The definition of a bond as an investment is as follows:

What is a bond?

A bond is an agreement between a borrower and a lender.

From an investing perspective, the ‘owner’ of a bond is the person who is entitled to collect the repayment and any interest.

This may not be the same person who originally provided the finance as most bonds can be traded between investors.

How can bonds differ?

Bonds come in many shapes and sizes. Before you consider investing in bonds, you should understand all the relevant terms and conditions:

- The term of the loan (When will the sum be repaid)

- The coupon rate (the interest the borrower must also repay)

- Whether the bond will be repaid in multiple instalments or by way of a single repayment at maturity.

- The seniority of the bond. This means the level of priority the bondholder will enjoy over other creditors in the event of the borrower becoming insolvent.

- Whether the bond can be freely exchanged with other investors.

Bonds can also be distinguished by:

- What exchange they are listed on

- What currency their repayments will be denominated in

- Whether the coupon rate is fixed or linked to an index, e.g. inflation

- Whether the bond was issued by a government, a company or other institution

All of these factors influence the risks and rewards that a bondholder will experience, and therefore they impact a bond’s value.

Example of a bond

Let’s take a look at a real bond to see how these different characteristics combined in a bond investment opportunity.

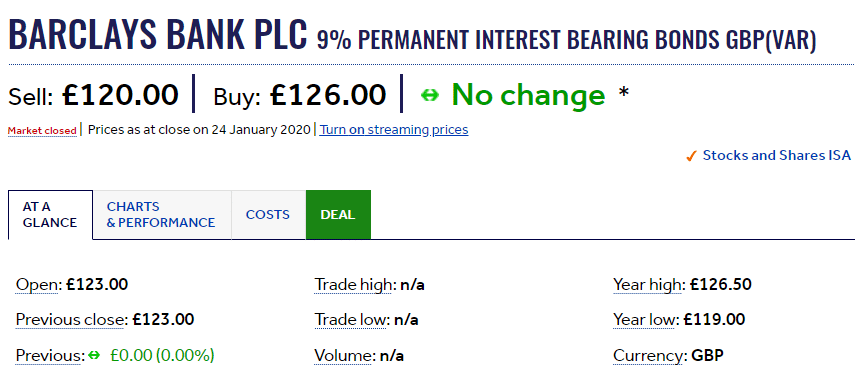

BARCLAYS BANK PLC 9% PERMANENT INTEREST BEARING BONDS GBP (VAR) (More information)

The borrower is Barclays Bank PLC. This is a company, so the bond is known as a corporate bond.

Barclays is a large UK business with a moderate to low credit rating. Therefore the sub-asset class in which this investment belongs would be

Corporate bond > high yield > GBP (Pound Sterling)

The coupon rate is 9%. This is similar to an interest rate, but an investor today is not guaranteed a rate of return of 9%. See our article what is a bond coupon rate for an explanation of this important concept.

The bond above does not have a maturity date as it is permanent, which means that the bondholder will simply receive a series of interest payments forever. This is an uncommon form of bond – most will repay a lump sum on maturity.

Interested in other bond definitions?

- Definition of a bond

- Definition of a corporate bond

- Definition of a junk bond

- What is the coupon rate of a bond?

If you’d like to explore other investment types which use debt as the main source of risk, please check out my guide to structured products and investing in peer to peer lending platforms.

Comments 1

9% seems like a high rate, even if Barclays is not the strongest of UK banks. What’s the catch?