A question I read frequently is ‘Do I need to put income and gains from my Stocks & Shares ISA on my tax return?’ or ‘Should I disclose my stocks & shares ISA dividends on my self assessment return?’. I want to give a quick and clear answer to this question.

Important tax disclaimer: For professional tax advice tailored to your circumstances, find an independent financial adviser using our impartial guide. Financial advisers can also assess your insurance needs and guide you towards the best funds to invest in. Financial Expert is not authorised to provide financial advice. This is a journalistic article, written with due care, but we offer no guarantees as to its completeness or accuracy and you should not rely upon it for investment decisions. One reason for this is that tax rates and rules change often, and therefore information can become obsolete quickly. Therefore I will provide links to the relevant HMRC website pages which will allow you to perform your own research.

Should you Disclose Stocks & Shares ISA Income and Gains to HMRC?

Everyone is quite familiar with the rule that stocks & shares ISAs are mostly tax-free. Confusion stems from how this tax exemption is actually given.

Do investors report their income & gains from stocks & shares ISAs, only for HMRC to charge 0% tax on that income. Or do investors omit it from their tax return altogether?

Failing to declare income is also known as tax evasion and is a criminal offence. For this reason, investors are usually cautious about whether to include or exclude income from their tax return.

Read more: The best fraud and forensic accounting books

So that’s why you’re here. So let’s cut to the chase. What is the correct treatment?

Here’s the simple rule: you do not need to include any income or gains on your tax return if they arose within a stocks & shares ISA.

Here’s the authoritative source for this response, directly from HMRC:

This means that if your entire portfolio of investments is held within a stocks & shares ISA, don’t need to feature it in a tax return. This really helps to cut down the number of sections in the tax return which you’ll need to complete if you have to complete a tax return for other reasons.

Even better; if you’re employed by a company that deducts payroll taxes, then your ISA investments will not require you to begin to complete one. Even if you make a £100,000 gain!

What if your investments weren’t in an ISA?

Let’s contrast this with the best stockbroker (UK) accounts that don’t carry the ‘ISA’ label. Each year, your stockbroker will send you a paper or digital copy of a tax statement that discloses the income and gains which you generated from that account for the previous tax year.

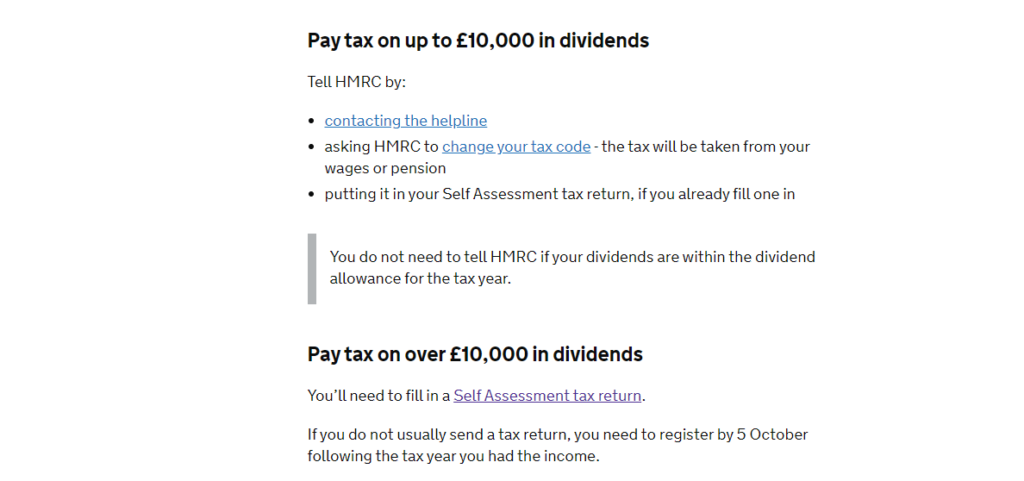

This would need to be disclosed on a self-assessment tax return – depending on the value of the dividends received. This is explained by HMRC below.

If you earn below £2,000 in dividends (which is the value of the dividend allowance at the time of writing), you don’t need to declare the income at all.

If you earn between £2,000 – £10,000 in dividends and also receive a taxable salary from an employer, you can ring HMRC and declare the income without filling in a full tax return, and they’ll liaise with your employer to collect the tax through PAYE deductions on your payslip.

For dividends greater than £10,000, you will need to complete a self-assessment tax return.

For any dividend growth investor, this can present quite the headache even before the cash cost of paying taxes is counted. This is why it can be very lucrative to use your latest stocks & shares ISA allowance each year to ensure that the maximum value of dividends is completely shielded from tax. You can read more about dividend investing tips with the best dividend investment books, which will provide you with the tools to select the best companies to invest in for dividend income.

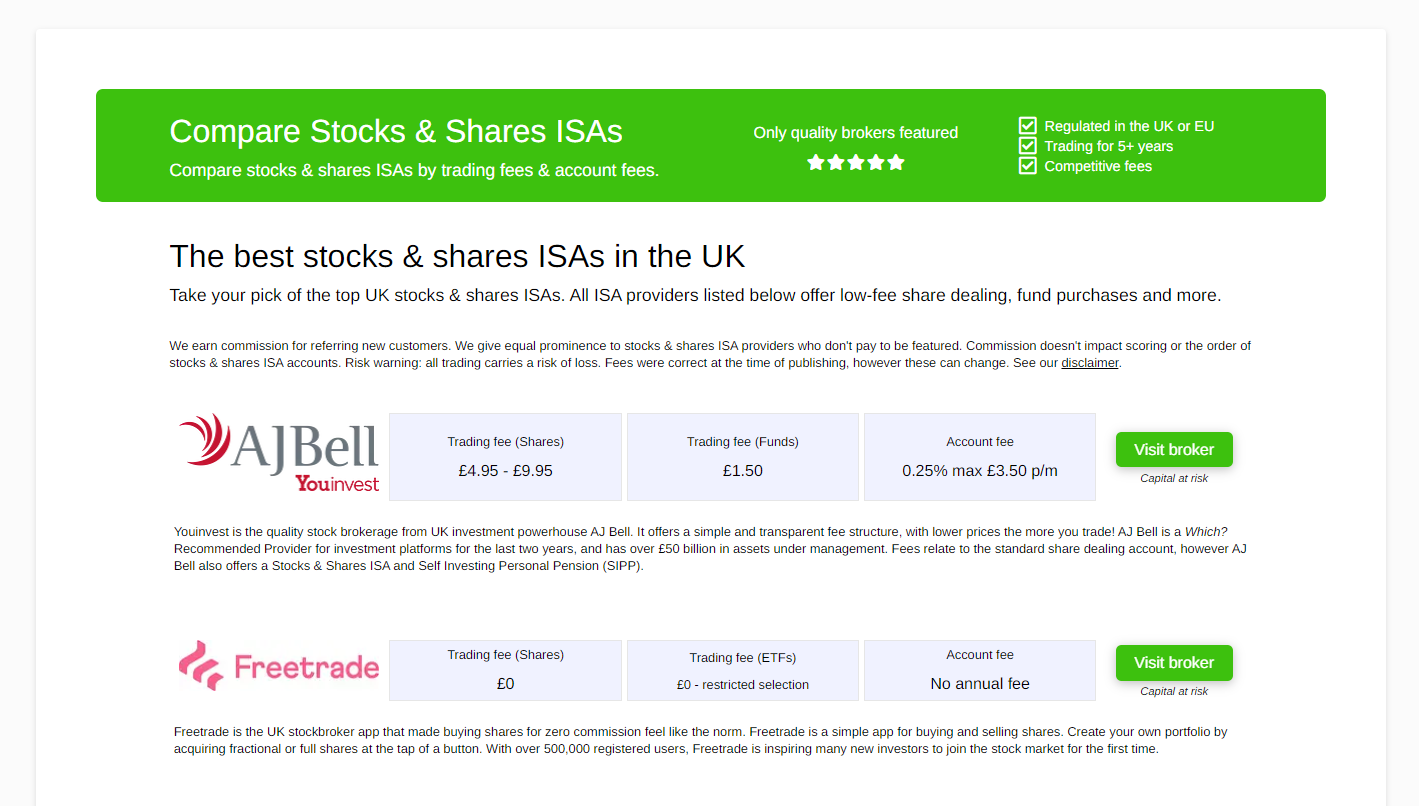

Which are the best stocks & shares ISAs?

We’ve shortlisted the best of the best stocks & shares ISAs below to help your search:

Large UK trading platform with a flat account fee and a free trade every month. Cheapest for investors with big pots.

The UK’s no. 1 investment platform for private investors. Boasting over £135bn in assets under administration and over 1.5m active clients. Best for funds.

Youinvest stocks & shares ISA offers lower prices the more you trade! Which? 'Recommended Provider' for last 3 years.

Buy and sell funds at nil cost with Fidelity International, plus simple £10 trading fees for stocks & shares and ETFs.

Capital is at risk

Summary: do you need to include stocks & shares ISA income in your self-assessment return?

In summary, HMRC lets savers and investors keep things really simple. If you hold an investment in one of the many best stocks & shares ISA accounts, you don’t need to report any income or gains from those investments on a tax return. This should hopefully take a worry off your mind!

Everything you need to know about stocks & shares ISAs

- What is a stocks & shares ISA?

- What investments can be held in a stocks & shares ISA?

- How to become a stocks & shares ISA millionaire

- The history of stocks & shares ISAs

- Who can open a stocks & shares ISA?

- What is the minimum amount needed to open a stocks & shares ISA?

- Are stocks & shares ISAs only available in the UK?

- Full list of stocks & shares ISA providers

- How risky are stocks & shares ISAs?

- What fees do stocks & shares ISA accounts charge?

- What is the current stocks & shares ISA allowance?

- Are stocks & shares ISAs tax free?

- Do you need to disclose income and gains in stocks & shares ISA on your tax return?

- What happens to a stocks & shares ISA when I die?

- Stockbroker reviews (UK)