Frontier markets are, like the name suggests, on the fringes of the comfort zones of even experienced equity investors. In this article we’ll explain what are frontier markets, how can you invest in them and does the potential reward outweigh the risks?

What are frontier markets?

Frontier markets are less developed economies that have promising growth potential. They are the highest risk category of stock market which are still considered ‘investment grade’ by some institutional and retail investors.

The list below should help you understand where they sit in relation to other markets:

- Developed markets

- Emerging markets

- Frontier markets

- Uninvestable markets

Developed v emerging v frontier economies

We can describe common characteristics of each category of economy, although the factors below will not always apply to each member of a group. Countries are varied and vibrantly different. The unique combination of This is a function of the varied

The key characteristics of developed economies are:

- Strong institutions

- Political stability

- Protected asset rights and a consistent application of the rule of law

- Lower levels of perceived corruption

- High GDP per capita

- High levels of education and public health

In short, developed economies create an ideal environment for investment. Investors want low risks and predictability. If investors are more confident about the likelihood of future earnings, they will place a higher value on the shares of a company.

The key characteristics of emerging economies are:

- Strong economic growth

- Youthful population

- Higher levels of foreign direct investment

- Undergoing process of industrialisation

- Growing middle class

- Moderate levels of perceived corruption

- Lower wages than developed economies, but these are rising

- Asset rights are less protected

The key characteristics of frontier economies are that they are either perceived as high risk or are too small to cope with large inflows of capital.

Examples of frontier markets based on size include Iceland.

Risk factors of high-risk economies are:

- Higher costs of doing business

- Higher levels of corruption

- Higher levels of political interference and a higher risk of arbitrary asset seizures

- Higher risk of political instability

Frontier markets could be on a trajectory to one day become an emerging market economy. For this reason, they’re sometimes referred to as ‘pre-emerging’ markets.

List of frontier markets

The MSCI Frontier Markets Index includes the following markets (A-Z):

Bahrain, Bangladesh, Burkina Faso, Benin, Croatia, Estonia, Guinea-Bissau, Iceland, Ivory Coast, Jordan, Kenya, Lithuania, Kazakhstan, Mauritius, Mali, Morocco, Niger, Nigeria, Oman, Romania, Serbia, Senegal, Slovenia, Sri Lanka, Togo, Tunisia and Vietnam.

However, definitions and methodologies differ regarding the exact composition of this group of economies. Refer to our full list of frontier markets for a useful comparison of the leading frontier market indexes.

How to invest in frontier markets

Frontier markets, are by their very definition, very difficult to access. Even the best UK stockbrokers do not offer their clients the opportunity to directly invest in frontier market companies. The demand is so low for frontier equities that it isn’t worth the expense.

Most investing apps only offer a selection of US, European, Japanese stocks and only the very largest emerging markets companies.

Furthermore, because frontier markets don’t attract institutional investment, frontier markets don’t attract the same level of press, journalism and analyst coverage. It’s simply harder to get reliable information about these companies.

This is frustrating for retail investors looking to invest in frontier markets. However, you can still tap into this market through collective investment schemes.

Frontier markets funds

The following frontier market funds are available to UK investors. These are not recommendations or an invitation to invest in the funds below. Please perform your own research before making any investment.

BlackRock Frontiers Investment Trust plc (LSE: BRFI)

Investment strategy: this Blackrock investment trust focuses on its own definition of frontier markets, which also includes emerging markets so long as they don’t feature in the top 8 countries in the MSCI emerging market index. For reference, this means any emerging market other than Brazil, China, India, Korea, Mexico, Russia, South Africa, and Taiwan.

This means the official benchmark index for the fund is a hybrid: “the MSCI Emerging ex Selected Countries + Frontier Markets + Saudi Arabia Index.“

Team & fees: BlackRock Frontiers Investment Trust plc is co-managed by Sam Vecht and Emily FletcherIt has an ongoing charge of 1.36%. It follows an accumulation distribution policy.

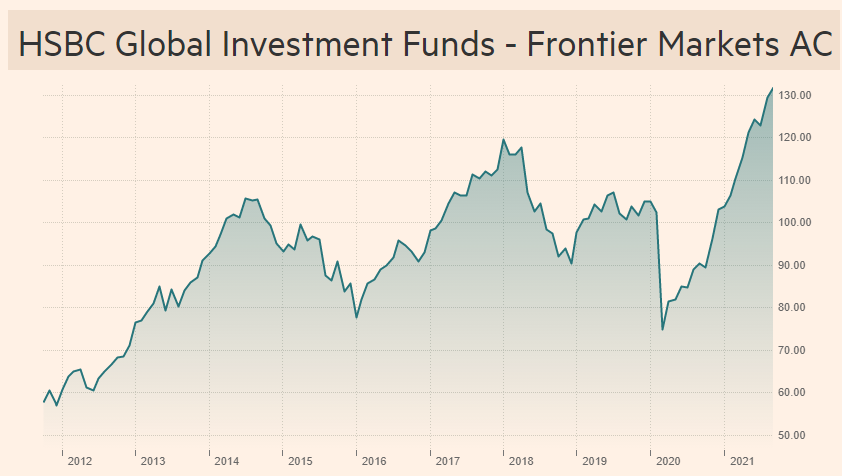

HSBC Global Investment Funds – Frontier Markets AC

Investment strategy: This close-ended fund holds equities and derivatives to gain exposure to listed companies in Frontier markets or companies that have great exposure to frontier markets. A minimum of half of the fund’s assets must comprise equity securities.

The fund’s benchmark is MSCI Frontier Emerging Market NR USD.

Team & fees: HSBC Global Investment Funds – Frontier Markets AC is co-managed by Ramzi Sidani and Jennifer Passmoor. It’s NAV is $220m at the time of writing. The frontier fund has an ongoing charge of 2.25%.

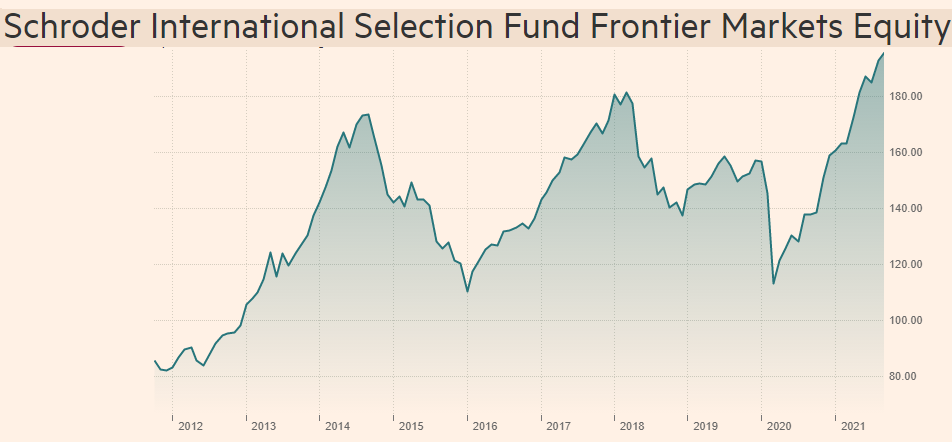

Schroder International Selection Fund Frontier Markets Equity A Accumulation USD

Investment strategy: This closed-ended fund denominated in USD, aims to provide capital growth in excess of the MSCI Frontier Emerging Markets (FEM) Index (Net TR) with Emerging Markets capped at 10% after fees have been deducted over a three to five year period by investing in equities of frontier emerging markets companies.

The benchmark is MSCI Frontier Emerging Markets (FEM) Index (Net TR).

Team & fees: The fund is co-managed by Rami Sidani and Tom Wilson, who have each managed the fund for over ten years at the time of writing. The ongoing charge is 1.98%.

Is investing in frontier markets worth the risk?

To understand the potential rewards of investing in frontier markets, we can look at the performance of the funds we have highlighted above.

BlackRock Frontiers Investment Trust has not performed well over the maximum period available on Google.com. As you can see below, the trust has struggled to hold onto its gains over the longer period.

Over the 10 year period covered in the chart, the price of the trust has increased. However, when you compare this against the performance of the S&P 500 index (below), it has lagged behind.

The S&P 500 index has experienced a spectacular period of growth, driven by growth companies which make most other indices look poor in comparison. But in exchange for the level of risk, investors would be reasonable in expecting a better performance over a relatively benign decade for equity markets.

HSBC Global Investment Funds – Frontier Markets AC has performed better, particularly over the 2020 & 2021 years.

The chart below shows that £1,000 invested in the fund in 2012 would be worth over £2,000 today.

The Schroder International Selection Fund Frontier Markets Equity accumulation fund has also performed in a very similar pattern. Recovery subsequent to the pandemic has exceeded pre-pandemic valuation levels. Please be aware that as an accumulation fund, the returns of the Schroder and HSBC funds include the effect of dividends being reinvested inside the fund.

You will have to make your mind up as to whether the returns from these illustrative frontier market funds appear to justify the risks involved. Historical returns are not an accurate predictor of future returns. However, within this niche equity asset class, it is one of the few readily available data point that investors have visibility over.