If you’re searching for a savvy place to invest your money, you’ll have an eye-out for fees. Stocks & shares ISAs allow you to grow your money tax-free in shares, bonds and funds. That tax saving will help to boost the bottom line of your account. But fees and charges will work against you. Investors need to keep reducing investing costs on their agenda to ensure that they don’t ‘leak’ financial returns to institutions. This article will cover what fees stocks & shares ISA providers tend to charge. After reading, you’ll know what to look for when comparing stocks & shares ISAs (or any stockbrokers for that matter).

Please be aware that ISA providers regularly update their fees and charges, therefore while fees quoted in this article were accurate at the time of writing, they may have subsequently changed. Please confirm the fees of any provider directly on their website before choosing any bank account or stockbroker account.

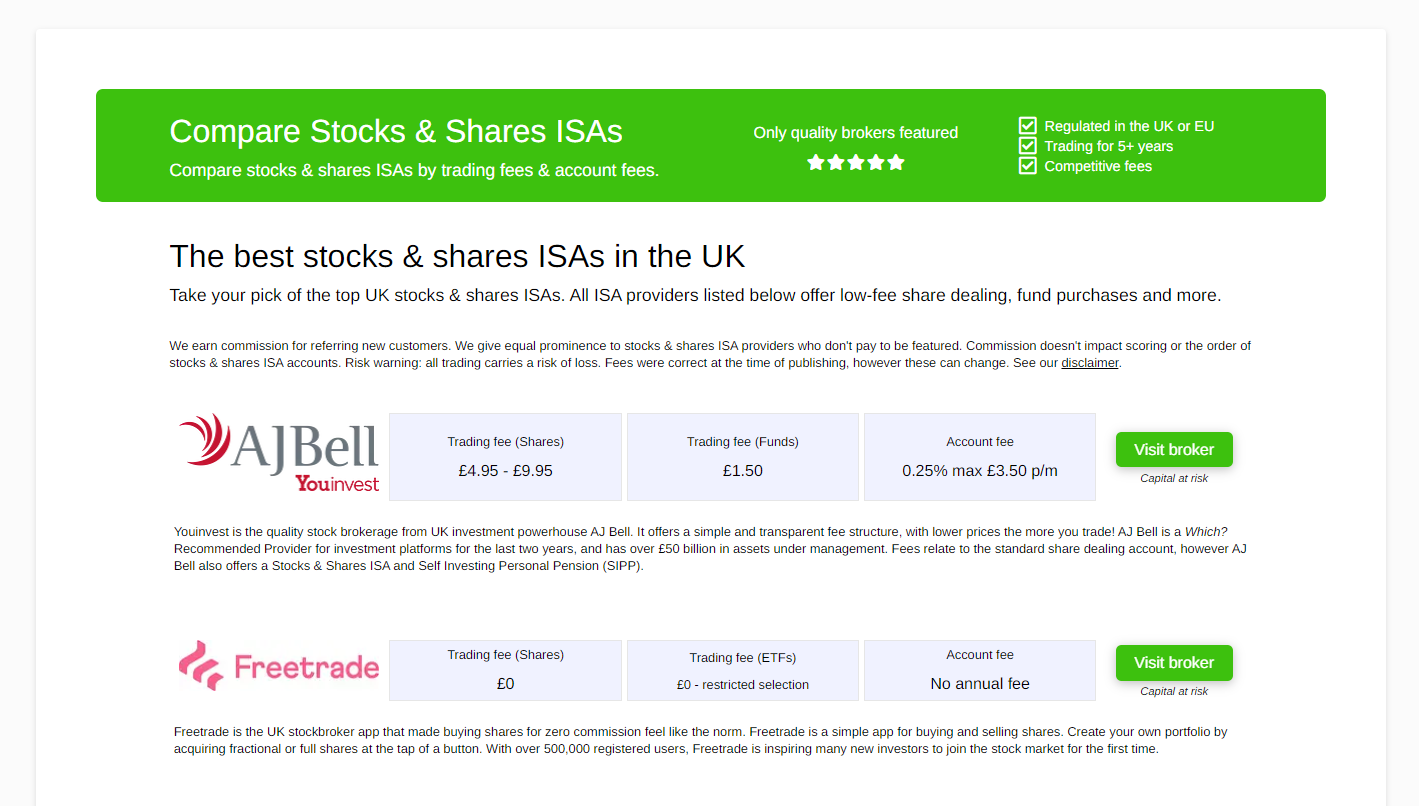

Which are the best stocks & shares ISAs?

We’ve shortlisted the best of the best stocks & shares ISAs below to help your search:

Large UK trading platform with a flat account fee and a free trade every month. Cheapest for investors with big pots.

The UK’s no. 1 investment platform for private investors. Boasting over £135bn in assets under administration and over 1.5m active clients. Best for funds.

Youinvest stocks & shares ISA offers lower prices the more you trade! Which? 'Recommended Provider' for last 3 years.

Buy and sell funds at nil cost with Fidelity International, plus simple £10 trading fees for stocks & shares and ETFs.

Capital is at risk

Please also see our Hargreaves Lansdown review, our AJ Bell review and interactive investor review.

An overview of common fees and charges

Stocks and shares ISAs tend to include the following fees and charges. Providers sometimes use a range of names for the same type of fee, so I will group them together for simplicity:

- A platform charge (also known as account fee, administration fee or periodic fee)

- A trading fee (also known as a trading commission or dealing charge)

- Stamp duty

- An initial investment charge (also known as front load or an entry charge)

- An exit fee (also known as transfer-out charges)

- Currency conversion fees

Your invested money will also feel the following costs, although these are not directly charged by the stocks & shares ISA provider. We won’t cover these in this article.

- The total expense ratio of funds such as ETFs, OEICS and Unit Trusts

- The bid-ask spread of any publicly traded asset

- Corporation tax (in some cases)

Stocks & shares ISA charges – in detail

Let’s talk through the fees above in detail, one at a time, to help you understand which fees are mandatory, which costs can be reduced, and which costs can be avoided altogether.

Platform charge

This is a general account charge which covers the ongoing administration of the ISA provider. As this fee will repeat every year like clockwork, you’ll want to choose a provider with a platform charge that suits your portfolio size. It won’t change in size regardless of what you invest in.

If you’re investing £1,000 then an ISA with a £5 per month platform charge is going to seriously hamper your returns. However, if you have a £1,000,000 portfolio, then equally a 1% platform fee will equate to an eye-watering fee of £10,000 per year.

It’s about finding the right charge structure that works for your current and medium-term portfolio size.

Very few providers levy no platform charge, however it is worth noting that some companies waive or reduce the platform charge if your account value stays above a certain size, e.g. £50,000.

Trading fee

If you’re making regular contributions to your stocks & shares ISA, then trading fees may be the largest component of expenses in your account.

Trading fees are charged by an ISA provider when you buy securities such as stocks, shares, bonds and publicly traded funds such as investment trusts and Exchange-Traded Funds (ETFs). These cover the actual dealing costs of the broker, who executes your order on an exchange, plus a healthy margin.

Fund purchases can be an exception as these are not traded via an exchange. It’s possible to find stocks & shares ISAs which charge nothing to buy units in a UCITS authorised fund. If there is a charge, it’s likely to be lower than a share trade. Free fund dealing is often offered by stocks & shares ISAs which are tied to a particular fund manager, such as the ISAs offered by Fidelity or Vanguard.

However, you’ll have to weigh up the trade-off between cheap fund purchases and a lack of choice, as these accounts tend to restrict you to a narrower range of funds. This narrow choice could still include some of the best funds to invest in, so this is a judgement to make before you sign-up to a platform.

Reducing trading fees to zero

Recently, several stockbrokers have made the decision to charge zero commission on trades. Examples include eToro which I review here. However, these zero-commission accounts are not usually within the stocks & shares ISA wrapper.

Stamp duty

Stamp duty, or Stamp Duty Reserve Tax to give it the full name, is the tax you will pay when directly buying UK shares. This will include shares in Investment Trusts and ETFs. The tax is levied at 0.5% and is unavoidable.

You will not pay stamp duty on the purchase of units in an unlisted fund, however the fund itself will pay stamp duty on its trading activity, and these costs are passed onto investors via deductions from the funds assets.

This is not a cost that can be avoided, therefore needn’t factor into your choice of stocks & shares ISA.

Initial investment charge

An initial investment charge is an entrance fee to an investment opportunity. This can apply to investments where you directly purchase from the provider, such as when buying funds within a stocks & shares ISA.

Funds should clearly state in their keyfacts document if they apply an initial charge. These can range from 0.5% to 5% and can generally be avoided by shopping around. Competition from ETFs (which cannot charge entry fees due to their structure) and DIY investing has helped to push initial fees out of the industry. Now rare, but they do still exist so are worth watching out for.

Exit fee

This is a difficult one to assess, as you don’t know how long you will stay with your stocks & shares ISA provider. If history shows that you tend to bounce from one provider to another every few years, then it’s worth examining what charges they will apply if you choose to leave.

This could range from a simple account closure fee to a ‘stock transfer’ fee which may apply if you transfer your holdings from one provider to another without selling. The effect of a transfer fee is to almost collect the trade commission the broker could have collected if you had sold your holdings. However, it may still be economical to transfer shares and pay the exit charge, as you will also save money by not having to buy them back with your new provider.

Currency conversion fees

If you buy shares or funds denominated in another currency, such as US shares which are priced in US Dollars, then your trade will have two elements

- A swap between your local currency and USD

- The purchase of the securities with your new USD balance

And the opposite needs to occur when you come to sell your shares and convert any proceeds back into your local currency.

Most stocks & shares ISAs have a policy for the currency that involves a % fee or FX commission based on the size of any conversion. A flat fee may also be applied on top of the transaction – to ensure the revenue has a minimum value on tiny deals.

From personal experience, I’ve seen a range of different charges, although I find it difficult to get particularly excited about comparing stocks & shares ISAs on the basis of FX charges.

This is because unless your provider has an egregious policy, it’s not likely to have a material impact on your returns and you can manage your FX risk by using foreign currency cash to buy more assets in that same currency, avoiding the need for constant conversions back and forth.

Books to help you learn more beyond fees and charges of stocks & shares ISA

Take a look at these fascinating books to discover more about stocks & shares in general, and how to use ISAs and other legal tax avoidance strategies to minimise the tax you need to pay on your investments:

With the help of the great authors behind these titles, I hope you’re able to keep investing costs to a minimum and enjoy as much of your profits as possible. These titles will also suggest which are the best companies to invest in.

Everything you need to know about stocks & shares ISAs

- What is a stocks & shares ISA?

- What investments can be held in a stocks & shares ISA?

- How to become a stocks & shares ISA millionaire

- The history of stocks & shares ISAs

- Who can open a stocks & shares ISA?

- What is the minimum amount needed to open a stocks & shares ISA?

- Are stocks & shares ISAs only available in the UK?

- Full list of stocks & shares ISA providers

- How risky are stocks & shares ISAs?

- What fees do stocks & shares ISA accounts charge?

- What is the current stocks & shares ISA allowance?

- Are stocks & shares ISAs tax free?

- Do you need to disclose income and gains in stocks & shares ISA on your tax return?

- What happens to a stocks & shares ISA when I die?

- Stockbroker reviews (UK)