If you’re a lazy investor like me, you love investing funds. Funds help us do away with the torturous process of stock picking. However, picking a fund can be just a difficult as picking stocks. This guide on how to pick funds will explain the key criteria applied by many investors what order to consider them.

How you decide to weigh each factor will depend upon your own personal preference, therefore think of this as a framework rather than a full system.

How to pick funds

1. Consider limitations on your fund choices

Before you pick funds from the whole of the market, consider any restraints upon your investing options that might narrow your search.

- Does your chosen stockbroker only allow you to buy units of approved funds?

- Does your investment account allow you to buy funds domiciled abroad?

- Are you investing with a small sum of money, which may fail to meet the ‘minimum initial investment’ requirement of high-class funds such as hedge funds?

These are all examples of fund limitations. Some can be navigated (by choosing a different stockbroker, for example).

2. Choose your strategy

The first decision to make is whether you want an actively managed fund or a passively managed fund.

There are far more active than passive funds in the marketplace, so this choice could whittle down your choices significantly.

Active fund managers place trades using research and analysis. They hope that their expert valuation methods and market timing skill will generate a premium return which would beat the market average.

The theoretical debates continue to rage as to which investing style is the best.

Active managers have proven themselves before fees, but after fees they tend to produce a return which is lower than the market average.

3. Looking for great value service

Like any professional service, fund managers try to run a tight ship delivering a quality service for their clients at the lowest cost. However, due to differences in scale and organisational structure, some funds you pick will offer much better value for money than others.

When you pick funds, you’ll want to carefully filter out the funds which aren’t priced competitively.

It’s worth bearing in mind that different asset classes and investing styles come with different cost bases:

- Active management requires expensive research and analysis, whereas passive funds calculate their trades almost automatically.

- The costs of investing in emerging market bonds will be more higher than development world equities.

Therefore, it’s only fair to compare funds on a ‘like-for-like’ basis when looking at costs.

When you’ve grouped together some funds with similar characteristics, the modern way to measure a funds value is the Ongoing Charges Figure, or OCF for short.

This charge, which should be quoted in the Fund Factsheet, comprises the annual management charge and some other operating costs. It gives a fuller picture of the costs eating away at a funds’ assets than the annual management charge alone.

If you can pick funds which have noticeably lower OCFs than competitors, then you’ve given yourself a fighting chance at outperforming the rest of the fund market. An investing cost is an investing loss, after all.

4. How to pick funds: brand only goes so far

In the fund management world, brands can be valuable. Investors are keen to place their money in well-known, old institutions with an expectation that this will be a secure investment.

This assumption begins to fall apart as soon as you apply any scrutiny. The reality is that any equity funds you pick will be investing in an incredibly similar pool of stocks & shares.

The idea that the ‘reputation’ of the manager – created no doubt under the leadership of a very different manager in very different times – would influence the market returns of your investment today is doubtful.

But brand is still a relevant factor. Like any investment, you will want to ensure you have vetted and researched any financial institution you entrust your money with.

However, I see this as a mandatory hygiene factor used to narrow the field, rather than a useful way to select between two good candidates.

5. History does matter – for index trackers

The health warning that ‘past performance is not indicative of future returns’ applies when trying to pick a fund.

All fund factsheets will display historical charts, and it can be difficult to remain objectively neutral about a fund which has happened to deliver a huge return over the past year.

However, historic pricing data can demonstrate whether passive funds, which are engineered to closely track a particular index, have succeeded in achieving their goal.

Tracking an index is more of a financial engineering challenge than one requiring wisdom and judgement. If a fund has failed to replicate the performance of an index in the last 3 years, then you should be under no illusion that it will do so under your ownership.

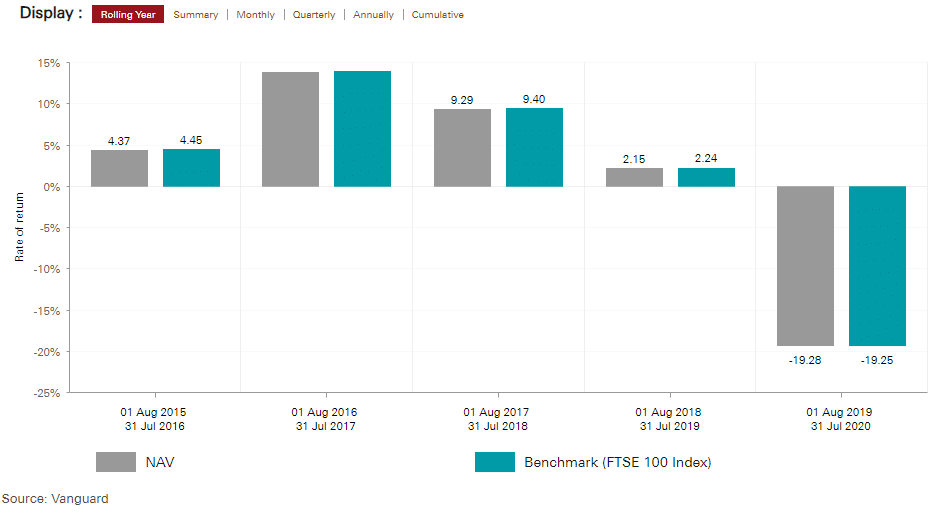

This type of tracking error is nothing less than an additional layer of volatility above and beyond the stock market itself. It’s largely avoidable, therefore pay close attention to charts which show the performance of the fund against the index benchmark.

If an index fund has mirrored its index over a long period, this is the mark of a reliable manager. You cannot use history to guess where the stock market will head in the next 6 months, but you can conclude whether the fund will track its direction in an accurate manner.

How to pick funds: in summary

Knowing how to pick funds is like knowing how to cook great food.

This isn’t a quick skill which can be quickly conveyed or absorbed in 10 minutes.

It’s a decision making framework, and entire school of thought around a multitude of factors. How to pick funds is about weighing up various factors, which may not all point to the same fund as being superior.

This is where your own investing preferences come into play, as you can weight your judgement towards the factors which you value highly.