Part of my article series on investing mistakes.

This article will explain a mistake made by new investors following active investing strategies.

When actively trading, an investor is attempting to buy undervalued shares and sell shares when they have reached an optimal price point.

Successful active trading is incredibly easy to describe, but incredibly difficult to pull off in practice.

Of course, the question of when is the right time to buy, and when is the right time to sell shares can never be answered with certainty. Plotting the future walk of prices on a price chart sometimes feels like reading a crystal ball.

An active trader needs to use all the information they have to hand to form a trading judgement. In the face of so much uncertainty, and with plenty of money on the table, these are difficult decisions to make objectively.

What is over-trading

Over-trading is when an active investor (or their financial adviser) churns through their portfolio excessively.

Portfolio churn is the buying and selling of investments. If you held each investment for only 180 days on average, then you could say that you churn through your portfolio twice per year.

On the other hand, ‘buy to hold’ investors have low churn, as they do not sell their investments, but merely add to them.

Why is over-trading a mistake?

Portfolio churn, you could argue, is an essential part of short term active trading.

Any active investor will usually enter into an investment with a target price or time horizon which will trigger an exit. If those happen to be very short positions, is that an issue?

Well, the success of an active investing strategy could be measured by its annual return.

The issue with over-trading is the level of investing costs that you incur.

Short term trades are likely to make smaller profits per trade. This is because your holdings will have less time to move while you hold them (with few exceptions, shares don’t tend to move significantly over a matter of days, the larger price movements occur over months if not years).

However, trading costs are fixed. Regardless of which stockbroker you choose, you will be charged the same trading commission whether you held an investment for 2 days or 2 months.

This means that when your churn increases, your expected return does not increase, but your cost base does. This eats away at your total annual return.

The house disadvantage

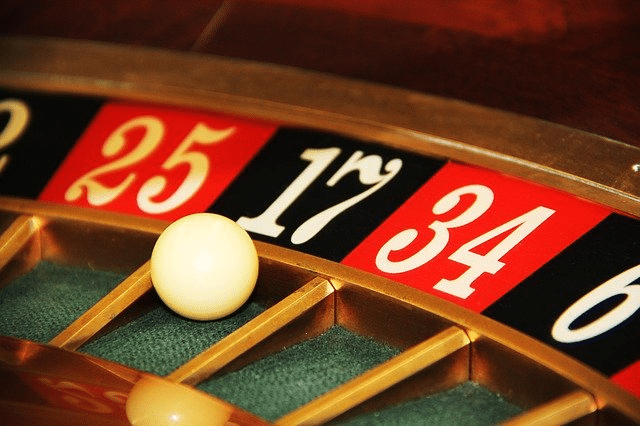

Another way to think about it is your investment costs are a hurdle you must overcome before you begin to see a positive return for your efforts. The more trades you make, the higher this hurdle rises.

Remember, a passive investor who is sat in an index has virtually no investing costs in comparison. So their very first return goes straight to their return.

Over-trading therefore creates a ‘house disadvantage’ – a larger and larger cost which you must overcome through clever trading before you even begin to produce a positive return – never mind a market-beating return.

Studies have shown that women make for better investors than men, precisely because they trade less frequently. On average, everyone’s trades converge to an average level of return, but women spend less while doing so, meaning they preserve more cash in their portfolio.