If you’re just starting out on your investment journey, you may be investing with little money each month, or have a small lump sum to begin your nest egg. It’s important that you can compare stocks & shares ISA minimum deposit limits, to find a provider who will help, rather than hinder your first steps.

Finding an ISA provider which will accept a tiny deposit is only the first step.

In my guide How to invest £1,000, I explain that investing fees can also make-or-break your portfolio. Your investments won’t grow if they’re being plundered by fees that were designed for much larger portfolio sizes.

So in this article I will answer the question of what is the minimum deposit allowed to stocks & shares ISA, and how to find the best stockbrokers in the UK which will keep fees low to help your money grow.

Minimum contribution to open a stocks & shares ISA

The smallest amount you can use to open a stocks & shares ISA is £1. I’ve reviewed our complete list of stocks & shares ISA providers to see what is the lowest sum that can be used to open a real account.

Wealthify stocks & shares ISA – £1 minimum investment

This referral link which includes a £25 bonus for signing up if you can invest £500 to open your account.

The fee structure of Wealthify also complements small investors, because their single management charge is calculated as a %, which means that it scales perfectly down to the size of your first investment. No rounding up or fixed price charges for you!

What’s more, you don’t have to agonise over what to invest in, as the Wealthify team and algorithms help guide you to that decision as part of a simple onboarding process.

Scottish Friendly – £10 regular contribution

An honourable mention goes to the Scottish Friendly Stocks & Shares ISA which allows investors to sign-up with a regular contribution of £10 per month. This was also quite a rare offering.

Other stocks & shares ISA providers asked for a minimum deposit of £25 – £100 in most cases. The smallest amounts tended to be regular investment schemes, where you sign up to a monthly direct debit for the small sum. A regular investment direct debit is not generally an obligation, so it can be cancelled if you wanted to stop investing further money into the ISA. However, it’s best to always read the terms and conditions for the ISA you are interested in, as T&Cs can vary.

Its also worth noting that the Scottish Friendly stocks & shares ISAs come in different flavours, with some tied to funds that carry some higher charges, such as the Unitised With-Profits fund which has a charge of 1.5% per year, which is high for an equity fund and might not be the best fund to invest in for the long term for this reason. The cheapest equity ETFs have an annual charge of less than 0.2%.

Therefore certainly do your research when choosing what to invest in now and be sure that you understand the total charges that will be deducted from your investments and account each year.

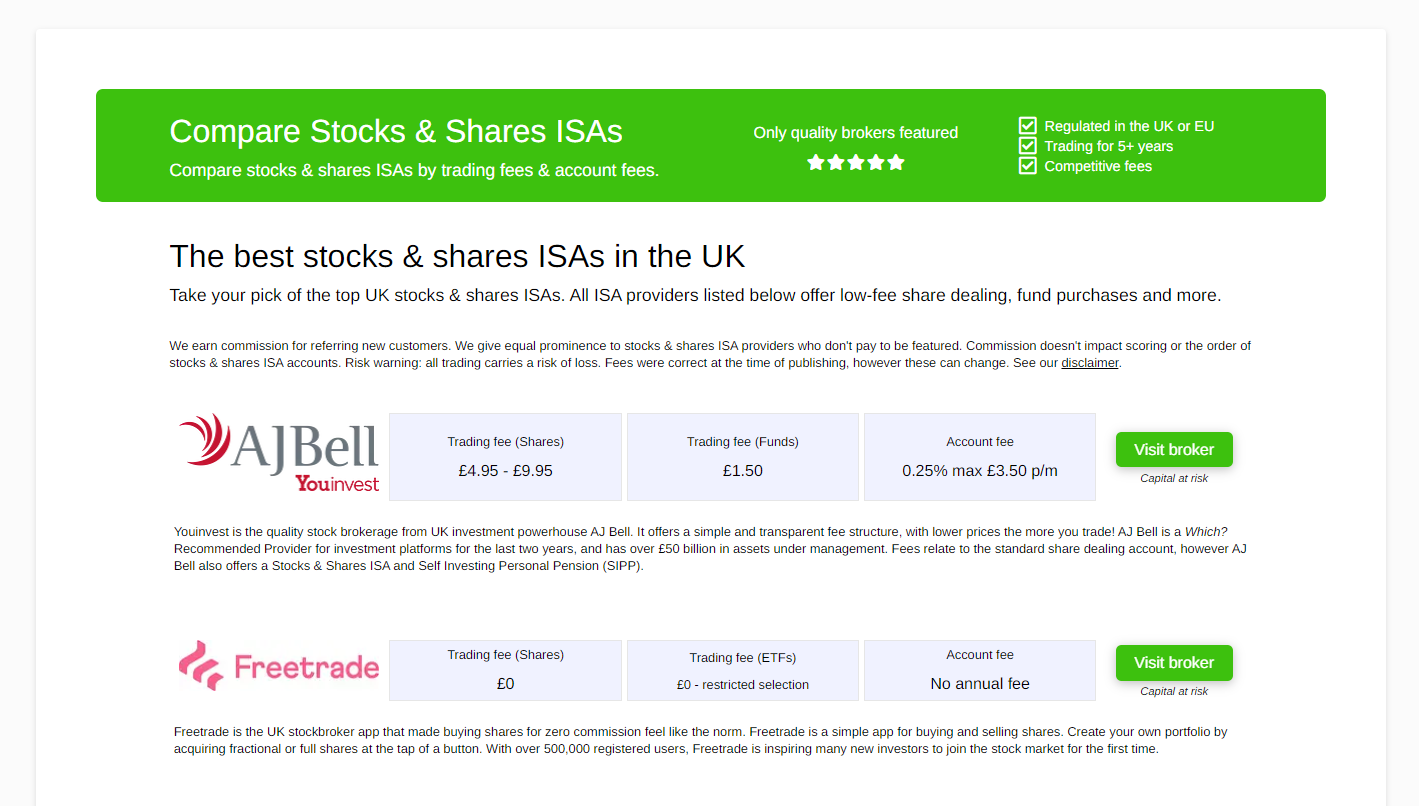

Which are the best stocks & shares ISAs?

We’ve shortlisted the best of the best stocks & shares ISAs below to help your search:

Large UK trading platform with a flat account fee and a free trade every month. Cheapest for investors with big pots.

The UK’s no. 1 investment platform for private investors. Boasting over £135bn in assets under administration and over 1.5m active clients. Best for funds.

Youinvest stocks & shares ISA offers lower prices the more you trade! Which? 'Recommended Provider' for last 3 years.

Buy and sell funds at nil cost with Fidelity International, plus simple £10 trading fees for stocks & shares and ETFs.

Capital is at risk

Please also see our Hargreaves Lansdown review, our AJ Bell review and interactive investor review.

Everything you need to know about stocks & shares ISAs

- What is a stocks & shares ISA?

- What investments can be held in a stocks & shares ISA?

- How to become a stocks & shares ISA millionaire

- The history of stocks & shares ISAs

- Who can open a stocks & shares ISA?

- What is the minimum amount needed to open a stocks & shares ISA?

- Are stocks & shares ISAs only available in the UK?

- Full list of stocks & shares ISA providers

- How risky are stocks & shares ISAs?

- What fees do stocks & shares ISA accounts charge?

- What is the current stocks & shares ISA allowance?

- Are stocks & shares ISAs tax free?

- Do you need to disclose income and gains in stocks & shares ISA on your tax return?

- What happens to a stocks & shares ISA when I die?

- Stockbroker reviews (UK)