A stocks and shares ISA is a type of regulated investment account. Retail investors (members of the public) can use a stocks & shares ISA to buy shares in companies listed on the stock market.

A key feature of all stocks & shares ISA is that they are tax-free. There’s no need to compare stocks & shares ISAs for their level of tax protection, as all stocks and shares ISA accounts have the same tax rules. If you understand how investments are taxed for UK residents, you’ll be aware of how amazing an ISA can be for your investment growth.

The tax-free status of a stocks & shares ISA is so attractive that the government places a limit on the amount that any individual can contribute to ISA products each tax year. This is the year ending 5 April. This limit prevents the wealthiest individuals from using ISAs to avoid paying any tax on investment income.

You can ‘transfer’ existing ISA investments or cash from one ISA provider to another, without that transfer counting towards the ISA contributions for that tax year. This is different from withdrawing the money to your bank account, and then depositing it in another ISA provider – that would count as a fresh contribution and use your allowance.

What does ‘tax-free’ mean for stocks & shares ISAs

The concept of a ‘tax-free’ investment account sounds useful. But what does it mean, and how different is this from a normal stockbroker account?

Income earned from investments held in a stocks & shares ISA is not subject to income tax

- Any dividend income earned from share investments are tax-free

- Any interest income from cash or bond investing are tax-tree

- Any property-related income or dividends from are tax-free

Also, any capital gains earned from the share of investments at a higher value than you paid for it, will not be subject to capital gains tax.

How does a stocks & share ISA differ from a stockbroker account?

The general features and the user experience of an ordinary investment account will be very similar to a stocks & shares ISA. However, there are few differences:

- General investment accounts have no ‘tax-free’ status and therefore the normal income tax and capital gains tax rules

- General investment accounts can hold a wider range of investments than a stocks & shares ISA

- General investment accounts may have different fees and charges to a stocks & shares ISA (usually slightly lower)

No tax-free status

Income and capital gains generated from a general investment account are subject to tax. Tax rules can change, therefore I will link here to the most recent rules on tax on dividends.

The general principle is if your dividend income is non-trivial then you would file a personal tax return with HMRC each year. To the extent that your dividend income exceeds the dividend allowance and personal allowance, you will be taxed on that income at your rate of income tax (basic rate, higher rate, additional rate).

Any capital gains which crystallise in the year will be subject to capital gains tax if they total more than the capital gains tax exempt amount.

This leads to a situation where a significant slice of your dividend income and capital gains could be paid over to HMRC each year. This will lead to your investment portfolio growing at a slower pace than if you could keep 100% of your investment income and gains.

Wider range of investments

General investment accounts can hold more exotic investments than a stocks & shares ISA. The government restricts the types of investments that can be held in a stocks & shares ISA to listed shares, funds and bonds. Of course, this extra choice makes the decision of what to invest in now even more tricky!

Stockbroker accounts could hold derivatives, allowing options trading and futures trading. They could hold preference shares, which are an uncommon form of share which pays a more structured dividend each year. Stockbroker accounts can hold leverage – money borrowed from the broker to make further investments.

Derivatives trading and trading on leverage are high-risk activities that aren’t recommended for investors saving for retirement. They are certainly not suitable for beginners in investing. Therefore while stocks & shares ISAs may feel more restricted, you shouldn’t notice the difference.

Different fees

A stocks and shares ISA places a higher burden of administration on the provider, who must keep track of your ISA allowance and generally conform to a stricter set of rules. As a result, some providers charge slightly higher platform or account fees for their ISA product compared to their general product.

That being said, an investor is usually better off in a higher-fee ISA because the tax saving on their investment income may exceed the additional fees. This will almost certainly be the case for larger portfolios or individuals in a higher tax-bracket.

The ISA market is very competitive and the mainstream providers charge reasonable platform fees for ISAs, so as long as you compare stocks & shares ISAs, you should be able to find a great deal.

Which are the best stocks & shares ISAs?

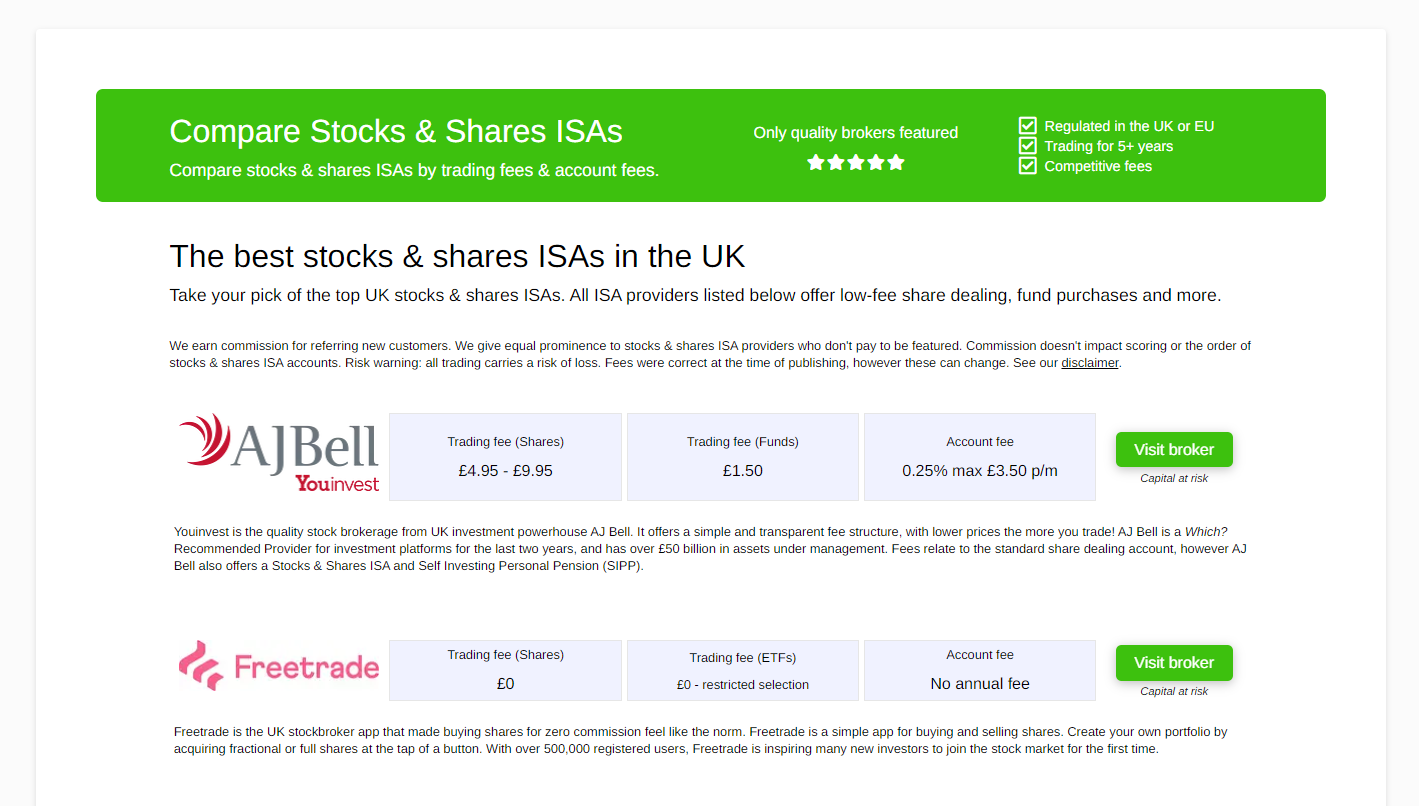

We’ve shortlisted the best of the best stocks & shares ISAs below to help your search:

Large UK trading platform with a flat account fee and a free trade every month. Cheapest for investors with big pots.

The UK’s no. 1 investment platform for private investors. Boasting over £135bn in assets under administration and over 1.5m active clients. Best for funds.

Youinvest stocks & shares ISA offers lower prices the more you trade! Which? 'Recommended Provider' for last 3 years.

Buy and sell funds at nil cost with Fidelity International, plus simple £10 trading fees for stocks & shares and ETFs.

Capital is at risk

Please also see our Hargreaves Lansdown review, our AJ Bell review and interactive investor review.

Books to help you learn what is a stocks & shares ISA

In this short article, we’ve covered many different topics that might interest you as someone new to investing.

We’ve discussed buying shares, investing in bonds and saving tax. Here are some excellent lists of the best books of all time which cover those topics:

You can explore these topics and more by looking at our full range of book topics on our investing books page.

What is a stocks and shares ISA – Summary

- A stocks and shares ISA is a tax-free investment account.

- You can make deposits each year so long as you do not exceed the ISA allowance.

- Stocks & shares ISAs can hold cash, shares, bonds and funds.

- Any income or capital gains earned from investments within an ISA will not be taxed, and do not need to be reported on a tax return.

- Stocks & shares ISA accounts come with more restrictions than a stockbroking account, and sometimes slightly higher fees. However, the ‘tax-free’ benefit usually outweighs these drawbacks.

Everything you need to know about stocks & shares ISAs

- What is a stocks & shares ISA?

- What investments can be held in a stocks & shares ISA?

- How to become a stocks & shares ISA millionaire

- The history of stocks & shares ISAs

- Who can open a stocks & shares ISA?

- What is the minimum amount needed to open a stocks & shares ISA?

- Are stocks & shares ISAs only available in the UK?

- Full list of stocks & shares ISA providers

- How risky are stocks & shares ISAs?

- What fees do stocks & shares ISA accounts charge?

- What is the current stocks & shares ISA allowance?

- Are stocks & shares ISAs tax free?

- Do you need to disclose income and gains in stocks & shares ISA on your tax return?

- What happens to a stocks & shares ISA when I die?

- Stockbroker reviews (UK)