If you’ve been researching actively managed funds recently, you may have come across a relatively new breed called absolute return funds. What is an absolute return fund, and could they benefit your stocks & shares ISA? Let’s find out.

The absolute return strategy

The phrase ‘absolute return’ refers to a group of investment strategies used by the fund manager when managing assets.

The name has no link to the legal structure of the fund vehicle itself. Therefore an absolute return fund could take any form, such as an investment trust, a unit trust, an open-ended investment company (OEIC) or a hedge fund. However, depending on the legal structure, the fund may have more investment opportunities available to it to achieve its objective.

The objective of the absolute return strategy is to generate a positive return in all market conditions. The goal is to beat a steady benchmark, such as one linked to interest rates, rather than a volatile stock market index like the FTSE 100.

Whether you’re new to investing or not, you’ll appreciate that absolute return funds are pursuing Wall Street’s version of the holy grail. An investment that delivers profits even during a downturn would be surely worth its weight in gold.

How do absolute return funds invest their money?

Absolute return funds do not simply invest in bonds or shares for the long term. This would provide a positive expected return in the long run but would leave investors with losses each time the overall market falls in value.

Instead, investment managers will use a wide range of strategies designed to create profits irrespective of which direction the market is headed.

Value investing – where the investment manager buys companies that appear to be undervalued compared to the rest of the market, making a profit when the valuation naturally ‘corrects’ over time.

Hedged trades – where the investment manager will buy a company they like, and short-sell another similar business. Trading in opposite directions in this way means that the effect of overall market movements is negated. This leaves the trade as a bet that the price of the favoured company will perform better than the average.

Arbitrage based strategies – where the investment manager takes advantage of inconsistent pricing across similar assets or the same asset across different markets. They will buy the underpriced asset and sell the same quantity of overpriced assets. Their overall exposure to movement in the asset price is zero, locking in an immediate profit.

Private equity – where skilled buy-out managers acquire a business with a view to increasing its value considerably over the medium term, or splitting up the business assets in a way that achieves better value for shareholders.

What most of these investment strategies have in common, is that their expected returns are not linked to the cycle of the stock market. They tend to generate their returns through sophisticated bets on valuation and pricing.

By including some or all of these elements in an absolute return fund, it is entirely possible that an investment manager could grow the value of fund assets even while the stock market is tanking.

Asset allocation – in addition, absolute return funds will usually diversify into different asset classes which behave very differently during downturns.

The value of government bonds, for example, tend to rise during a market crash. We cover this concept and how you can incorporate diversification into your investment portfolio in our free investing courses.

Do absolute return funds actually work?

You might be able to guess the answer to this question if I tell you that absolute return funds still remain a relatively tiny portion of the actively managed fund market.

The truth is that absolute return funds have not been as successful as their promoters might have hoped. This is because their performance has disappointed. Don’t expect to be seeing investment bookshelves filled with titles telling tales of Absolute Return success stories.

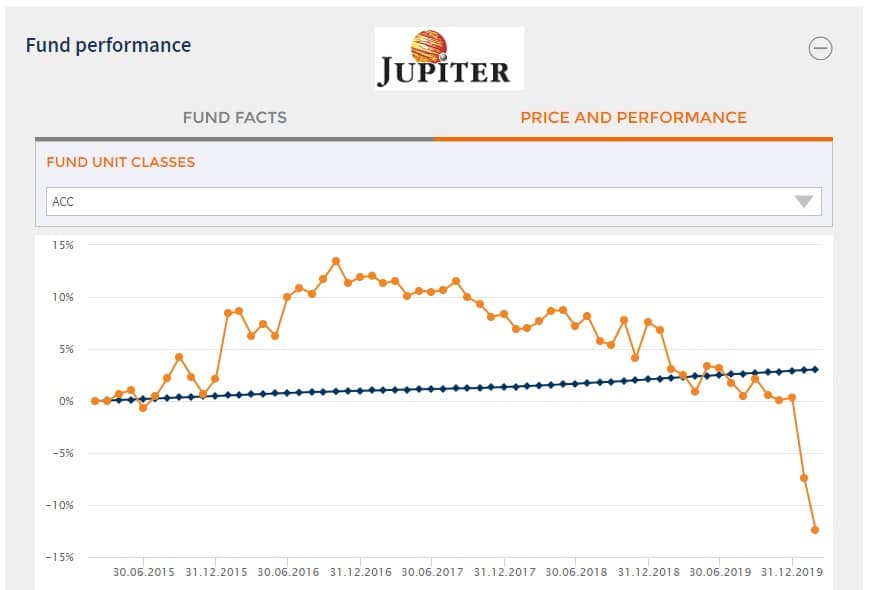

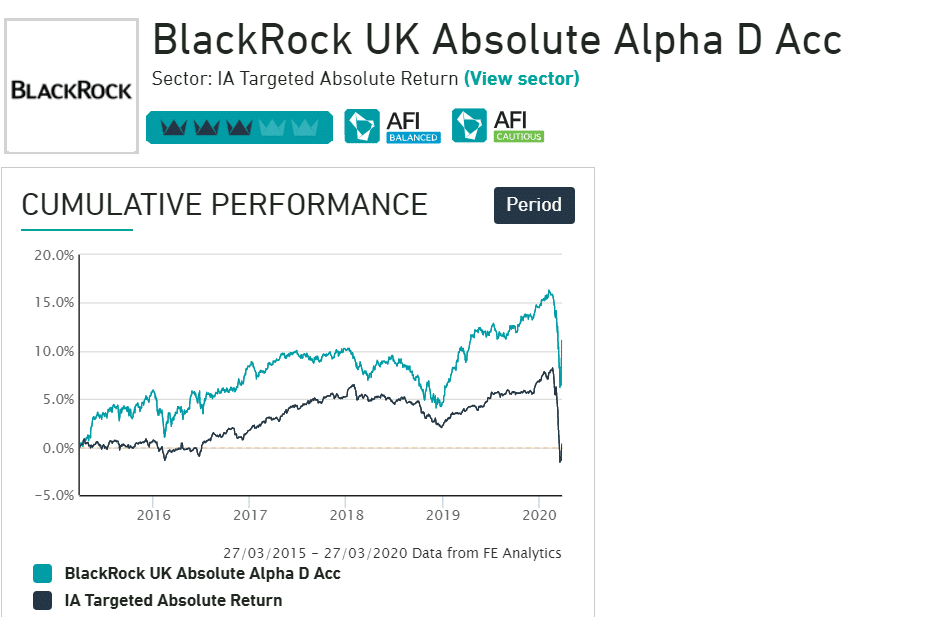

The true test of an absolute return fund is to look at how they perform during difficult periods. In March 2020, stock markets around the world saw huge drops in excess of 20% as investors reacted to the pandemic which spread across the world.

Let’s take a look at the performance of absolute return funds, and compare against the rest of the market.

You will notice an uncomfortable trend with both funds, that their prices fell through the floor in the same month that global stock markets routed. Both funds fell by more than 10% in the space of a month.

This leads me to conclude that absolute return funds do not live up to their optimistic promise of avoiding negative returns. If your investing risk appetite deters you from buying shares for fear of a crash, these products are not a silver bullet for you.

Comments 1

Did the absolute funds lose less value in Mar20 than the index ? No fall can’t be guaranteed but a reduced fall has so value of it’s own as long as the upside in good times is comparable or better ?