This article is part of my Q&A series on financial advice. Today’s question is ‘Is having a financial adviser worth it?’

As I explained in How much does a financial adviser cost? financial advice can be pricey.

Advice comparison website VouchedFor.co.uk calculated that investors pay a fee equivalent to 1.74% of assets on average.

As these fees are paid immediately, a starting pot of £100,000 would only see £98,000 of its cash actually placed in the investment plan.

It’s easy to count the costs, but what are the benefits? Are financial advisers worth it overall?

Is having a financial adviser worth it?

To answer this question, we need to measure the value added by financial advisers. We can then compare this to the cost (their fees) to decide whether financial advice is worth it.

Value-added = Your future investment performance compared to no advice

You may have already spotted some difficulties with this formula:

- Different financial advisers will recommend different portfolios and their performance will naturally differ

- We can’t reliably predict the future performance of a portfolio

- Your investment performance without advice will depend on your own investing knowledge.

Not to worry, we can still make some assumptions.

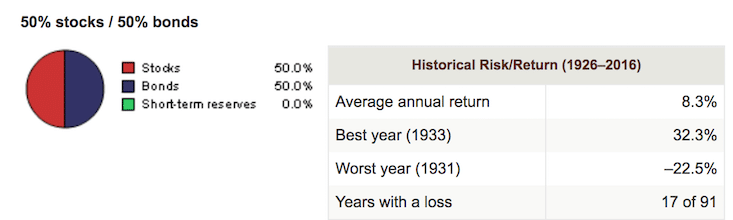

We could assume that a professionally managed portfolio would produce an annual return similar to the historical return of a corporate bond and equities portfolio over recent decades.

Given that you are seeking financial advice, we can also assume that you do not feel confident to invest in the stock market on your own. Let’s assume you haven’t graduated from investing courses or worked through several investing books. This allows us to guess that your return without advice would be the interest rate on a bank account.

Will a financial adviser increase my returns?

As we explain in the first topic in our Foundation investing course, the average real return on a savings account is 0% after accounting for inflation.

Vanguard analysed the performance of different investment portfolios and concluded that the nominal return of a 50:50 stocks and bond portfolio was 8.3% annually. This equates to a real return of 6% after inflation.

So what does this mean? It means that if you would only be prepared to invest in the stock market through a financial adviser, then you could earn 6% more per year as a result.

Against this upside, financial advice of 1.74% looks like a great deal.

It comes as no surprise to hear that the Value of Advice report published by Unbiased.co.uk in 2015 found that those who took advice on saving near the start of their careers saved an average £34,300 more than people who didn’t.

Is the adviser producing the return or the market?

However, do remember that you could invest in bonds or the stock market without a financial adviser.

Most of the additional return is driven by the simple the decision to invest rather than save, rather than the skills of the adviser.

You could choose a stockbroker online today and build a simple portfolio with two passive funds which would have a similar expected return.

It’s therefore always worth considering whether investing some time and money into investment training might be beneficial, to allow you to save £1’000s in fees.

It isn’t all about the money

My final point is that the answer to Is a financial adviser worth it may not sit purely in the numbers.

Financial advisers do more than just push each client into stocks and shares; they listen and advise.

A good financial adviser could steer a keen client away from risky investments if they felt that the client’s risk appetite was not up to it. This could avoid stress and anxiety.

A great financial adviser can also provide reassurance and confidence to an investor during market turbulence, who might otherwise have sold their shares and abandoned their retirement strategy.

It might be tricky to weigh up the beneficial impact of these behavioural nudges as the benefit isn’t always quantifiable. But they should be considered nevertheless when finding a financial adviser.