, no additional fee will be deducted from your account, and all of the £200 will be spent on the investment.

On any market, the latest price to buy will always be slightly higher than the latest price to sell. This is known as the ‘bid-ask spread’, or simply the ‘spread’. This always causes a small cost to the investor, as they will buy at the higher price (e.g. $78.20), and will only be able to sell that item at the selling price (e.g. $77.80).

The ‘spread’ cost will always apply to any investor buying and selling in the market. The impact of spread is negligible if you are investing for the long term.

What shares can you trade on eToro?

At the time of writing, the securities of over 2,000 individual companies can be traded on eToro. These can’t be viewed as a single list, but by drilling into each exchange we can reach a total view as follows:

- New York Stock Exchange – 766 companies

- London Stock Exchange – 303 companies

- NASDAQ – 491 companies

- Hong Kong – 134

- Frankfurt – 133 companies

- Paris – 107 companies

- Zurich – 50

- Milan – 43 companies

- Stockholm – 42

- Madrid – 41

- Amsterdam – 36

- Oslo – 23

- Copenhagen – 22

- Helsinki – 20

- Brussels – 13

- Lisbon – 3

- Saudi Arabia – 1

Total: 2,223. This will contain duplicates where a company is dual-listed on more than one exchange.

With a number that big, it’s pretty likely that any publicly traded company you’ve heard of can be traded on eToro’s platform. Here are just some examples:

Apple, Spotify, Nike, Aramco, Netflix, Tesla, McDonalds, Manchester United, Astra Zeneca.

Notably, Japanese and South Korean exchanges are not supported, so you won’t be able to buy Asian companies unless they happen to be listed on a western exchange too. Dual listings are fairly common though, which means you can still trade stocks in large Asian corporates such as Samsung, Toyota and Sony.

To open an account with eToro and be

Sign-up to eToro today with a minimum deposit of just £80 / $100 (UK investors)

Capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Trading cryptocurrencies with eToro

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

How does it work?

Buying and selling crypto assets on the eToro platform follows exactly the same process as shares.

- Search for a crypto asset in the search bar, and tap on the company name.

- This brings up the crypto info, showing the current price (in USD), price history, and comments from other users about this asset.

- Tap ‘trade’, and then input the value you’d like to invest

- Using the latest share price, eToro will calculate automatically how many units of cryptocurrency this equates to.

- Once you’re happy with the value you want to invest, tap buy and confirm, and the transaction will be completed instantaneously.

What does it look like?

Here’s a screenshot of the trade screen when buying cryptocurrency. This illustration shows a Bitcoin (BTC) purchase.

The screen shows the current price of Bitcoin ($8,085.05), the price movement over last 24 hours ($332.97 gain, or 4.3%).

The ‘market open’ label shows that you are able to place a trade right now. Unlike stock trading, cryptocurrencies aren’t constrained by a 9-5 stock exchange opening hours timetable.

The user has typed in $500 as the value they want to spend. The app has automatically calculated that this equates to 0.06 units of Bitcoin. If the user taps on the Units button, they can instead choose to type in the exact quantity of BTC they wish to buy, with the app calculating the value as a balancing figure instead.

‘4.01% of equity’ indicates that a $500 purchase would represent 4% of the users total portfolio value.

‘Exposure: $500’ means that $500 (the amount invested) is the maximum possible loss to the investor. This might seem like a very obvious fact. However, when trading CFDs, the amount at risk will be different to the cash spent to open a trade. But for purchases of real assets, exposure should always equal the amount invested.

The note at the very bottom of the screen is important, it confirms to the user that this is a real crypto asset trade. The emphasis on ‘real’ is to contrast this from a CFD trade.

How much does it cost?

On any market, the latest price to buy will always be slightly higher than the latest price to sell. This is known as the ‘bid-ask spread’, or simply the ‘spread’. This always causes a cost to the investor, as they will buy at the higher price (e.g. $78.20), and will only be able to sell that item at the selling price (e.g. $77.80).

This ‘spread’ cost will always apply to any investor buying and selling in the market. This is 1% on crypto assets.

When you have sold your investments and wish to withdraw your cash from the eToro platform, eToro charges a flat $5 fee per withdrawal.

Sign-up to eToro today with a minimum deposit of just £80 / $100 (UK investors)

Capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider

whether you can afford to take the high risk of losing your money.

Trading CFDs with eToro

A Contract for Difference (CFD) is a ‘bet’ struck between a trader and eToro. The bet states that for each unit of movement in the price of a given asset, the investor will see a specific gain or loss.

For example, for every £0.01 increase in the price of a share, the investor will gain £1. For every £0.01 reduction in the price of a share, the investor will lose £1.

This can look and feels quite similar to owning a real asset, however there are some key differences:

- CFDs are a contract between the investor and eToro, and does not represent ownership of a real asset.

- CFDs contain leverage, this means that eToro only requires investors to stake a small fraction of the theoretical size of the investment.

- CFD positions can be long or short, which means that an investor can bet on a price rising or falling

- CFDs include fees and interest charges, either leveed on the account or incorporated within the pricing of the trade.

What does leverage mean?

At the time of writing, eToro allows leverage of up to x5 on stocks. This means that, for example, an investor can enter into a contract that provides similar exposure to a $10,000 basket of shares, but only needs $2,000 in their account to open the trade.

Leverage results in risk. Because the underlying exposure is higher relative to the money ‘invested’, this results in far greater volatility for each £1 invested. With exposure of $10,000, it would only take a 20% fall in the price of the share to result in a loss of $2,000 – which would wipe out the investor’s equity to $0.

Conversely, leverage can also lead to larger wins. A share price increase of 20% would lead to a $2,000 gain, which is equivalent to investor doubling their amount staked.

CFDs are high-risk products that can lead to large losses. For the purposes of this eToro stockbroker review, we have not factored in the CFD products, as we assume that investors who simply want to buy and sell shares will ignore this risky option, and will take advantage of the zero-commission stock trading instead. Also, crypto CFDs & leverage trading is restricted for FCA/ UK users.

For the curious: the full review of eToro’s background

Who owns eToro?

eToro was originally founded by Yoni Assia (LinkedIn), Ronen Assia (LinkedIn) together with David Ring (LinkedIn). Yoni continues to serve as CEO of eToro.

eToro went through multiple rounds of fundraising as a private company, receiving equity investment from many investor groups, including venture capital firms, private equity firms and foreign institutional investors.

In March 2021, eToro announced that it was becoming a private company, by merging with a company already listed on the US Nasdaq stock exchange. It was reported that the newly combined company would be 91% owned by the pre-existing shareholders of eToro.

Once the deal is finalised, shares in the company will be able to change hands freely between investors on the stock market. Therefore the ownership of eToro is quite diluted, and indeed even you could own a piece of eToro!

Who regulates eToro?

If you’re a UK investor, you’ll officially invest through eToro (UK) Ltd which is a company registered in England. eToro UK is authorised and regulated by the Financial Conduct Authority (FCA), under firm reference number 583263. You can read the full FCA page about eToro here.

eToro (UK) Limited is audited by EY LLP, one of the Big Four audit firms. EY recently provided an unqualified audit opinion on the accounts for the year ended 31 December 2019. This was published 16 December 2020. You can see it in page 9 of this document.

An external audit opinion does not provide a guarantee that accounts are free from fraud, error or misstatements. However, it serves to provide some reassurance to shareholders that the financial statements of a company are a true & fair representation of its financial position.

What protection does eToro or UK regulations offer investors?

Financial Services Compensation Scheme (FSCS)

As a UK stockbroker registered with the FCA, eToro falls under the Financial Services Compensation Scheme. At the date of writing, this scheme provides up to £85,000 of protection to UK investors from any losses suffered due to a failure of the stockbroker. See details about the FSCS scheme in general here, and eToro’s own detailed statement about the FSCS scheme here (though be aware that eToro’s statement is out-of-date, referring to the £50,000 level of protection which applied until 30 March 2019).

Ringfencing of client assets

UK regulation requires UK stockbrokers to ‘ring fence’ client monies and client holdings, which means that these are kept separate from the cash and assets of eToro as a business. This should mean that even in the event of eToro ceasing to trade, these assets should be untouched and could be passed to another broker to administer. This does however rely upon these rules being followed to the letter of the law.

The FSCS scheme mentioned above, is designed to step in if this initial level of protection fails, and investors don’t receive their assets back.

eToro private insurance policy

eToro states on its website that it holds a specialist insurance policy from Lloyds of London (a collection of specialist insurance brokers) which will allow clients to claim up to £1m each, in the event of any losses caused by eToro’s insolvency. The insurance covers cash, all CFD positions, and securities. Note that cryptoassets trading (non-CFD) are not covered by the insurance.

This insurance policy is not a regulatory requirement, and is an example of a broker going above and beyond the norm to improve their resilience. Conservative investors will be particularly grateful for this additional layer of protection, which will provide additional peace of mind.

Investment risks

Please remember that investor protections are designed to help investors in the event that their stockbroker goes bankrupt. The FSCS scheme is not designed to compensate investors who have simply experienced investment losses on their stocks & shares. Investments are made entirely at your own risk.

Financial position

The 31 December 2019 financial statements of eToro UK showed that the company had a net asset position of £5.3m, this meaning that after settling all debts, the company would have roughly £5.3m of cash leftover.

As just one company within a global group, the consolidated net asset position would be a more meaningful figure, however this is not publicly disclosed due to eToro being a private company.

It is worth pointing out that the deal to take eToro private valued the business at roughly $10 billion US dollars.

It impossible for us to comment on how ‘secure’ eToro is as a stockbroker relative to other regulated businesses. To do so, we would need to compare the internal controls and procedures and financial health of the business to comparable companies. However, this information is not publicly available.

Before we summarise: a risk warning

This eToro review wouldn’t be complete without a clear risk warning.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading

CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to

leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should

consider whether you understand how CFDs work, and whether you can afford to take the high risk of

losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy trading is a portfolio management service, provided by eToro (Europe) Ltd., which is authorised and

regulated by the Cyprus Securities and Exchange Commission.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the

accuracy or completeness of the content of this publication, which has been prepared by our partner

utilizing publicly available non-entity specific information about eToro.

Sign-up to eToro today with a minimum deposit of just £80 / $100 (UK investors)

Capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider

whether you can afford to take the high risk of losing your money.

The pros and cons of the eToro platform

Pros:

1. Most user-friendly investing app on the market

eToro is, in our opinion, one of the most user-friendly trading app interfaces on the market. This makes it perfect for beginners, who simply want to invest in shares without having to learn about ‘back-end’ technical terms such as settlement periods.

eToro has an excellent Trustpilot rating at the time of writing (4.2 / 5.0) which evidences the positive experiences are having on the app.

2. Instant trading without the lag

The trading experience inside the app is lightening quick. After making a trade, shares immediately appear in your portfolio. This provides instant clarity on your latest position.

When making financial transactions like buying or selling shares, investors always like to check their portfolio afterwards to check that the trade went through correctly. Many investors using other stockbrokers are out-of-luck, as the impact of their trades don’t immediately show up in their account, forcing investors to wait hours or even days to see their new position.

3. Zero commissions on share trading is a big win for small investors

Paying nil trading fees is a brilliant feature for small investors, and here’s why. On most trading platforms, trading fees are charged at a flat rate per trade. For example, £7.50 to buy some shares and £7.50 to sell some shares.

- Buy some shares then later decide to top-up your holding some more? You’ll need to pay commission twice.

- Want to buy only a small value of shares? The fee stays the same, eating up a chunk of your trade value.

- Trading commissions hurt small investors in particular because they form a larger % of small trades.

That’s why platforms such as eToro are particular attractive to younger investors or new investors. These two groups of investors tend to have modest portfolios, and therefore stand to gain more from commission-free trading.

Cons:

1. ‘Social trading’ feels gimmicky

We found the ‘social trading network’ a bit unnecessary if we’re being honest. If all of eToro’s social features were removed from the app, we wouldn’t deduct any stars from our rating. Some people love it – we recognise that. But we don’t feel that it adds much value to the user experience.

The extensive comment threads underneath each asset are fast-paced and feature comprehensive debate. That’s not disputed. We just question whether this stream of commentary is particularly helpful to an individual investor; particularly someone looking to ‘buy and hold’ for the long term.

Confirmation bias is the tendency for us to seek out and pay greater attention to opinions and ideas that are consistent with our own, or are otherwise what we suspected to hear. This bias comes into play when scrolling through hundreds of opposing views about a stock. Are you as likely to heed both sides of the argument in a balanced fashion, or are you likely to come away having only reinforced your existing view? We’ll leave that for you to decide.

2. It’s easy to slip into a very optimistic mindset when copying successful traders

The CopyTrader™ and CopyPortfolios™ features provide a unique way for users to delegate the management of their investments to more experienced investors. However, is affected by what is known as survivorship bias.

Survivorship bias is the absurd phenomenon where all active investments appear on average, to have performed above average.

How is that possible? Mathematical laws haven’t been broken. It’s all because of the reality that failed investments are closed or sold and ultimately remove themselves from the population. What’s left is a ‘filtered’ list of investments that have survived, and are therefore more likely to show a good performance.

This concept should be held in mind when you consider the CopyTrader™ and CopyPortfolios™ experience. As you browse this feature, you are naturally presented with a shortlist of high performing investors to follow.

It is easy for your brain to see this sea of profits, and assume that:

- These traders are likely to repeat their past performance

- Overall, investors see better returns by copying the best traders.

When you closely scrutinise each of these assumptions, you will realise that they sit on shaky foundations.

Firstly, as is often repeated; historic performance is not a reliable predictor of future returns.

Secondly, when considering your odds of success, you should remind yourself that loss-making eToro traders have been removed from this population of options, which could be influencing your level of confidence.

Overall, CopyTrader™ and CopyPortfolios™ are neat features that are heavily used by users on the platform. We don’t see them as inherently good or bad but want to encourage you to challenge your assumptions about profits if you use them.

3. Traders must be alert as share trading & CFD trading is offered on the same screen

The combination of share trading and CFD trading on the same platform could cause confusion to new investors. This particularly applies when placing a trade, as you can do both from the same tab. While I believe that eToro makes it very clear whether you are trading ‘real’ stocks or you are taking a leveraged CFD position, it would be neat if eToro could offer users the option to completely turn off CFD functionality if they are not interested. This would reduce the chance of mistakenly buying a CFD rather than an underlying asset.

To open an account with eToro and begin trading with pretend or real money, click here. Capital is at risk.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider

whether you can afford to take the high risk of losing your money.

Overall eToro review verdict: our top pick for 2022

The conclusion of this eToro review is that eToro is delivering on its promise to open up investing to all, and we currently rate it as our top stockbroker for 2022.

If you want to be able to open an account quickly, buy shares in a few taps, and pay no annual or trading fees to do so, then eToro could be an excellent investing partner for you.

When we want to trade a trend or take a stake in an individual company, we personally use eToro to trade ourselves. We’re excited to see what new features or user improvements will be rolled out over the coming year.

To open an account with eToro

Sign-up to eToro today with a minimum deposit of just £80 / $100 (UK investors)

Capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider

whether you can afford to take the high risk of losing your money.