About the psychology of investing series

This blog post forms part of our investing psychology series designed to be read alongside our comprehensive investing ‘How-to’ articles that come with our free investing courses:

- How to invest in stocks & shares

- How to invest in property

- How to invest in land

- How to invest in commodities

While these articles take you step-by-step through the process of investing in shares, property, land, and commodities, they don’t discuss the mental fortitude needed to become a good investor.

Any stock market veteran will agree that the mental challenges of being an investor can exceed the technical or financial challenges!

I’ve written articles about whether now is a good time to invest in the stock market, when investors should buy shares and when is the right time to sell shares. The popularity of those articles in particular, leaves me with no doubt that indecision and insecurity play a chunky role in guiding our investing decisions – whether we want them to or not!

Don’t become the prey of media organisations ‘churning’ out content

In an arena with as much uncertainty as the stock market, it’s no surprise that we look for ‘agreeing views’ in the media to support our investing decisions.

However, taking a peek at journalist write-ups in anticipation of making a financial decision is not a sound idea. I have witnessed on many an occasion where writers produce two articles in the space of a week that give both an optimistic and pessimistic view on the stock market. This might be done for the purpose of providing ‘balance’, but it completely undermines the idea that we should look to financial journalism for trading ideas, reassurance or financial advice in general.

This is just a single example of how investing psychology can make or break a portfolio.

To create an investment strategy that you can stand behind for decades to come, I think you will greatly benefit from greater knowledge of investment psychology.

This psychology of investing series will comprise six bite-sized articles which will each focus on a single problem (a stressor) or a solution (a mindset). I hope to challenge your views and encourage you to reflect upon how the stresses of investing affect you, and how your portfolio can be protected against negative urges.

Remember, if you’re interested in learning more about investing psychology then visit our shortlists of the best investing psychology books.

The dangers of exuberance

On Financial Expert, I write most of my free investing course content with the purpose of building the investing confidence of my readers.

This article swims in the opposite direction. I hope to share a cautionary tale or two to warn against feeling unbeatable in the stock market.

I’ll explain below the dangers of overconfidence when investing.

1. Over-confidence means over-trading

Too much confidence in your investing judgments means that you are likely to attempt to trade more of them.

A pessimist might assume that most of their trading ideas might turn out differently to how they hoped. In contrast, a confident investor will be keen to try many more of them, on the basis that they have ‘faith’ in their profitability.

This can lead to what is known as ‘over-trading’. This is where an investor trades frequently – often more than once per year with the same money – and sees stockbroking fees eat away at their market return.

As we explain in our article ‘How to reduce or eliminate investing costs‘, keeping fees low is an easy way to maximize the return on your basic investment portfolio.

Shares are a good investment because the stock market has positive expected returns. Simply joining the fun and playing normally should provide you with a positive result.

However, the stock market begins to resemble a casino when you trade frequently, for two reasons:

- You create a ‘house advantage’ for the stockbroker

- Investments begin to look more like ‘bets’

Taking these points in order; a shareholders’ total return will be the underlying performance of their assets, minus fees. If you invest sensibly, your returns should vastly outstrip your fees.

High frequency traders fall foul of this equation and create a ‘house advantage’ which works against them. Every buy and sell order will incur trading fees and a bid/offer spread cost which comes straight out of the value of their portfolio.

The more frequently someone churns through their holdings, the higher fee they pay per £1,000 of investment each year. If you trade enough, this fee level will exceed the expected return of each £1,000. At this point, an investor has completely frittered away the market return, in the pursuit of something more.

Sometimes a short-term trade might pay off, and sometimes it won’t, but a fee will always be taken in every scenario.

Secondly, investors who over trade may only take positions for a few weeks or months. This means that they begin effectively making equity investments with a time horizon of less than one year. We don’t advise anyone investing in the stock market without the intention of holding the asset for five years or more.

Over a shorter time frame, history shows that the likelihood of a positive result diminishes. As the timeframe approaches one day, the chance of success shortens to 51%. That feels more like a spin of the roulette wheel than ‘investing’ to me.

2. Certainty leads to active approaches

If your confidence in your own investment ability is high, it follows that you are also willing to place faith in the skills of others.

As I explain in my article ‘Passive funds versus active funds‘, statistics show clearly that active fund managers rarely achieve premium returns over the long run. It follows that active managers cannot deliver the returns needed to cover their own costs.

However, if you’re already willing to follow a ‘gut feel’ for your investing decisions, you will be more inclined to believe the marketing of ‘star fund managers’ and take a punt in their strategies.

Again, active fund management has no prove benefits which match the increased cost of such approaches.

3. Get ready to buy high and sell low

Investing confidence can manifest itself in the ultimate trade; the decision to sell your equity investments after predicting an imminent crash.

It sounds like a bold move, but because of the apparent safety of cash, its not a very scary decision to make. After all, you are de-risking your portfolio. You are moving to an apparently risk-free investment, so what’s the risk?

There are plenty of risks of moving into cash:

Risk 1: The equity market continues to rise and you miss out on these gains. While your cash balance will read out the same number, you have in fact lost money because had you taken no action, you would be in a better position. Your decision to sell thus caused your portfolio a loss.

Risk 2: Inflation reduces the value of your cash in real terms. Unlike real assets like property and equity stakes, the value of cash is eroded by inflation.

Risk 3: You spend £100s in trading fees, only to buy back into the market again in a few months/time. These fees were unnecessary and have ultimately impeded your return.

A cautionary tale

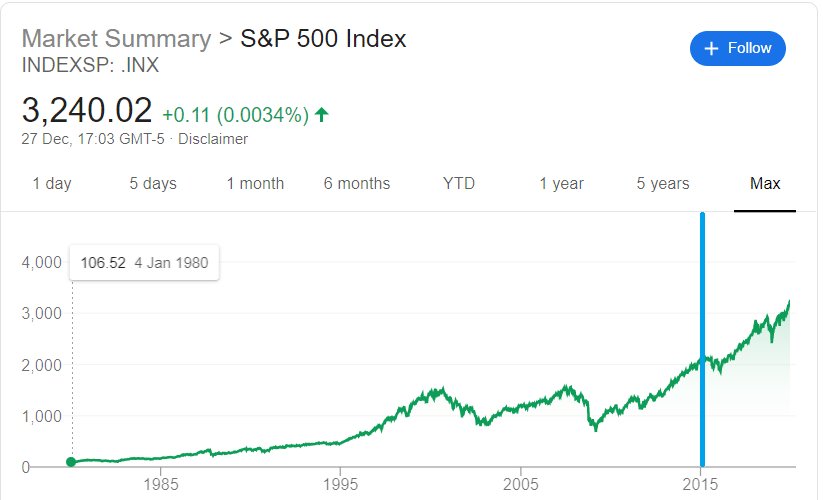

As a cautionary tale – back in 2015, many investors argued that the global stock markets were heading for a crash. See the blue line below.

Predictions were made for a host of different reasons, but the argument made intuitive sense to many because they could see that historically the US stock market would crash every 5-10 years, after extending past previous highs. 2015 looked ripe for a contraction.

What would you have done? Would you have taken the decision to exit the market? As you can see from the chart, the stock market index continued to surge through the 2,000 level and stands at 3,240 at the time of writing. This understates the total return as the effect of dividends would increase this further.

The cost of sitting in cash for the 2015 – 2020 period was to miss out on a 50% – 70% gain. What a financial disaster.

Of course – it’s true that the stock market could have crashed. In this example, it just happened not to.

The point I want to make is that the objective of investing is to receive a fair return for taking on these risks. By stepping out of the market, you are removing the risk of a crash, but you waive all rights to a good return. You are no longer behaving like an investor and therefore deserve no profit.

In my opinion, you either have the investment risk appetite to stay in, or you should admit that you don’t have the right risk tolerance and you should stay out indefinitely.

Investing in shares in the blind hope that you will ‘dodge’ the next crash is folly.

You should only invest in the stock market if you’re prepared for the worse, and if you can afford to leave your funds invested during difficult periods. History has shown that you will be richly rewarded. But shares are a risky investment and are simply not suitable for everyone.