This is a finance theory article that answers a common question of curious investors when they start investing. It’s very apparent that over most long time horizons shares outperformance bonds and cash. But the question, why? Why do the best companies to invest in produce a higher financial return than cash?

The initial answer people hear is that ‘with higher risk comes greater’ return. But again, this is an observable phenomenon and not a clear answer to the question ‘why do shares have a higher expected return?’

Why do shares produce high returns?

A guaranteed £1 in the future is worth more today than an uncertain £1. This concept alone will explain why high-risk investments such as shares produce higher returns.

The mystery box illustration

The following thought experiment will help demonstrate this principle.

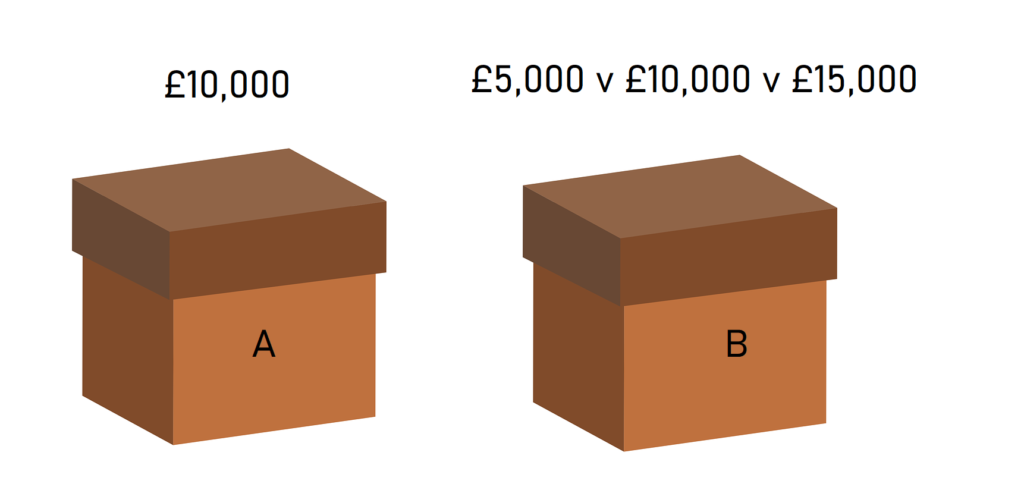

How much would you be prepared to bid in an auction for each of the following two boxes?

Box A contains £10,000 in cash.

Box B will contain either £5,000, £10,000 or £15,000, each with an equal chance of each appearing.

Have a think about how much you would personally be prepared to bid for Box A and Box B if you were given this opportunity today.

…

If you calculated the average cash benefit of Box B, you will have concluded that it is worth £10,000 on average, which is the same as the first box. However, Box B contains much more risk.

What would I bid for each box?

I would personally be prepared to bid up to £9,999 for Box A. Any price up to this point will provide me with a guaranteed profit in exchange for taking no risk, so I would always increase my bid until the auction price reached £9,999.

However, I would not be as generous for Box B. The £5,000 potential outcome creates a real possibility of loss, which I would not be prepared to take for the sake of a small profit. Therefore my realistic bid for Box B would probably be £7,500.

This would give me a 33% chance of incurring a £2,500 loss, a 33% chance of a £2,500 profit, and a 33% chance of a £7,500 profit. For me, the possible return is enough at this price point to compensate me for the risk of losing money.

By setting my price lower, I have increased the likely return of this investment, to ensure that I am compensated for the risk I am taking.

Why shares return higher than bonds to investors

This is the same phenomenon that is silently driving the stock market returns of investors.

Because of the risk, investors generally bid lower when buying shares (when compared against the price they would pay for a safe bond that had similar income potential).

This means that on average, their potential for returns is much greater because they are buying a similar future stream of income for less.

This doesn’t guarantee profits. In the example above – I could still have incurred a loss on Box B by paying £7,500 for it. But what is important is that if the game could be repeated over and over it would have resulted in far higher profits than my Box A strategy.

This is why it is important for investors to buy many different shares and hold them over a long time horizon. This is equivalent to them selecting Box B over and over and over again. When this process can be repeated, the odds increase that any unlucky blips of poor performance are overwhelmed by the higher expected profits they locked in through the lower valuation of shares.

Why shares perform so well: the bottom line

What this article has explained is that it is the return demanded by investors which ultimately shapes the return they receive. If investors accept a lower return, they will place a higher value on a future cash flow and ultimately pay more for investments.

If an investor sees risk then they will demand a higher return, so they will bid low on the asset price and only transact if they can secure the investment at a discount.

In this way, the financial markets set prices that generally see the riskiest assets pay the highest expected return. When considering what to invest in, investors always consider the relative risk and return of an investment before deciding how much they would be prepared to pay.

If an investment opportunity came alone which had a higher return or lower risk than the market rate, then its price would quickly be adjusted by the collective trading activity of market participants.

This is ultimately why retirement investment portfolios and other long term investment accounts managed by professionals have a sizeable allocation of their funds in equities.

Learn more about finance theory

If you enjoyed investigating one of the many cogs of the financial markets, you’ll probably enjoy reading the best finance books, the best personal finance books, and the best economics books. Each of these book shortlists is packed full of titles with many insightful explanations of how the money world works.