Is it possible to retire at 50 without bringing in a lucrative salary, or pinning hopes on the lottery?

Retiring early is possible, and it’s backed by the simple personal finance principle I explain in this article. This principle is so incredibly simple that most folks have almost forgotten it.

How to retire at 50 or sooner

The spending/income ratio is crucial to retirement success.

The proportion of your income that you spend is the key driver of your retirement age.

- Get it wrong, and you will struggle financially for the rest of your life.

- Get it right, and you will be able to ride a wave of wealth past all of your peers.

The ratio has a huge effect that reaches far beyond what you might first imagine.

Let me walk you through the maths which will reveal that each change you make to spend less, will have a vast effect on your retirement age.

An example: a typical British consumer

Imagine you are a typical British consumer. You take home an after-tax salary of £20k per year.

Let’s assume that you spend 90% of your salary (£18k). 5% of your salary goes into your pension, and 5% ends up in your savings account, but to all intents and purposes this simply amounts to £2k being added to your savings pot each year.

Modern families struggle to curb their spending

Now let’s calculate how much savings you will need to be able to live off the interest at your current level of spending. Assuming that you can generate an income of 5% per year on your investments, you will need to accumulate £18k/0.05 = £360k in tax-free investments. With a £360k nest egg, your 5% investment return would cover your £18k expenditure.

We have instantly encountered the elephant in the room. If the average Joe is only saving £2k per year, it would take 47 years for their savings pot (growing at 5% annually, with £2k annual contributions) to reach £360k.

This scenario would lead to retirement failure; a delay to retirement or a drop in living conditions.

The accelerator effect

Now suppose you are a bit more savvy with your money, and you choose to save twice as much. Would this half your working life? Let’s find out by doing the maths.

If you save £4k out of £20k then you must only spend £16k per year. Therefore you will require £16k/0.05 = £320k in your savings pot. If you are saving £4k per year, it will need 33 years to reach your target.

What about saving more?

If you save £6k/£20k then you now only spend £14k per year. Therefore you will require £14k/0.05 = £280k in your savings pot. At a rate of £6k per year, it would only take 25 years to reach your target.

If you save £8k/£20k then you now only spend £12k per year. Therefore you will require £12k/0.05 = £240k in your savings post. If you are saving £8k per year, you will need just 19 years to reach your target.

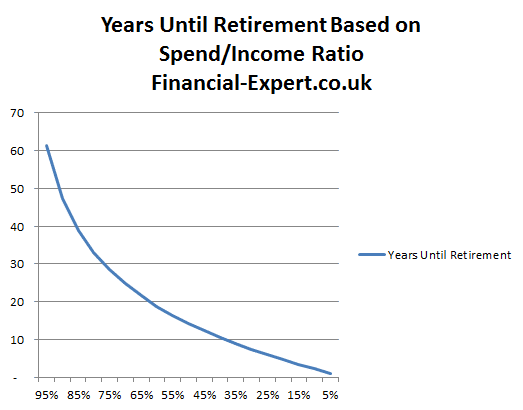

See the graph below to see the relationship between your ratio and number of saving years required.

As you can see, rather than a simple straight-line relationship occurring, there is a rapid acceleration at the beginning. Further gains become more difficult as the helping hand of compounding interest becomes weaker when very short time periods are involved.

Can you retire at 50? Where are you on the curve?

The benefits of saving some of your income are demonstrated very clearly in the graph.

Someone who spends 65% of their income, as opposed to 95% of their income, can retire 3 times faster!

The difference in their retirement plan is dramatic, although the spending cuts are not, as they have only given up a third of their income. This is a win for the ‘learn to live with less’ camp.

Are you the type of person who sees money as a ‘permission to spend’, or do you instead only spend on the important things in life, and save all the rest? The latter approach to consuming will pay enormous dividends following these principles.

How wealthy would I be if I worked to 65?

Perhaps retiring early isn’t your goal. Instead, you might wish to work until 65 but use your enhanced savings to fund an exciting lifestyle.

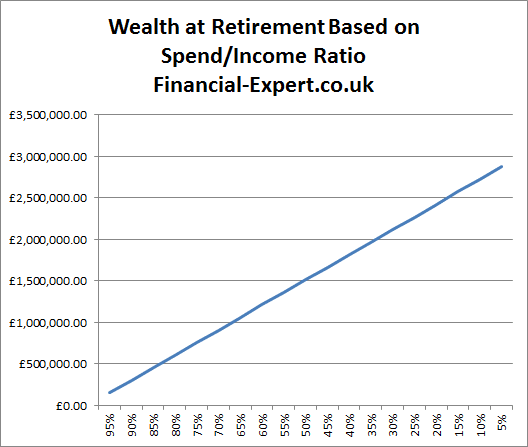

The spending/income ratio continues to dominate your success at achieving this goal. The following chart shows the results for a £20k after-tax salary.

Look at the size of those possible numbers involved!

The maths doesn’t lie. You can become a multi-millionaire on a £25,000 salary if you cut your outgoings to 2/3 of your ingoings.

Whilst this graph holds so much possibility, it is also a sad reminder of the current finances of the majority of the general public.

Someone who saved 35% of their income would be sitting on a cool £million, but where would our ‘typical British consumer’ be?

A 10% saver would only have about £300k to fund their retirement (£1,250 income per month).

If only they could cut a 10% slice out of their expenses, they would have retired on double the income – £2,500 per month. They could have lived out their retired years spending many months abroad, giving financial support to their family, and having the freedom to live where they wanted. Instead, they have to live off a salary lower than their original income during their working lives.

With just a relatively small change to your lifestyle and spending habits, you can enormously change the financial prosperity of your retirement. You don’t need an investment training program to tell you that!

The massive problem: spend swell

If my charts are correct – someone who saves a quarter of their income can retire by the age of 50, but so few individuals manage to do so.

So what is the problem? Is something wrong with the model?

There’s no denying it – my model is based on solid reasoning.

The problem that kills the chances of retiring early is what I’ll call ‘spending swell’ – the natural tendency for us to spend more on things as we grow older.

When we start our career and own a cheap run around car, we are fairly content. However after half a decade of blood sweat and tears in order to progress ones career, people feel the nature urge to increase their spending in line with their salary.

As we get promoted to manager, we buy a larger car, move into a larger house and go on more lavish holidays.

Simply put, rather than keeping expenditure constant and funnelling ever-larger amounts into savings – people tend to keep their spending as a fixed % of their salary.

This wouldn’t be too bad if their tendencies were to spend 75% of their salary, but we all know that on average people tend to spend almost everything they receive.

The real dilemma here is that as the spending swell advances, the amount of capital required to fund it in retirement becomes impossible to fund.

Imagine that by the age of 50 you have risen to an after-tax salary of £42k. If still spend 90% of this amount, your target pension fund has risen to £750,000, whereas your annual savings contributions are a relatively paltry £4,200. This imbalance will inevitably lead to a massive drop in quality of life upon retirement.

The problem is therefore discipline. Could you keep living the same lifestyle as your income increases, or is the urge to climb up the materialistic edge of the social ladder too strong to resist?

Let’s not forget, your partner will probably be clamouring to improve some aspects of spending when they hear about a promotion, so it’s not only yourself that needs convincing. Occasionally a couple completely agree on this matter, and support each other in ‘aggressively saving’.

A nod of the hat here should go to the owner of Extreme Early Retirement, who took the Spend/Income ratio to the absolute extreme by living on 20% of his income, and retired from fulltime work in fewer years than you could count on both hands.

Let’s aim higher

In the case above, I’ve played it safe and used conservative figures (5% is very easy to get from a savvy portfolio), and I’ve also assumed that you will earn roughly the national average salary in the UK.

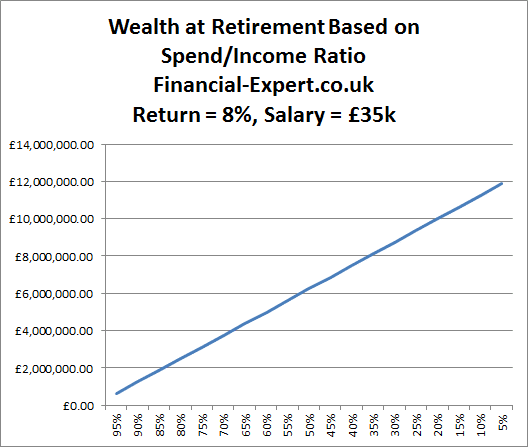

But now I want to change the cards a little to really get you excited about your retirement prospects. In the real world, 8% is often given as the standard average return from a portfolio heavy in stocks and shares.

I also notice you’re reading material about early retirement on the web, which actually suggests you earn higher than the national average.

Also, your proactivity in reading about financial topics tells me that you will work towards higher earnings than the average Joe, because it is clearly a priority for you. So I will now assume you earn £35k for each year throughout your career. This changes the game completely. See for yourself:

The ultimate irony of the early retirement ‘spend swell’ dilemma is that those who refuse to swell their spending during their career will live out the rest of their long retirement with more money than they know what to do with!

Conversely, those who show the greatest desire for material possessions will be unable to fund a desirable lifestyle.

I’ll leave you to drool and leave a comment below. I hope you enjoyed this article about how to retire at 50!

Notes:

- I appreciate that ‘averaging out’ a salary across whole career is cheating a little bit, as this throws more of the investment into the early years, allowing for greater compounding effects, but I can assure you that even when this is taken into account, the overall effect is still just as pleasing!

- A 5% yielding portfolio is attainable for people with a balanced investment risk appetite. Explore our foundation free investing courses for ideas on how you could construct a basic investment portfolio to generate a 5% return.

- An 8% yielding portfolio is only achievable with an advanced investment portfolio and would not be suitable for investors with sensitivity to risk. Such portfolios could involve investing in land, investing in commodities and investing in property in addition to investing in the stock market.