This is the latest in a series of stockbroker excellence posts. We lean into all the finer points that separate the top contenders battling to be the UK’s best stockbroker.

As consumers, we love to leave customer reviews when we’ve experienced great customer service, and when we’ve experienced bad customer service. When we believe a product ticks all the boxes, or when it completely misses the mark, we look to the web for a place to share our feedback.

The creation of client reviews provides brands with a continuous stream of feedback that they can use to detect themes and measure the effectiveness of solutions in real-time. Of course, the spectre of fake reviews is always an issue, and when assessing any aggregated review score, we should always read a sample of reviews to understand their context and gauge their credibility.

Trustpilot has emerged as the UK’s most popular location to log feedback on the organisations and firms we do business with every day. Buying shares is no different, and so we see Brits leaving reviews on the Trustpilot pages of investing apps and investment platforms every day of the week.

The list we have created below is useful for investors because the Trustpilot website itself doesn’t have a complete view that displays all UK stockbrokers on a single page.

That’s because some of the businesses below are categorised as either;

- Banks

- Stockbrokers

- Investment services

- Asset managers

This means that no single category page contains all of these businesses to allow for easy comparison.

Let’s take a look at the Trustpilot scores of the top UK stockbrokers and dwell on what an investor can and cannot draw from a high or low score.

Which UK stockbrokers have the highest Trustpilot score in 2021?

Below, we’ve extracted the Trustpilot score of a list of UK stockbrokers. These scores were taken from the Trustpilot website on 2 May 2021. Scores may have subsequently changed and therefore we encourage you to check out the latest live score on Trustpilot to see the latest data for yourself. We’ll provide links to help you do so.

Notes about compiling this list

Scoring scale

All scores are a number of stars out of a maximum of 5, with 5.0 being the highest possible score.

Multiple pages

Where a stockbroker had multiple listings (due to separate pages for different websites, or variations on the company name), we picked the score of the page with the most reviews. We didn’t attempt to aggregate or average the scores.

The risk of fake reviews

Readers should be aware of the possibility that some reviews may not be genuine. False positive reviews are possible (but difficult to detect). However more noticeable are occasional negative reviews which don’t appear to be genuine.

We have noticed on some review pages – particularly investing apps, that many negative reviews had a suspicious pattern:

- The review is 1 or 2 star

- It alleges that the reviewer had lost money through the app, for various reasons

- It provides an email address or web address for users to contact in case they have also lost money, with a testimonial that the same individual apparently allowed them to reclaim funds they had lost

- The contact details have been oddly typed or include symbols and spaces designed to avoid system filters

These reviews appear to be a spam-based recruitment technique used to lure disappointed investors onto a malicious website, where they may be tricked out of more money. They are certainly not pointing to the best FCA regulated brokers! Investment scams of this nature are particularly tragic considering that they exclusively target those who have already suffered one loss.

We have noted that these reviews are flagged by proactive brokers on a periodic basis and are removed by Trustpilot. However, depending on the timing of each purge, the overall broker score could be impacted by recent reviews.

UK stockbrokers ranked by Trustpilot score

Data taken 2 May 2021.

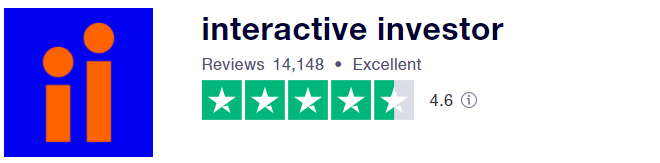

Interactive Investor – 4.6 stars from 14,149 reviews (source)

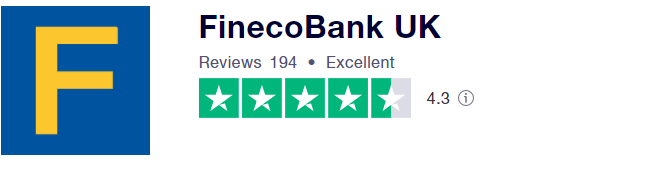

Fineco Bank UK – 4.3 stars from 194 reviews (source)

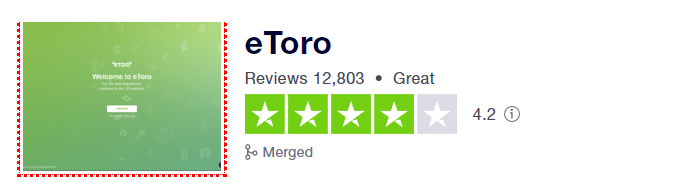

eToro – 4.2 stars from 12,803 reviews (source)

Trading 212 – 4.2 stars from 11,669 reviews (source)

Hargreaves Lansdown – 4.1 stars from 4,436 reviews (source)

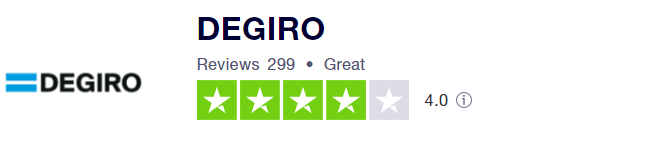

Degiro – 4.0 stars from 299 reviews (source)

Fidelity International – 4.0 stars from 1,776 reviews (source)

AJ Bell YouInvest – 4.2 stars from 1,424 reviews (source)

Vanguard Investor – 3.6 from 208 reviews (source)

Charles Stanley Direct – 3.6 stars from 7 reviews (source)

Freetrade – 3.6 stars from 1,006 reviews (source)

Stake – 2.1 from 99 reviews (source)

What can we draw from a high or low Trustpilot score for a broker?

We warn against a knee-jerk reaction of assuming that the highest scoring brokers are fantastic brokers and those receiving poor scores are poor brokers (as the TrustPilot score labelling might suggest).

We urge you to follow these rules of thumb before interpreting a score

- Read a sample of reviews to understand what specific complaints are driving the score up or down

- Don’t compare from broker to broker without looking at the detail of each first.

What does a high broker score mean?

A high score from a broker generally indicates that they have responsive a customer service team who is able to effectively put things right when something goes wrong.

This tends to be the number one factor that drives scores. More than how great the product is, how cheap the fees are

This hands an advantage to the more expensive brokers who charge higher fees and provide a better customer service.

Yes, all of their clients may be paying more for their trades, those same customers feel looked after and have little reason to complain. Furthermore, as the clients knew what the trading fees were when they signed up, giving a bad review on the basis of broker fees doesn’t make sense.

Therefore, we would interpret a high score as a sign that the company is able to deal with issues in a timely manner. We would not conclude that the brokerage service is cheaper than the competition.

What does a low broker score mean?

This is a really difficult question to answer. A low broker score could mean a lot of different things:

- It could mean that the broker is a poorly run business that does not take its custodial duties seriously.

The broker could regularly experience outages, technical errors and these may even cause financial losses for its clients which are not put right. After leaving a Trustpilot review, the next port of call for any client who has experienced this type of service from a UK regulated stockbroker would be the Financial Ombudsman Service, where they can raise a formal complaint via the UK regulator.

2. That the broker took a decision which angered a group of its clients

This one might take a bit of subjective evaluation. We have seen cases where brokers (such as eToro) have made the decision to restrict new trades in certain instruments due to the excessive risk level they are seeing across their client base. Brokers are within their right to take such a move, and when done for these reasons, are sensible and made in in the best interests of their clients.

However, from the perspective of a risk-hungry day trader who feels they have missed out on the opportunity to make a quick profit, this causes anger which can translate into a barrage of negative reviews on TrustPilot. Did the broker actually serve its clients poorly, or did actually act responsibly?

This is the equivalent of soliciting bars & pub reviews from individuals who have been asked by bouncers to leave the premises for the sake of the safety of other customers.

- Are those individuals likely to leave a positive review?

- How would that score impact the bar’s overall score?

- Is their review useful for other customers?

It is very subjective and depends upon the precise facts behind the complaint.

3. The broker is slow to process the administrative aspects of brokerage services

A common theme of negative broker reviews are delays experienced by clients when trying to perform administrative tasks such as:

- Being verified and ID checked to set up the account

- Making payments into the account

- Withdrawing funds from the account

- Transferring in a stocks & shares ISA from another provider

During 2020 and 2021, brokers have experienced a phenomenal wave of sign-ups as keen savers have been interested in speculating and investing during the pandemic. Cryptocurrencies and the Gamestop saga have put day trading in the public eye, and many new clients have decided to sign-up with a broker for the first time.

This has lead to some firms dealing with 4 x, 6x the normal level of paperwork. They simply haven’t been able to cope, forcing some providers to temporarily halt the onboarding of new customers to try to protect the level of customer service to existing clients. Other brokers haven’t taken such steps, and many of the reviews on Trustpilot are good evidence that the customer service teams are simply overwhelmed at the moment.

4. The broker attracts inexperienced clients with unrealistic expectations

One of the biggest reasons why we urge readers to not jump to early conclusions when comparing Trustpilot scores is that it is noticeable from detailed inspection that the reviewers of different brokers seem to hold the firms to different standards.

This might sound surprising, but when you look at the client base of the different stockbrokers, you will see clear differences in the age, experience, and investment objectives of their customers.

The curse of attracting brand new investors

The free investing apps such as Trading 212, eToro, Freetrade and Stake have a different proposition to the larger stockbrokers and tend to market themselves towards younger users. They focus on speculative, active trading and their marketing kindle an optimistic hope that they will be able to beat the market.

These younger investors may have less experience of investing and stockbroker accounts in general. It, therefore, follows that they will be more likely to leave a negative review than a veteran investor.

Why would we speculate that this is the case?

Inexperienced investors are more likely to make mistakes, which lead to losses

Inexperienced investors are less likely to understand the mechanics, fees and charges and other aspects of stockbroking. To be specific, they are more likely to take grievance with the following points which, while sometimes frustrating, are not always the fault of the broker:

- The fees and charges of the account which were clearly set out in the fees & charges page on the website

- The time it takes to settle a trade fully (trades can sometimes take 3 days to fully settle)

- The need to provide verification and identity documents to comply with know your customer regulations

- The need to adjust the range of securities on offer if their clearing broker (the broker which they rely upon to fully transact trades on their behalf) restricts liquidity in certain markets.

We have seen many 1 star reviews which repeat these themes on many of the brokers which attract younger clients.

Stomaching such reviews, which in some cases appear quite harsh, appears to be a cost to brokers of doing business with newer investors.

High stakes trading with CFDs is more likely to result in losses, and therefore complaints

Another client group is the high-risk contract for difference (CFD) traders who trade much higher risk products and use more complicated functionality within the apps. eToro, Degiro, and Trading 212 offer CFD trading products alongside the more ordinary stockbroker services. Between 50% and 80% of CFD traders lose money. The precise percentage for each forex broker is quoted on their website.

In such a market, where traders enter the market with the hope that they will beat it. And where the data shows that most investors will actually lose money. It’s a recipe for disappointing experiences and therefore we would expect that negative reviews will follow.

When trading such products, only a small mistake (on either side) can cause much greater losses and therefore invoke a higher volume of furious reviews. Reviews referring to ‘Margin call’ ‘Stop loss’ and ‘Spreads’ are quite likely to be describing the CFD products rather than ordinary buying and selling of shares.

With all of this context, the strong Trustpilot reviews for Trading 212 – a platform that markets itself to young traders and offers CFDs – should be lauded. Despite the factors stacked against them, they have still managed to attract very high praise from their clients.

Other investment platforms such as crowdfunding platforms (e.g. Funderbeam) are not included in the scope of this article. We define a stockbroker as a firm that provides access to publicly traded financial instruments.