Overall broker score:

ii is the UK's second largest UK stockbroker. By charging a flat account fee and providing a free trade every month, ii has become the preferred broker for investors with large pots.

Capital is at risk

Breakdown:

Trading fees

Account fees

Investment range

User experience

UK Regulation

Size of firm

Customer service

Account opening

Pros:

Lowest management charge for £100k+

One free trade per month

Competitive trading fees available

ISAs & SIPPs available

Cons:

Flat fee unsuitable for very small pots

Web interface needs overall

In this review of UK stockbroker interactive investor, we’ll unpick the fees, platform, service levels and customer satisfaction of this larger player in the shares & funds market.

We’ll go into the level of detail you’ll need to see before making a decision whether interactive investor is the best stocks & shares ISA provider for you.

Impartiality & editorial standards

Financial Expert provides many reviews of UK stockbrokers to help investors find their perfect investing partner. The difference between a poor broker and the perfect fit could mean £1,000s in cumulative fees over an investing lifetime. We take this part of our website very seriously.

Like the 10+ other stockbrokers reviewed on Financial Expert, we are remunerated by interactive investor for referring new clients. However, our editorial is independent of these incentives. As we have a similar relationship with each of the top UK stockbrokers by size, we succeed as a business by helping investors find the perfect broker in a single session.

Our visitors keep coming back for reviews of brokers such as interactive investor because we provide evidence-based insights. Read more about our editorial policy on our about page.

interactive investor review: a summary

- The second-largest UK stockbroker

- Popular for its flat fees of £9.99 per month – cheapest option for large portfolios

- One free share trade is included per month in this fee

- Outstanding customer scores – holds a 4.7/5.0 rating on Trust Pilot

- Offers a comprehensive range of funds and the widest range of international shares

- Recently acquired by abrdn, formerly known as Standard Life Aberdeen plc, the largest active asset manager in the UK.

Sign-up to interactive investor today with a minimum deposit of just £1

Read on to learn about the advantages and disadvantages of interactive investor, and read an insiders view of what professionals in the wealth management sector really think about interactive investor.

interactive investor detailed review

Background: who is interactive investor?

interactive investor was founded in 1995. It grew quickly and went public on the London Stock Exchange in 2000 during the dot com boom in AIM listings.

After struggling to meet the high expectations of the mania, it was taken private by Australian financial services giant AMP in 2001, and ownership has since changed to private equity firm J.C. Flowers & Co.

Under private equity ownership, ii has gained customers organically and through acquisition. In 2017, it bought the business of TD Direct Investing, and in 2020 it bought the customers of The Share Centre.

In December 2021, Scottish investment management business abrdn plc (formerly known as Standard Life Aberdeen plc) finalised an agreement to acquire ii for £1.5bn. In a press release, ii CEO Richard Wilson explained that investors would see no change to the flat subscription pricing as a result of the acquisition.

The value of Abrdn plc’s floating shares is £5.2bn. This is known as its market capitalisation. This compares to a market capitalisation of £6.1bn for Hargreaves Lansdown plc and £1.5bn for AJ Bell plc

Our view is that following this acquisition, interactive investor has solid financial backing which helps to place it among the most financially robust brokerage businesses in the UK.

interactive investor in numbers: how large are they?

Interactive investor holds close to £55 billion in client assets on behalf of 400,000 individual investors. This places ii second in our league table of the largest UK stockbrokers by number of clients.

Here is the recent track record of growth in new customers, taken from historic ii press releases:

- Jan 2020 – 300,000 investors

- December 2020 – 350,000 investors

- December 2021 – 400,000 investors

In the last year, the value of assets under management has increased from £30 billion to £55 billion. While stock market growth has helped to boost this figure (The FTSE 100 is up 10% from the start of the year), this demonstrates the success that ii is having in convincing investors to switch to its platform.

Sign-up to interactive investor today with a minimum deposit of just £1

Why is interactive investor so popular?

ii holds an edge over smaller stockbroker rivals:

- Maturity of the business – trading for 25 years

- Financial stability – part of £5bn asset management group

- Economies of scale – 400,000 clients

At the same time, it holds an unbeatable edge over larger rivals:

- Flat fee structure makes ii the cheapest stockbroker for larger portfolios

This allows ii to make a strong case for the business of larger investors. Compared to the headline 0.45% annual account charge of Hargreaves Lansdown, the £9.99 monthly fee of ii would be more economical for accounts worth more than £27,000.

This explains the high account value per ii customer. £55 billion of assets divided by 400,000 active clients, gives a mean average of £137,000 held per client. Due to the skewing of this figure by high net worth investors, the median or ‘typical’ investor will be much smaller than the mean, but is still likely to be above the £27,000 milestone at which ii is the savvy choice for a cost-conscious investor.

At Financial Expert we rant and rave about the importance of reducing investing costs. £1,000 in fees saved is as valuable as £1,000 of extra returns. It’s all money in the same pot. We suggest that you do the maths today to decide which stockbroker would be the cheapest for you. Read on to learn more about about ii fees are below.

Sign-up to interactive investor today with a minimum deposit of just £1

What accounts do interactive investor offer?

Interactive investor offers 8 different types of investment and savings accounts at the time of writing:

- Trading

- Stocks & Shares ISA

- SIPP

- Junior ISA

- Joint Trading

- Company account

- Pension trading

- Cash savings

It’s easy to imagine fans of ii opening up to three separate accounts to allow them to maximise the tax relief available through pension and ISA accounts. Any surplus savings which can’t be contributed to the best Stocks & Shares ISA or a pension scheme could then be held in the general trading account.

What investments does interactive investor offer?

interactive investor offers a wide range of shares, funds and other investments.

Compared to the market leader, Hargreaves Lansdown, ii offers slightly fewer funds, the same range of UK shares, and a wider range of international shares. Here is a summary of ii’s offering:

- 100s of UK shares

- 3,000+ funds, including OEICs and unit trusts (HL: 3,700)

- The widest range of international shares on the market

Interactive investor provides direct online access to stock exchanges in the following countries:

United States, Canada, Ireland, Germany, France, Spain, Belgium, Italy, The Netherlands, Australia, Hong Kong, Singapore.

Access is also available to Swiss and Swedish exchange via telephone orders.

In conclusion, ii offers a market-leading range of investments, making it perfect for adventurous investors looking for direct access to international companies or obscure funds.

Sign-up to interactive investor today with a minimum deposit of just £1

What fees does interactive investor charge?

Management charge

II charges a flat monthly platform fee of £9.99 for its ‘investor’ subscription option – the cheapest subscription level.

Dealing fees

The dealing fees charged by ii vary depending on your level of subscription. In return for a higher fixed monthly payment, you can receive more free shares and lower trading costs.

We’ll replicate the ii pricing table below so you can see the full interaction between account type and dealing fees.

ii highlight on their website that most customers pay no dealing charges whatsoever because the free trades included in their plan, and their free regular investing service meet their needs with no additional trades being required.

Other fees

Other fees apply, such as a foreign exchange commission of 1.5%, which reduces for transactions worth over £25,000. Trades with a £100,000 value or more attract a special £40 dealing fee.

The full list of charges and fees is quite detailed, therefore please take a look at II’s fees and charges on the ii website for full details.

Is interactive investor cheapest investment platform?

Let’s now try to compare interactive investor stocks & shares ISA fees against that of its main competitors; Hargreaves Lansdown (review) and AJ Bell Youinvest (review)

To perform a meaningful comparison, we must consider a combination of dealing and account fees. Some stockbrokers offer lower account fees but charge more to trade, while others have higher fees but charge less on each trade. For this reason, it’s pointless to directly compare only the share dealing fee or account fee in isolation.

We’ll compare fees for three scenarios for all three brokers for three different portfolios to show which brokers are advantageous

- Portfolio 1: “Fund Simplicity” – £50,000 of funds such as OEICs, Unit Trusts (not ETFs) with 2 fund purchases per month.

- Portfolio 2: “Armchair investor” – £250,000 of shares with 10 trades per month.

- Portfolio 3: Passive newbie – £10,000 of ETFs with one trade per month.

We encourage you to perform your own assessment because many factors could differ including your blend of assets, your account value and how frequently you intend to trade.

Fund Simplicity – £50,000 of funds with 2 fund purchases per month

AJ Bell total investing cost: £161 per year (£1.50 per deal, 0.25% annually on fund value)

Interactive investor cost: £167 per year (2 free fund trades included in ‘Funds fan’ membership for £13.99 per month.

Hargreaves Lansdown cost: £225 per year (£0 per deal, 0.45% annual on fund value)

AJ Bell is the cheapest stockbroker for a modest value of funds due to its low dealing charge paired with a competitive annual charge.

“Armchair investor” – £250,000 of shares with 10 trades per month.

Note: 10 share trades per month will qualify for discounted trading fees for HL and AJ Bell. ‘Super Investor’ plan qualifies for discounted dealing charges for ii.

Interactive investor cost: £622 per year (£3.99 per deal, two free deals per month, £19.99 per month for ‘Super Investor’ plan).

AJ Bell total investing cost: £636 per year (£4.95 per deal, £42 capped annual fee on shares value)

Hargreaves Lansdown cost: £1,119 per year (£8.95 per deal, £45 capped annual fee on shares value.

Based on our calculations above, interactive investor is the cheapest stockbroker for an account with a large account value and 10+ trades per month. We noticed that the AJ Bell online charges calculator gave an artificially high estimate because it did not incorporate the dealing fee discounts for 10+ trades per month, therefore we used our own calculation.

“Passive newbie” – £5,000 of ETFs with one trade per month.

Interactive investor cost: £119.88 per year (Free deal per month included in ‘investor’ plan for £9.99 per month.)

AJ Bell cost: £131.90 per year (£9.95 per deal, 0.25% annual fee on ETF value)

Hargreaves Lansdown cost: £165.90 per year (£11.95 per deal, 0.45% annual fee on ETF value).

Based on our calculations above, interactive investor was the best value broker due to their inclusion of a single free trade per month which meant no incremental dealing fees were incurred even when on their most basic membership plan.

Sign-up to interactive investor today with a minimum deposit of just £1

What do real clients think of interactive investor?

To include more voices in this interactive investor review, we’ve analysed the TrustPilot score of interactive investor so that you don’t have to.

At the time of writing, interactive investor scores a 4.7 / 5.0 based upon 18,781 reviews. This actually tops the list of stockbrokers by Trust Pilot score. Congratulations to the interactive investor team for achieving the highest score in the industry. Here are the ratings of other UK investing accounts:

- Vanguard Investor – 4.2 / 5.0

- Fidelity International – 4.1 / 5.0

So what is driving these positive reviews? What do clients love about interactive investor which has earned their loyalty? The answer is customer service.

As a representative selection of public reviews:

Brenda wrote that “I spoke to Carlos Torres about a corporate action I didn’t know how to find and about a share that has been delisted. He was extremely patient and helpful and solved the issues for me.”

Phoebe wrote “Polite and helpful staff. I was having difficulty with my first log-in after my shares were transferred to ii, the phone was answered immediately and staff member Jennifer B was very polite and helpful.”

Paul shared the following account: “I had a problem with effecting a trade, called ii and the issue was resolved in real-time online. Thanks, Jacob and colleagues at ii – excellent service.”

While only 7% of reviews give the broker the lowest rating of 1/5 the theme of these reviews relates to delays in transfers in or out of regulated products, such as SIPPs and ISAs.

Does interactive investor offer financial advice?

If you’re an unsure investor, II offers some helpful options that may guide your investment decisions, but the broker does not provide financial advice. On their website, the ii team reiterate that “none of the opinions we provide are a “personal recommendation”, which means that we have not assessed your investing knowledge and experience, your financial situation or your investment objectives.”

Ii does try to make investing as simple as possible though, and these three areas could help:

Quick-start funds – a super shortlist of 6 basic funds which may be a useful starting point for beginners.

ii Super 60 – a selection of 60 investments including funds, individual companies and investment trusts which ii analysts think are great picks

Model portfolios – choose from five pre-made equity-orientated portfolios. They’re built for different investing preferences but all contain a moderate to a high degree of risk because they’re primarily stock market portfolios. Allocate money to a portfolio and let ii manage the portfolio.

Sign-up to interactive investor today with a minimum deposit of just £1

What does the interactive investor platform look like?

In this part of the interactive investor review, we’ll show you what user interface you’ll find after registering for an interactive investor account.

The illustrative screenshots we’ve included below show the key screens investors use when buying shares.

These screenshots show the short steps in executing a purchase of Tesco shares.

How is interactive investor regulated?

interactive investor PLC is authorised by the UK’s Financial Conduct Authority to hold client money and client assets. The FCA is a respected regulated which maintains high standards across the industry.

If you’re interested in learning more about the regulations that UK stockbrokers comply with, and how this helps to protect your assets, please read our full guide to stockbroker regulation in the UK.

Is interactive investor safe?

The financial failure of UK stockbrokers is extremely rare and when this occurs, client assets should be transferred to an alternative stockbroker. Compliant stockbrokers will ringfence client assets from their own corporate money, meaning that clients should not be significantly affected if a broker was to fail.

interactive investor is part of one of the wealth managers in the UK; abrdn plc. In its latest annual report, it has reported that profit rose from £271m in 2019 to £838m in 2020.

These financial statements (included within the annual report) are subject to external audit by an independent firm of accountants KPMG.

An audit is not a guarantee that financial statements are free from error, but they provide a level of assurance that abrdn plc’s financial health is materially consistent with what is reported.

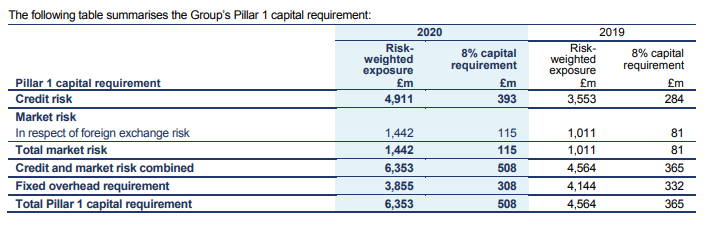

As part of its remit, the FCA requires financial services firms to disclose metrics that allow it and the wider public to assess the financial resilience of the company to shocks. Companies withstand financial shocks by holding a minimum buffer of assets to allow it to suffer losses without the operations of the firm being affected. These minimum buffers are known as capital requirements.

The following extract from ii’s Pillar disclosure document shows that the application of FCA rules requires interactive investor plc to hold £508m of tier I capital.

interactive investor review conclusion

- The second-largest UK stockbroker

- Popular for its flat fees of £9.99 per month – cheapest option for large portfolios

- One free share trade is included per month in this fee

- Outstanding customer scores – holds a 4.7/5.0 rating on Trust Pilot

- Offers a comprehensive range of funds and the widest range of international shares

- Recently acquired by abrdn, formerly known as Standard Life Aberdeen plc, the largest active asset manager in the UK.

Visit interactive investor and sign-up today.

Sign-up to interactive investor today with a minimum deposit of just £1

How does interactive investor compare?

Trade shares with zero commission. Open an account with just $100. High performance and useful friendly trading app. Other fees apply. For more information, visit etoro.com/trading/fees.

Large UK trading platform with a flat account fee and a free trade every month. Cheapest for investors with big pots.

The UK’s no. 1 investment platform for private investors. Boasting over £135bn in assets under administration and over 1.5m active clients. Best for funds.

Youinvest stocks & shares ISA offers lower prices the more you trade! Which? 'Recommended Provider' for last 3 years.

Choose a pre-made portfolio in minutes with Nutmeg. Choose your level of risk and let Nutmeg efficiently handle the rest.

Buy and sell funds at nil cost with Fidelity International, plus simple £10 trading fees for stocks & shares and ETFs.

Capital is at risk

Trade stocks & options on the advanced yet low-cost Freedom24 platform that arms retail investors with the tools to trade like professionals.

Capital is at risk