Update: This article was originally written in 2019. In response to market turmoil arising during the pandemic, several Peer to Peer lenders have changed their business models, either by modifying fees, restricting withdrawals, or deciding to limit access to their investment opportunity to corporate investors only.

Peer to Peer lending (P2P), is a new form of investment which appeared one decade ago.

The return on investment falls somewhere in between bank interest and the returns from investing in shares on the stock market.

Unlike bank accounts, the FSCS £85,000 compensation scheme does not generally cover peer to peer lending investments.

Some investors see peer to peer lenders as ‘low risk’, on the basis that their track record for losses has been minimal to date. However, this understates the risk to investors, particularly during a downturn.

In this guide, we will cover:

- How peer to peer lending works

- What different products are available

- What interest rate you can achieve

- How to save tax on interest income

- What are the risks, and how can these be mitigated

Before we begin – I will caveat that each peer to peer lender will operate in a slightly different way. The industry is still new, and providers continue to change their offerings and roll out improvements to their service. Each provider will have different fee structures and different set of account types. Each platform also handles early withdrawals in a slightly different way.

For simplicity, this guide must make generalisations about peer to peer lending in general. You should carefully research each individual platform before investing, rather than relying upon the information contained in this guide.

What is peer to peer lending?

Peer to peer lending is where an investor lends money directly to a consumer or a business, in return for interest on the repayments. This is different from a peer to peer platform that fundraises for charities – where there is no expectation of a tangible return on the part of the donor.

Peer to peer lending platforms act as a matchmaker between cash-hungry loan applicants and cash-rich investors. As well as matching up supply with demand, the platforms perform the credit checks and manage all aspects of loan repayments.

From an investors perspective, a peer to peer platform may ‘feel’ just like any other bank account. This is because some P2P products invest your funds automatically without needing any further prompting. We’ll discuss this further in the next section.

The key difference between a peer to peer lending platform and a bank is the source of the funds they use.

Even though banks do technically make loans with savings deposits, savers only have a claim on the balance in their savings account. Peer to peer lenders actually own a piece of the loans themselves.

A platform never uses its own funds to make loans. Instead, it provides the technology and manpower needed to ensure the lending process runs smoothly.

Which are the largest peer to peer lending platforms?

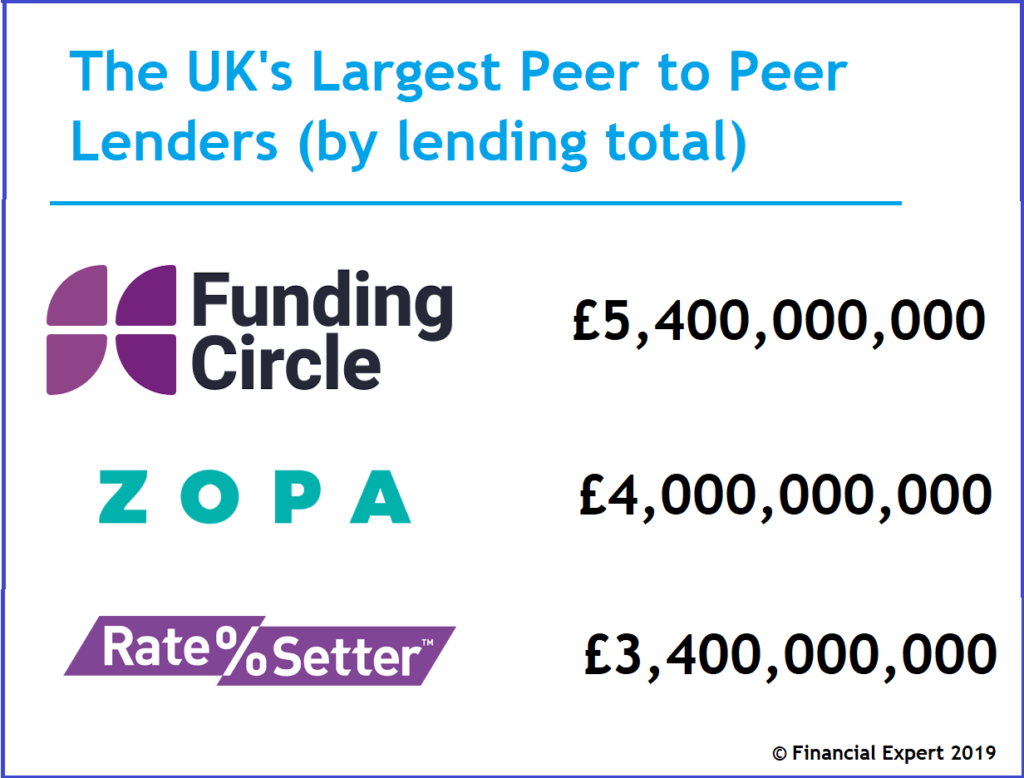

The largest players in the industry are Funding Circle, Zopa and Ratesetter.

Funding Circle specialises in loans to small to medium-sized businesses, while Zopa and Ratesetter focus on consumer lending.

Can you get Peer to Peer lending ISAs?

All reputable peer to peer lending platforms offer an ‘Innovative Finance ISA’. It’s an obscure name, but you can think of this as a peer to peer lending ISA.

Just like any ISA, any income that you earn within the account will be completely tax-free. Tax can have a significant impact on the return you ultimately receive, so keeping your investments within ISAs is an easy way to reduce or eliminate your investing costs. This particularly applies if you are a higher or additional rate taxpayer.

Perhaps you chose a stockbroker which offered a Stocks and Shares ISA and are already contributing to that account? That’s ok! As long as your combined payments into all your ISAs does not exceed £20,000 each tax year.

The important thing to know is that you can only open and fund a single account for each ISA type per tax year. This effectively puts a limit on how quickly you can open Innovative Finance ISAs across multiple platforms. In the meantime, while you are limited to one or two platforms, resist the temptation to place a huge chunk of money in a single provider. (See the risks section for why this would be inadvisable).

How does peer to peer lending work?

Let’s walk through the process of signing up to a platform and making your first loan.

First, you’ll create an account on one of the platforms, and deposit funds via one of three methods:

- Debit card

- Bank transfer

- ISA transfer from an existing ISA

This cash will sit in a cash holding account until you continue along the process.

What different products are available?

Next, you’ll select which type of lending strategy you want to subscribe to. Each large platform offers a choice between at least two strategies.

Platforms usually call these ‘accounts’ or ‘products’ which you can allocate your cash to when you are ready to invest.

This choice allows you to pick the level of risk which fits your investing risk appetite. Some accounts also offer a quicker, easier or cheaper withdrawal process, which is helpful if you have a short investment time horizon.

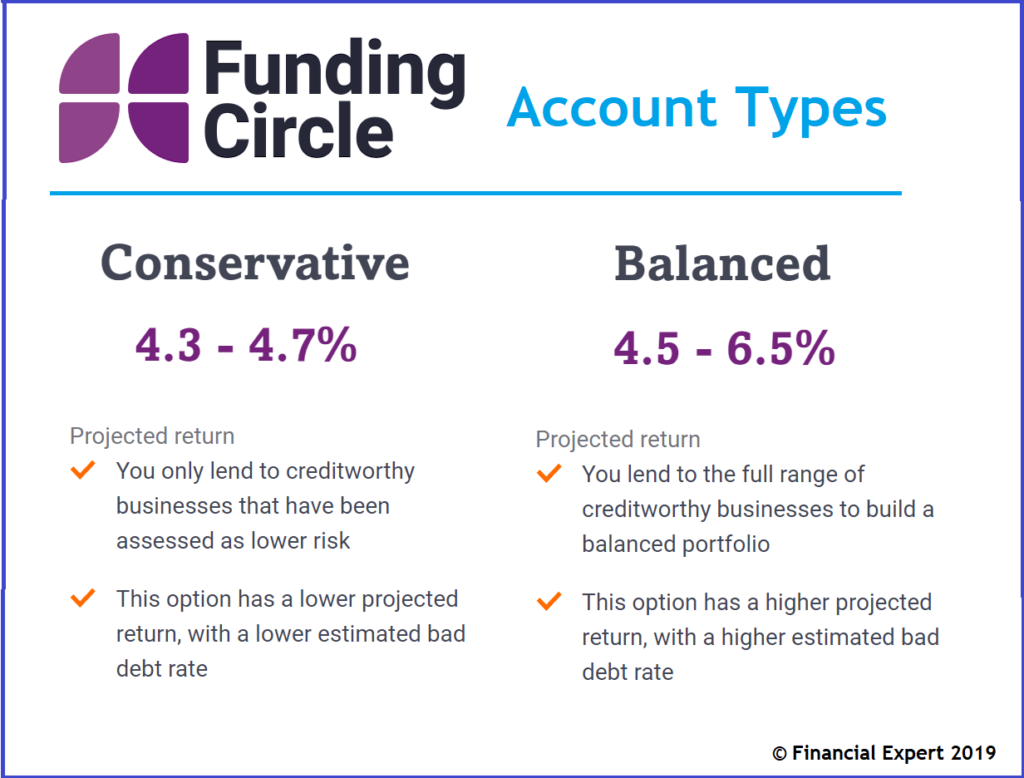

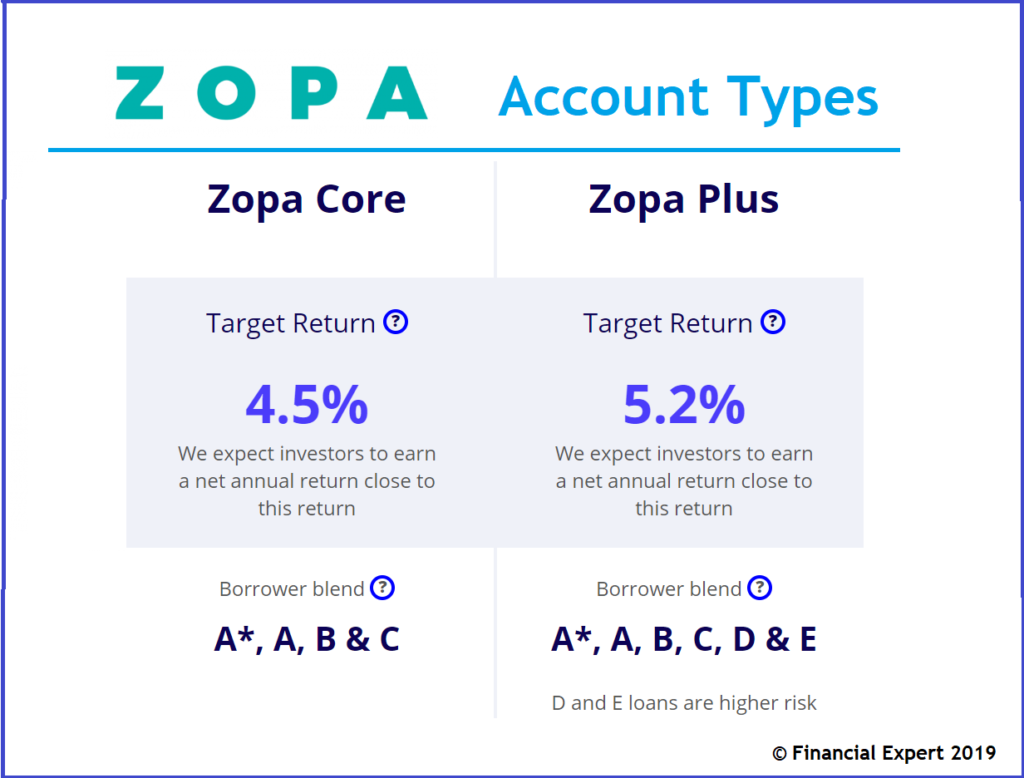

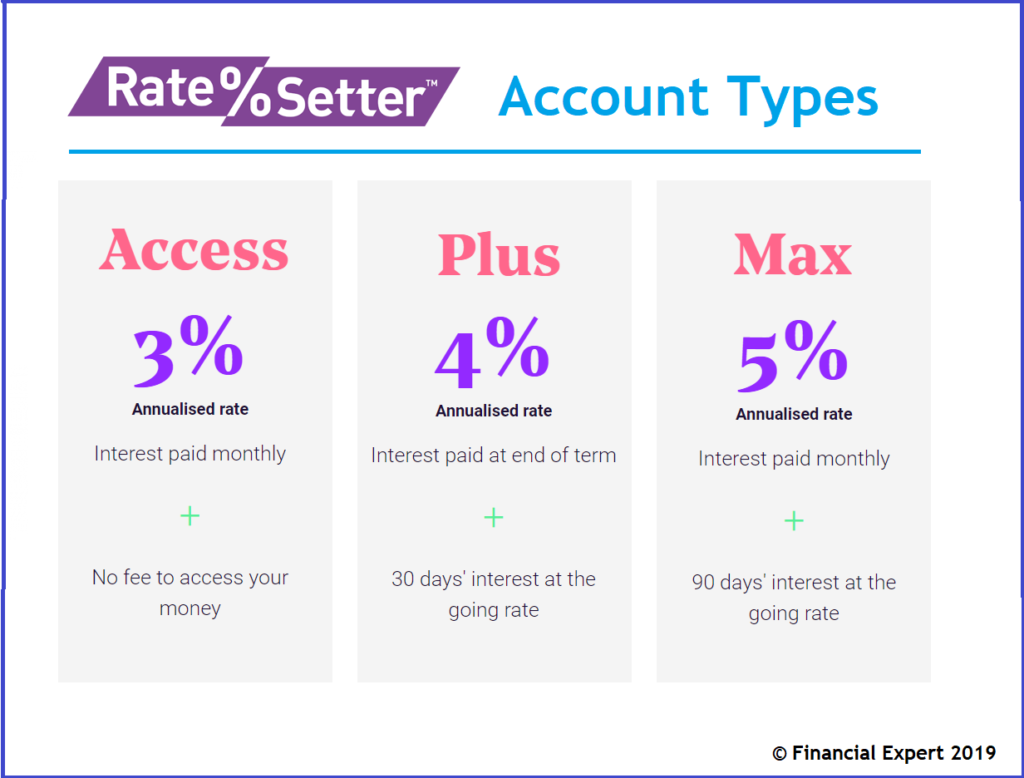

Each platform’s offerings vary, therefore I have created the following visual summaries which give a snapshot of each product’s features.

Peer to Peer Product Comparison

Funding circle applies a minimum credit check that all potential borrowers must pass to be listed on their platform. A Balanced account will invest users’ funds across all qualifying businesses. The Conservative account will only invest funds in a sub-group of borrowers which received a higher credit score.

Zopa investors have a similar product choice. If you wish to allow up to 20% of your funds to be lent to riskier consumers with a credit score of ‘D’ or ‘E’, you can select the Zopa Plus product which offers a slightly higher return.

Otherwise, the Zopa Core product restricts loans to only borrowers with an A* – C rating.

Zopa’s website explains these gradings in more detail. For context, it claims that A* – E graded borrowers represent the top 20% of applications that they receive. Zopa doesn’t engage in the scam that is payday loans!

Ratesetters’ product line-up is brand new for autumn 2019. The ‘Access, Plus and Max‘ options have replaced ‘Rolling, 1 year and 5 year’ options.

You may have noticed that Ratesetter accounts offer higher returns to investors who are happy with a higher withdrawal penalty. This will be very familiar to those of you who have used long term savings accounts, which often work in a similar way.

Once you commit your funds to a product, the platform does all the work for you! It usually takes between 1 – 24 hours to fully lend your money and build your portfolio for you.

This is because the platforms obey the science of diversification. They don’t simply match you against the next loan issued. Instead they spread your money evenly across the next hundred or so. This means that your experience of defaults should be closer to the average default rate across the whole loan book.

Can I see what loans I have invested in and can I choose the loans myself?

Usually, you cannot see the list of loans that you currently own.

Products which advertise a clear target return, e.g. Ratesetter’s Access account, give a high degree of certainty in terms of the rate you will receive. The flip side is that the platform needs to manage the process entirely to give themselves the best chance of delivering that return!

This means that you have no ability to favour certain types of loans, or avoid others. It’s a very hands-off process – too hands-off for some investors in fact.

Those investors might want to explore (slightly) smaller platforms which still provide the opportunity to approve loans individually. An example is the Manual Lending Account at Assetz Capital.

The advantages of handpicking your loans are:

- You can use the control to increase the risk and reward profile of your investment. You could exclude loans offering less than 8% interest to create a high-risk, high return account. (Some loans on funding circle offer over 10% interest).

- It can be an engaging experience to read loan applications and using the information to make a lending decision.

However, I believe these are outweighed by the downsides:

- Approving loans by hand becomes very time-consuming, particularly if you want to diversify your funds over 100 loans or more.

- Without specialist lending expertise, you do not have an edge when selecting loans – so why do it yourself?

- High-interest loans carry a high degree of risk – their default rate is much higher, which means during a recession (when default rates multiply), they are highly likely to suffer heavy losses.

What happens if a loan isn’t repaid?

Defaults occur all the time. They are an unavoidable part of the peer to peer experience. But don’t worry. It might surprise you to learn that most investors don’t even notice them.

Platforms mitigate the impact of defaults in the following ways:

- They spread your money across many loans, meaning you should not be significantly ‘exposed’ to any individual borrower failing to pay.

- Interest rates charged on loans are tailored to the borrower’s risk.

- Higher risk borrowers pay more interest. Ratesetter for example, charges between 4% and 49% to borrowers.

- These rates are calculated with a premium included that is designed to compensate for a portion of the loans going bad.

- Some platforms have a ‘provision fund’ which compensates borrowers for defaults. These are usually not available for manual accounts.

Provision Funds

Some platforms, such as Ratesetter, have a ‘Provision fund’ in place which reimburses investors for defaults.

This fund is replenished by a deduction made from all interest payments before they reach investors.

Investors who experience a default are automatically reimbursed by the fund. As you’re repaid in full, you wouldn’t even notice this has happened.

Because the money comes from deductions from investor returns – no money is actually being added or taken out of the platform – so the existence of the fund doesn’t generate any additional returns overall.

A provision fund is therefore not a miracle feature – it doesn’t really ‘increase returns’ or ‘reduce bad debt’. Its ultimate purpose is actually diversification – it spreads the pain of default equally across all investors.

This is actually very useful because it increases the consistency of returns. It means that regardless of the 100 specific loans you might own – your returns will be the same as if you had invested a few pennies in every similar risk loan on the platform.

The provision fund is not unlimited. As of writing, it stood at £12.5m. Therefore it will not be able to fully reimburse investors if default rates are significantly above expectations. It will act as a temporary buffer, but will eventually be depleted.

Is peer to peer lending safe?

This brings us to the key question: ‘How safe is peer to peer lending?’

This is such an important question to ask when you are moving savings from a bank account into an Innovative Finance ISA, because the risk profile is completely different.

There are several risks in peer to peer lending. We have more control over some, and less control over others. Let’s consider each in turn:

- Losses on loans

- Losing quick access to funds

- Platforms going bust

- Asset theft or mismanagement

Risk of losses on loans

As we mentioned earlier, the FSCS compensation scheme does not cover losses in a peer to peer lending account. This means that you’re on your own if borrowers fail to repay.

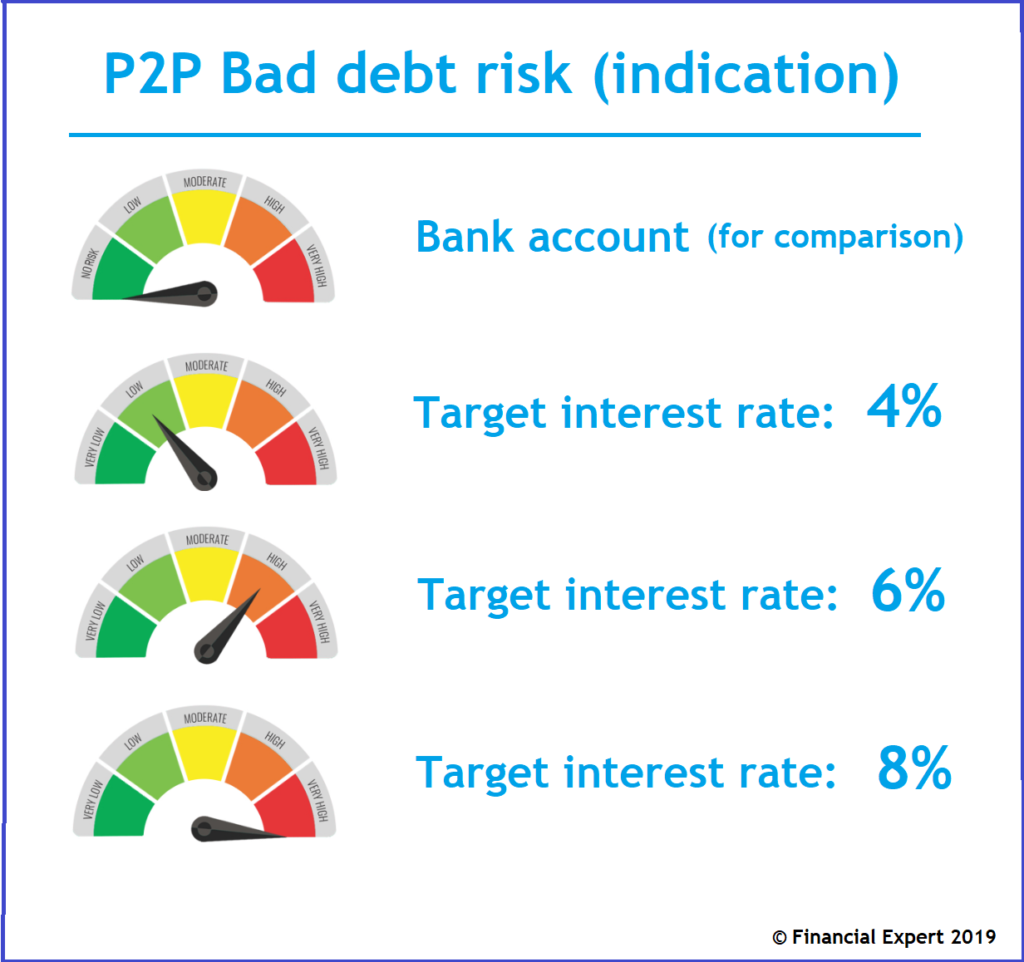

Peer to peer lending can be both low or high risk. It totally depends on the product you have chosen and the interest rate you seek.

Products which offer interest rates of 4% will only include loans to the highest-quality borrowers, such as homeowners with a spouse.

This class of borrower rarely defaults on a debt, because they are more resilient to financial stresses such as redundancy and illness. This translates to a small bad debt percentage (e.g. 1%) when the economy is healthy. Because the baseline default level is so low, your return is less vulnerable to economic jitters. Even if this increased fourfold in a severe economic downturn, the extra defaults would eat up your interest but probably leave your capital intact.

As the target interest rises to 6% then 8%, more and more cash is being used to lend to riskier borrowers, such as tenants and people with lower incomes. With riskier borrowers comes a much higher default rate – e.g. 4% per year. You can now appreciate that if this quadrupled in a severe recession, you could stand to lose both interest and capital. The bad debt rate would be 16% under that scenario!

These bad debt rates and scenarios are only rough indications. What is clear is that at some point in the peer to peer interest rate spectrum, a real risk of capital loss kicks in.

Risk of losing quick access to funds

Platforms can provide easy ways to access your money before borrowers pay back the loans. This is only possible by the platform selling your loan on to another investor. In other words, you can only make a quick exit provided someone else wants in.

In good times, you may make use of this accessibility and take it for granted. However, if default rates spike, inflows may dry up completely. If this is the case, no investors will need to wait until their loans are repaid, which will only occur gradually over several years.

Therefore, it would be wise to only invest funds in a peer to peer lending platform if you don’t need to access it for at least three years (unless the account invests in loans which mature in a shorter period).

Risk of platforms going bust

All peer to peer lending companies are start-ups, and few are profitable.

This creates a risk that a peer to peer lending platform will cease to trade if it can no longer attract investment and funding to finance its activities.

As the legal owners of the loans, investors would not be directly affected if a platform went out of business. Investors would still have the legal right to collect the loans, and borrowers would be obliged to continue making payments.

The large platforms have appointed independent trustees to manage the repayment of loans ‘beyond the grave’.

In short; it would be a messy process but investors shouldn’t lose out financially.

What would be lost, however, is the ability for any investors to withdraw funds before they are repaid by the borrower. Early access features are a bonus and wouldn’t be supported by a trustee.

Risk of management stealing or mismanaging investor funds

I raise this risk because peer to peer platforms are still relatively small companies, and therefore we can expect them to have less rigorous internal processes than banks.

Some peer to peer companies are tiny. And I mean tiny. Whilst writing this article, I investigated a small platform called ‘Leap Lending’ which I saw on a Google Ad. The website looked sensible, but a glance at the unaudited accounts of the company (Signia Money Limited) told me that only 9 employees work there.

Small companies which handle investor cash pose a risk of malicious employees misdirecting investor funds away from the matching process, and into their own bank accounts.

Companies can make mistakes too. In May 2019, a relatively new UK ‘property finance’ peer to peer platform ‘Lendy‘ collapsed, leaving investors on the hook for an alarmingly high bad debt rate.

The Financial Times reported that of its £160m outstanding loans, £90m were experiencing repayment issues.

Unlike banks, start-ups simply lack the financial firepower to be able to compensate investors if a large scale fraud or catastrophic mistake were to occur.

How to reduce the risks of peer to peer lending

That’s quite a healthy dose of risk warnings, but I felt it was my duty to communicate them as clearly as possible with you all.

Now that you understand the risks insightfully, you will understand why I suggest you follow the following rules to reduce the risks of peer to peer lending:

- Only invest money you can afford to lose. Whether you see peer to peer as ‘medium risk’ or ‘low risk’, when investing in a new platform you must accept the remote possibility that you could lose your entire investment.

- Only invest money that you don’t need for three years or longer (unless the loans themselves mature earlier).

- Spread your money across multiple platforms rather than concentrating on one. This will also ensure you are exposed to a healthy mix of different borrower types

- Only invest in the very largest peer to peer lending platforms. Platforms which manage the most loans and have been trading the longest will have developed the most sophisticated internal systems.

- Stick to products which automatically diversify your money across a wide range of loans. You can sometimes even call up the company ahead of investing, to create a rule for the maximum amount that you want to invest in a single loan.

- Don’t just chase the highest yield. High-interest rates will mean a rocky time when a recession arrives.

Why I use peer to peer lending platforms

I personally use the following platforms in my own portfolio:

- Ratesetter (Max)

- Zopa (Plus)

- Assetz Capital (Great British Business Account)

The average projected return from the combination of these accounts is about 5.3%.

For me, that’s a return that rewards me for the moderate risk.

My peer to peer lending accounts provide me with a very predictable interest income. It isn’t guaranteed of course, but it’s a stable counterweight to the large equity exposure I have in my portfolio.

This is why I aim for a 5% return – I purposefully want an investment which has a lower risk profile than stocks and shares.

Which is the best peer to peer lending site?

I will not hold up a single peer to peer platform as being ‘the best’, on the grounds that each platform has a different level of risk and reward, and therefore I think you should look for the platforms that offer an investment you’re comfortable with!

Course Progress

Learning Summary

Investing in Peer to Peer Lending Platforms

Peer to peer lending platforms are online marketplaces which match borrowers with investors seeking a return.

Peer to peer lending delivers a much higher interest rate than bank accounts, typically between 4% - 6%.

The premium interest rate comes with risks. For example, any investor losses will not be covered by the FSCS compensation scheme.

Peer to peer lending platforms usually offer an ISA account, which is strongly recommended. Within an ISA, platforms offer a range of products with different risk profiles, duration and target interest rates.

To diversify, use the automated investment products which will spread your money across hundreds of loans. This will reduce your exposure to an unlucky pattern of defaults.

Only invest money that you can afford to lose, and which you do not need to touch for at least three years. Total capital loss is highly unlikely but technically possible.

To avoid putting your eggs in one basket, open the maximum one ISA account per year so that after three years you can spread the risk across three different platforms.

Choose the product that is right for your portfolio. Consider whether you want to minimise risk, create a moderate risk investment, or speculate to chase a high yield. Choose a product that complements that strategy.

Quiz

Take Action

- Use this savings calculator to quantify the upside of switching a portion of your savings from your existing savings account to a peer to peer lending platform paying 5% per year.

- Visit each of the peer to peer lending platforms featured in this article to continue your research. These are the largest, so are a sensible place to begin.

Completion of the Intermediate Course

Turn off your device and pop some champagne! You have armed yourself with all the tips and tricks you need to boost your investment returns to 8% per year, (dependent on the level of risk you are comfortable taking of course).

Please leave me a comment below to let me know which topic you personally found was the most useful.

Share this course with your friends

If you found this course helpful, then why not share it with your friends? I don't charge anything for providing these courses. Therefore I have no budget to spend on promotion. This is why it means a great deal when others help spread the word!

Progress to the Advanced course

Continue onwards to the Advanced level course if you are interested in learning more about higher-risk investment opportunities for sophisticated investors.

Comments 2

I will be retiring within the next 12 months and wish to invest some of the lump sum from my workplace pension so it can hopefully last through my retirement. Thie article was a great insight into investing for a novice like myself.

I found the course quite wide but would have liked some more information on, Insurance bonds, Trust Funds and more about taxation treatment of investing

As a seasoned investor, I found the course confirmed my approach to investing was in fact “Balanced”.

It also confirmed my feeling that I should now be moving to more passive funds and a low cost investment platform. I am looking at moving my investments to the Vanguard platform and investing in a selection of their Index funds for all developed equity and bond markets.

Yes at age 73, I am giving up; having had 30+ years of ups and downs, but generally positive outcome in my portfolio.