There’s a lot of information about stocks and shares ISAs on Financial Expert. But this site gets a lot of international visitors from the US, the Middle East, Africa and India. A question I’ve seen appear a few times with a few variations is:

- Can I get a stocks & shares ISA in the US?

- Or are stocks & shares ISAs available outside the UK?

- Can US residents open a stocks & shares ISA?

This isn’t a surprising question. Stocks & shares ISAs are brilliant investment accounts that protect investments from almost every form of tax, including income tax, capital gains tax and recently even some inheritance tax (caveat: tax rules can change).

It’s therefore a highly demanded investment account. People from outside the UK are therefore asking the sensible question of whether the account is restricted to UK citizens, or whether stocks & shares ISAs can be opened outside of the UK.

Can stocks & shares ISAs be opened outside of the UK?

Let’s address this point first.

The answer is no, stocks & shares ISAs cannot be opened with financial institutions outside the UK. Any stocks & shares ISA must be opened through a UK registered company. That provider must carry all the relevant permissions from the UK Financial Conduct Authority and be authorised to offer ISA products to the general public.

Technically speaking, you can open stocks & shares ISA with a UK institution while you are physically located in another country. Most banks and stockbrokers process applications quickly and efficiently online and almost entirely digitally. However, not everyone can do this, please keep on reading to find out more.

Can stocks & shares ISAs be opened by non-UK Citizens?

Yes, a stocks & shares ISA can be opened by a citizen of another country other than the UK. You don’t have to be a British citizen to have one of these accounts.

However, you must be tax resident in the United Kingdom. Tax residency is a complex area. But in short: if you weren’t born on British soil then to be tax resident in the UK, you will spend at least 183 days of each year living here and you will have registered with HMRC and have received a National Insurance number.

Banks will request your National Insurance number during the stocks & shares application process. This is a required piece of information that will confirm your right to open a stocks & shares ISA. It confirms that you fall within the UK tax net (and therefore will be liable to tax on employment or other income whilst in the UK) and can participate in the ISA scheme.

In summary:

- You can only open a stocks & shares ISA through a UK-registered financial institution

- Citizenship is not a requirement for opening and account.

- However, you must be UK tax resident and possess a National Insurance number

I hope this clarifies the questions you have about who can open a stocks & shares ISA.

If you have any doubts about your eligibility, compare the best stocks & shares ISA providers you can find and give the best a phone call. After providing your information, they will be able to confirm if you would be accepted as a client. A financial adviser may also be able to provide more insights into how are investments taxed (UK).

Which are the best stocks & shares ISAs?

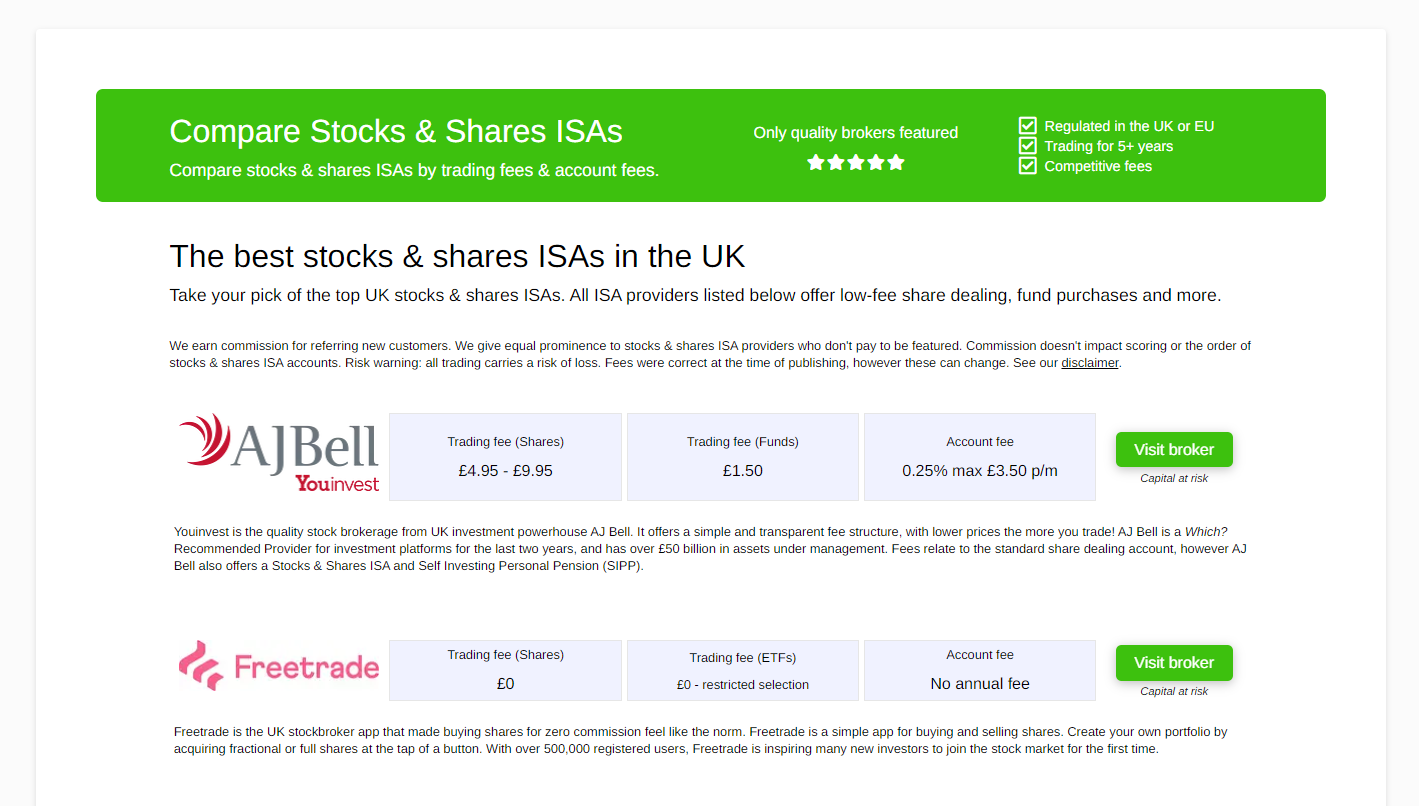

We’ve shortlisted the best of the best stocks & shares ISAs below to help your search:

Large UK trading platform with a flat account fee and a free trade every month. Cheapest for investors with big pots.

The UK’s no. 1 investment platform for private investors. Boasting over £135bn in assets under administration and over 1.5m active clients. Best for funds.

Youinvest stocks & shares ISA offers lower prices the more you trade! Which? 'Recommended Provider' for last 3 years.

Buy and sell funds at nil cost with Fidelity International, plus simple £10 trading fees for stocks & shares and ETFs.

Capital is at risk

Please also see our Hargreaves Lansdown review, our AJ Bell review and interactive investor review.

Books to help you learn more beyond opening a stocks & shares ISAs

Take a look at these fascinating books to discover more about stocks & shares in general, and how to use ISAs and other legal tax avoidance strategies to minimise the tax you need to pay on your investments:

These books about savings (and occassionally, stocks & shares ISAs) will help you explore this topic in incredible detail. Don’t settle for a half-measure of knowledge, when your personal prosperity is at stake.

Everything you need to know about stocks & shares ISAs

- What is a stocks & shares ISA?

- What investments can be held in a stocks & shares ISA?

- How to become a stocks & shares ISA millionaire

- The history of stocks & shares ISAs

- Who can open a stocks & shares ISA?

- What is the minimum amount needed to open a stocks & shares ISA?

- Are stocks & shares ISAs only available in the UK?

- Full list of stocks & shares ISA providers

- How risky are stocks & shares ISAs?

- What fees do stocks & shares ISA accounts charge?

- What is the current stocks & shares ISA allowance?

- Are stocks & shares ISAs tax free?

- Do you need to disclose income and gains in stocks & shares ISA on your tax return?

- What happens to a stocks & shares ISA when I die?

- Stockbroker reviews (UK)