A stocks & shares ISA is a tax-sheltered investment account, but contrary to popular belief, stocks & shares ISAs are not completely tax-free. One of the taxes not shielded by a stocks & shares ISA is inheritance tax. So what happens to your stocks & shares ISA when you die? Let’s explore this topic in this article.

This article won’t focus on the process of probate and acting as the executor for an estate. I.e. What steps should an executor follow to deal with any savings or investment account after someone passes.

Instead, we’ll be focusing on what the tax rules say about your stocks & shares ISA account specifically. And we’ll compare stocks & shares ISA rules against ordinary stockbroker accounts.

Caveat: This article is journalistic by nature and should not be read as financial advice which is tailored to your individual circumstances. Inheritance tax planning is a complex area where professionals can help you understand the rules and develop a plan to meet your own life goals while minimising inheritance tax. Find an independent financial adviser to assist if you are unsure of your choices.

What happens to your stocks & shares ISA when you die?

To explain the tax rules surrounding ISAs after death, we need to talk through several common scenarios as the tax rules can vary depending on your marital status and the order of spouses passing on.

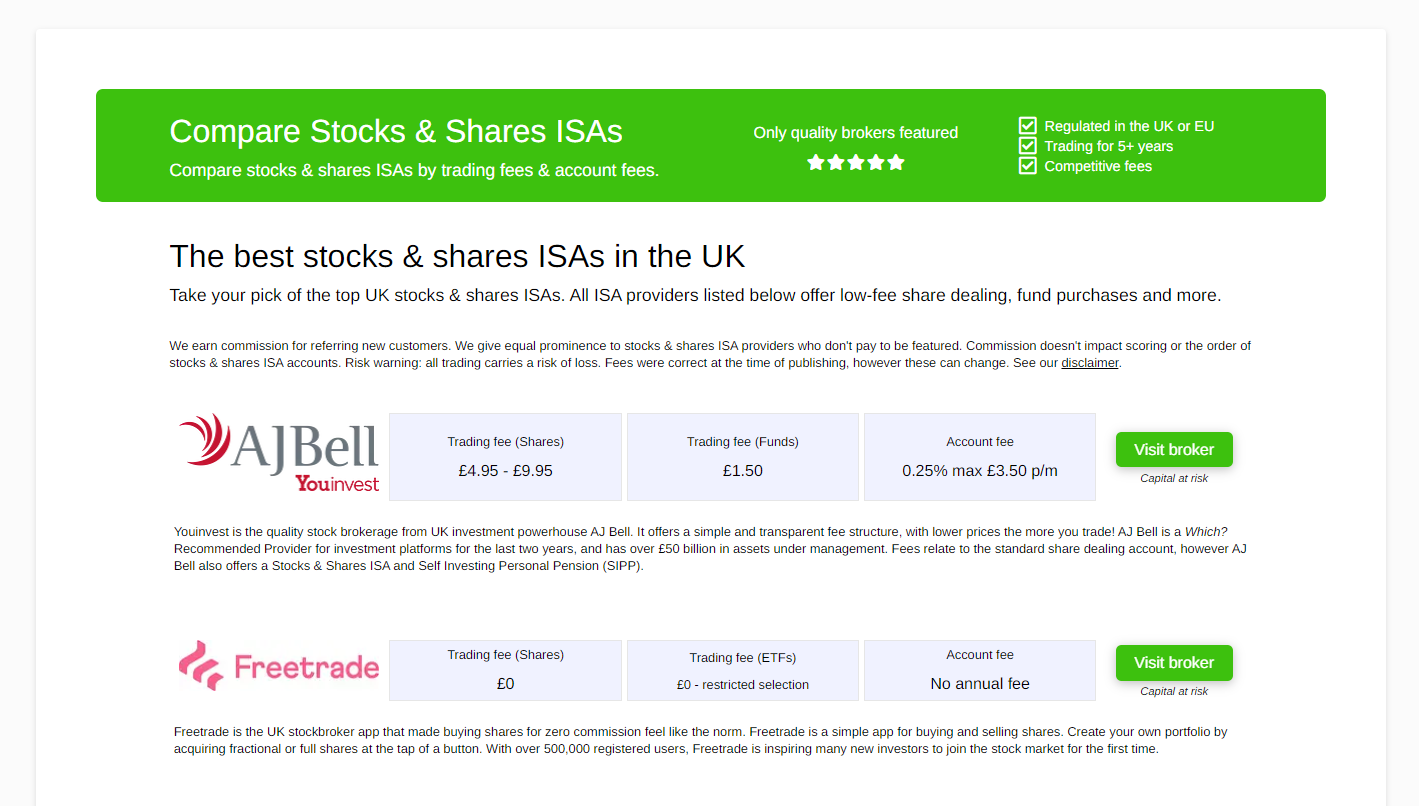

Which are the best stocks & shares ISAs?

We’ve shortlisted the best of the best stocks & shares ISAs below to help your search:

Large UK trading platform with a flat account fee and a free trade every month. Cheapest for investors with big pots.

The UK’s no. 1 investment platform for private investors. Boasting over £135bn in assets under administration and over 1.5m active clients. Best for funds.

Youinvest stocks & shares ISA offers lower prices the more you trade! Which? 'Recommended Provider' for last 3 years.

Buy and sell funds at nil cost with Fidelity International, plus simple £10 trading fees for stocks & shares and ETFs.

Capital is at risk

If you die before your spouse

If you are married or have a civil partnership, and you die before your partner then the following rules apply:

All of your assets may pass between you and your partner after your death without incurring any inheritance tax. This includes houses, possessions and investments such as those held in a stocks & shares ISA.

If you die after your spouse

If your spouse has already passed (and therefore you received assets from them free-of-tax) then most of your estate will be exposed to inheritance tax by default at the end of your life.

There are still exceptions, such as your primary residence, certain business & farm assets and so on, which we won’t go into in this article. However, we can assume that simple savings and investment accounts will be exposed to inheritance tax.

However, before inheritance tax is charged, you can deduct what is known as the ‘nil rate band’ amount. This is a tax-free allowance. The individual nil rate band is currently £325,000 (although this may change in the future).

If your original spouse passed all of their worldly possessions to you as the surviving spouse, then they also pass on their own nil rate band too. This means you’ll effectively have £650,000 of nil rate band which will protect the first £650,000 of your estate against inheritance tax.

If your spouse left some assets to other family and friends in their will, then the value of these gifts will reduce the available nil rate band which can be passed on to you, as it was utilised by those gifts. If your spouse gave more than £325,000 to others on their death, then they have already used up their entire nil rate band and will not pass any onward to you.

Any taxable assets above your total available nil rate band will be taxed at the prevailing rate of IHT, which is currently 40%.

What does this mean for your stocks & shares ISA? Well, if your taxable estate including your ISA is worth more than your nil rate band, then you’ll be paying tax on that surplus.

Example: If your taxable estate comes to £800,000 and you have £650,000 of nil rate band, then IHT would be levied at 40% of £150,000 = £60,000. This works out as an effective rate of 7.5% across all of your taxable assets.

Inheritance tax is fiendishly complex

I should emphasise again that inheritance tax is a complex area, and there’s more to the calculation than what I have just described.

Any substantial gifts given in the 7 years preceding death would also count towards your estate value, for example.

Please look at our shortlist of the best inheritance tax & estate planning books to learn about the rules in a longer format. Alternatively, get professional and independent advice on how investments are taxed in all scenarios from an IFA.

Comparing stocks & shares ISAs to ordinary investment accounts

If you’ve followed the example above, then you may have already worked out that there is no special rule for how ISAs are treated after you die.

Stocks & shares ISAs, like any ordinary stockbroker accounts, are a taxable asset that will count towards the value of your estate, and therefore will potentially be taxed if you exceed the nil rate band.

Read widely to become an expert at taxation

Financial Expert has several shortlists of tax books which will help you become an expert at taxation. Use our recommendations to discover the book which will take you from newbie to expert!

- The best saving tax books

- The best financial planning books

- The best inheritance tax books

- The best corporate tax textbooks

Everything you need to know about stocks & shares ISAs

- What is a stocks & shares ISA?

- What investments can be held in a stocks & shares ISA?

- How to become a stocks & shares ISA millionaire

- The history of stocks & shares ISAs

- Who can open a stocks & shares ISA?

- What is the minimum amount needed to open a stocks & shares ISA?

- Are stocks & shares ISAs only available in the UK?

- Full list of stocks & shares ISA providers

- How risky are stocks & shares ISAs?

- What fees do stocks & shares ISA accounts charge?

- What is the current stocks & shares ISA allowance?

- Are stocks & shares ISAs tax free?

- Do you need to disclose income and gains in stocks & shares ISA on your tax return?

- What happens to a stocks & shares ISA when I die?

- Stockbroker reviews (UK)