About the My Portfolio series

My Portfolio is a series of blog posts which share the secrets of my own investment portfolio. These will give you the opportunity to peek at the logic behind my biggest investment decisions.

A rare advantage that bank account savers enjoy over investors is that they can save with certainty. When they move their cash to a higher-performing account, they can easily measure the extra interest their effort has earned.

This encourages them to continue spending time searching for the best deals.

Investing is more uncertain. We know that history tells us that shares should return somewhere between 6 – 10% per year. But we also know that those returns can be elusive.

What keeps me on the right path is calculating my expected return.

An expected return isn’t a guarantee – it’s almost certainly wrong. What it represents is the average annual return that should expect to receive each year if I stay true to my investing strategy over the long term.

If you have a go at this exercise, I hope you’ll also be motivated by the percentage that appears on the screen. That percentage is why we go the extra mile when finding a home for our cash.

In this article, I’ll show you how to calculate your expected return. I’ll also show you my own workings so you can compare!

How to calculate the expected return of your portfolio

The overall return of a portfolio is a weighted average return. This means that the individual returns of each investment must be given weight based upon their size.

Fortunately, you may already have these weightings on a spreadsheet – the same spreadsheet you used to build your investment portfolio.

To illustrate, I couldn’t have created my asset allocation pie chart without calculating the percentages first.

- List your individual investments and their values

- Calculate the percentage of the total value each investment represents.

- Assign each investment an expected return (see below)

- Multiply each investment’s % allocation by its expected return

- Sum up the result of these overall and express as a %.

How can you determine an expected return for each investment?

- For any savings products or income-based investments such as bonds, or peer to peer lending, use the interest rate or net income yield.

- For any equity investments, you could use 8%.

- For any property investments, you could use 5%

- For any other investments, use the advertised rate of return if available.

You can contact me for assistance if a figure eludes you.

Be sure to consider the expected return carefully where an investment includes both equities and bonds. In that case, calculate an expected return which reflects this mixed nature.

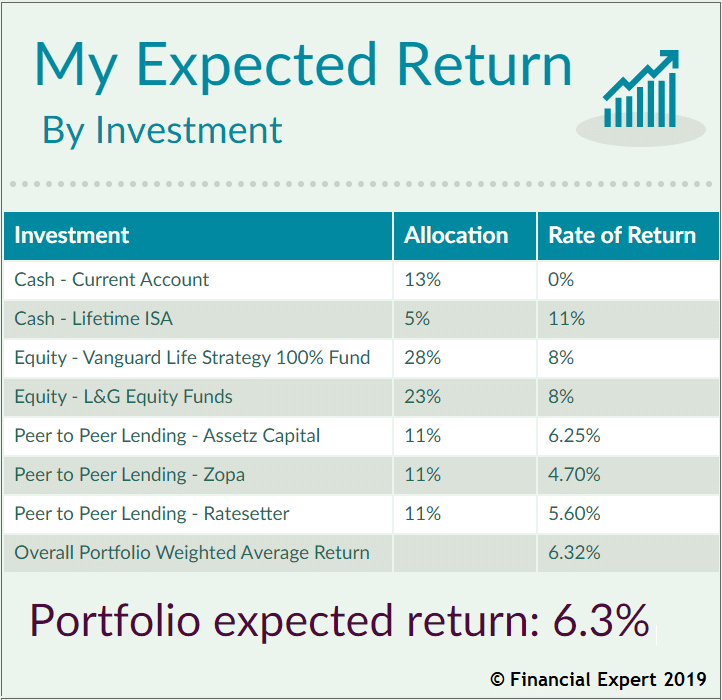

My expected return

Unusual investments

Each portfolio usually has one investment which demands more thought than the rest. My Lifetime ISA was a good example.

A cash lifetime ISA pays little interest but attracts a 25% government bonus on any funds deposited. It wouldn’t be correct to call the 25% bonus an ‘annual return’, because it’s a one-time reward – not a recurring bonus.

My savings will have sat in the account for an average of just over 2 years before I will empty it to buy a house. I’ve therefore calculated that the bonus will equate to roughly 11% per year.

My result: 6.3%

As you can see above, my portfolio should return about 6.3% per year. This is a very encouraging thought. At that rate, an investment would almost double in value every ten years!

A savings account growing at 1.5% interest would only rise by 16% over the same period.

Creating the table about has also encouraged me to reflect on whether every part of my portfolio is working hard.

My attention is drawn to the large current account balance which generates zero interest. This investment is a serious drag on my overall return.

I’ve previously explained that I cannot invest this cash fully due to time horizon restrictions. However, I’ve decided today to move it to an instant access bank account and earn 1.5% interest. This will lift my overall return to 6.5%.

As you calculate your own portfolio returns, please let me know what number you got in the comment section below!