When researching bonds, you will notice that each bond will state its coupon rate.

Beware the coupon rate

Below, I’ll explain exactly what a coupon rate is. But I’ll also explain what it is not.

A trap that many new bond investors can fall into is confusing coupon rates with a rate of return.

With some investments, such as a savings account or savings bond offered through your bank, this will hold true. Your rate of return will be the headline interest rate advertised.

This is not the case with bond investments.

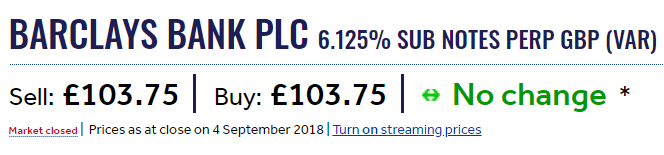

A coupon rate of 6.125% does not guarantee that you will earn 6.125% as an investor. The reasons for this are several, and I’ll take you through them in this explainer.

What is a bond coupon rate?

The coupon rate of a bond is the rate of interest that a borrower will pay on the original amount they borrowed.

The coupon rate is usually stated in the name of the bond. To illustrate this: GLAXOSMITHKLINE CAPITAL PLC 5.25% NT REDEEM has a coupon rate of 5.25%.

Said another way, the coupon rate is the relationship between

- How much cash the borrower originally received

- How much cash the borrower will pay as interest each year

If you know the principal value, and the coupon rate, you can quickly calculate the annual interest each bond will pay its owner.

If a bond coupon is 9% and each bond represented an original loan of £1,000, then each year an interest charge of 9% (£90) will be paid to the bond-holder.

Why is the coupon rate not the personal rate of return?

So far, the maths is quite easy to follow.

So why is it dangerous for an investor to confuse a bond coupon rate with a rate of return? Why wouldn’t an investor see gains of 9% per year by owning a bond which pays a 9% coupon?

The answer reveals a very useful investing concept.

The rate of return for an investor is the relationship between:

- How much cash the investor originally invested

- How much cash the investor will receive back in total

- The timing of this income also matters

You may notice that these factors aren’t identical to the coupon rate relationship factors above. What’s different?

First of all, the amount invested does not need to match the amount the borrower receives. Any bond which is bought on an exchange after it was issued, will be bought at a market price, with the sum going to the recent owner of the bond, not the underlying borrower.

An investors rate of return focuses on the amount paid by the investor – not the bond’s original value.

Secondly, the coupon rate is not affected by what lump sum is repaid to the investor on maturity – if anything is paid at all.

Clearly this number is important to the investor and affects their returns. A bond which pays 9% per year, then returns the original sum is clearly more valuable than a bond which pays 9% per year indefinitely, without ever returning the lump sum originally borrowed.

How does an investor calculate their personal rate of return on a bond?

For the two reasons above, an investor should largely ignore the headline coupon rate on a bond, and instead look for the yield to maturity.

The yield to maturity (YTM) is the fancy term for the personal rate of return that a bond, bought at its current market value, expects to deliver to an investor on average until it matures. In other words – its the number you want to know when you’re research potential investments.

The YTM looks at the cost to acquire, and the stream of cash flows to the investor (usually a combination of coupon payments and a lump sum) over the future. These data points are crunched into a single YTM percentage, e.g. 6.45%. This is the relevant figure to compare against the potential returns of other investments.

A YTM figure is factual – it doesn’t require judgement. However, it is not a guarantee. For the investor to experience the YTM, two things must happen:

- The investor must hold the bond until maturity

- The company must meet its obligations to make all the scheduled payments

Therefore, investors expect a higher YTM on a bond issued by a business in poorer financial health.

This is why the best investing books will carry a general warning – don’t be tempted by the bonds with the highest YTM. This isn’t a free lunch. Far from it – the high rate communicates that the bond issuer has a higher likelihood of failing to repay the bond.

Interested in other bond definitions?

- Definition of a bond

- Definition of a corporate bond

- Definition of a junk bond

- What is the coupon rate of a bond?

If you’d like to explore other investment types which use debt as the main source of risk, please check out my guide to structured products and investing in peer to peer lending platforms.