Are you curious about investing in emerging markets? In our article ‘How to build a basic investment portfolio‘ we suggested that investors with an ‘adventurous’ or ‘balanced’ risk profile should consider including these exotic investments in their portfolio.

What are emerging markets?

Emerging markets are the stock, bond and property markets of rapidly developing economies.

MSCI, a leading index company, includes the following countries in their ’emerging market’ index:

| Americas | Europe & Africa | Asia | Middle East |

|---|---|---|---|

| Argentina Brazil Chile Colombia Mexico Peru | Russia Turkey Czech Republic South Africa Egypt Greece Hungary Poland | China India Indonesia South Korea Malaysia Pakistan Philippines Taiwan Thailand | Saudi Arabia UAE Qatar |

Why do investors include emerging markets in their portfolio?

As any emerging markets investment books will show, this asset class has generated spectacular returns over the last decade.

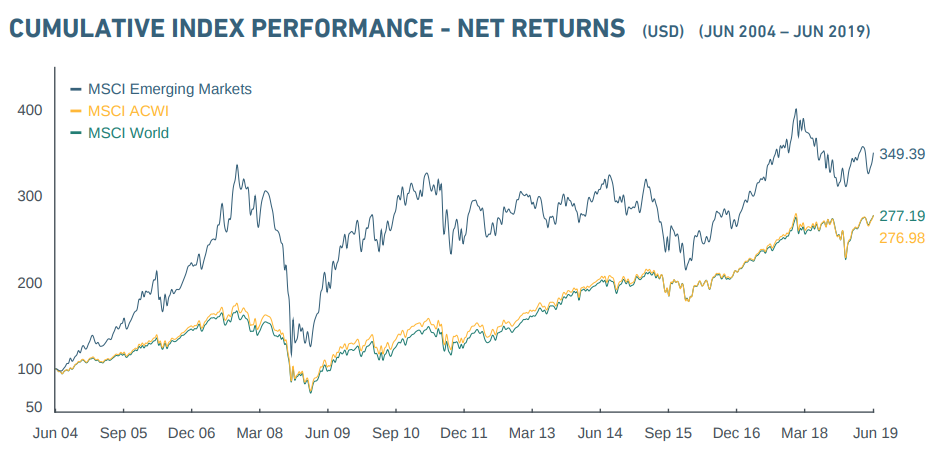

Despite a large price fall in 2008, the chart below shows that £100 invested in emerging markets in 2004 would have tripled to £300 by 2014.

Emerging economies tend to have higher growth rates than developed economies such as the UK and Germany. For example, China’s economy grew by 6.9% in 2017, compared to a 1.8% increase in Britain’s economy. This leads to a rapid expansion of corporate profits, and therefore stock markets also expand in value.

As we will explore further this article; emerging countries also tend to have greater risks compared to richer economies. These include political instability (e.g. Egypt), pervasive corruption (e.g. Pakistan) and weaker property rights (e.g. Russia). These all lead to more volatile earnings, uncertain valuations and a bumpy journey for investors. One factor that ties most emerging countries together is a higher cost of doing business. Emerging market shares are priced to deliver higher returns to compensate investors for this risk.

How to invest in emerging markets

Investing internationally is more costly than buying UK shares. International trading fees are much higher. They tend to range between £12 – £20.

International stock exchanges price their shares in their local currency. For example, South Korean Won is the pricing unit for Samsung shares. While your broker will take care of the FX conversion automatically, they will charge a separate fee for this service. FX fees are approximately 1%. Altogether this means a £1,000 international share purchase could cost £30 (3%), compared to £10 for a domestic purchase.

Furthermore, many stock exchanges in emerging markets are not accessible through retail stockbroking accounts. Chinese shares are a perfect example. This keeps some of the key emerging markets out of reach of amateur investors looking to buy direct.

Whether due to the prohibitive cost or restrictive access, investors stay away from individual shares when investing in emerging markets. The mainstream route for investing in emerging markets is overwhelming via funds. Passive emerging market funds will track a large index of companies such as the MSCI Emerging Markets Index.

A prime example is the Vanguard Emerging Markets Stock Index Fund. With £8 billion of assets under management, the fund can convert currencies and place international trades efficiently. Ongoing charges come in at just 0.27% per year.

Which are the best UK stockbrokers?

We’ve shortlisted the best of the best UK stockbrokers below to help your search:

Trade shares with zero commission. Open an account with just $100. High performance and useful friendly trading app. Other fees apply. For more information, visit etoro.com/trading/fees.

Large UK trading platform with a flat account fee and a free trade every month. Cheapest for investors with big pots.

The UK’s no. 1 investment platform for private investors. Boasting over £135bn in assets under administration and over 1.5m active clients. Best for funds.

Youinvest stocks & shares ISA offers lower prices the more you trade! Which? 'Recommended Provider' for last 3 years.

Choose a pre-made portfolio in minutes with Nutmeg. Choose your level of risk and let Nutmeg efficiently handle the rest.

Buy and sell funds at nil cost with Fidelity International, plus simple £10 trading fees for stocks & shares and ETFs.

Capital is at risk

Trade stocks & options on the advanced yet low-cost Freedom24 platform that arms retail investors with the tools to trade like professionals.

Capital is at risk

Please also see our Hargreaves Lansdown review, our AJ Bell review and interactive investor review.

If I invest in an emerging markets equity fund, what am I investing in?

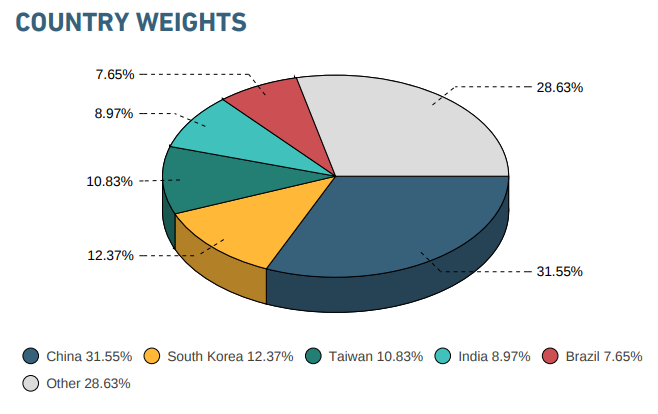

Given that the MSCI Emerging Markets index covers 26 countries, you might expect that an emerging markets fund tracking this index would scatter your wealth evenly across many countries. In fact, upon closer inspection, the index is weighted heavily towards just four countries. Companies in China, South Korea, Taiwan and India account for 64% of the index by value.

This is generally reflective of the huge variation in the size of their stock markets compared to smaller members such as the Czech Republic and Qatar. China’s Shanghai Stock Exchange rivals the London Stock Exchange in size, and therefore it is not surprising to learn that this attracts a large portion of the funds.

Practically speaking, this means an emerging markets fund that tracks the MSCI index is not as diversified as you might think. The index will be very sensitive to Chinese news and events, such as the release of economic data like GDP statistics. If you’re wondering what to invest in to avoid news sensitivity, the only true answer is a bank account. All equity markets gyrate in response to news events.

This is for your information, rather than a warning. Concentration isn’t unique to emerging market funds. Investors in ‘developed world’ funds will find a similar share of the fund directed into American companies due to their dominance of the corporate world.

What are the risks of emerging markets?

1. The returns are extreme in both directions

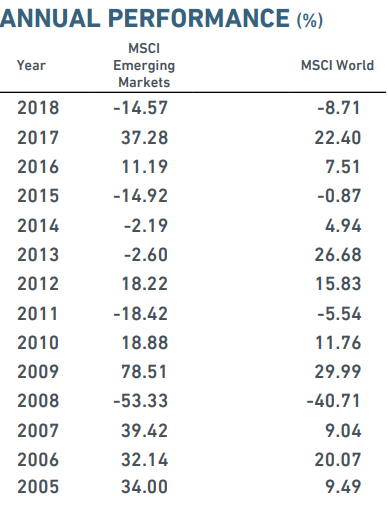

The price-performance of emerging markets has a chequered history. The table below shows the performance of emerging markets, compared to MSCI World (a developed world index).

From this comparison, we can see that the emerging market return is sometimes double or triple the developed return. We can also quickly draw the conclusion that emerging market shares are a high-risk investment.

Let’s reflect on the magnitude of those price swings. The data begins with a golden period of three straight years of 30%+ returns in 2005 – 2007. The index then retracted by 53% in 2008, (the same year of the Lehman Brothers collapse). This was followed by a blistering 79% recovery in 2009 which almost recouped earlier losses.

Put yourself in the shoes of an emerging market investor during that time period. This would have been a wild ride for those who chased the high returns and had allocated too much of their portfolio towards this asset class.

This is why even our adventurous example portfolios allocate no more than 20% of equities to emerging markets.

The second thing you may notice is the correlation between the two series of data. They move in opposite directions in only 2 years out of 14. This is a disappointing observation, as correlation between two parts of a portfolio is undesirable. We explain why in our article The Science of Diversification.

To an extent, this is to be expected, as developed and emerging market equities are both types of equities. Therefore, they share many risks in common and will respond in similar ways to global economic events. In fact, the fact that these sub-asset classes do not walk in perfect harmony all the time is positive. It demonstrates how spreading your equity holdings across multiple sub-classes would still help to diversify a portfolio.

2. Political and legal risks are real

The political systems of developed economies are usually stable, predictable and democratic. On the other hand, the political regimes of emerging market economies can vary wildly. This can lead to unfair outcomes for companies, and periods of uncertainty.

South Korea’s political system broadly resembles its rich democratic neighbours such as Japan.

China’s Communist Party offers a large dose of stability, however, President Xi Jinping wields significant autocratic power. This increases the risk of a Chinese company being nationalised or placed under arbitrary sanctions if it falls out of favour with the ruling elite.

After a popular uprising, Egypt voted for its first democratically elected leader in 2012, only for the military to depose him in a coup and install their own preferred leader just one year later.

In Turkey, an embattled President Erdoğan continued his attempts in 2019 to exert influence over the central bank which sets interest rates. This stoked fears that mismanagement of the economy could occur in the pursuit of political ambition. All investors prefer an economy with ‘independent’ management.

Any good consultant advising a business that is rapidly expanding into emerging markets will usually encourage the business to utilise local experts as much as possible to ensure that the business operations can quickly ‘fit’ into local regulatory systems and cultural norms. You can see why deciding which is the best company to invest in is even more difficult with this added layer of complexity.

Read more: The best consulting books.

3. Foreign currency movements will Impact your portfolio

The denomination of shares will be the local currency of the exchange on which they trade. Therefore the price of a Chinese company is expressed in RMB, and Brazilian shares are priced in Real.

This introduces an additional layer of risk – that the value of this currency may falls against your domestic currency, e.g. Pound Sterling.

The same is true of developed foreign markets such as the US and Europe. However, their currencies tend to be more stable and therefore this is a headache that most investors can overlook.

To explain how emerging markets really elevate this issue – take a look at the exchange rate between Pound Sterling and Brazilian Real over the last decade.

This chart shows that during 2011 you could exchange 2.5 Reals for a pound. As of writing, 5 Reals equal one pound.

From a British investor’s perspective – all assets priced in BRL have halved in value over this time period. Simply due to the change in the exchange rate. Equally, the circumstances could have been reversed; the rate movement could have been favourable and could have led to a windfall gain in a British portfolio. However, there is no ‘expected’ return from foreign currencies. Thus, the FX element adds nothing but volatility and risk to emerging markets investments.

As we have pointed out before, extra volatility without a matching reward will lead to poorer performance over the long run.

Is Emerging Markets the Riskiest Equities Classification?

The three risk factors above help explain why the returns from emerging markets are so dramatic compared to developed economies.

Emerging markets are not, however, the riskiest sub-asset class of equities. The MSCI Emerging Markets index is, actually a rather exclusive list of countries. This is because MSCI applies various tests which countries must pass before they are included. These tests include whether the financial markets have sufficient liquidity (i.e. can they cope with large volumes of buyers and sellers?) and whether the regulatory environment is sound.

Where countries do not meet these requirements but are still developing at a faster rate than the least developed countries, they may be included in the MSCI Frontiers Index.

The frontiers index includes countries such as Vietnam, Kuwait, Morocco and Kenya.

It is common to see actively managed funds cover this investment area, due to the patchy liquidity and small size of the companies concerned. MSCI promotes countries into the main emerging markets index as they continue to develop. This causes headaches for fund managers which track the index religiously, as the reshuffling of index constituents requires them to sell off more the established companies and move capital into poorer, less regulated environments.

Frontier markets are at the extreme end of the risk spectrum and therefore Financial Expert would not expect to see the inclusion of frontier market funds within all but the most adventurous portfolios.

Emerging Markets – Part of your Portfolio?

Like stock markets in a slingshot, the demographic and economic development of emerging market countries continues to support an investment case.

However, emerging markets are vulnerable to the same boom and bust cycles of developing markets. Indeed, due to their smaller size, emerging markets are actually more vulnerable to the flight of capital during tough times, which can hammer both their stock market and currency.

The inclusion of an emerging markets fund in your stocks & shares ISA could enhance the breadth of your global diversification.

The best portfolio management books tend to recommend that adventurous investors put no more than 10% of their equity allocation into emerging markets.

However, emerging markets are like a hot chilli sauce. They possess a strong kick and should only be used sparingly, by those with a strong stomach!

Course Progress

Learning Summary

Investing in Emerging Markets

Emerging markets are high growth countries which are still in a phase of developing their legal, political and financial systems.

I do not recommend investing directly in the shares of emerging market companies. This is due to the prohibitive cost of trading in emerging markets, and the limited range access available to retail investors. Most investors gain exposure to this sub-asset class by purchasing funds.

Historically, emerging markets have beaten the returns of developed economies. However, this success comes with extreme volatility.

Emerging market funds commonly track the MSCI Emerging Markets index. This is weighted towards China and other developing Asian economies.

Due to the high risks, adventurous investors tend to invest a small percentage of their equities in emerging markets, such as 10%.

Quiz

Next Article in the Course

Before you move on, please leave a comment below to share your thoughts. Are you excited by or fearful of emerging markets?