About the My Portfolio series

My Portfolio is a series of blog posts which share the secrets of my own investment portfolio. These will give you the opportunity to peek at the logic behind my biggest investment decisions.

Selecting investments has to be the most time-consuming aspect of building an investment portfolio for the first time.

In the first My Portfolio article, I showed how I allocated my portfolio across the major asset classes.

In this article, we will be delving one step deeper into what I’ve invested in.

Below, I’ll reveal precisely which investments sit in my own portfolio. I’ll also explain my reasons for choosing them above all others.

As always, I should repeat that my portfolio is tailored to my personal risk appetite and investment time horizon. The investments below might not be suitable for you. This isn’t a magical wealth formula. Please always carry out your own research before investing.

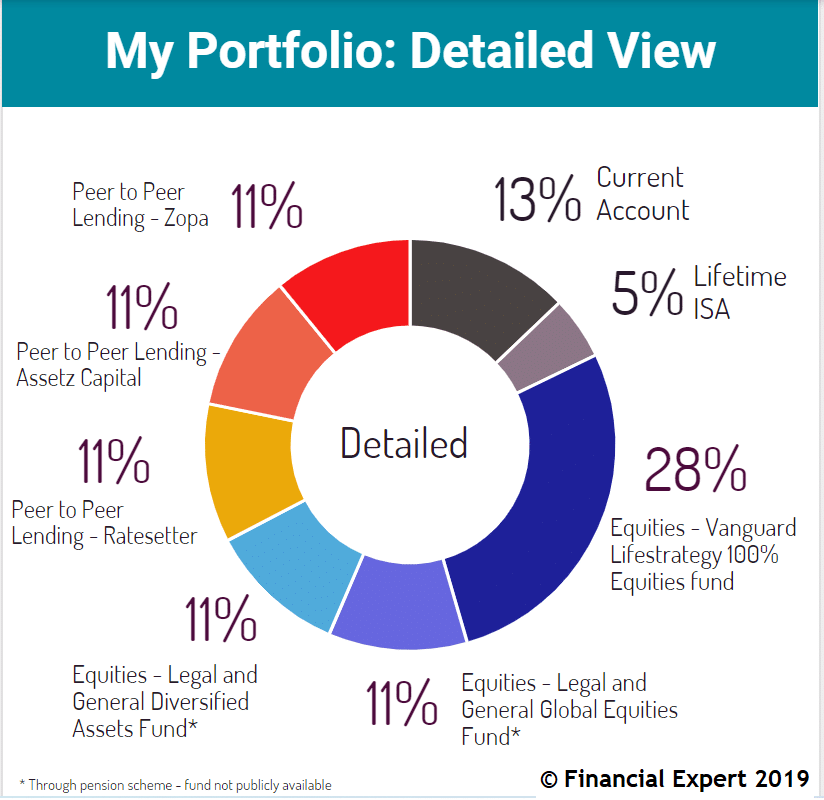

My Detailed Portfolio

Equities – split but not by choice

This chart would consist of a single shade of blue if I had my way.

The Vanguard Lifestrategy 100% fund invests in the shares of large companies in developed countries.

The ‘100%’ in the fund title reflects a 100% allocation to equities. Other variants exist which allocate between 20% and 80% of the funds value to corporate bonds.

I already have debt assets in the form of peer to peer lending, therefore I had little reason to further water down my equity holdings by selecting one of these.

The ongoing management charge of the Vanguard fund is 0.22% – vanishingly small. I prioritise reducing investing costs to maximise my returns, therefore this was a key factor for me.

If I had a choice, I would have happily invested my entire equities apportionment in the Vanguard fund. However, legal rules get in the way.

The remainder of my holdings sits within my private workplace pension. Unfortunately, the pension provider restricts me to just 13 funds.

Fortunately, I found two of the best investment trusts in the UK within that choice. They each carry tiny management charges of below 0.2%. I’ve therefore been able to select these Vanguard-look-alikes.

A three-way-tie between the peer to peer platforms

You’ll see that I’ve followed my own advice from my peer to peer lending platform guide to the letter.

Starting in 2017, I opened one new Innovative Finance ISA each year, so that I now have a total of three platforms to spread my P2P allocation across.

A key risk of peer to peer lending is platform risk. This is the risk that the whole platform will fail. This could be triggered by a surge of bad debt, a loss of investor confidence, or bankruptcy of the provider.

Platform failure is particularly worrying in the peer to peer sector because of the young age of these companies. Except for Zopa, no peer to peer provider has experienced the stress of a recession yet, because they weren’t trading back in 2008.

Only by minimising the exposure to each company can I reduce the impact that a single failure might have on my portfolio.

I will, therefore, continue to open new peer to peer lending accounts until I run out of large and reputable providers. I hope to have at least five, which will limit my exposure to 6.6% per provider.

Something I could do to limit platform risk would be to move some money out of each account and invest in corporate bonds instead.

As I explained in my asset allocation article, I see corporate bonds and peer to peer lending as comparable investments. They both act as stabilisers on a portfolio and both offer a yield of between 3% and 6%. I have a preference for P2P lending but I will consider whether I am overexposed to this sector when I next revisit my portfolio.

Cash is king – when it comes with a bonus

Within my sizeable allocation to cash, I have a Lifetime ISA account.

Lifetime ISAs are available to under-40s and their cash counterparts pay a relatively poor rate of interest.

They do however come with a government bonus of 25%, paid 30 days after each deposit. Strings do come attached. The cash can only be used for a first-time house purchase or retirement living. Withdrawals for any other reason incur a penalty which outweighs the interest and bonus.

If you are saving for a house in the very near future (as I am), this 25% bonus represents an unbeatable return for zero risk.

My savings will have only sat in the account for an average of two years. This means that my personal rate of return will be 11% annually without any risk.

The ISA rules permit a maximum investment of £4,000 per year. I save money in this account first, to ensure I fully use this allowance each year.

Keeping it simple

You might be surprised at how simple my investment selection process is:

- Use up the Lifetime ISA allowance first as it represents an unbeatable opportunity

- Split the peer to peer allocation across as many reputable providers as possible

- Invest the equity allocation in a basic, passive and cheap index fund.

Even the best asset allocation books will often recommend a quick and simple approach such as this.

Leave me a comment below if you have any questions or thoughts on my investing choices. I’d love to discuss it further with you.