If applying for a credit card, while your credit is frozen, most likely, you won’t get approval. A credit card freeze blocks people from accessing your credit reports, and, therefore you cannot go through validation procedures properly.

The good news is — the failed application won’t impact your credit score. There are a few ways to find out if your credit has been frozen, and in this article, we’ll share some of the life hacks.

Main Options

You can unfreeze your credit report in two of the following ways:

Temporarily lift credit freeze: your file is open for a certain period of time, and then the agency refreezes it back

Permanently remove credit freeze: your credit report stays open until you request the next credit freeze

How long will it take?

The three main credit bureaus are obligated to release the freeze within an hour of receiving your online or telephone request. You can submit the request by mail, however, keep in mind that it will take longer. The credit bureaus must lift the restriction three working days after being notified.

In case you need the emergency money now, you may request an online loan with no credit check. Although, you have to remember the consequences of failed repayment for your financial health and don’t take on too many obligations that you cannot fulfill.

Unfreeze your credit score easily

You must submit a request to each credit reporting agency in order to unfreeze your credit.

To ensure that you can supply all the necessary information, keep your name, address, and Social Security Number (SSN) close. To unfreeze your credit with each major credit agency, follow these steps:

Experian

Find a Security Freeze Center page on your account and select “retrieve my personal identification number (PIN)”. The system will then redirect you to the “Request your PIN” screen.

Then, you’ll be subject to two of the following scenarios:

- In case the PIN is available, the agency will provide it to you to unfreeze the credit

- In case the PIN is not available, it means the credit isn’t frozen, and you’re good to go!

You can also dial the number 888-397-3742 and follow the prompts. The specialist on the other line will ask about your SSN and ZIP code. When the identity is confirmed, you’ll have more extensive options, such as unfreezing your credit score.

Equifax

The easiest way to check your credit is via the my Equifax account. After logging in, you’ll see the tile in the upper right corner indicating your freeze status.

If you didn’t set up an account, try calling 800-349-9960 and follow the next steps to confirm your identity. You’ll only hear the options for freezing credit, in case it wasn’t frozen at all. On the contrary, if the credit was frozen, you’ll be given access to unfreeze it.

TransUnion

It works the same way as Equifax: when you have an account, you can do it online in a few minutes. When you don’t have an account, it’s easier to call 1-800-916-8800 and follow the prompts.

Preventing identity theft

While your credit is solely your responsibility, it’s vital to ensure your personal data is safe. One of the possible solutions is an Identity Protection Pin (IP Pin).

It is a six-digit number helping you to prevent an unauthorized tax return from your account. Only you and the IRS (Internal Revenue Service) know the number. It is also the main information to provide when you file an electronic or a paper tax return.

Using the online Get an IP PIN tool is the fastest way to obtain an IP PIN. You must register on IRS.gov in order to verify your identity if you don’t already have an account. The IP PIN tool is accessible from mid-January to mid-November.

Credit freeze vs. credit lock

Both credit freeze and credit lock prevent unauthorized individuals from accessing your credit report, making it more challenging for them to register new accounts in your name. Every one of them, however, provides a unique amount of security.

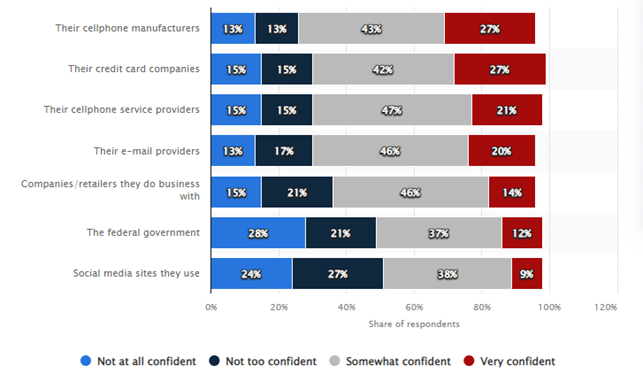

The statistics (source) show around 15% of individuals don’t trust their credit card companies. It is a bad thing since they feel more perceptive to identity theft.

Credit freeze

The federal government guarantees and controls a credit freeze, making it a more secure option. If something goes wrong, such as someone obtaining unauthorized access to your credit record, you won’t be held financially liable. Your credit report with the three credit agencies can be frozen and unfrozen cost-free.

Credit lock

The three credit agencies provide a service called “credit locking,” which is similar to a credit freeze but lacks some legal safeguards. Credit locks may come at an extra charge, even though they provide more benefits, such as the ability to lock and unlock your credit with a single swipe on an app.

Credit freeze vs. fraud alert

Another precaution to help shield you from identity theft is a fraud alert. A fraud alert urges companies to contact you after activation before processing a loan or credit card application.

In contrast to a credit freeze, a fraud alert is controlled by only one credit bureau: you choose one agency to hold responsibility, and they contact two other companies on your behalf.

The bottom line

A credit freeze prevents lenders from seeing your credit record, preventing the possibility of identity theft. Even if a criminal possesses important details, such as your Social Security number or birth date, they won’t be able to create an account without access to your credit reports.

Without a credit score, lenders will likely deny your application. But at the same time, a thief can’t open new loans or lines of credit in your name.

To freeze your credit, get in touch with all three credit bureaus. Credit freezes are cost-free, reversible, and have no impact on your credit score. Besides, even if you’re not aware the credit is frozen, applying for another loan won’t affect your financial health.