This is a companion article to how to invest in shares which forms part of the free investing courses available on Financial Expert.

If you follow dividend growth investing, or seek dividend income from the basic investment portfolio you’ve built, understanding which companies pay dividends will be crucial information you need.

Do all equities produce dividend income?

The simple answer is that not all companies pay dividends to investors. If you own a basket of shares within a stocks and shares ISA, you’ll notice that some companies pay a dividend payment each quarter, some semi-annually and some annually. But some don’t pay any at all.

There’s a general rule of thumb which can allow you to guess whether companies pay dividends, and there are also robust methods of company research and financial statement analysis books that will allow you to find out definitively.

Which types of companies generally pay dividends?

As a general rule (with exceptions), the companies which tend to pay dividends are:

- Long established businesses with decades of trading history

- Companies operating in mature (and potentially saturated) markets

- Companies with slow growth but dependable profit margins

- Large corporations that feature in the top stock indexes such as the FTSE 100 or the Dow Jones 30.

The companies which tend to not pay dividends have the following characteristics:

- Start-ups or companies with disruptive business models

- Loss-making

- Companies racing to reach a critical mass or network size to defend against competition (e.g. Uber, Deliveroo)

Why do some companies refuse to pay dividends?

At first it may seem disrespectful or counter-intuitive to see companies withholding all income from investors, but this strategy can be in the interest of all shareholders.

When companies are in their ‘growth phase’, they typically require ever-increasing amounts of capital to fund new equipment, new facilities, research & development and to cover initial losses.

Under these circumstances, it is not in the Director’s interest to return capital to shareholders.

As any dividend investing books will explain; any dividend paid would only need to be replaced by another form of fund raising, such as an IPO or a bank loan. Cash-hungry businesses need to retain as much cash as possible, not pay it back out to shareholders.

As long as this strategy is well communicated to shareholders, it won’t cause concern. Shareholders place value in their shares not on its ability to produce income now, but their ability to produce potentially larger income streams when the business matures.

That being said – you may have a strong preference for dividend-paying companies because you need to receive an income from your investments. In this case, dividend-non payers may be best avoided.

How to tell whether companies pay dividends

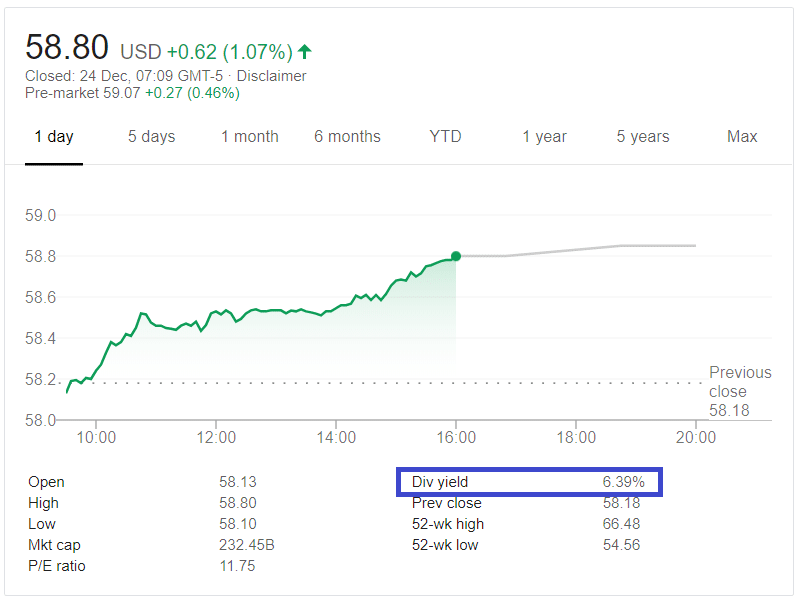

As we explain in our guide to researching share prices and company information, Google Finance is a very helpful tool for dividend hunters.

When looking at the summary company metrics, you will see a ‘Div yield’ percentage. Dividend yield is the annual dividends per share divided by the cost of one share. Without dividends, this cannot be calculated and therefore will show as blank or a ‘ – ‘.

As a final thought, before you write-off dividend-blocking companies completely, do consider the following list of companies which have (at some point in their corporate life) not paid dividends:

- Apple

- Amazon

- Netflix

Each of these companies has delivered returns in excess of 1000% to investors – despite paying zilch in income. Any shareholder who excluded these technology giants from their portfolio on the basis of their tight dividend purse strings, will have missed out on a major component of the US stock market gains from 2013 – 2020.

Books about growth investing explain a school of thought which states that investors will do well by investing in high growth companies, regardless of their dividend policy.

Thanks for reading our article on ‘Do all companies pay dividends?’

I’ve collected together a list of other investing Q&A articles from the blog that you might also want to explore:

Do you have a question that I haven’t already answered? Please leave a comment on this article and I’ll be sure to create an article which covers it.