The benefits of stocks & shares ISA accounts make them truly unique accounts when comparing UK stockbrokers. However, the tax-free perks of stocks & shares ISA have a catch – there’s a strict limit on how much you can deposit each tax year.

Read on to find out the current stocks & shares ISA allowance, and to learn how this limit interacts with other ISA types.

The stocks & shares ISA allowance for the 2021/22 tax year

As announced in the 2021 budget on 3 March 2021, the headline ISA allowance will remain at £20,000 for the tax year ending 5 April 2021. The allowance was originally raised to £20,000 back in 2016 – a significant leap at the time from £15,000. It appears that the Chancellor is determined to keep tax-giveaways low in a year in which the tax burden of the UK is set to reach a 60 year high.

The stocks & shares ISA allowance for next year

The ISA allowance for the 2022/23 tax year ending 5 April 2023 has not yet been announced. Details of any changes to the allowance are expected to be announced in the 2022 Budget Statement which could take place in March 2022.

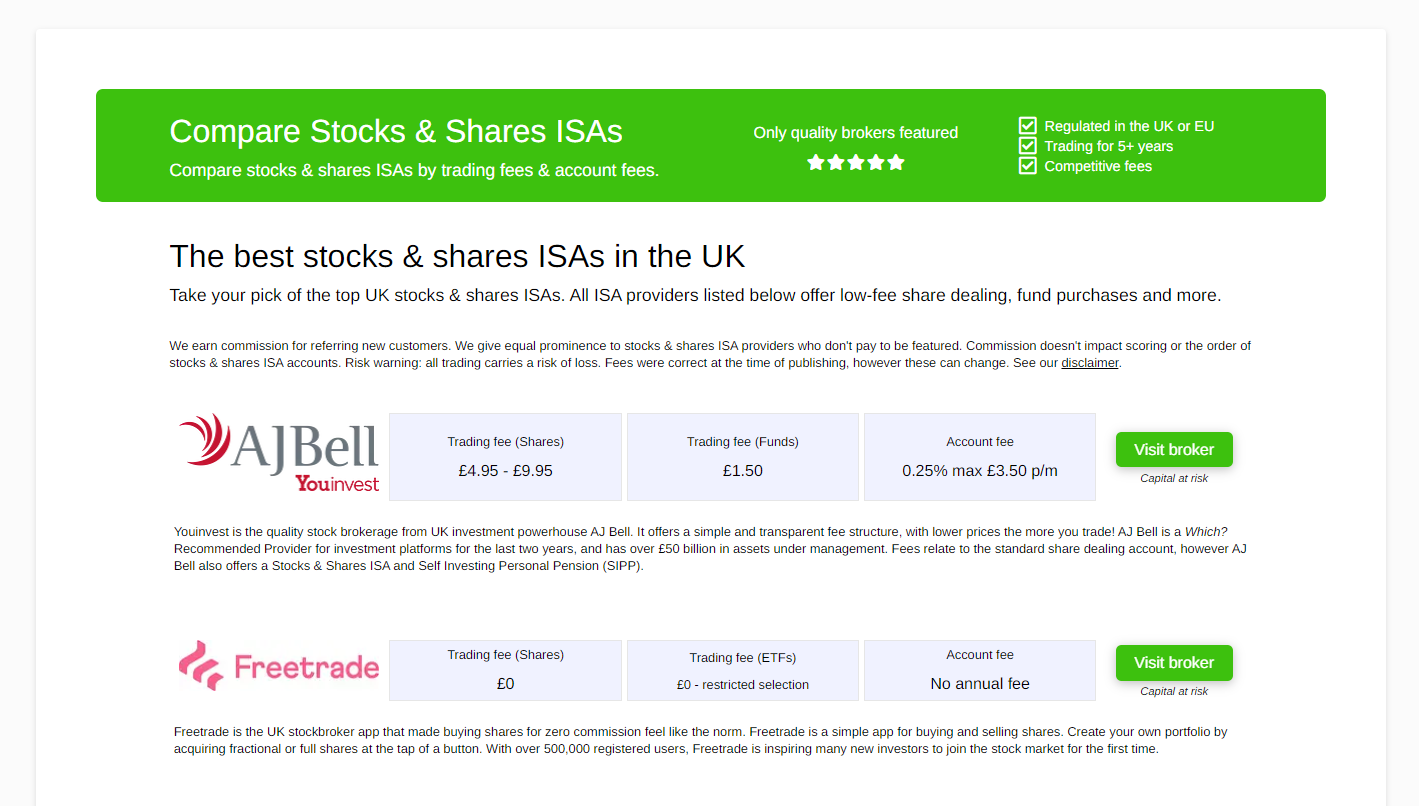

Which are the best stocks & shares ISAs?

We’ve shortlisted the best of the best stocks & shares ISAs below to help your search:

Large UK trading platform with a flat account fee and a free trade every month. Cheapest for investors with big pots.

The UK’s no. 1 investment platform for private investors. Boasting over £135bn in assets under administration and over 1.5m active clients. Best for funds.

Youinvest stocks & shares ISA offers lower prices the more you trade! Which? 'Recommended Provider' for last 3 years.

Buy and sell funds at nil cost with Fidelity International, plus simple £10 trading fees for stocks & shares and ETFs.

Capital is at risk

Historic stocks & shares ISA allowances

We have compiled a record of the stocks & shares ISA allowances dating back to the creation of the stocks & shares ISA itself. You can compare stocks & shares ISA allowances over the last twenty years with this simple list.

Once a tax year has passed, there is no way to retrospectively ‘use’ the allowance. In other words, savers cannot catch-up for unused allowances in prior years, or roll that unused allowance into future years.

- 20/21: £20,000

- 19/20: £20,000

- 18/19: £20,000

- 17/18: £20,000

- 16/17: £15,240

- 15/16: £15,240

- 14/15: £15,000

- 13/14: £11,520

- 12/13: £11,280

- 11/12: £10,680

- 10/11: £10,200

- 09/10: £7,200

- 08/09: £7,200

- 07/08: £7,000

- 06/07: £7,000

- 05/06: £7,000

- 04/05: £7,000

- 03/05: £7,000

- 03/04: £7,000

- 02/03: £7,000

- 01/02: £7,000

- 00/01: £7,000

- 99/00: £7,000

Speculation: Will ISA allowances continue to rise?

Beyond the Budget announcements, Chancellors do not tend to speak publicly about the ISA allowance. It is often only a footnote even in the articles appearing in financial media about the key takeaways from the Budget announcement.

The long term trend

You only have to glance at the historical list of rates to see the upward trend in ISA allowances. The ISA is seen as a useful savings vehicle by both those on low incomes and high incomes, therefore there are few objections to increases in the generosity of the account.

Although in fact, due to the various tax breaks on offer – it is unlikely that savers with small accounts would have had to pay much tax anyway:

- The £2,000 dividend allowance

- The £12,500 personal allowance

- The £12,300 capital gains tax exemption

- The £1,000 interest allowance

(@ 20/21 rates – these allowances will change)

The political angle

But we must remember that like any other changes to taxation & fiscal policies, these decisions are also political.

The Conservatives have an older, wealthier voter base who disproportionately benefit from further increases in the stocks & shares ISA allowance. To say this another way – most Labour voters would not even notice if the allowance was reduced back to £15,000. I demonstrated this in my article the history of the stocks & shares ISA allowance, where I calculated that a worker earning £65,000 per year and saving 43% of their salary would use up the allowance.

When you consider that the national average age is £30,420 (Source: £586 median weekly wage in 2020 – ONS), it demonstrates how high the current ISA allowance is relative to peoples ability to save. For many, their pay packet and budget is the limiting factor, not the ISA allowance.

When we apply the political lens, we can expect that the Conservative Party will remain in power at least until May 2024.

The current Chancellor of the Exchequer did not touch the allowance in the 2021 budget even though he was clearly looking for significant savings elsewhere. Given that pressure on the governments finances, it is unlikely that he will seek to increase ISA allowances at a time when taxes are rising.

Therefore I predict that the stock & shares ISA allowance will remain at £20,000 until 2024, although this is entirely speculation.

Books to help you discover more about saving money

Our shortlists below will guide you through the world of money, with expert authors, entertaining reads and more information than you could ever need!

Everything you need to know about stocks & shares ISAs

- What is a stocks & shares ISA?

- What investments can be held in a stocks & shares ISA?

- How to become a stocks & shares ISA millionaire

- The history of stocks & shares ISAs

- Who can open a stocks & shares ISA?

- What is the minimum amount needed to open a stocks & shares ISA?

- Are stocks & shares ISAs only available in the UK?

- Full list of stocks & shares ISA providers

- How risky are stocks & shares ISAs?

- What fees do stocks & shares ISA accounts charge?

- What is the current stocks & shares ISA allowance?

- Are stocks & shares ISAs tax free?

- Do you need to disclose income and gains in stocks & shares ISA on your tax return?

- What happens to a stocks & shares ISA when I die?

- Stockbroker reviews (UK)