What is spread betting?

Spread betting is a special type of wager entered into between a customer and a bookmaker. Is spread betting profitable? Read on to find out in this exhaustive guide to spread betting.

In an ordinary bet, the gambler risks a ‘stake’ in return for a return based upon fixed odds which are agreed when the bet is placed. If specific conditions are met, such as the victory of a football team, the customer sees their stake returned, with a profit.

In contrast, spread bets are placed upon a prediction of whether a price will move up or down. Examples include the value or price of an asset such as an index or a share. The amount won or lost by the gambler will vary depending on how much the price has moved.

An example of a spread bet:

A customer could wager ‘£1 per point increase in the FTSE 100’, with a starting index value of 6,700.

If the index rises to 6,800, the customer would win £100.

If the index falls to 6,600 the customer would owe £100 to the bookmaker.

This relatively new form of betting has given birth to a new bread of companies that allow people to bet on the financial markets using this betting system. Often, the providers of spread betting don’t look that different to stocks & shares ISA providers. After all, their websites talk about trading stocks, profiting from the financial markets, and commissions.

What are the Advantages of Spread Betting?

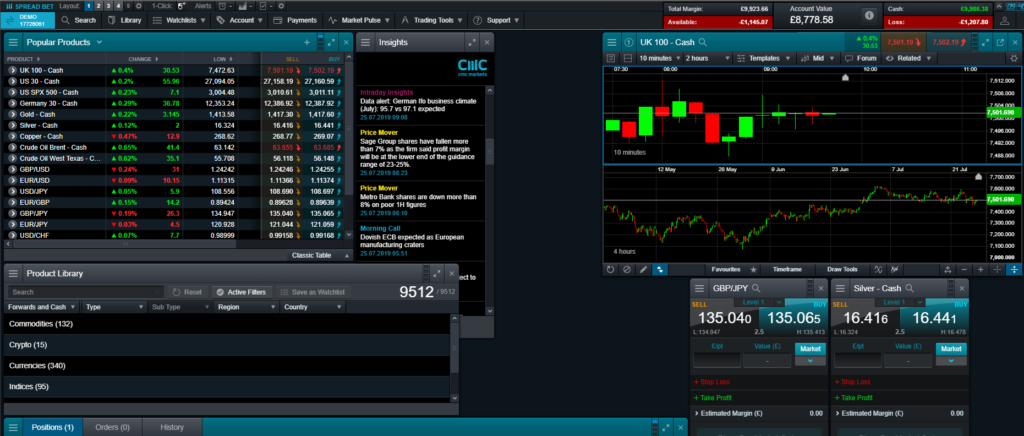

The websites of spread betting providers, which include CMC Markets, IG and CityIndex, make interesting claims on their websites. These may encourage investors to consider using spread betting as an alternative to ordinary investments. These claims include:

- Enjoy access to broad range of markets, including shares, indexes and foreign currencies.

- Spread betting profits are tax-free

- Trade like a professional on high tech trading platforms using live market data

Is Spread Betting Profitable?

It’s difficult to say for an individual. Most CFD providers disclose that the majority of customers on spread betting sites lose money when trading CFDs. Therefore on the balance of probabilities, the answer is that on average, traders don’t win.

However, a proportion of traders clearly do make money. Newcomers to trading, therefore, seek to understand what trading strategies and investing psychology are employed by those successful traders to gain an edge.

Placing a single large bet with a large proportion of your portfolio is quite similar to making a wager at a casino. Even the best day traders don’t get it right every time.

But if you execute a successful trading strategy over the medium term, taking multiple positions with each trade only using a small proportion of your portfolio, a great trading idea can be turned into profit.

It’s a balanced conclusion to the question. Some traders win, and some traders lose. The same could be said of many financial markets.

More Differences Between Spread Betting and Ordinary Betting

In spread betting, you do not gamble with a fixed stake. This means that the ‘downside’ of a spread bet is potentially unlimited. If we apply more extreme circumstances to the spread betting example above. At the stake level of £1 per point, the customer would lose £3,300 if the FTSE 100 fell to 3,500 as it did in 2008.

Spread betting companies allow customers to place ‘stop-loss limits’ which try to automatically close a bet if the loss exceeds a pre-determined level. In theory this should cap losses.

However, in reality these do not work all of the time. Occasionally the underlying index or share price can slip quickly and skip past the exit price, which may result in the stop-loss failing to activate. Alternatively, it may execute but at the lower price (and hence a greater loss).

That being said, recent UK regulations have stepped in, which have encouraged all spread betting and CFD providers to guarantee that no client can lose more money than they have in their account. These are known as ‘guaranteed stops’ and are a very useful feature.

Another key difference is that very little cash is required to fund a large bet. When customers only need to pay a portion of their exposure in cash, this is known as ‘trading on margin’ or ‘using leverage’. The counterparty (in this case the bookmarker) is effectively lending you the remaining cash to create the full position. Therefore this will attract an interest charge if your bet remains open for more than a day.

For example; CMC Markets offers a ‘5% margin’ rate for bets on large UK companies. This means that only 5% of the maximum loss needs to be deposited upfront by the customer.

This isn’t just about convenience for the customer. Leverage dramatically increases your profit or loss. Being able to use less cash to fund a large position, means that you will take large positions compared to zero leverage. Therefore, the outcomes will be larger relative to the cash invested.

A Comparison to Real Investing

As we explained in our article ‘What are Shares and Why do People Invest in Shares?‘, investors are entitled to dividends from ordinary shareholdings. However, you will not receive dividends from a spread betting company while you hold an upward bet on a share price. This is because you are placing a bet with a counterpart rather than actually investing in a profitable asset.

If you trade via a stockbroker, you pay a transparent trading fee to buy or sell shares. When spread betting, you pay indirectly by trading at the ‘spread’. This means that the prices you ‘buy’ and ‘sell’ at are biased in the bookmaker’s favour (See ‘The House Edge’) below.

If you hold shares, you gain voting rights and the ability to attend an Annual General Meeting (AGM) of the company. If you bet on a company via spread betting, you do not gain such rights, as you do not legally own a share. Instead, you are a party to a contract with the bookmaker.

Due to the complex way in which spread bets are structured, you will actually be charged interest for holding a bet open longer than one working day. This is effectively a ‘charge for leverage’.

The upside of leverage

In the introduction, we explained that a spread bet requires only a small upfront deposit relative to the ‘size’ of the exposure. Let’s use an example to look at how this works in practice:

Leverage in action

The share price of a company is £2.50. A spread betting company offers 5% margin on bets. A customer bets £1 for each pence increase in the share price.

In real life, to experience a £1 gain for every pence increase in a share price, you must own 100 shares. Therefore the theoretical investment that this bet replicates, is a £250 shareholding of 100 shares.

The maximum loss will occur if the share price became zero. In this instance, the customer would lose £250. (250 pence movements x £1 bet per point).

At 5% margin, the bookmaker would ask the customer to deposit 5% of the £250 exposure as a stake. This is just £12.50. Again, the customer has invested just £12.50 of their own cash, and now has the same price exposure as if they held £250 of shares.

If the share price subsequently increases by 5% to £2.63, the customer has won 12.5 pence movements at £1 per point, so £12.50.

This demonstrates the amplification of returns by leverage. Using only £12.50 of cash, the customer experienced a profit of £12.50 (a 100% return) on an underlying share price increase of only 5%.

The Downside of Leverage

Of course, leverage can also work against the customer. If the share price had fallen by 5% instead, the resulting £12.50 loss would have wiped out all of the customer’s deposit.

6/100 companies listed on the London Stock Exchange saw falls of 5%+ on the day this article was published. Any customers betting upwards on these companies at 5% margin could have seen their stake completely wiped out.

The House Edge – Spreads

You might be wondering – how does a spread betting company make a profit?

The chance of a share increasing or decreasing on a single day is approximately 50% each way, therefore given that punters can choose which direction to bet, how does the house have an edge on the bets you place?

The answer lies in the ‘spread’. The spread is the starting price at which your bet actually begins to make a profit.

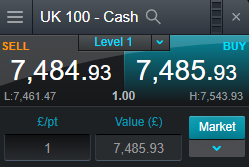

In the example in the image, the real FTSE 100 level was 7.485.43. To bet upwards, you must agree to a starting point of 7,485.93. This means you will only begin to profit if the index moves 0.5 in your direction. If betting downward, you must agree to a starting point of 7,484.93.

This subtle shift of the goalposts tilts the odds towards the provider. Now, if the price moves against you or stays the same, the provider will win. This is the digital equivalent of the provider slightly weighting a coin in their favour after you have backed a heads or tails.

The wider the spread between the buy and sell price, the more margin a bookmaker earns. The spread on the FTSE 100 above is very narrow, as spread betting providers compete fiercely on spreads. However – whilst the spread looks small, the effect is amplified by the leverage factor. As we explain in our demonstration later, the spread will cost a minimum of £50 for each £10,000 trade, so this is not an insignificant expense.

Risk management tip #1 – volatility

The spread is not actually the main factor working against investors on the spread betting platforms. The largest risk factor is volatility.

You may recall from our article on risk and diversification that volatility is harmful to returns. Despite having a positive ‘average return’, a series of sharp gains and losses will destroy a portfolio’s value. This table featured in that article:

| Investment performance | Mean average return per year | Actual portfolio value after ten years |

|---|---|---|

| 5% annually | 5% | £1,629 |

| 3% then 7% alternating | 5% | £1,626 |

| -5% then 15% alternating | 5% | £1,556 |

| -15% then 25% alternating. | 5% | £1,354 |

| -25% then 40% alternating | 5% | £904 |

| -50% then 60% alternating | 5% | £328 |

The final row is an extreme example that is unlikely to occur in an ordinary trading portfolio of shares. However, it’s representative of what can occur when trading with leverage.

This is why traders placing spread bets should monitor their underlying exposure, not the stake or deposit at risk. It’s the magnitude of the underlying exposure which will determine the magnitude of the volatility. Therefore by keeping an eye on the right measure, you should avoid surprises.

Risk management tip #2 – avoiding gambler’s ruin

Another fact you should keep in mind is that a retail customer has finite funds, whereas the provider’s resources are virtually unlimited.

Gamblers’ ruin is an observable concept that:

- If two players play a game with equal odds of winning

- Where one player has finite money and the other has infinite money

- For an unlimited number of games

- The player with infinite funds will win 100% of the time.

If a customer makes a large gain, the provider will still be able to continue to bet against the player in the future, and indeed will encourage the customer to continue to do so. Given that the wins and losses are occurring randomly if the customer plays long enough, a losing streak will eventually emerge which will beat the player.

This effect can be powerful. Again, because of leverage, even a small losing streak can wipe out an investor if they are placing wagers which are too high a proportion of their total portfolio.

The solution here is to ensure that wagers are not likely to result in a loss of 10% of your portfolio. This margin of safety will help to protect against ‘black swan’ events which may exceed expectations.

Trying demo accounts to discover if spread betting is profitable for you

Spreadbetting companies always offer demo accounts for prospective customers. Demo accounts are filled with play money and customers can use this to place bets and see what happens. This is a sensible product to have, to allow customers to familiarise themselves with the interface of a trading platform, and get to learn spread betting in a risk-free environment.

If you’re wondering: ‘Is spread betting profitable?’, you can put that question to the test by trying it yourself with pretend money and no risk of real loss.

Read more: books about spread betting and day trading

Is Spread Betting Profitable? It is for the Spread Betting Companies!

From which perspective is spread betting most profitable? Based on the loss disclosures, it’s probably the provider’s perspective! Unlike a traditional stockbroker, a spread betting company will only generate income if their clients lose.

The major spread betting and CFD providers report close to a billion dollars of net operating income, which demonstrates that they must be winning a good chunk of trades.

We hope this article has answered the question of ‘Is spread betting profitable?’

As an investing pursuit, if you only play with money you can afford to lose, spread betting could be fun. CFDs and spread betting is high risk and carries a real chance of loss.

Therefore good risk management, solid investment psychology and some good trading ideas will be needed to give yourself a good chance at being a profitable trader yourself.

Course Progress

Learning Summary

An Investors Guide to Spread betting - Is Spread betting Profitable?

The answer to 'Is spread betting profitable?' is 'Yes for some traders' but 'no for most traders'.

A spread bet is a directional bet, where the gambler wagers a stake per unit of price movement in any direction.

Spread betting is different to ordinary investing. The objective of spread betting is to profit from short term movements in market prices, not the steady increase in company values over years.

As a spread better, you will receive no dividends and will need to pay interest if you hold buy positions for longer than 24 hours.

Share and bond investments have a positive expected return, whereas 70% - 85% of spread betting clients lose money. This differs between providers.

The top three providers reported over £1bn in net income in 2017.

Spread betting clients encounter several challenges which require good risk management:

1. The 'spread' between the up and down starting prices of bets (or 'open and close') provides a margin

2. The high 'leverage' inherent in spread bets can produce volatile returns, compared to a traders deposit.

3. A short losing streak has the capability to wipe out a customer's deposit if their bets are too large in relative terms.

Quiz

Next Article in the Course

Before you move on, please leave a comment below to share your thoughts. Have you used spread bets as an investing tool in the past? Please share your successes and failures!