This guide on how to avoid tax when investing will arm you with a series of tweaks you should consider making to your portfolio to maximise your returns.

The reduction of taxes is a risk-free method to bring a basic investment portfolio up one notch in terms of sophistication, which is why we include this article in our intermediate learning experience.

We introduced the principle in our article How to reduce or eliminate the costs of investing that “investing costs are investment losses“.

Taxes are really just another type of cost and therefore this mantra is very relevant here. Investors who follow the passive investing approach have a sharp focus on management charges, but taxes can be a far more significant number.

It follows that we should take all reasonable steps to avoid taxes, with the same enthusiasm that we apply to other risk-reducing tasks such as applying the science of diversification and building an investment portfolio.

Disclaimer

As the disclaimer states, the information in this article is not regulated independent financial advice.

Tax laws change continuously, and tax rules can apply differently to investors if they have different circumstances. Steps to avoid taxes that work now may be rendered obsolete in the future.

Finally, the tax status of an investment should always be a secondary concern. Never make an investment which clashes with your investment risk appetite or your investing time horizon.

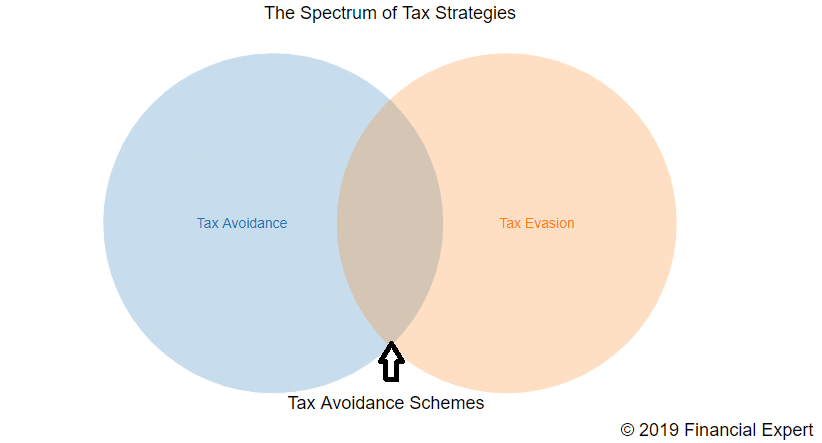

Avoidance versus evasion

Let’s define the objective of ‘avoiding tax’ so that there is no confusion about the ethics of this article.

Tax avoidance is getting into the habit of arranging your financial affairs in a sensible and legal manner. This is done so that you only pay HMRC the minimum legally-required tax.

An example of the most common form of tax avoidance is the ISA; government-approved, tax-free savings account available in the UK.

- Tax evasion is the malicious dodging of lawfully due taxes

- Misleading taxation authorities

- Making false tax returns

- Disguising the source of funds or using secrecy to hide an asset from authorities

The conviction of Cristiano Ronaldo in 2019 is a recent example. Ronaldo directed income to shell companies based in the British Virgin Islands and Ireland. He then failed to declare that income on his tax return.

Tax evasion is illegal and we clearly do not condone these methods.

The grey area

A third group of strategies live in the grey area between avoidance and evasion. We call these ‘tax avoidance schemes’.

Avoidance schemes are transactions that tax accountants devised to help people reduce their tax liabilities. They comply with the law, on the face of it, but this could be disputed in court. They have little economic substance and their principal purpose is to save tax for participants.

The UK tax authority, HM Revenue & Customs (HMRC) are more than aware of such schemes and it spends considerable resources challenging them and occasionally winning in court.

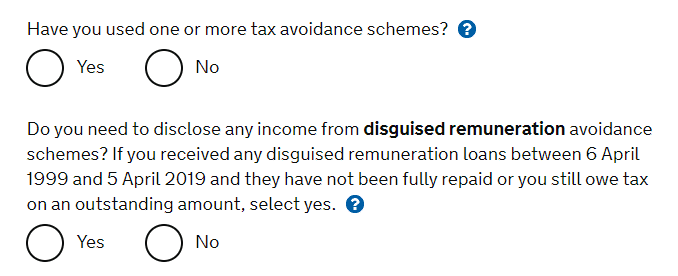

Promoters formally register schemes of this nature with HMRC. Also, and any participants in such schemes need to formally disclose them on their tax return too.

We do not recommend tax avoidance schemes for the following reasons:

- Although a promoter will register a scheme with HMRC, HMRC does not express approval of the scheme at that stage. Therefore a promoter can never guarantee that a scheme is safe from legal challenge.

- HMRC’s stance on avoidance schemes continues to toughen as public opinion hardens against them.

- Scheme promoters, typically tax accountants, will charge high fees.

- HMRC may choose to scrutinise and/or fine the members of a scheme at any time if it judges that the scheme breached tax law. This could result in an unexpected tax bill.

In summary, tax avoidance schemes carry both financial and reputational risks. HMRC warn that the promoters of such schemes often use misleading language in marketing materials which overstate the legitimacy of schemes and downplay the risks.

As recent crackdowns have shown, these schemes can come back to haunt and bankrupt their members. Therefore, steer clear of them if you want a smooth investing journey.

How to avoid tax when investing

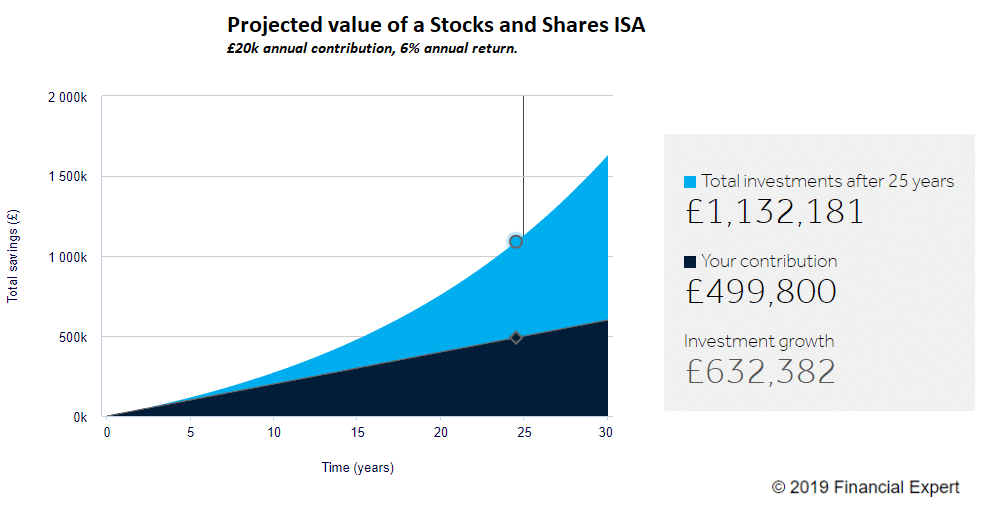

1. Wrap your investments in an ISA

Imagine having a £1m investment portfolio, which incurs no tax on:

- Dividend income

- Interest income

- Capital gains

This is possible using the ISA tax-wrapper, a widely held account-type available in the UK.

Virtually all stockbrokers and investing platforms offer an ISA product called a Stocks and Shares ISA. An ISA account usually has the same features as an investment account, although account fees can slightly vary.

If you’ve read our article ‘What are shares?‘, you’ll know that ‘stocks’ and ‘shares’ are actually the same thing. To confuse matters further, any quoted investments like property investment trusts and corporate bond funds can also be held in a Stocks and Shares ISA. It is, therefore, easier to think of it as a ‘Stockbroker ISA’.

When Stocks and Shares ISA’s were originally launched in 1999, you could only pay in a maximum of £7,000 in total each year. The annual limit increased dramatically to £20,000 in 2017. The limit is now so high that it won’t affect the majority of savers. See the full ISA rules here.

The growth of the ISA has been very positive for the investing community because the ISA wrapper remains the most effective way to protect a wide range of assets from income and capital gains taxes.

This has two useful benefits when saving for retirement:

- Investments in an ISA will compound at a faster rate because dividends and interest can be reinvested in full. Therefore ISAs will reach their target value faster.

- Retirees who live off the income from a Stocks and Shares ISA pay no income tax on withdrawals. This allows the target value of retirement savings to be lower than if income was taxed.

Which are the best UK stocks & shares ISAs?

We’ve shortlisted the best of the best UK stockbrokers below to help your search:

Trade shares with zero commission. Open an account with just $100. High performance and useful friendly trading app. Other fees apply. For more information, visit etoro.com/trading/fees.

Large UK trading platform with a flat account fee and a free trade every month. Cheapest for investors with big pots.

The UK’s no. 1 investment platform for private investors. Boasting over £135bn in assets under administration and over 1.5m active clients. Best for funds.

Youinvest stocks & shares ISA offers lower prices the more you trade! Which? 'Recommended Provider' for last 3 years.

Choose a pre-made portfolio in minutes with Nutmeg. Choose your level of risk and let Nutmeg efficiently handle the rest.

Buy and sell funds at nil cost with Fidelity International, plus simple £10 trading fees for stocks & shares and ETFs.

Capital is at risk

Trade stocks & options on the advanced yet low-cost Freedom24 platform that arms retail investors with the tools to trade like professionals.

Capital is at risk

Please also see our Hargreaves Lansdown review, our AJ Bell review and interactive investor review.

2. Use your allowances

The UK tax rulebook has a long list of tax allowances. You should familiarise yourself with the list to ensure you are making the most of them.

Here is a simplified overview for the tax year to 5 April 2020:

Savings allowance. The first £500 or £1,000 of bank interest is tax-free, depending on whether you are a higher basic rate taxpayer.

Dividend allowance. The first £2,000 of dividends are tax-free.

Property allowance. The first £1,000 earned as rental income each year is tax-free.

Personal allowance. For wages, self-employment income or investment income above the allowances above, the first £12,500 is tax-free.

Capital gains annual exempt amount. The first £12,000 of capital gains you trigger in a year by selling assets is tax-free.

The capital gains annual exempt amount is a prime example of where tax can be avoided by carefully managing your portfolio.

If you own shares which are worth £36,000 more than you paid for them, complete disposal of these would trigger a capital gain which exceeds the Annual Exempt amount of £12,000. This would attract Capital Gains Tax (CGT) at 10% – 28% to be paid on the remaining £24,000 gain.

Alternatively, you could choose to sell a fraction of the shares each year over multiple years. If you are careful not to crystalise more than £12,000 in a given tax year, you could utilise the exemption of multiple periods and avoid Capital Gains Tax entirely.

3. Avoiding tax within collective investment schemes

As we explain in our article How to buy shares and invest in the stock market, collective investment schemes (known generally as ‘funds’) are popular and take many different legal forms, including listed investments:

- Exchange Traded Funds (ETF)

- Investment Trusts

- Real Estate Investment Trusts (REIT)

And unlisted investments:

- Unit Trusts

- Open-Ended Investment Companies

How income and expenditures are taxed within the fund itself, does differ slightly depending on the legal structure. However, this is too minor to be a key consideration when picking a fund. Other factors, such as the fund’s ongoing management charge and its performance against its benchmark are far more relevant.

What is important to clarify, is that the overall tax outcome from owning units in a fund is not so different from holding all of the fund’s individual assets yourself. In other words, investing through a collective investment scheme does not add a layer of taxation into the equation.

As we explain our article How to invest in property, REITs are completely exempt from paying corporation taxes within the fund itself. The same would not be true if an investor used a private company to buy a property themselves. Therefore the REIT confers a tax advantage in this circumstance.

4. Enterprise Investment Scheme (EIS) and Venture Capital Trusts (VCTs)

HMRC has established several schemes that provide tax relief to investors who invest in private companies.

Private company investments differ from ordinary investments in funds because:

- Private investments have high transaction costs, e.g. due diligence, solicitor

- As a result, they will have a high minimum investment

- Private holdings can be difficult to sell, and as there is no open market, it will take some time to agree on a valuation with the other party

- Opportunities are not widely marketed and are generally only available to sophisticated investors

High-growth start-ups private companies are often hungry for additional capital but due to the risks, they struggle to find it.

HMRC has responded by providing generous tax relief on investments into qualifying private companies. The most well known of these are called Enterprise Investment Scheme tax relief (EIS) and Venture Capital Trust tax relief (VCTs).

A large tax deduction in the year of investment, up to 30% of the investment value. This means that for every £1 invested into a small business, the investor would receive a 30p refund on their tax bill that year.

You may be interested to know that ‘Angel Investor’ investments such as those made by the wealthy investors on the BBC television series Dragons Den would qualify for tax relief under EIS.

Both EIS and VCT relief schemes come with strings attached. Investors must remain invested for several years, for example.

Investments which qualify for these schemes carry extreme risks and are only suitable for wealthy, highly sophisticated investors (such as the Dragons themselves), so we won’t explore this further in the Intermediate Learning Experience.

Read more: The best venture capital books

How to avoid tax when investing: Do your research

The secret of how to avoid tax when investing is not about joining a dubious and complicated tax scheme. It’s about having a firm understanding of when taxes are due and on what income. We’ve created a guide on how investments are taxed which you might want to use for further research.

Saving tax is an incremental process rather than an all-or-nothing strategy. For example, you may struggle to pay less stamp duty, but could personally find income tax particularly easy to avoid.

Begin saving tax on your investments right now by reviewing the summary and action points below.

By making one change at a time, and keeping abreast of tax rules, you can ensure that your portfolio grows unencumbered by unnecessary tax.

For further reading, check out our shortlist of the best personal finance books, where you’ll find tax-efficient strategies.

Course Progress

Learning Summary

How to Avoid Tax when Investing

Taxes should be viewed like any other expense incurred while investing. It can usually be reduced, which will deliver a risk-free increase in returns.

Financial Expert advocates legal tax avoidance; taking simple steps to better organise your affairs to avoid paying unnecessary taxes.

Tax evasion is the strategy of illegally dodging taxes with malicious intent, by filing false returns. This is clearly not recommended.

We also suggest that investors steer clear of 'tax avoidance schemes', which usually only obey the 'letter of the law' rather than the spirit of the rules. HMRC occasionally rules against the legitimacy of such schemes and orders their participants to pay fines and back-taxes.

A range of allowances and exemptions exist in the UK tax rulebook. Understand each of these to check that you are managing your affairs in a way that maximises their use.

A range of allowances and exemptions exist in the UK tax rulebook. Understand each of these to check that you are managing your affairs in a way that maximises their use.

While different types of funds are subject to different tax rules, they are all generally tax efficient. You will not save tax by buying individual shares yourself versus using a collective vehicle.

Generous tax relief is available to private investors who make qualifying investments in small and medium private businesses. However, these types of investments are not appropriate for an intermediate level investor.

Quiz

Take Action

- Review your current savings and investment plan in the context of tax efficiency. Have you made maximum use of Cash or Stocks and Shares ISAs to make your investments? If you hold investments outside of an ISA account, could you arrange for them to be transferred in?

Next Article in the Course

Before you move on, please leave a comment below to share your thoughts. Have you successfully avoided tax in the past? What is your opinion on outright tax evasion?