How much truth sits behind the common maxim as safe as houses?

In investor-speak, a bricks and mortar investment is an opportunity to buy something tangible and real. It signals security and lower risk. But how closely does this reflect reality? It can take years to save up a house deposit (see our guide on how to save a house deposit), so you are probably keen to understand how safe that money will be once used to buy a property.

Master the basics of property investment

This is a companion article to our ‘How to invest in property‘ ultimate guide and ‘How to invest in land‘. In the property article, I outline 8 different ways you can access the property asset class.

Property is a useful asset class to consider as you build an investment portfolio. It might be appropriate for you if you score ‘Balanced’ or ‘Adventurous’ in my investment risk appetite questionnaire, and have a time horizon of longer than 5 years.

I recommend that you check our main ‘How to invest in property’ article out before you read onwards, as it covers a lot of common ground which this post will build upon.

I also suggest you look at my list of the best property investment books which I’ve recently compiled.

How safe is property as an investment?

There are several ways of approaching this question.

- We could look at the safety characteristics of property – how does the property market protect our investment?

- We could explore safe investments and compare them to property. Does property offer the same level of security as those?

The safety characteristics of property

Is property investing inherently safe due to the ‘bricks and mortar’ nature of houses and offices? Let’s examine the underlying nature of property investments to answer this question.

Is property safe: liquidity

A safe investment is one that can be easily converted back into cash. In other words, it is ‘liquid’.

Property investments do not generally possess this feature.

If you directly purchase residential property, it may take you 3 – 12 months to sell it for a reasonable market price.

Selling a property is usually a lengthy process due to the legal complexity and the time it takes for a buyer to complete checks on the property.

When market volumes are low (i.e. fewer homes are changing hands), it can be difficult to generate buyer interest at all without offering a discount.

This makes most forms of property investment illiquid. This reduces its safety as you may become ‘locked into’ the investment against your will at a time you need to access your funds. You may need to dispose of the property below its market value in order to receive cash quickly.

Is property safe: price volatility

A safe investment is one without dramatic changes in valuation. Safety comes from knowing that an assets’ value in 12 months is unlikely to be significantly different from its current value. This allows you to plan ahead and make reliable assumptions about the investment’s future value.

Property as an asset class has medium price volatility. If you invest in a single property, you will experience higher volatility than the national average due to the lack of diversification.

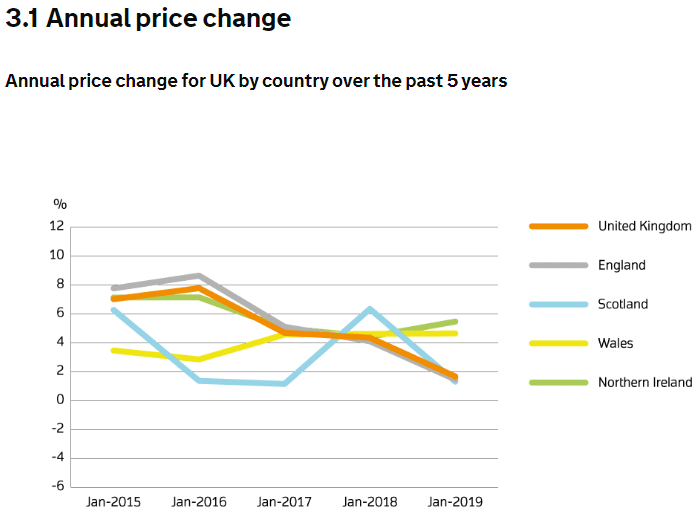

Take a look at the following chart prepared by the UK government which shows the annual price increase in over the last 5 years.

The orange line, which represents the whole of the UK, has a maximum annual increase of 8% in 2016, compared to an increase of 1.7% in 2019.

This shows that the returns from property investments can vary, but within a medium range of returns.

If we compare against buying shares, the annual changes in the FTSE 100 stock market index give a more extreme range. The FTSE 100 returned +19.1% in 2016, then suffered a drop of -8.7% in 2018. These figures include the effect of dividends.

Is property safe: price trending

Another safe characteristic is whether the investment value tends to trend upwards. Many investors may think of a volatile investment as ‘safe’ so long as it still produces a positive return each year.

So does property carry a risk of loss?

The data above shows that national average prices have only risen in the past five years. However, property values did fall by 16% in 2008 as reported by the Guardian at the time.

This was in response to a sharp tightening of lending requirements, meaning fewer potential house buyers were being approved for smaller mortgages. This led to a reduction in demand and cash to throw at properties for sale, so prices came tumbling down.

After a decade of low-interest rates, property investors have become complacent in assuming that home buyers will easily find large, cheap mortgages to fund their purchases. However, the day will come when interest rates increase and the financial firepower of buyers shrinks once more.

Therefore despite a positive track record in recent years, investors should accept the risk of house prices decreasing.

Furthermore, investors don’t invest in the national property market – they usually buy a small number of properties. At a local level, other factors come into play such as:

- Crime rates

- School quality

- Local development

- Transport links

- Size of the local job market

- Condition of neighbouring properties

- Subsidence and damp issues

- Damage to the property

Changes in these factors could cause the value of a property to fall despite an increase in national prices.

A phrase often quoted by books about investing in land is; “They’re not making any more of it”. What is being implied here is that the value of land is protected by its finite and constrained supply.

The amount of land stays roughly the same, decade after decade. Yet the population and economy grows, resulting in more people with more money looking to acquire some. This provides a really positive environment for land investments.

However, that’s not the same thing as suggesting an investment in land is always safe. The underlying value of land might be high, but this doesn’t stop the market price from exceeding 200% of this, before subsequently crashing to a level consistent with underlying value.

Safe investments v property – how does property compare?

Short-dated government bonds and bank accounts are objectively safe investments. They are liquid, have low volatility and risk of loss is very low.

Guarantees

Government bonds are backed by HM Treasury. In theory, the government could print additional currency to ensure that it can repay its debt.

Bank accounts are partially protected by the Financial Services Compensation Scheme. This will repay a saver (up to a limit) in the event that their bank collapses. This mechanism sprang into action in 2009 to bailout the savers of Iceland Bank IceSave and others.

In contrast, property owners benefit from no similar guarantees. In some circumstances, an investor could launch legal action against their advisers (such as their lawyer, surveyor or estate agent) if their negligence led to a loss. Otherwise, simple market movements are borne entirely by the investor.

Bankruptcy

If property was as safe as a bank or bond investment, it would rarely cause bankruptcy.

Anecdotally speaking, property investments are a frequent cause of personal bankruptcy in the UK.

This is because it is common for investors to use leverage (debt) to buy property. Debt allows an investor to acquire a much larger asset than they would otherwise be able to afford. This allows them to enjoy larger rental income or price increases.

However, high leverage introduces the risk that a property-owner is unable to continue to make payments on the borrowing. If a property falls in value after purchase, it can mean that even selling the property will fail to raise enough cash to pay off the loan. This is a predicament known as ‘negative equity’.

Borrowing to invest can dramatically change the risk of the property asset class, and I do not personally recommend it.

Overall is property a safe investment?

To summarise;

- Property is an illiquid investment which can take months to exit.

- The price of a diversified property portfolio will see a medium rate of price volatility

- Over some time periods, property investors have seen losses.

- There are no ‘government guarantees’ over the value of a property

- Using debt to buy property increases its risk further

Overall, I consider property to be a medium to high-risk investment.

Medium: If you are fully diversified within the property asset class and use no leverage.

High risk if you directly invest in few properties and if you use a mortgage to finance the investment.

Yes, properties can feel like a ‘safe’ investment because they’re solid and won’t disappear in a week, unlike Bitcoins and spread betting investments. But that doesn’t mean that property is without risk.

A cheap supply of credit and a run of price increases has resulted in a high point which may not be sustainable if economic conditions change.

I cannot agree that property is a safe investment because it doesn’t have any key features in common with bank accounts and bond investments.

You might be also interested in articles such as are shares a risky investment?