Knowing how to spot investment scams is an essential skill for a modern investor.

Collectively, investors represent a gold mine for organised criminals. Think about it: Is there an easier target? Investors are prepared to pay thousands of pounds to a new organisation in return for something intangible. The opportunities for fraud are staggering.

The online space, in particular, can be a dangerous place. It is difficult to tell apart an adventurous investment from a potential black hole.

As the best money laundering books and the best fraud books will explain, you need to be hyper-vigilant to filter out the malicious players in such a large sea of choice.

Follow these three steps to increase your vigilance and detect investment scams with more confidence.

1. Beware of unauthorised firms and unregulated investments

The Financial Conduct Authority (FCA) regulates only certain types of investments and investment firms.

For the maximum protection against scams – you could stick to regulated investments offered by authorised firms, such as a stocks & shares ISA offered by a mainstream financial provider. Doing so will give you the following cover:

- Access to the complaints watchdog (the Financial Ombudsman) if you believe you have been treated unfairly

- Up to £85,000 compensation if the firm goes bankrupt and you cannot recover your money as a result.

FCA authorisation is not a guarantee that you will not be a victim of fraud, but it provides you with more safeguards than if the firm was not authorised.

How can I tell if a firm has FCA authorised status?

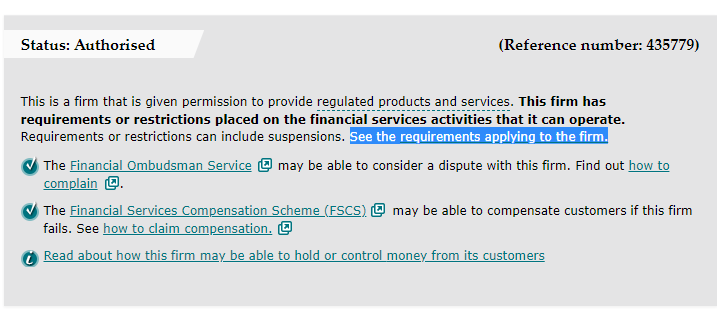

You can search the FCA register of firms to check whether a provider is authorised.

Companies can gain different levels of authorisation, or permission, to carry out different activities, therefore it is essential to check that their permissions cover the proposed investment.

After finding the firm on the register, click to ‘see the requirements that apply to this firm’.

The next page reveals whether the firm has authorised status. Authorisations could cover holding your money and selling specific types of financial products.

You can also search directly on the FCA Warning List to check that an investment firm isn’t flagged as a suspicious or fraudulent organisation.

What is the difference between regulated and unregulated investments?

Even if an authorised firm promotes a particular investment, this provides no guarantee that the FCA considers the investment as ‘regulated’. We can sort regulated investments from unregulated investments using the following rule-of-thumb lists:

Regulated:

- Shares

- Funds

- Cash

- Residential and commercial buildings

Unregulated

We should assume that any investments that don’t fall under the regulated categories are unregulated. Examples include:

- Land

- Mini-bonds (Loans issued directly between a borrowing company and an investor)

- Cryptocurrencies such as Bitcoin

- Car park spaces

- Woodland and forestry

- Storage units

- Shipping containers

- Diamonds and other precious stones

- Wine

- Gold

- Overseas property

How to spot investment scams posing as regulated investments or authorised firms

Unfortunately, this is also an issue. Many scammers present themselves as FCA firms, when in fact they are not. The scammer may be relying on you not looking them up on the register.

More sophisticated scammers steal the identity of a real authorised firm. Like a wolf in sheep’s clothing, they use fake branding to fool investors into handing over their money. The clients may falsely believe that the FCA regulates their investment, only to discover otherwise when the scam unravels at a much later date.

If someone contacts you and claims to represent an authorised firm, you can quickly put their credentials to the test. First, politely end the call. Ring the firm back using a number you have obtained from their official website. Ask the switchboard to put you back in touch with the person you were speaking with.

Are all unregulated investments scams?

‘Unregulated’ is not the same as ‘fraudulent’. ‘Unregulated’ simply means that the investment in question does not fall under the FCA’s remit.

Many investors find legitimate and profitable opportunities in wine, land and gold. Investments such as these, often referred to as ‘alternative investments’, help diversify their basic investment portfolio.

The ‘unregulated’ label merely demands a heightened sense of scepticism. Scammers naturally prefer to operate in areas under lower regulation and therefore these investments will have a higher rate of scams.

When a company approaches you with a scheme which involves an unregulated area, this should now raise a red flag.

2. Watch out for unrealistic promises

Realistic average returns for risky investments range from 4% to 8% per year. Scammers may offer 10% or even 18% per year in an attempt to lure investors.

Sometimes scams will advertise a reasonable-sounding rate of return but will also claim that the investment carries “low risk” or “no risk”. This is equally alarming, due to the unbreakable relationship between risk and return.

High returns will always come with additional risk. This is because investments only offer higher returns to compensate investors for extra volatility.

Therefore, by definition, higher returns will always have higher volatility and therefore can never be “low risk”, and no amount of risk management will reduce risks to nil.

Reality check: Worldwide, investors have placed £billions into US government bonds which pay 0 – 2% interest. Investor accept these low returns because of their risk-free status. Why would so much money stay in these low-return bonds if higher returns elsewhere could be had without risk?

Our advice for how to spot investment scams is to blacklist any printed promotional material or online adverts which promise 8%+ risk-free returns. The scam rate across this group of opportunities is eye-watering.

Are all comforting assurances fraudulent?

This depends on what assurance is provided, let’s explore a few examples:

No history of losses

Investment providers may point to investors never having lost a penny. This declaration might be factually true, and useful information to share. It is certainly not indicative of fraud. However, we need to apply scepticism and not take such assurances at face value. Past performance is not a guarantee of future performance. The historical period may have been short, or during the boom years of an economic cycle. For these reasons and more, losses could still be on the horizon for new investors.

FSCS Protected

Investments may use language such as ‘FCA Protected’ or ‘FSCS Protected’. These terms give the impression that the investment qualifies for the Financial Services Compensation Scheme. Unscrupulous investment companies may emphasise this in a misleading manner.

First of all, for regulated investments, the FSCS protection will probably only cover any cash held with the company, rather than your investment. Secondly, the scheme does not payout just because a regulated investment has underperformed. This is simply the risk you take on as an investor. If a company states that the FSCS scheme will guarantee the return of an investment, run away.

Government-backed

We see this term used in a variety of ways across investment brochures. Some are more valid uses than others!

Some investments, such as Premium Bonds issued by National Savings & Investments (NS&I), are physically financed by the government. This is a very legitimate use of this phrase.

Some companies claim that the government invests in their products, or uses their service.

This is little more than a company wanting to ‘show off’ its prestigious customers. Continue to be wary, however, as even government institutions have made poor investment decisions in the past:

- Several UK councils and other bodies lost a combined £1bn when Icelandic bank IceSave collapsed during the ‘credit crunch’ of 2009.

- In 2019, Kent Council found itself unable to redeem funds from the now infamous Woodford Equity Income fund after requesting a withdrawal. The fund was not fraudulent but had followed a controversial investment strategy of investing in illiquid investments. The fund found itself unable to raise cash to repay investors on demand, and was forced to close the door to outflows until it could sell its investments.

- Hampshire County Council found itself the victim of fraud when it invested £7.1m in a fund managed by Bernie Madoffs, which collapsed when it transpired that the miracle fund had been nothing more than the world’s largest Ponzi scheme.

3. How to spot investment scams – look for the hard sell

We all appreciate passion and enthusiasm from the employees that we interact with. Who would buy a cappuccino from the coffee shop that only claimed to sell the ‘Eighth best coffee in the city’?

In contrast, you should seek out the exact opposite qualities in those who manage and promote investments. A responsible adviser acknowledges that all investments could lose their client money, and may not be suitable for all. This sober realisation tends to remove the rosy tinting from the language to sell legitimate investments.

If you see an investment firm using similar sales techniques to a car dealership or butcher, you should, therefore, be very concerned.

All legitimate investment firms understand the following:

- No investment is suitable for every investor.

- An individual’s personal risk appetite and time horizon are important considerations to take into account.

- Firms must explain risks clearly to allow an investor to weigh up the cost and benefits associated with an investment.

By pushing a single investment hard onto all interested parties, scammers break all of these rules in their pursuit of chasing your cash.

What selling techniques should I look out for?

Emotional advertising

Throwing ethical principles to the wind, scams will regularly appeal to peoples emotions and aspirations to seal the deal. Marketing materials are often crammed full of Carribean imagery and supercars.

The exclamation mark is a clear sign that something isn’t right. An excitable tone is another attempt to drive emotional rather than logical decision making.

Cold calling

Investment scams have used cold calling for decades now, and show no sign of ceasing. I have personally received several sales pitches over the phone from dubious sources.

From personal experience, I can reveal that these scammers are not easy to spot. If you are imagining someone speaking broken English similar to a Nigerian email scammer, you couldn’t be further from the truth.

In the past, I have received phone calls from young men with well-spoken, southern English accents. They claimed to be calling from a firm with a generic name such as ‘London Capital Markets’. I kept them on the phone to learn more about what exactly they were peddling, and what their sales pitch sounded like. I came away impressed with their ability to hold a challenging conversation with an experienced investor.

From this experience, I want to share a dire warning for all advanced investors. Do not rely on your intelligence or investment knowledge to discern a real caller from a fake one. On the phone, where talking is the only currency, scammers are in their element. They are more practised at the game than you are. The only way to win is to not play at all.

Refuse all cold calls that relate to investments. Perform due diligence checks on investment opportunities that are right for your basic investment portfolio, at the time that is right for you.

Read more: The best due diligence books

Time pressure

Investment scams may also apply time pressure to encourage an unwise snap decision to invest. For example, the scammer may explain that the fund closes to new investment by the end of the day.

Time pressure removes the opportunity for you to carry out diligent research and speeds up the cash generation process. If you feel pressured to make an investment ‘in the moment’, don’t. Only in a fictitious scenario would an investment opportunity being marketed to retail investors disappear within a matter of hours.

Scammers will say whatever they believe will part you from your cash. However, their linguistic and marketing tricks set them apart from reputable firms. Looking out for aggressive or enthusiastic marketing language is a great can be how to spot investment scams.

A comprehensive checklist for spotting investment scams

I’m delighted to share my own 30-point comprehensive scam checklist for spotting scams like a private investigator.

If you stick to my methodology, you’ll be able to tell apart a legitimate offering from a dangerous doppelganger.

Are the website owners who they claim to be?

This could should be either a private limited or public limited company name. For example 'Stakeholder Investments Ltd' or 'Absolute Returns PLC'.

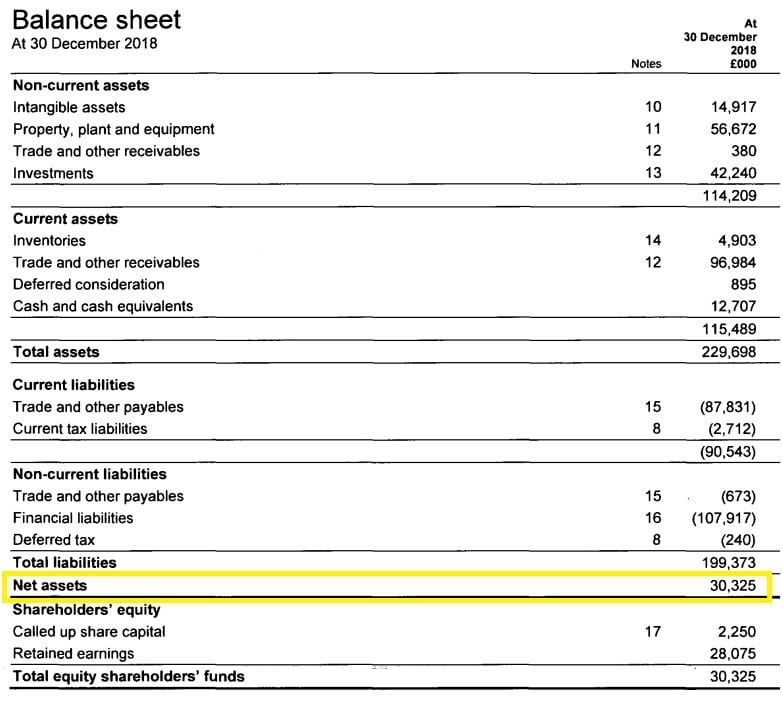

Is the investment company financially sound and well managed?

Search by company name on the Companies House website and look at all the company filings for the last few years.

The accounts of the company will give a snapshot of the balance sheet at a recent date, giving details of its assets and liabilities. The confirmation statement will give insight into the ownership structure of the company (together with the accounts).

The 'People' tab will display all current and past directors of the company. Take note of these names.

Also take note of the registered address and incorporation date shown on the 'Overview' tab.

Is the firm authorised to provide or introduce investments?

Enter the legal company name into the online FCA register to see if the firm is authorised.

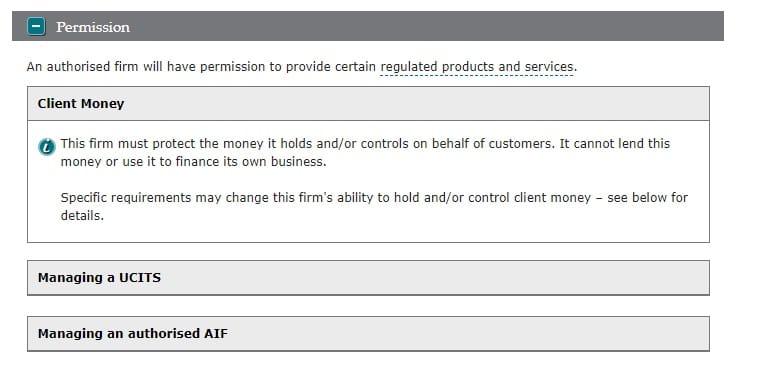

Don't stop clicking when you see the word 'authorised' against a company name. The FCA gives permission on an activity by activity basis. An 'authorised' firm may have one permission or ten.

Click onto the company name and expand the 'permissions' section. As an example, the following company has permission to hold client money and manage investment funds.

If a firm does not have permission to hold client money, it may only faciliate a payment from you to another party. It would not be permitted to hold funds on your behalf in a client bank account.

Does the company act professionally and operate with a full staff?

Its humanly possible for a rare typo to slip through the cracks of a company once in a blue moon. However, finding multiple errors or errors on very prominent parts of a homepage is a big hint that you are dealing with a team of one.

Is the company as large and successful as it claims?

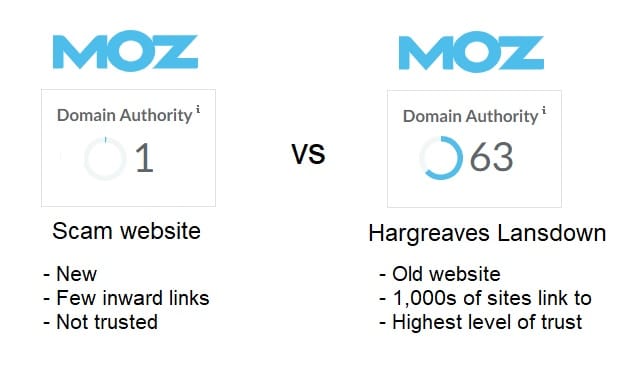

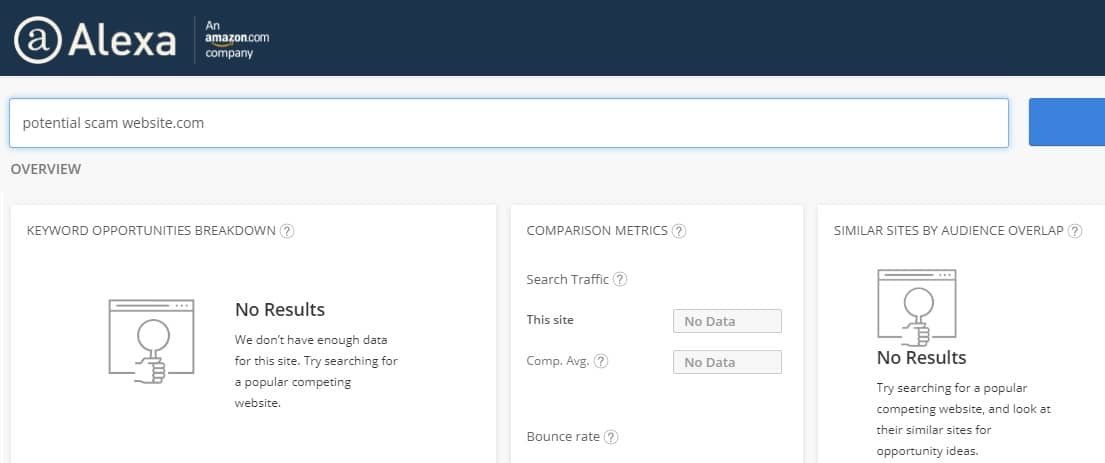

Run the domain name through Moz.com's Domain Authority (DA) scoring system. DA is a measure of the quantity and quality of the links pointing towards a website.

DA is scored in a range between 1 and 100, with 100 representing a behemoth like Google. A score of one suggests that the web is barely aware of its existence. An typical score for a commercial website would be 20 - 40.

DA isn't a solid method of deciding whether a site is legitimate. Web activity can be bought, and notorious websites receive links too.

The best way to use DA is as a sense check against grand claims main on investment websites. If a website claims to be an industry leader, and yet it has a DA of 4/100, you can be sure that the claim is false.

Does the company have a culture of compliance and ethics?

Does the website include plenty of risk warnings, or does it play down the risk?

There are many cautious pieces of wording found on genuine investment websites. Making customers aware of risks is the easiest way to protect a firm from customer complaints and legal risks, so proper firms do their best to inform their customers of the possible downside.

Examples could include:

"Past performance is not a guarantee of future performance"

"The investments are volatile and may lose value"

"You should consider seeking financial advice before investing"

"The investment is highly illiquid and therefore this is intended as a long term investment"

"This opportunity is only available to sophisticated investors"

Here's a real example from a well known UK stockbroker website:

Does the investment opportunity feel realistic?

If an investment is projected to return more than 6% per year, ensure that you understand 'why' the reward is so high.

Earning more than 6% is equivilent to investing in the stock market. Investments in the stock market bring volatility and a real risk of loss.

If an investment opportunity promises a 10% return without similar risks - you must be missing something.

An investment firm would gladly pay a lower return to investors if it could. The very fact that it needs to offer such a high return speaks volumes about the nature of the investment.

A high return doesn't communicate what type of risks are present, but it gives a strong indication of the overall level of risk.

Does the situation feature any other scam indicators?

If 25% of your deposit is redirected to a sales agent instead of being invested in assets - what hope does your investment have?

Avoid being caught in that trap by searching on the investment firm website and on Google for 'affiliate schemes' or 'referral schemes' relating to the investment manager. Some schemes are kept private, but others are made public to encourage participation.

If you learn that the investment manager is prepared to pay more than 1% for investor funds, stay away. This cost will ultimately be passed onto you, either through high management charges or deductions from your investment.

Trustworthy Resources

When falsehoods and fake news abounds, you need to have a clear set of authoritative sources to hand. I’ll point you to the websites that give me reliable information which I use to bust online criminals.

The following websites are have proven themselves to be reliable sources of information.

- Moz Link Explorer

- Alexa Site Info

- Companies House

- Money Advice Service

- Financial Conduct Authority ScamSmart

- HMRC Tax Avoidance Schemes

When reading the best personal finance books, be wary for authors who use their titles as a sales pitch for further courses and consultations. These sometimes come with high prices and are sometimes sold with aggressive sales techniques.

The best get rich quick books I’ve highlighted on our dedicate page don’t do much of this, but it’s a common criticism of many other get rich quick books still on shelves today. Be sure to do plenty of online research before signing up to courses by an author.

Remain aware of the possibility that the web may have lots of positive reviews or pages written by affiliates looking to earn a commission by promoting the scheme. The high margins made on such courses allows the course providers to remunerate such affiliates quite highly.

A financial adviser is like an insurance policy against scams

Use an FCA authorised independent financial adviser to guide you into the investment. They may advise against the investment for other reasons.

Even if you go ahead, you will have some protection under the Financial Services Compensation Service if the investment turns out to be a scam. This would be on the basis that you may be able to claim that the advice was negligent.

Only invest a small proportion of your wealth. The FCA recommends never investing more than 10% of your funds in a single investment. I further recommend you apply a more conservative 5% rule if the investment represents a single asset.

Course Progress

Learning Summary

How to Spot Investment Scams

Advertised returns above 8% per year are a red flag. Challenge why this could be the case.

'Risk free' or 'guaranteed' returns above 2% are equally suspicious.

For maximum safety, stick to regulated investments. These include mainstream stocks & shares, funds, and property.

Deal only with FCA authorised firms. Use the online FCA register to check.

Watch out for aggressive sales techniques, including bold assurances, and the absence of risk warnings.

Be suspicious of language designed to invoke emotion or creates time pressure to encourage you to make a decision.

Ignore cold callers completely. Don't even express an interest in receiving 'additional information'.

Above all, exercise a relentless level of skepticism. If in doubt, don't invest.

Quiz

Next Article in Course

Before you move on, please leave a comment below to share your thoughts. Have you been the victim of an investment scam? Have you come across any while researching investments online? Share them below!

Comments 3

Good day, everyone! i don’t want to terrify anyone, but the rise in cybercrime is concerning. i was duped by an investment fraud organization that promised a 100 percent return in a week. I realize it’s greedy, but it can happen to anyone. I fail to this scam and lost up to $385k worth of cryptocurrency i taught that i was dealing with the right team until i requested for my withdrawal after some weeks of my membership but the process got declined, i tried to contact the customer care system for help they rather ask that i deposit an extra $64k usd for maintenance fee and some tax fees after i already have a total of $385k usd on hold, the whole situation got me really depressed and frustrated then. To my greatest surprise and fortunately for me this genuine registered recovery and trading company called quickrecoverydeck helped me retrieve my 385k worth of bitcoin and funds in 3 working days and I decided not to keep this great testimony to my self..if your a crypto scammed victim and you need help to recover your lost crypto funds which was scammed from you, contacting this company that helped me via the company’s mail Quickrecoverydeck at consultant dot com will be your biggest testimony in recovering your lost crypto funds and assets which was scammed from you.

I usually don’t write comments, I just read some few reviews and go my way, but it will be a heartless act seeing people talk about their ugly experience about scam brokers and not share my experience how ( jamesRodriguez)(@)(Cyber-wizard) DT( com) got my funds back

i was also a victim this company held my money for over 2 months i was lucky enough to see some positive reviews here about mr ebraham crypto fx @ gmail.com and my funds were successfully recovered congratulations to my self.