Have you ever wanted to add some preferred stock, or covered warrants to your investment account? Did your stockbroker actually let you? The term stockbroker is used to describe a wide variety of brokerage accounts. Some brokers specialise in share dealing, while others generously allow you to fill your investment account with as many types of investments as possible.

In this article, we’ll share the results of our original research comparing the leading UK stockbrokers, by comparing the number of instrument types that stockbrokers allow you to trade.

By reading this article, you’ll quickly learn whether your preferred broker is relatively restrictive or has an open door to rarer instrument types. Which UK brokers will allow you to buy preference shares and Exchange-Traded Commodities (ETCs) for example? Find out more below. We’ll rank this listing in order from most restrictive to the highest degree of freedom.

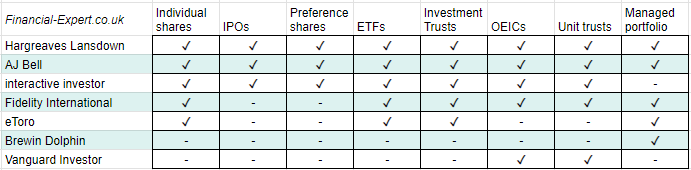

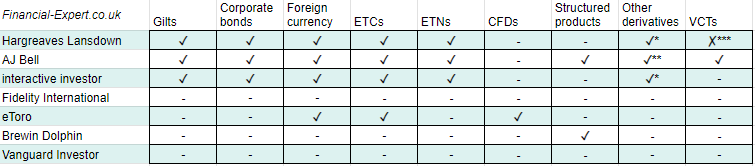

Please note that the table below represents the availability of instrument types across a broker’s full range of account types. You may not be able to hold each of the below in a single account, for example, a Stocks & Shares ISA, and may need to open a general investment account to access additional options, owing to ISA rules and other discretionary policies of the broker.

Core equity essentials:

Fixed income & alternative investments

Notes:

Which UK stockbroker offers the broadest range of investments?

From our original research, we can crown AJ Bell as the king of investment diversity.

AJ Bell offers every instrument in our table except for CFDs, which is a very excusable omission when we consider the poor historic returns experienced by retail investors trading CFDs.

This means that choosing this broker would unlock the maximum possible number of investment opportunities as a UK retail investor.

Do you fancy holding some Government bonds (GILTs) directly, or perhaps participating in the initial public offering of a new tech start-up? Judging from our product review, AJ Bell’s standard brokerage account will stand behind your purchases.

Where are the REITs?

We have elected to not show Real Estate Investment Trusts separately from investment trusts, on the basis that their equity class has identical trading characteristics to investment trusts and therefore all stockbrokers we reviewed that offered investment trusts also allowed investors to buy shares in REITs.

Are all retail investors eligible to trade the investments shown in the table?

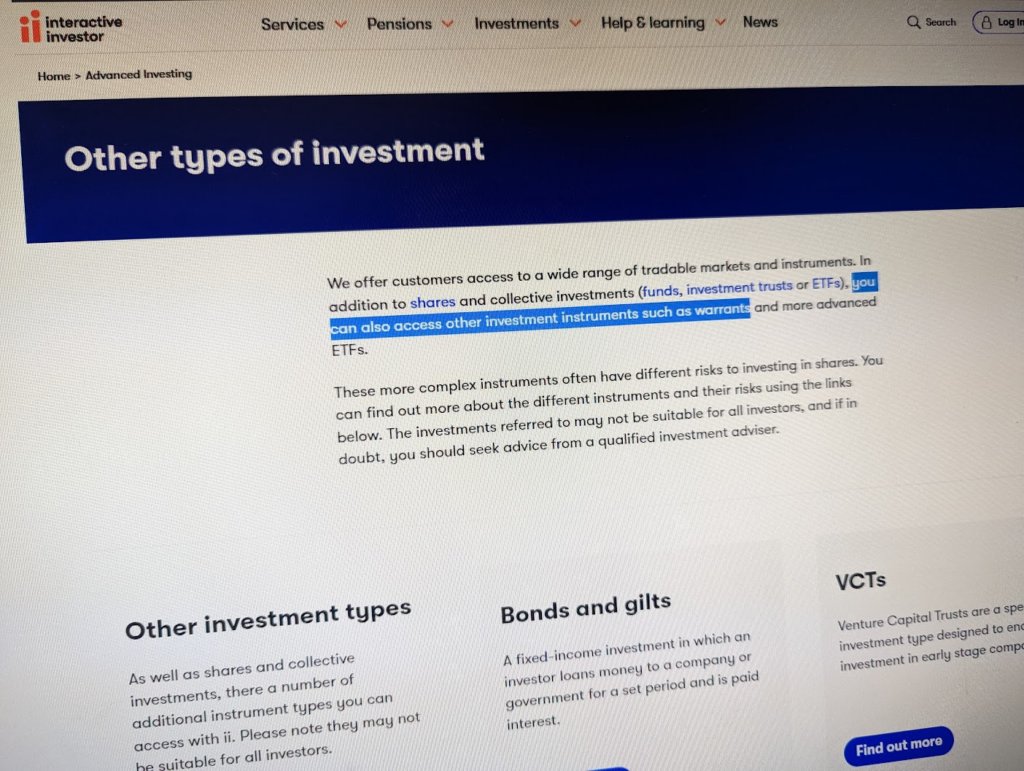

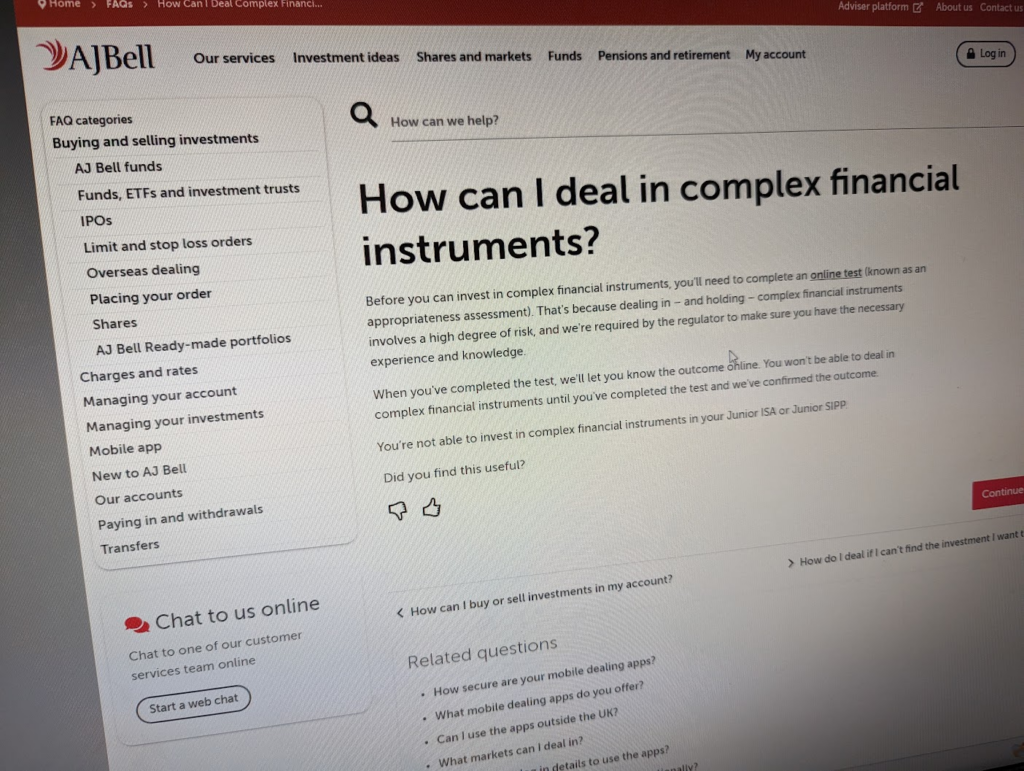

The more complex instruments featured in the table above, such as ETCs, Structured products, VCTs, CFDs and other derivatives are not made available to all clients who open an account.

These are examples of complex financial instruments that carry an additional burden of responsibility for brokers that offer them to clients. The FCA dictates the rules for which class of sophisticated investors may be offered these products, and therefore a broker has their hands tied in many cases.

Take a look at the AJ Bell process for applying to access complex financial instruments:

Ahead of the test, AJ Bell takes steps to highlight examples of the downsides that make complex financial instruments a more risky prospect:

- “Insufficient opportunities to dispose of, redeem or otherwise realise the instrument at prices publicly available and validated by valuation systems independent of the issuer

- Any actual or potential liability you face that exceeds the cost of buying the instrument

- A clause, condition or trigger that could fundamentally alter the nature or risk of the investment or pay-out profile, such as financial instruments that incorporate a right to convert the instrument into a different investment

- Explicit or implicit exit charges that could make the investment illiquid – in spite of technically frequent opportunities to dispose of, redeem or otherwise realise it

- Insufficient comprehensive and easy-to-understand information publicly available for an average retail client to make an informed decision whether they’d like to invest

- Certain fixed interest or debt instruments with features that make them difficult to understand. These include features that embed a derivative, have a complex mechanism to determine or calculate the return, and that are dependent on the performance of an asset pool or other instruments which in themselves are difficult to understand, or have a complex mechanism to determine or calculate the return

- Structured Deposits incorporating a structure that make it difficult to understand the risk of return, or the cost of exiting before term.”

Which UK stockbrokers are the most restrictive?

Our review has concluded that fund platforms such as Vanguard Investor offer the most restrictive investment experience online.

Rather than allowing investors to buy and sell individual shares, they offer a selection of funds-only. In Vanguard’s case, the restriction is increased by their list of available funds being limited to their own Vanguard-branded mutual funds and ETFs.

This means that a private client of Vanguard personal investor is limited to 86 funds at the time of writing.

Do more investment options lead to higher returns?

Restriction isn’t necessarily a curse, however. Vanguard offers a wide range of sectors, asset classes and geographical exposure through their mostly-passive funds. This is enough to provide you with the building blocks to build highly customised portfolios with a wide range of risk-return characteristics.

If 86 funds allow for this degree of customizability and result in an award-winning platform – this begs the question ‘what is the point of being able to trade 20,000+ individual instruments via a standard discount stockbroker?’

The trade-off here is control and the discretion to invest in precisely what you want. When investing in a fund, you relinquish all stock-picking control to the fund manager or to the index that the fund passively tracks.

If you desire to double down on a specific company or avoid investing in one stock entirely due to ethical concerns, you will not be able to tweak your holdings. You’re either holding the entire basket or not holding the basket at all.

If you’re an active investor, you’ll effectively default to a broad stockbroker because funds are not specific enough to make directional bets on the short or medium-term outperformance of individual companies. At best you could attempt to time the market or skew towards individual sectors, but these are macro-plays rather than trades to leverage fundamental or quantitative research.

The perks of using a restrictive stockbroker

Finally, it’s worth considering the behavioural side of investing. Studies have consistently shown that retail investors are their own worst enemy when managing their portfolios. Constant financial news, app notifications, social media and the urge to take control of their finances can lead many investors to overtrade and consequently overspend on brokerage services.

Using a broker that heavily restricts your investment experience to a selection of broad funds can help to reign in such behaviour, which could prove to be to your advantage in the long term.

The exotic investments offered by AJ Bell and Hargreaves Lansdown may appeal to the adventurous investor, but these high-risk options can also produce the highest losses. For investors that treat their portfolio too much like a gambling fund, wide access to complex investments merely opens the door to an investment nightmare.

In a similar way to overtrading, restrictive brokers can help to guide retail investors towards options that are more suitable for their financial circumstances, and away from options built for institutions and advanced professional traders.