Cryptocurrency, being a mode of transaction, has gained an escalation far more significant and composed any other rival. Cryptocurrency connected via the internet has gained massive support from people who have been connected to any form of social media. Cryptocurrency platforms have been projected as ideal for those seeking a quick profit. However, this is true to some extent. It hides many risk factors associated with this platform, thus making it misleading.

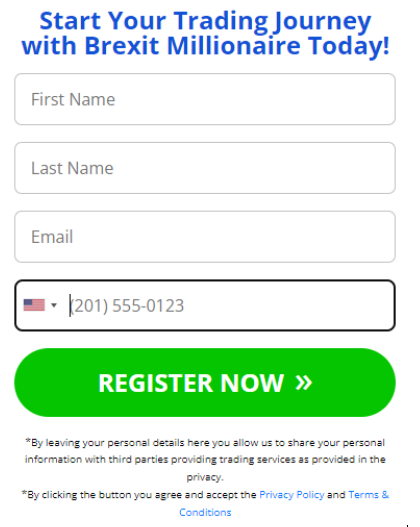

Cryptocurrency, when first introduced, was seen as a revolution by many investing communities and traders, being security considerate, easily accessible via the internet, globally acceptable and because of previous factors, demanded between consumers. Check websites like brexitmillionaire.org to know more about cryptocurrency trading. But over time, people released the flaws cryptocurrency hides beneath its perfection. Its volatility, anonymousness, and decentralized properties that were pros shifted to cons.

So the question arises: Why are cryptocurrencies defective against those measures one can solve? Not easily, though. Is cryptocurrency liable for its title as The Future of Currency and transaction? Let us summarize, review and understand the topic first, which will be adequate to reach an answer.

Advantages of a cryptocurrency over traditional currency

Cryptocurrency, as introduced, holds quite the upper hand against the traditional currency. Firstly, cryptocurrency is decentralized, thus immune to external factors such as government interference, political interruption, or economic factors, which might have influenced the traditional currency. Secondly, cryptocurrency is a digital currency accessible to everyone through the internet. So, people can buy and use cryptocurrency without approaching any authority. Finally, cryptocurrency also provides anonymity among trading parties, making the leaking of credential information nearly impossible.

Cryptocurrency platforms also have volatile prices, which lure investors and traders seeking profit, making the market a hot war zone between the investor to get the highest advantage and gain higher profits, deliberately enhancing the total market shares to considerate proportions. Cryptocurrencies are just digital tokens, having a different context than the traditional currency, which are a nation’s asset, leading to having less restriction to usage and more freedom to traders and investors.

Cryptocurrencies are undoubtedly high-risk and this article is not a promotion of cryptocurrencies. We don’t advise which is the best cryptocurrency to invest in with certainty because this simply isn’t known. How to invest in cryptocurrency is more of an art form than a science, although good due diligence and risk management can certainly improve your odds.

Demerits of cryptocurrency and why some worry about the future of currency

As discussed, cryptocurrency provided an opportunity to new investors to gain profits thanks to its volatility, but this turns to a setback as ordinary consumers or traders are not as benefited as the investors. It is due to the simple fact that cryptocurrency loses or gains value rather drastically than regular currency. The features make cryptocurrency a risky job for traders and buyers. And such actions reduce the number of newcomers as the cryptocurrency they buy might lose, for example, half of its value any mere second.

It also questions the existence of cryptocurrency itself as an alternative to cryptocurrency. Currency should be stable between the recommended courses of the period. So that trades can be made at a stable price without risking the consumer any loss of money.

Cryptocurrency also provides an open market to everyone without restrictions imposed by traditional currency. But similarly, this merit can be misused for illegal or criminal works, disrupting the reputation of cryptocurrency platforms. At the same time, they remain out of track behind the anonymousness of these virtual coins.

There is also the concept of using cryptocurrency as a currency. However, cryptocurrency is seen more as an investment asset than a currency alternative. For example, investors tend to invest in cryptocurrency to guarantee its price will increase. Resulting in them keeping the virtual coins to themselves and not spending it, defeating the purpose of cryptocurrency being a currency.

This kind of practice and factors is why Bitcoin is seen as a rather unfitting candidate for being the future version of currency and payments methods. However, these setbacks do not bury the feature cryptocurrency provides and the potential it contains. As in the current perspective, the future will be fully functional with technology, and regular paper currency will not settle with that period considering many theoretical aspects.

So, if to choose, cryptocurrency does have the capacity to be the future of currency, considering the new set of technology it bought along. Moreover, it has adapted over time as many cryptocurrency companies have bought significant market use changes. Therefore, it would be unwise to disband cryptocurrency of its progress because of its perfection in adapting to the economic balance.