The Capital Asset Pricing Model (CAPM) is a fundamental concept in finance that plays a pivotal role in portfolio management and investment decision-making. Developed in the early 1960s, the CAPM is a widely recognized and applied financial model that helps investors assess and quantify the expected return on an investment relative to its risk.

In this comprehensive guide, we will explore the CAPM, its components, assumptions, and practical applications in the world of finance. We’ll split this article into six sections to aid in learning.

Understanding CAPM

1.1 What is the Capital Asset Pricing Model (CAPM)?

The Capital Asset Pricing Model, abbreviated as CAPM, is a financial model that provides a framework for estimating the expected return on an investment based on its risk. CAPM helps investors determine the appropriate risk-adjusted return for an investment by taking into account the risk-free rate, the expected market return, and the asset’s beta.

1.2 The Key Components of CAPM

To understand CAPM fully, it’s essential to break down its key components:

1.2.1 Risk-Free Rate (Rf): This represents the hypothetical return an investor could earn with zero risk. Typically, the yield on a government treasury bond is used as a proxy for the risk-free rate.

1.2.2 Expected Market Return (Rm): This is the expected return of the overall market, often represented by a broad stock market index like the S&P 500.

1.2.3 Beta (β): Beta measures the asset’s sensitivity to market movements. A beta of 1 indicates that the asset moves in line with the market, while a beta greater than 1 implies higher volatility, and a beta less than 1 suggests lower volatility.

1.3 The CAPM Formula

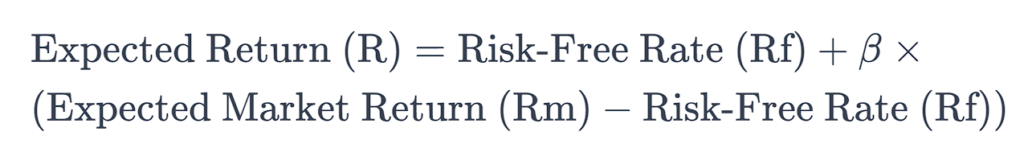

The CAPM formula is relatively straightforward:

This formula calculates the expected return on an investment based on the risk-free rate, beta, and the expected market return.

Assumptions of CAPM

2.1 Perfect Capital Markets

CAPM relies on the assumption of perfect capital markets, which implies that all investors have access to the same information and can trade freely without transaction costs.

2.2 Risk and Return

CAPM assumes that investors are risk-averse and seek to maximize their expected return while minimizing risk. It suggests that investors evaluate investments solely based on their risk-return profiles.

2.3 Single Time Period

CAPM focuses on a single investment period, making it suitable for analyzing short-term investments rather than long-term strategies.

2.4 Homogeneous Expectations

The model assumes that all investors have the same expectations regarding future returns and risks of assets.

2.5 No Taxes

CAPM in its simplest form neglects the impact of taxes on investment returns. However, this can be factored in with a more advanced version of the formulae which we will not cover in this Financial Expert explainer article.

Practical Applications of CAPM

3.1 Portfolio Management

CAPM is a valuable tool for portfolio managers. By using the model, they can determine the optimal asset allocation within a portfolio to achieve a desired level of risk and return.

3.2 Cost of Capital

Businesses use CAPM to calculate their cost of capital, which is crucial for making investment decisions and assessing the viability of projects.

3.3 Valuation of Securities

Investors and analysts often use CAPM to estimate the required rate of return for valuing individual stocks or other financial assets.

3.4 Performance Evaluation

CAPM can be employed to evaluate the performance of mutual funds, hedge funds, and other investment vehicles by comparing their actual returns to the expected returns based on the CAPM.

Limitations of CAPM

4.1 Market Assumptions

CAPM assumes that investors have rational expectations and behave in a risk-averse manner, which may not always hold true in the real world.

4.2 Solely Market Risk

The model focuses solely on market risk, neglecting other forms of risk, such as company-specific risk or geopolitical risk.

4.3 Beta Sensitivity

The accuracy of CAPM depends heavily on the estimation of beta, which can be sensitive to changes in the selected time period and market conditions.

4.4 Shortcomings in Diversification

While CAPM emphasizes diversification, it may not fully account for the benefits of diversifying a portfolio in the presence of non-systematic risk.

Real-World Examples

5.1 Application in Investment Banking

Investment banks often utilize CAPM when advising clients on mergers and acquisitions, helping determine the appropriate discount rate for cash flows.

5.2 Use in Equity Research

Equity research analysts use CAPM to evaluate the attractiveness of individual stocks by estimating their required rates of return.

Companies apply CAPM to assess the cost of capital when making investment decisions, including capital budgeting and project evaluation, however, this is rarely the sole factor. It will likely form some of the quantitative analysis used in valuation packs.

Criticisms and Alternatives

6.1 Criticisms of CAPM

We’ll delve into some of the criticisms and debates surrounding CAPM, including discussions on the model’s validity in certain scenarios.

6.2 Alternative Models

Explore alternative models and approaches to estimating asset returns and risk, such as the Arbitrage Pricing Theory (APT) and the Fama-French Three-Factor Model.

Conclusion

The Capital Asset Pricing Model remains a cornerstone in the world of finance, despite its limitations and criticisms. It provides a valuable framework for understanding the relationship between risk and return in investment decisions. Investors, financial analysts, and portfolio managers continue to use CAPM as a foundational tool for making informed financial choices.

In this comprehensive guide, we have delved into the intricacies of CAPM, from its components and assumptions to its practical applications and real-world examples. As the financial landscape evolves, so too will the debates and discussions surrounding this enduring model. Understanding CAPM is essential for anyone seeking to navigate the complex world of finance and investment.

In practice, CAPM isn’t used to explicitly calculate the value of stocks or to make invest/don’t invest decisions. Rather, it’s a theory that helps students to explain the relationship between risk and return in financial markets. This is what makes it such a popular topic in ‘Finance 101’ courses at Universities and other financial qualifications.