When designing an investment portfolio, one of the factors you must consider is your investment time horizon.

The consequence of overlooking your time horizon is discovering that your investments have produced a disappointing return at the point you need to sell your investments and use the funds for their intended purpose.

What is my investment time horizon?

Your time horizon is the length of time until the point you need to withdraw your funds as cash.

If you are 25 years old and expect to buy a house at 30, then your housing saving time horizon is 5 years. If you are 45 and expect to retire at 67 then your retirement time horizon is 22 years.

What is my investment time horizon if I don’t know when I will reach my milestone?

The only certainty in life comes in the knowledge that life will unfold in uncertain ways. Life milestones, particularly long term goals, may fall away if your circumstances change.

Your happy relationship may unfortunately dissolve. You may even be in a different career or a different mindset altogether in ten years from now. The things that you covet and treasure now, may begin to feel unimportant compared to bigger dreams and wishes that your future self may conjure.

This makes it difficult to choose a time horizon with confidence. In such cases, picking a shorter horizon is a safe option.

Although a time horizon is entangled with goals, milestones and desires – it is really a solemn promise to not touch your investments until a given date. This means that a shorter time horizon is an easier promise to keep, and gives more flexibility should circumstances change

Common time horizon mistake: Setting the time horizon too long

This is a common mistake made by hopeful house buyers, and is basically a failure of forecasting. When starting to save for a house, savers often overlook several upsides:

- Promotion – house buyers are often in their 20s and 30s and therefore progressing up a career ladder

- Returns – your savings may produce strong returns that accelerate your movement towards your milestone.

- Love – a saver may budget as a singleton but eventually buy their first home jointly with a partner.

It would take a stroke of luck to enjoy all three upsides whilst saving for a house, but anyone of these events could dramatically bring forward your house buying. It would be very unfortunate to need to delay the house purchase because you are unable to exit an investment early..

Common time horizon mistake: Setting a short time horizon for all savings

This mistake is a slow burner, as it only becomes apparent over time. By considering this upfront you may avoid it entirely. Many of the best financial planning books will back this up.

May savers will set a single time horizon for their entire investment portfolio, by looking ahead to the next major purchase such as a house purchase, career break or even the first day of their retirement.

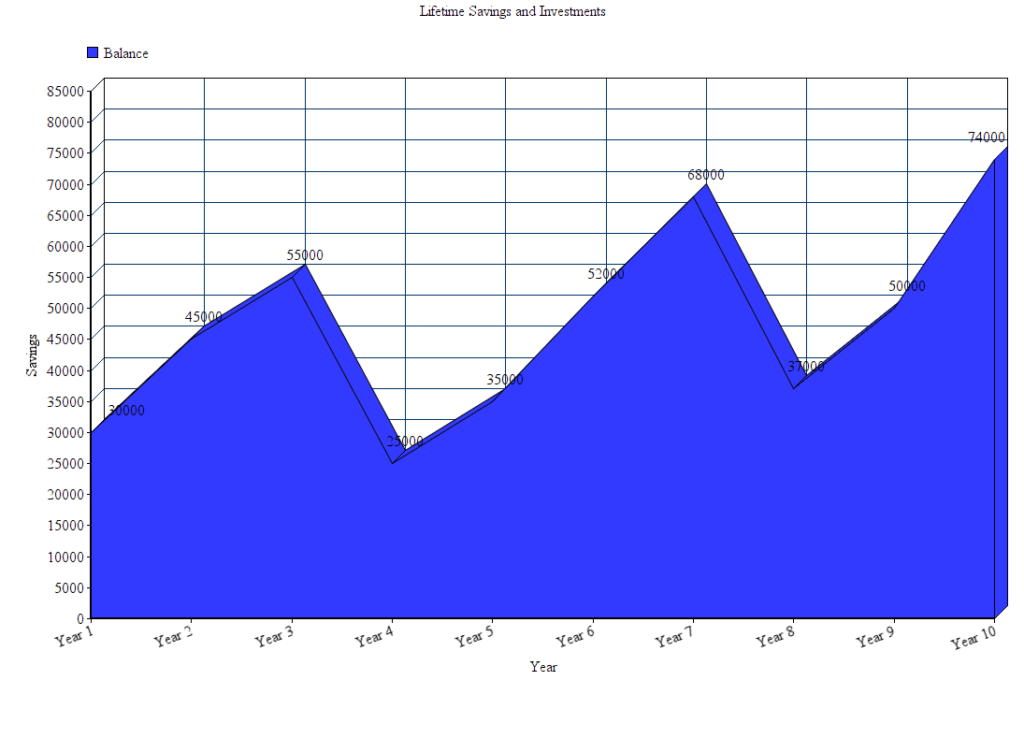

However, it is unusual in practice for bank accounts to be drained to zero in these events. If you do not over-stretch financially when choosing a house, a buffer of savings and investments will probably remain untouched. The graph below gives an illustration of how £25,000 of savings remained across a ten year period in spite of several large short term purchases.

This ‘bottom slice’ of wealth should instead be treated as a separate investment with a longer time horizon. This will allow you to take advantage of the higher returns available for a portion of your savings.

How the time horizon impacts an investment portfolio

In our article Should I save or Invest? Why you deserve better than a Savings Account, we introduced different asset classes:

Savings Accounts, Equities (Shares), Debt, Property, Commodities

Each of these has a minimum time horizon. If your time horizon does not meet these minimums, then they will be inappropriate to hold in your portfolio. A stocks and shares ISA would not be an appropriate place to save for a short term goal, for example.

A time horizon works like a ‘blacklist’, which becomes less restrictive the further out into the future you can lock away your funds for.

| Asset Class | Sub-Asset Class | Minimum Time Horizon |

|---|---|---|

| Cash | Current account | No minimum |

| Instant access savings | No minimum | |

| 1 year savings account | 1 Year | |

| 5 year savings account | 5 Years | |

| Debt | Quick access peer to peer lending | 1 Month |

| Government bonds (Close to maturity) | 1 Month | |

| Corporate bonds (Close to maturity) | 1 Month | |

| Government bonds (Long term maturity) | 3 Years. The market value of bonds with long term maturity dates are very sensitive to changes in interest rates. Therefore in practice, bonds of this nature should be treated with caution and not used as a short-term savings vehicle. | |

| Corporate bonds (Long term maturity) | 3 Years | |

| Junk bonds (Long term maturity) | 5 Years | |

| Government bonds (Long term maturity) | 3 Years | |

| Equities | All shares in publicly listed businesses | 5 Years |

| Shares in private businesses (sophisticated investors only) | 5 - 10 Years depending on exit routes available | |

| Commodities | Precious metals | No relevant time horizon - investors typically hold metals to speculate on price movement over a defined period. This period should be no longer than your time horizon. |

| Art, Classic Cars, Wine | 1 Year | |

| Property | Residential and commercial buildings (Buy to Let) | 5 Years (On the basis of high transaction costs and the slow speed of sales). Property should only be considered if your time horizon is sufficient for the overall return to be attractive, after accounting for these costs. |

Why we need time horizon rules: the die example

If you are interested in the science behind this guidance, I can share a helpful analogy which avoids complex maths.

All investments have positive expected returns over the long term, however, they have different levels of volatility. If an investment is highly volatile, then its return in each year may be significantly above, or significantly below the return you expected. Over the short term, you simply cannot be sure that the investment will produce a good return, or even produce any gain whatsoever. However, the longer you hold it, the closer its total return will move towards the expectation.

Imagine having two dice. One shows a ‘2’ on all of its sides. The other is normal. The objective of the game is to score 4+ with just two rolls. Which die would you use?

The ‘2’ die with would be a reliable companion. It would score 4 in each game. This die represents a bank account with a low but steady interest rate.

The ordinary die will often score higher but will occasionally fail to score 4. If the die rolls a 1+1, 1+2 or 2+1 then you lose. The odds of this occurring are 3 instances out of 36 possible outcomes, which gives an 8.3% chance of loss, despite the die having a higher expected score. This die represents share investments.

In 8.3% of games, the strongest die will fail. This is the curse of volatility. On paper, it was a high scoring die, yet they can disappoint if given only a couple of rounds to build up a score.

A solution?

We solve the volatility problem by extending the game. Over 3 rounds and a target score of 6, the failure rate of the ordinary die falls from 8.3% to 2.7%.

This is how the time horizon guidelines act as a safeguard against the risk of investments behaving abnormally. The more volatile the investment, the longer the minimum time horizon.

As we explained in this article, UK shares have never lost money over a 25-year horizon. Therefore if the game is extended to 25 rounds, the % risk of loss becomes virtually zero.

Often, a beginner to investing will race straight into finding out how to buy shares or how to buy property without mastering the essential rules like time horizon first. Take your time to understand all the principles before investing a penny.

If you’re investing with the longest time horizon of all – for retirement – consider looking at some of the best retirement planning books for ideas relevant to people with 20 – 30 years to invest.

Course Progress

Learning Summary

What is an Investment Time Horizon and how does it Impact a Portfolio?

The 'time horizon' is the length of time you do not need access to invested funds.

Volatile investments such as equities may have high 'expected returns' but are highly likely to deviate from this expectation in the short term.

Therefore for short term investments, shares and other risky assets may not be appropriate.

Failure to factor your time horizon into your investing choices could lead to disappointing returns or even losses at the point you need to access your funds.

Consider splitting your money into two portfolios with different time horizons, if you only anticipate using a portion of it in the short term. This will allow you to still benefit from higher returning asset classes for the portion that can remain untouched.

Quiz

Take Action

- Use this article to determine what your investing time horizon is. Consider your different saving objectives and upcoming life events. You may conclude that you have multiple time horizons for different pots of money. If this is the case, you should treat these as separate investment portfolios from now on.

- For each portfolio you wish to build, use the guide above to create a shortlist of investment types which would be appropriate.

Next Article in Course

Before you move on, please leave a comment below to share your thoughts. What time horizon are you working with? How will this affect your investment choices?

Comments 1

Some genuinely nice stuff on this web site, I love it.